Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello, I'm new at working with QB Online and I reconciled for 2018. I show a $0 difference, but I still have uncleared deposits and checks. What do I need to do in order to check them off my list? Will these uncleared items affect my overall P&L?

Solved! Go to Solution.

Thanks for dropping by, Cavecloth.

I can share with you some information about uncleared deposits and checks in QuickBooks Online.

The uncleared deposits and checks in QuickBooks Online are not yet cleared in your bank, so you can leave those transactions as is. You can filter the reconciliation page to show the cleared transactions only.

Transactions that are cleared and uncleared will not affect your P&L since the report is accrual/cash basis.

You can check these articles for more insights about reconciliation:

If you need help with QuickBooks in the future, you can call our dedicated team who will be happy to assist you. Our contact details can be found here along with our opening hours:

Should you need anything else, don't hesitate to fill me in. Have a nice day.

@Rose-A wrote:

Transactions that are cleared and uncleared will not affect your P&L since the report is accrual/cash basis.

It should be mentioned that this would depend on how old the uncleared items. If they are older than a week or 2 then they are probably errors.

the "accrual/cash basis" reference makes no sense

Thanks for dropping by, Cavecloth.

I can share with you some information about uncleared deposits and checks in QuickBooks Online.

The uncleared deposits and checks in QuickBooks Online are not yet cleared in your bank, so you can leave those transactions as is. You can filter the reconciliation page to show the cleared transactions only.

Transactions that are cleared and uncleared will not affect your P&L since the report is accrual/cash basis.

You can check these articles for more insights about reconciliation:

If you need help with QuickBooks in the future, you can call our dedicated team who will be happy to assist you. Our contact details can be found here along with our opening hours:

Should you need anything else, don't hesitate to fill me in. Have a nice day.

@Rose-A wrote:

Transactions that are cleared and uncleared will not affect your P&L since the report is accrual/cash basis.

It should be mentioned that this would depend on how old the uncleared items. If they are older than a week or 2 then they are probably errors.

the "accrual/cash basis" reference makes no sense

I'm also having the same problem. However the transactions are from years back. Almost as if checks were written but then never used or voided. They've been hanging out there for YEARS. I'm unable to find them or pull a report listing only these. The only time I see them is when I'm reconciling the monthly bank account. Having to scroll down 20+ lines of useless transactions to get to the current date is bothersome. Especially if there is a resolution to remove them properly.

Replacing the previous bookkeeper and I'm finding all these transactions when reconciling. These are years old and there are many of them. As if the transactions were not used or voided, just ignored. They don't surface until I'm scrolling through 20+ of them to work the current reconciliation. I've tried several different ways of reporting and they all hide. I can't fix them while in reconciliation, but I can't find them otherwise.

Hi there, @DeadWood,

You can delete those unused checks so they won't appear on your reconciliation page.

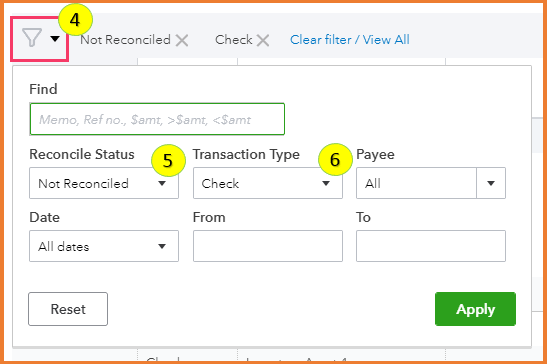

Let's first locate those checks from your Chart of Accounts, then delete them from there. It's easier to find them by customizing transactions using the Filter icon.

Here's how:

Upon sharing this suggestion, I still recommend consulting with an accountant first before making any changes on your account. He/she might have specific instructions on how to handle these transactions.

I've also added this article to learn more about bank reconciliation: How to Reconcile an Account in QuickBooks Online.

