Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I am working in an accountant's copy for our client and they have open payables that they need closed. I made journal entries to close them, put their names to the journal entries, and I see that the vendors have credits available through the "Pay Bills" section. Since it tells me I need to use the "Fix Unapplied Vendor Payment and Credits " under the "Client Data Review" feature I assumed I would see the journal entry in the payments/credits column but all I see are checks that the client has written. None of those payments apply to the payables I'm trying to clear out.

Solved! Go to Solution.

Thanks for coming back to the Community, KelbyR.

I appreciate following the troubleshooting shared by my colleague and letting us know the result.

As mentioned above, some payments were not applied to the payables. That’s why you’re unable to see the journal entry.

There are several ways on how to handle this type of situation in QuickBooks. The troubleshooting is scenario-based, so I suggest following the steps that fit your situation: Bill shows as unpaid after writing a check in QuickBooks Desktop.

If you wish to link the check to the bill, use this option if the entry has been reconciled. Let me guide you through the process.

To pay the transaction:

However, if these steps don’t apply to your situation, choose the solution that works for you. To keep your client’s accounts payable records in order, let me share this article that covers all the information: Accounts Payable workflows.

Please let me know if there's any other way I can be of assistance. I'm just a few clicks away if you have any questions. Have a great day ahead.

Hi @KelbyR,

Welcome aboard to the Community. I'm here to assist you with closing accounts payables in QuickBooks Desktop.

The general journal entry (JE) should show from the payments/credits column if the accounts you debit and credit are correct. I suggest reviewing the transaction to ensure you can apply it to the unpaid bills.

