Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowCan anyone, especially from Intuit, explain why when I file my 1099s through Quickbooks Online, I'm told that our contractors will all have their forms mailed to them. However, the email that each receives makes no mention of forms being mailed, instead leading them to believe they must sign up for an Intuit account to receive their tax forms.

I thought they weren't reading their emails carefully. Nope. That's exactly how the emails read. I view this as ... well, kind of slimy plus it's a pain in the butt to respond to all the contractor emails. I paid Intuit for the service of sending out these forms, not for them to use it as a data collection method.

Hi there, @bobransom.

I'd like to provide clarifications regarding the email that was received by your contractors regarding their forms.

When inviting a contractor to enter their W9 information, they can create a QuickBooks Self-Employed account for free. This way, they can securely share their tax info with you and view the 1099 form after you've filed them.

To learn more about this process, please see this link: Learn how your contractors can add their own 1099 tax info.

On the other hand, customers who have submitted their 1099 E-File forms will receive a confirmation email approximately a week after the IRS accepts and confirms submissions. You may not receive this confirmation until the middle of January or later.

After you submit the 1099-MISC to the IRS, your contractors will get an email when it's ready for download. Let them select the link in the email to sign in to QuickBooks Self-Employed.

They can sign in to QuickBooks Self-Employed to view or print your 1099-MISC.

To do that:

For more details about how they can view the 1099 forms, feel free to read through this reference: Learn how to sign in to QuickBooks Self-Employed to get your 1099-MISC.

Keep me updated here on how things turn out by clicking the Reply button below. I'll be here to help get you back to business. Take care!

BettyJane,

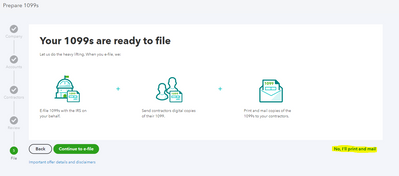

I think you missed my point. On my end, Intuit tells me:

"What happens next

Note item #2, "We'll print and mail 1099s..." Yet the email sent to the contractors makes no mention of this, instead leading them to think they HAVE to sign up to get their tax forms. And many don't want to sign up ... so instead they email me asking me to send their form because they don't want to sign up. Which ends up taking more time than if I'd just printed these out and had someone stuff envelopes. It would have been less hassle.

Thanks for coming back, bobransom.

Your contractors can download a QuickBooks Self-Employed (QBSE) trial version so they can submit and view the 1099's. After you submit the form to IRS, your contractors will be invited to your 1099s online. They can click on the link in the email they receive and they'll be redirected to log in to your account.

They can also access the QuickBooks Self-Employed Test Drive to view the 1099-Misc forms. Here's how:

For more details about this one, see the Fill out a W-9 and view your 1099-MISC in QuickBooks Self-Employed article. Feel free to visit our Tax forms page for more insights about adding and managing your tax forms.

I'd like to know how things going after your contractors perform the steps provided, as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Take care always.

Here’s an example email, one that I just received today:

————————

I understand the impact of any delay in sending the 1099 forms to your clients, @bobransom.

Let me share some information to ease the confusion on how your clients can access and view their 1099 forms.

When you initially prepare your client's 1099 form, they'd be asked to asked to enter their W-9 information. To do so, they'd have to sign up for a free QuickBooks Self-Employed account.

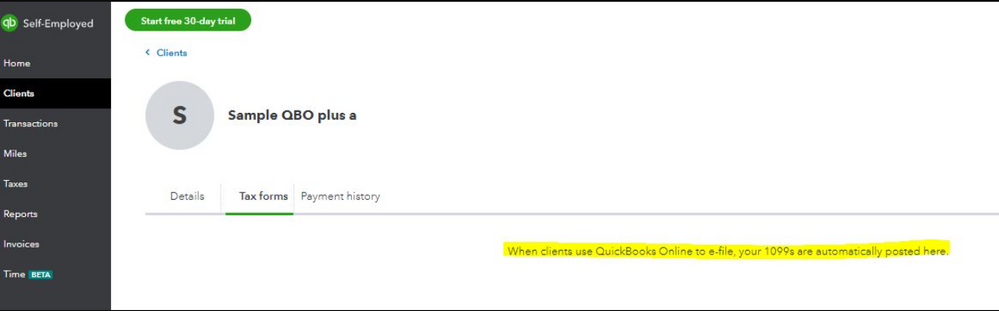

Once completed and you have e-filed the forms, it will be posted automatically to their free QuickBooks Self-Employed account. They'll see it in the Tax form tab.