Upon sharing this suggestion, I still recommend consulting with an accountant first before making any changes on your account. He/she might have specific instructions on how to handle these transactions.

Drop me a line if you have follow-up questions about the solution above and I'll get back to you.

Hi Deadwood,

I am experiencing this same issue. Uncleared checks/payments from months ago that are not duplicate transactions. I am unsure how to resolve and every time I call QB's support they can not figure it out either. Have you found a solution? Thanks.

It's nice to have you in the thread, @JP2016.

Since you've confirmed that the transactions aren't duplicates and haven't cleared, they will appear on the screen until they are marked as reconciled. However, I'd recommend double-checking these transactions to ensure that they haven't cleared your financial institution. While a vendor may not immediately cash a check, one would expect it to be cashed within the stated time frame.

I'm including an article on customizing a report to see uncleared checks to make this process easier: Run a report of uncleared checks.

Please feel free to let me know what you find by commenting below. Have a great day.

Having a related issue. We moved from QB Desktop to Online and ran our first reconciliation report just for the month of January 2020 since QB was up to date through 12/31/2019. However, the reconciliation included the entire history of transactions sitting in the QB import. We correctly reconciled January to a $0 amount. But the reconciliation report now shows all of the transactions from before Jan 1, 2020 as uncleared. This is causing the register balance as of 1/31/2020 to be off from the amount it should be. It should be lower by the amount of uncleared checks and deposits from January ONLY, not all the ones from prior periods. Is there a way to fix this?

Hello there, @ajlitt.

Let me provide some information about uncleared transactions in QuickBooks Online.

When you say you're having trouble reconciling, are you referring to your opening balance? If so, once you've unreconciled transactions from previous periods that have appeared on your bank statement but your opening balance matches, possible is, there are transactions that have already been accounted for (duplicated and marked with an R).

To resolve this, you'll need to identify the transactions by following the steps in this article: Troubleshoot reconciles when the opening balance is correct.

If you're referring to something else, any details you can provide is extremely helpful for us to narrow things down.

For additional reference, you can check this article: How to fix differences between QuickBooks balance and bank balance.

Drop your comment below if you have any have any other questions and concerns. Have a good day!

Thank you for getting back to me :).

The problem is that the now finished reconciliation report shows uncleared deposits and uncleared payments for our entire history (back to 2005). We were only trying to reconcile January 2020 since our books were up to date in QB Desktop through 12/31/2019. When we synced the bank statements, we only pulled transactions as early as 1/1/2020. I don't know why all of the QB transactions prior to 1/1/2020 were included in the reconciliation report. Now the line item at the top of the Reconciliation Report, "Uncleared transactions as of 1/31/2020) is off by a material amount. I need to know how to change this number to reflect reality, as the register balance on the Report is now overstated. I hope I've explained the issue better. Thanks again!

Thanks for clarifying this with us, ajlitt.

Once you connect your bank to QuickBooks Online (QBO), it automatically pull up 90 days of transactions. Thus, transactions prior to January 2020 will be included. This is the reason why it's showing an incorrect balance amount on your Reconciliation Report.

In this case, it's best to get in touch with your accountant as they have the special tools to help you clear those transactions and assist you with the whole reconciliation process.

Drop a comment below if you need more help or other questions. It's always my pleasure to assist. Have a great day ahead.

I am having an issue where we have some outstanding items from 2014 that do match online banking but were never reconciled. They continue to show as outstanding each month and I would like to clear them up. I did not prepare the reconciliations until 2018, and it appears that one big reconciliation was done from 2012-2015. Is there a way to fix this? They show as a C in the register, but if I attempt to change to an R it messes up my beginning balance for the next months reconciliation..

Thank you for providing the details of your outstanding transactions, @Lindsey B.

You can create a journal to write off the amount of your outstanding transactions in QuickBooks. However, you'll need to consult your accountant first before trying out this option to ensure if this is the best practice for your business.