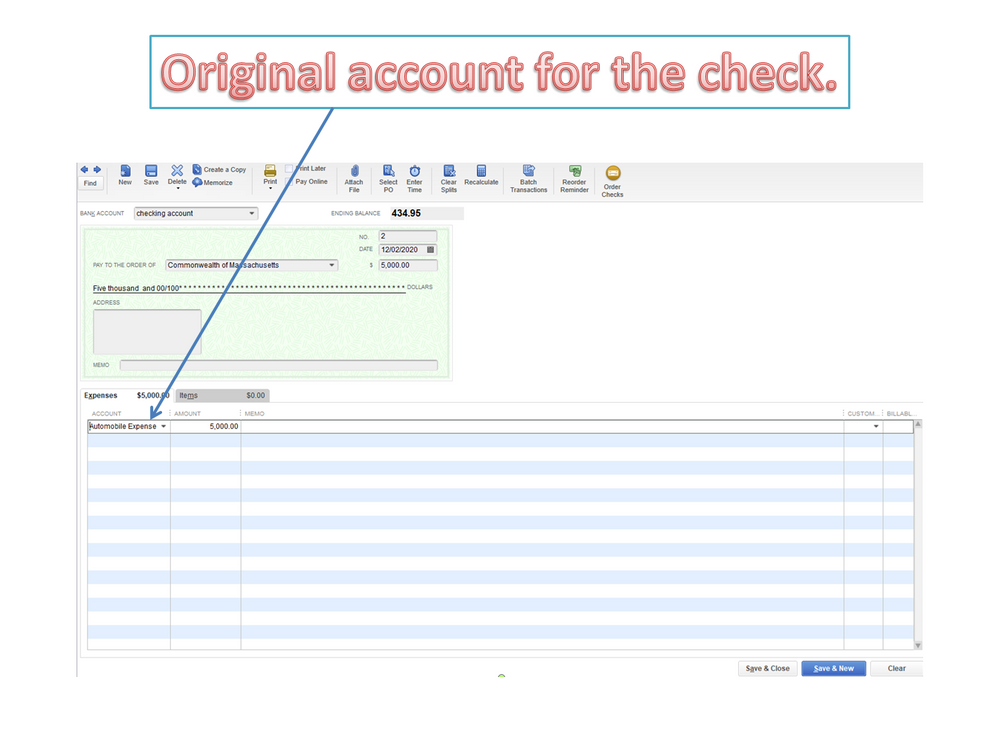

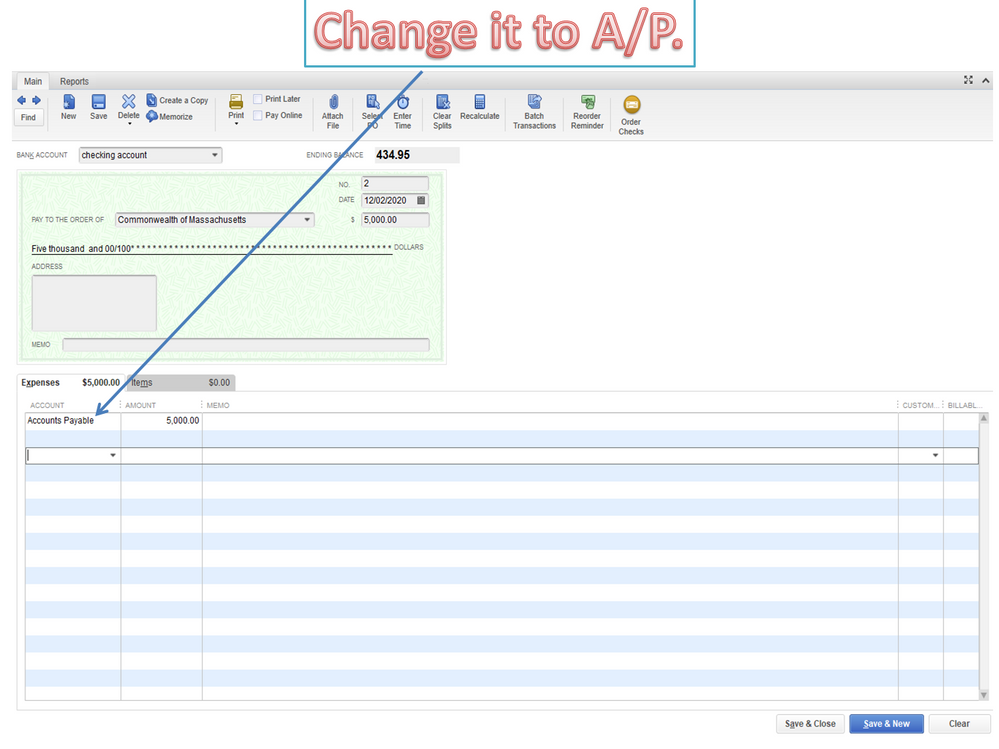

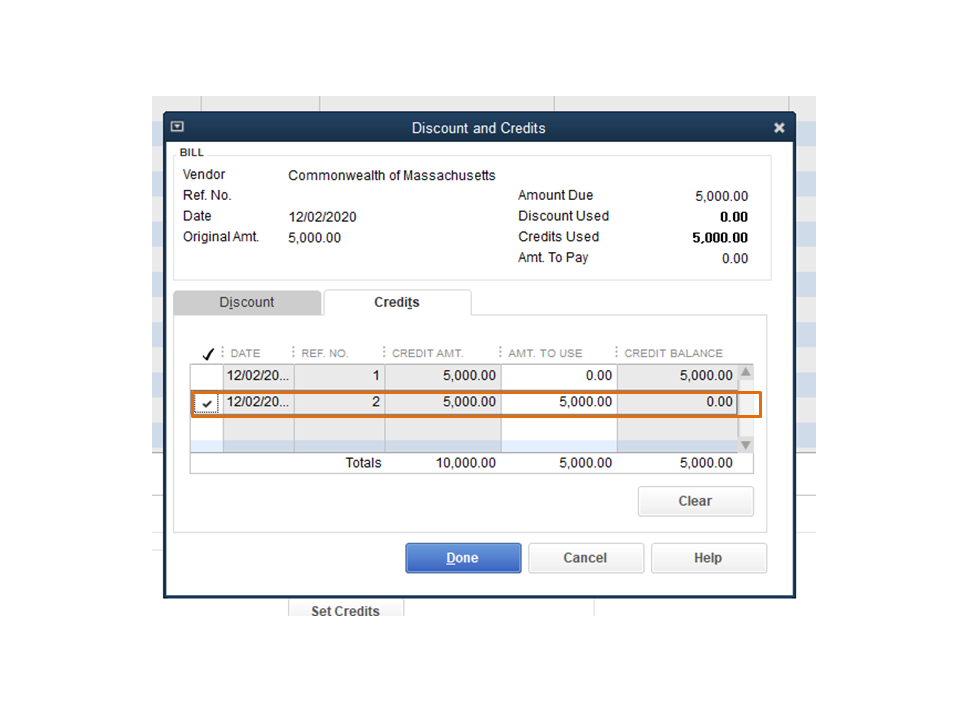

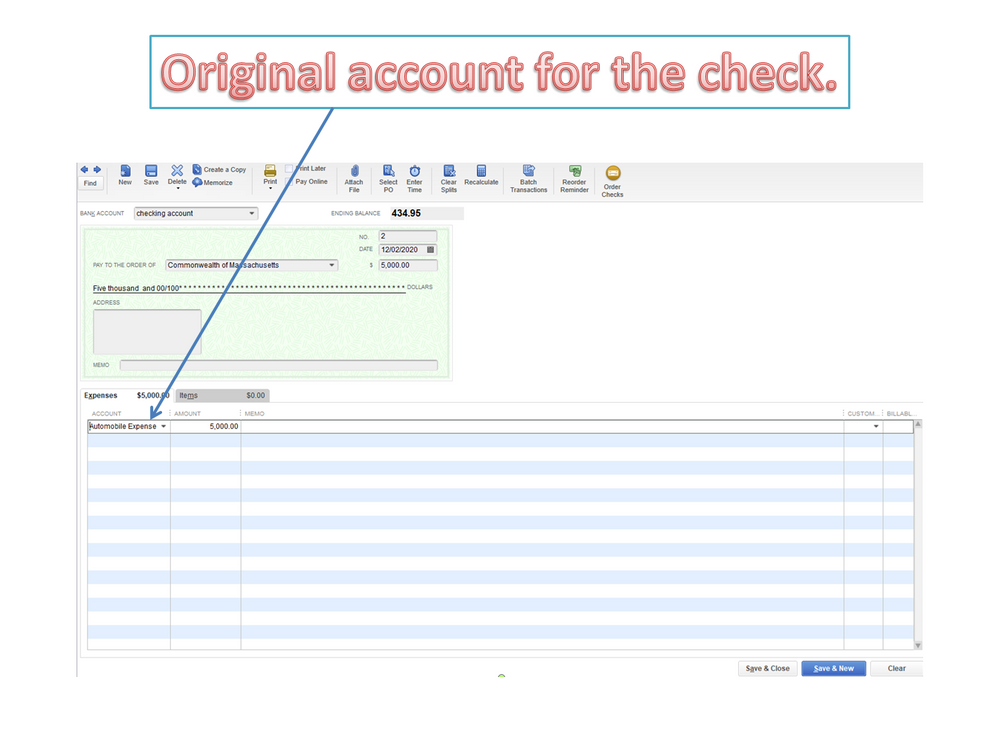

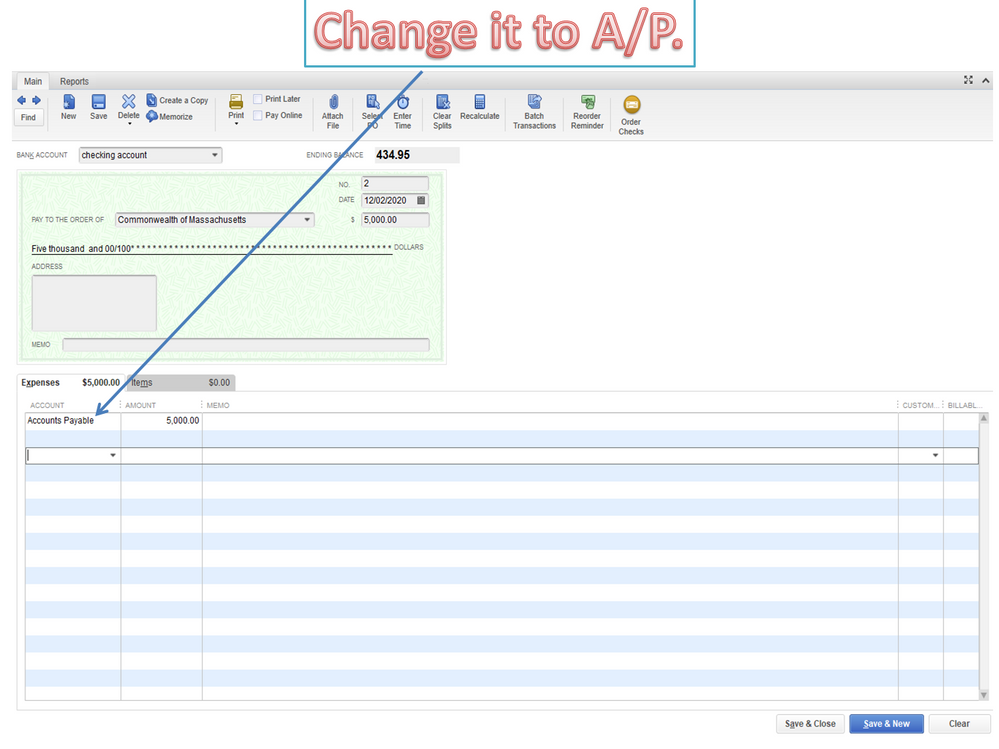

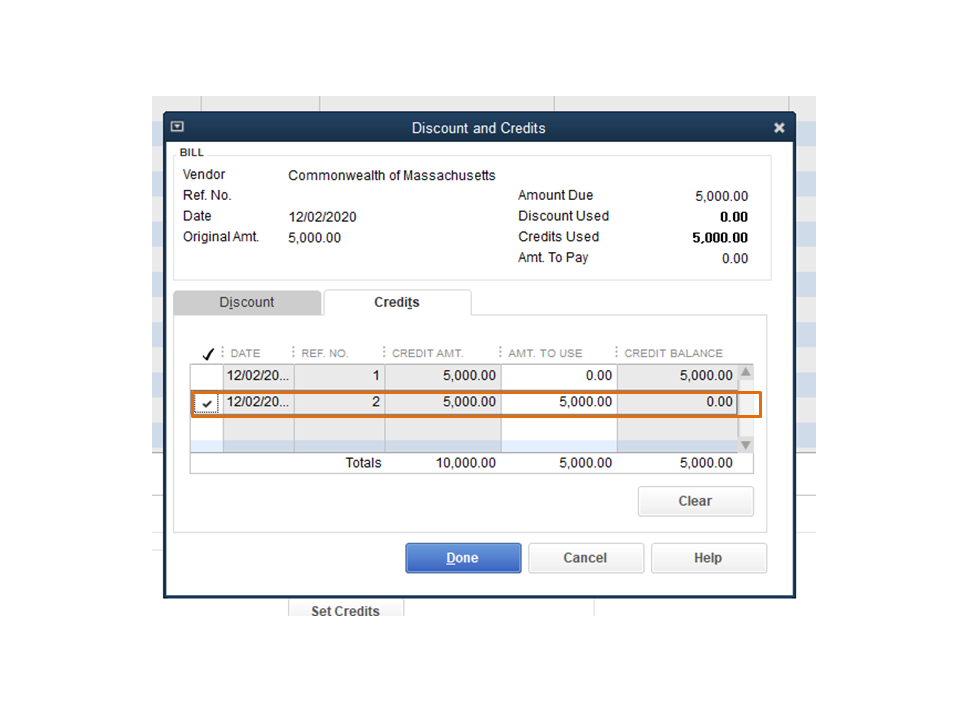

Also, please make sure you select the correct vendor from the JE to ensure it shows up to the credits. Please see sample screenshots below for your visual reference:

If you're referring to something else, please don't hesitate to let me know. You can add more details down below, and the Community will get back to you.

Additionally, I recommend visiting the following article to fix Accounts Receivable (A/R) or Accounts Payable (A/P) balances on a cash basis: Resolve AR and AP balances on the cash basis Balance Sheet.

Fill me in if you have additional questions about clearing the payables in QuickBooks Desktop. I'm always here to help. Take care always.

Still doesn't show up. I can see my journal entry in the same spots as your screenshots.

Thanks for coming back to the Community, KelbyR.

I appreciate following the troubleshooting shared by my colleague and letting us know the result.

As mentioned above, some payments were not applied to the payables. That’s why you’re unable to see the journal entry.

There are several ways on how to handle this type of situation in QuickBooks. The troubleshooting is scenario-based, so I suggest following the steps that fit your situation: Bill shows as unpaid after writing a check in QuickBooks Desktop.