Since your client no longer have a QuickBooks account, you can resend the invitation to them. The other way is to download and mail it to your clients. Here's how:

You can check our guide on printing 1099s in QuickBooks Online for more detailed steps.

Feel free to leave a comment below if you have other questions or concerns about tracking your income and expenses. I'm always here to help.

So...what if they already run their business on QB? I have one who has QB but can't access and would like to access. They shouldn't have to create a new account if they already have one.

Hi there, BurnsDC.

They don't have to create a new account. Can you tell us what happens every time the contractor accepts the invite and access QBSE?

Make sure to send the invite to the email address that they're using for their existing QuickBooks account. Use the step in this article for more details: Invite A Contractor To Add Their Own Tax Info.

Then, they have to open the link attached to the email and click Sign In. After successfully signing in, they would see a Clients menu where they can see their 1099s.

Add a reply below to share more details. We'd want to make sure that we get this sorted out.

Not sure the question Bob asked was ever answered, and the answer given leads to the same confusion I have when it comes to the email and the printed mailed copies. I would like to have it confirmed that BOTH an email will be sent AND a paper copy printed and mailed to the contractors by Qbooks.

Hi there, @melon 9649. I'm here to share additional information to clear up the confusion.

When you invite your contractors using QuickBooks Online (QBO), QuickBooks will send them an email inviting them to fill out and submit their W-9 info. They can either log in with an existing QuickBooks Self-Employed (QBSE) account or create a free account. If they update their info at any time in their account, the info automatically updates in QBO.

After you submit your contractors' 1099 forms to the IRS, they'll get an email when it's ready for download. Your contractors will have access to it in their accounts. For more info, direct them to this article: Fill out a W-9 and view your 1099-MISC.

Otherwise, if they don't want to create a QBSE account, the employer or client will be the one to give them their 1099-MISC. We also have a video tutorial for preparing 1099s: How to file your 1099-MISC and 1099-NEC.

The Community is always here if you need further clarifications with sending out 1099 forms. We're always here to answer them for you.

Hello, LieraMarie_A,

The point I was making in my original post was that the Intuit 1099 site said that all of my contractors would receive their documents by mail and that they could also log in to retrieve them electronically. Unfortunately, that wasn't how it worked at all.

As you have pointed out, in actuality they must either log in to an existing Intuit account or create a new one. Based on last year, at least half of our contractors do not have an account nor do they want one. From my point of view, I was told that copies would be mailed but they weren't — which made the investment in the 1099 program a waste of time and money.

I've gone back to sending everyone paper copies. In the end, it's easier and cheaper, and we don't have to take part in Intuit's "sign up for free" data gathering.

Hello,

This continues to be confusing. Your response indicates that I need to print and mail/give the 1099 to the contractors. However, on the qbooks page it says: See point #3.

E-file By 5PM (PT) on January 27, 2022 So, my question is, I signed up for E-file. WILL PRINTED COPIES BE SENT TO THE CONTRACTORS BY QBOOKS? |

I'm here to provide additional information about your 1099 e-filing concern, @melon 9649.

In QuickBooks Online (QBO), the digital and paper copies will be automatically sent to your contractors. A PDF copies of all your forms is created by Intuit E-file Service. To get more information about this, feel free to visit this article: E-file 1099s your way.

It's easy to track and monitor your employee information and your company's finances in QBO. To do so, you can pull up any payroll reports suit your needs. Each report has corresponding data that they display, you can also export or print them to have a handy copy that you can use as a reference.

If you have any other questions about e-filing your forms in QBO, please leave a reply below. I'd be happy to help you further. Have a good one.

I have a question for this that I don't think was fully answered -

I put in an email address to send the 1099 too, but that particular person was not the correct email address to have them view it. So I went in and took the email address out of the 'vendor' information and put in the correct information; however, the 'view your 1099' form is still being sent to the wrong email address. How do I get it to stop sending/spamming my vendor with 'view your 1099' when she's not the correct person to send that to? Thanks!