Here's how you can write off the amount for Accounts Receivable:

Once done, apply the JE to the existing credit/debit by following the steps below:

For Accounts Payable, here's how:

Then, apply the journal entry to the existing debit/credit.

I'm always here if you need further help with this process. Take care and have a nice day!

How can we remove customer payments and deposits that show in our uncleared payments and deposits report? When we reconcile the bank statements we are seeing lots of items that have not cleared the bank. Upon investigation we have found a mixture of duplicates and erroneous payments and deposits that we put into quickbooks but there was never a customer job nor real customer, how can we get rid of these and off the books.

Thank you for reaching out to the Community. I'm here to help you sort this out, @trcddc1990..

In QuickBooks Online, the transactions are downloaded automatically from your bank. We can exclude and delete the duplicate transactions to correct it.

I'll guide you on how to Exclude the Transactions:

Once transactions excluded, these items are no longer reported as part of your business finances and will not appear in any associated account registers or reports.

I've got a great article for you that provides additional details on excluding transactions. You can view it by clicking this link: How to exclude expenses from downloaded bank transactions.

That's it. This should help you point in the right direction. Let me know if you have further questions. I'll be here to answer them. Have a great day!

I have this same issue. the deposits are showing up on the reconciled statement but they're still here!!!

How is this happening...the issue is 2 accounts receivable payments that are showing up unreconciled!!

Thanks for joining this conversation, @cathymarietta99.

If the two accounts receivables are still uncleared, so you can leave those transactions as is as mentioned by my colleague above. However, if they're already cleared or reconciled by still showing, I highly suggest contacting our Support team. They have tools that can pull up your account in a secure environment and investigate this further. They can also perform some troubleshooting steps to fix this for you.

Here's how to reach them:

Just in case, I'll add these articles for future reference:

Please let me know how it goes or if you have any other issues or concerns. I want to make sure everything is taken care of for you. I'm always here to help. Have a great day!

Hi,

I am having the same issue. However, while the deposit made show cleared, the received payments are showing not cleared. The date for deposit and received payment are the same. I see on the bank statement that this deposit has been cleared as well. This is causing my bank actual balance vs. QBO bank balance to be incorrect.

For example:

On 3/27/2020 - a deposit made in the amount of $3800.00 This deposit consists of various invoices (see below)

inv#1 - recev'd payment $2400.00

inv#2 - recev'd payment $800

inv#3 - recev'd payment $350

inv#4 - recev'd payment $250

What do I have to do to clear the received payments?

Thank you

Thanks for joining us here, easybookkeeping123.

You can manually clear these transactions in your bank register. Here's how:

Let me also share these articles to share more details:

The Community is always here if you need anything else.

I have uncleared check and payments and uncleared deposits that are more than a year old. Those are obviously errors, but... How do fix them?

I'm glad to see you here in the Community, @orthosolutionsok.

You'll need to mark these transactions as "C" to clear them again in your bank register. You can follow the steps provided by my colleague, @JenoP, to fix the uncleared in register.

Before doing the steps, I'd also recommend seeking professional advice from your accountant about this. They'll be able to provide an option that suits your company setup.

I've added an article for more information about reconciling an account for months or year-old transactions: Reconcile.

Let me know in the comment section if you need further assistance. Have a good one.

I also see numerous items that are uncleared transactions after successfully reconciling the bank account. I have looked at some of the suggestions to clear these, but here is my question. Is there a way to do this on a backup copy of the books, in case my changes don't work as I had planned? Thanks

Thanks for joining us here, norm22.

We're unable to create a local backup copy of your data in QuickBooks Online. This means that there's no option to clear or changed a transaction's reconciliation status in a backup copy of your books.

You'll want to reach out to your accountant before making any changes to make sure that your bank account is reconciled properly.

You can also reach out to our chat or phone support while clearing the transactions so they can guide you through. Here's how:

Let me know if you need anything else.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here