If you wish to link the check to the bill, use this option if the entry has been reconciled. Let me guide you through the process.

To pay the transaction:

However, if these steps don’t apply to your situation, choose the solution that works for you. To keep your client’s accounts payable records in order, let me share this article that covers all the information: Accounts Payable workflows.

Please let me know if there's any other way I can be of assistance. I'm just a few clicks away if you have any questions. Have a great day ahead.

After reviewing the checking account I found that this method did create checks in the the checking account that threw off my cash balance. I don't recommend this method for anyone who finds this afterword.

I WANT THE $373.61 PUT BACK IN MY ACCOUNT. I DID NOT AUTHORITIES FOR YOU TO TAKE THIS MONEY

I hear your sentiments, hunter1952. I'm here to guide you to the right support available.

For security purposes, we are unable to access your account information through this public forum.

You'll need to contact our phone or chat support so our agents can take a look at the charges on your account and figure out what's going on. They can also process a refund if necessary.

Follow these steps to reach out to our support:

Just a heads-up, the operating hours for chat or phone support depend on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

Moreover, you can check out this article to learn about the charges on your account: Understand Intuit charges on your credit card or bank statement.

Please know that you're always welcome to post if you have any other concerns about managing your QBDT account. I'll be sure to get back to you. Keep safe!

How about QB gets fixed so that we accountants, using the accountant's copy, can actually just enter in this screenshot. Sure, there are highlighted fields, but we can't actually do anything in them. The solution shown above does NOT solve this issue.

Hello there,

I understand the importance of this matter to you and your business. Currently, this is the default design configured in QuickBooks Desktop. As we value your suggestions, I recommend sending your feedback to our Product Development Team. Here is how:

Also, feel free to visit our Feedback forum page to see a list of other QuickBooks users who have already suggested this feature and for the recent updates in QuickBooks.

You can utilize this article for future reference: Customize reports in QuickBooks Desktop.

For additional QuickBooks-related concerns, don't hesitate to post them here in the Community. We're always available and willing to lend a hand to your queries. Have a great day ahead.

Your help...is about worthless. This question was directly related to the Accountant's Copy and how to get it setup to allow for the Accountant to Set Credits. Obviously the Accountants who use this product know more than you do.

Not HELPFUL

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here