Hello, KStill333.

Let me help you get to the bottom of this and make sure you're able to send the 1099 to the correct email address.

Some functionalities in QuickBooks may not work properly due to an outdated cache files stored in your browser. Let's do the basic troubleshooting to rule this out.

We can start by opening an incognito or private browser. This mode will not save your browsing history.

You can use these keyboard shortcuts:

Next, sign in to your QuickBooks Online account and correct the email address in the Vendor information page. If the 1099 is sent to the correct email, go back to your regular browser and clear its cache. Finally, restart your browser to refresh the settings.

In addition, you can try using a different supported browser.

I'm adding this article to learn more about inviting the contractor or vendor to view their 1099s: Invite a contractor to add their own tax info.

Please keep in touch with me here if there's anything else you need. I'll be around to help you out again. Take care always.

I've fully taken out the vendor emails listed in the vendor profile. I just need the 'view my 1099' emails to stop spamming my vendor. Will taking out the email from their profile completely stop this? I already had done this previously and had put in the correct email but it's still being sent to the wrong one. I have now completely removed the email addresses on their profile.

Hello, KStill333.

Yes, you're correct. Removing the email address on their profile will stop them from receiving notifications.

Here's how to remove it:

Check the email address to where it was updated and confirm that 1099 was sent. You can also invite a contractor to add and view their own 1099 tax info.

Feel free to post your questions here if there's anything else that you need help with. You stay safe and take care!

What does the actual email containing the 1099 information look like? What email address is it sent from? Also, does Quickbooks mail copies of the 1099s to street address on file for each contractor? Thank you.

Hello @Rg1911,

Let me help share how your client will receive the email from QuickBooks for their 1099 tax information.

Normally, the email is an invitation letting your contractors create a free QuickBooks Self-Employed account for their tax information. When the forms are ready after you, as their employer filed them, they can view their 1099 form on the Forms section under the Clients menu.

Here's an article to read and learn more about how contractors can enter and view the said information: Fill out a W-9 and View your 1099-MISC in QuickBooks Self-Employed.

I've also included this reference so you can share this with your contractors: QuickBooks Self-Employed Overview.

If there's anything else that I can help you with aside from this 1099 information concern, please let me know in the comments below. I'll be here to lend a hand. Take care always!

Please answer the question: Does Quickbooks/Intuit mail actual hard copies of the 1099s to the independent contractor's street address on file? No one has answered this question yet...when I efiled the 1099s with Intuit it stated that the 1099 would be emailed and mailed.

Good morning, @rg,1911.

Thanks for coming back and asking for additional clarification on 1099s.

If you used the steps in this guide about creating and filing 1099s in your QuickBooks Online account, then we'll take care of mailing a printed 1099 copy to your contractors. Afterwards, they'll be able to use it for their tax filing.

There are also further questions at the bottom the article that we answer for you as well.

I hope this answers your question about 1099s. I'm only a post away if you need me again. Have a wonderful rest of your week!

When will the paper copies get mailed to the contractors? Thank you for your help.

Also, how do I send a reminder email to contractors letting them know they are able to view their 1099 online via Quickbooks? Most of our contractors deleted the email because they thought it was spam.

Hi Rg1911,

I understand the importance of making sure your contractors receive their 1099s. I'm happy to share information about the schedule.

If you filed through QBO and IRS receives your forms, that's the time we mail paper copies to your contractors. At the same time, we send them emails to view their forms online.

It's okay if they've deleted the email, they can just sign in to their Intuit account to view the forms. If they don't have one, they can click Create account on the Sign-in page to sign up for a QuickBooks Self-Employed free trial where they can view the forms.

View 1099 forms online:

On the other hand, if you want to know if the IRS received your submission, you can follow Step 5 of this article: Create and file 1099s using QuickBooks Online.

Let me know if you have additional questions about 1099s. Take care and have a good one!

Again, you're not hearing this person. It is WRONG for me as a business owner to pay for this service only to have you use this as a data grab for my vendors. He's right. It is a slimy practice. I want to end my relationship with you as soon as possible

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here