Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWorked perfectly! Thank you!!!!!!

Thanks for joining the Community, KLaughter.

I'm happy to hear my colleagues were able to help with preparing your 1099-NEC form(s).

You'll also be able to find many useful resources about using QuickBooks Online Payroll in our help article archives.

Please feel more than welcome to post a reply if there's any questions. Have an awesome day!

Thanks-I called QuickBooks again today and was told the problem with alignment still isn't fixed. I hope they fix it before the 2/1/21 deadline.

I have one vendor that I need to print a 1099-NEC for. Time is getting close to the deadline to submit these. I have checked the 1099 box on the vendor, and the vendor meets the threshold. But alas, he does not show up as needing a 1099. Do you have a step by step instruction for adding a Chart of Accounts account that will enable me to print a 1099 by the deadline?

I have another way to ensure that you'll find vendors on the 1099 list, Zakbar.

There are a few steps you can take now to ensure your chart of accounts is properly mapped for both the 1099-MISC and 1099-NEC forms and reports.

If you using QuickBooks Online, first create a 1099 Transaction Detail report to identify amounts paid to which accounts.

Step 2: Add a new account

Add a new account to your Chart of Accounts to track the separate payments.

Please read this article to complete the steps: How to Modify Your Chart of Accounts For Your 1099-MISC and 1099-NEC Filing.

For QuickBooks Desktop, if you need to file both the 1099-NEC and the 1099-MISC, you'll need to create a new expense account for all the accounts that will be reported on the 1099-NEC or 1099-MISC. A single account can only be used for each form. Then, once you have set up your new expense account in your QuickBooks file, you will need to use a journal entry to move the amounts from one account to another.

Also, make sure that you've properly set up your vendor profile so that the names will show on your report.

Then, make sure to run the 1099 Wizard to verify the data, map the accounts, and prepare the form for filing. Here's how:

Please read this article for your 1099's: How to Modify Your Chart of Accounts For Your 1099-MISC and 1099-NEC Filing.

For additional reference, check out these help articles for your payroll.

Post a comment on this thread if you have any other questions with 1099. We're always right here to help.

Thanks. Yes, that helped. However, I did have to go back and select the ACCOUNTS that I used to pay my contractors. (step 2)

All done.

PS, I did not have to create a new account in the Chart of Accounts.

Thanks. Yes, that helped. However, I did have to go back and select the ACCOUNTS that I used to pay my contractors. (step 2)

All done.

PS, I did not have to create a new account in the Chart of Accounts.

How does this rate a "SOLVED"? What are we to do if the software is not ready in time for filing?

I can help you prepare and file your 1099s, @finallysue1.

It'll be marked as Solved once accepted as a solution by the one who posted the question.

The 1099s are due to the IRS and your contractors by February 1, 2021. If you're e-filing from QuickBooks Online (QBO), we recommend you to do it before January 28, 2021 at 5:00 PM PT.

You can now create and e-file your 1099s in QBO. Here's how to do it:

For detailed guidance, I suggest checking this article: Create and file 1099s using QuickBooks Online.

If you need further help preparing your 1099s and or anything else, let me know in the Reply section below. Take care and have a great rest of the day!

I need to speak with m merchandel. We got cut off and had already spent about an hour working on my problem

The Community has your back, @m merchandel.

First, may I know the QuickBooks problem you're having? Is it related to the 1099 form? If so, you can leave a comment or add some details below. This way, I can assist you right away.

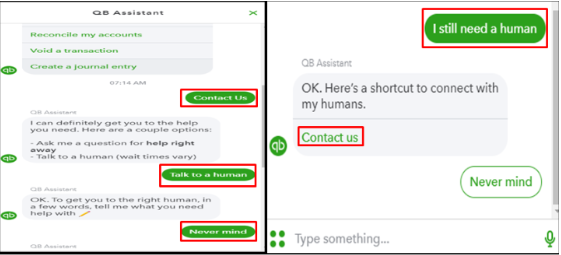

Meanwhile, I can help you get in touch with our live support. One of our representatives can help you connect with the previous agent (m merchandel).

You can also ask for assistance from other support agents and continue where you left off.

Please review our support hours to ensure they can assist you promptly.

Here's how to contact our support:

Also, you can visit our general support page for more QuickBooks tips.

I'll keep this thread open for further QuickBooks discussion. Feel free to click the Reply button to add your comments below. I'm looking forward to your reply soon!

skogensover,

Have you heard back from Intuit regarding the printing alignment fix? The alignment of data in both top and bottom 1099 forms is off and I cannot fix one form's alignment without messing up the other form even more.

Thanks.

Hi!

I tried all of the mentioned methods but still couldn't get my Quickbooks Desktop version to change from 1099-misc to the 1099-nec filing. I can see the 1099-misc forms being prepared (as in previous years) but I cannot see 1099-nec anywhere in this software. All our 1099 contractors need to be filed using 1099-nec starting this year, so the 1099-misc needs to switch to 1099-nec. Can anyone please advise where I can find the button to set up (or switch to ) 1099-nec? I've made sure I already updated my 1099 functionalities and payroll downloads, etc.. Your prompt reply will be greatly appreciated.

Thanks for bringing this one to our attention, DCP1.

We can report a payment as NEC if we met the following criteria below:

We'll have to modify your chart of accounts and create a new account to be used to track the payments made for your 1099 - NEC forms. Just follow the steps and details in the How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing article. Then, print your 1099-NEC form by following the steps below:

For more details about filing 1099s, see the Create and file 1099s with QuickBooks Desktop article for more details. To learn more about how you can prepare the form with the detailed steps outlined in this article: Learn what you need to do in QuickBooks if you need to file both a 1099-MISC and 1099-NEC.

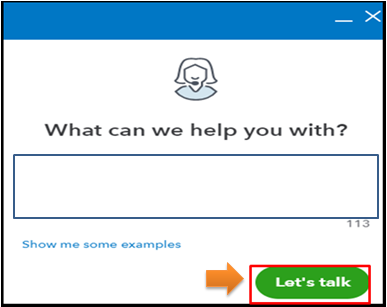

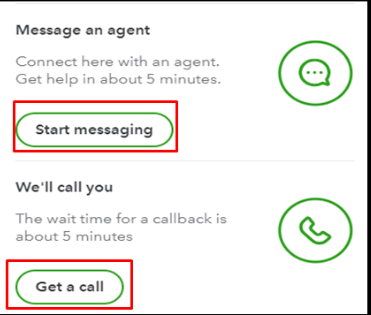

If you need further assistance in creating your 1099-NEC, feel free to reach out to our Customer Support Team. They'll pull up your account in a secure environment and help you with this one. You may send a message via chat, call us at a time convenient to you, or we’ll get in touch with you instead. To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. See our support hours and types for more details about this one. Here's how to reach them:

I'd like to know how things going after contacting our support agent, as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Take care always.

When I view the 1099 nec before e-filing, it shows one of the state withholding numbers of the company but not the one for the state the independent contractor lives. How do I change that or get it to omit the state withholding number since no taxes were withheld?

I'll be glad to guide you in editing your withholding number in QuickBooks Online, ARP.

Here's how:

For more information about filing Federal 1099s with QuickBooks Online, I suggest checking this article: Prepare 1099s.

Additionally, you can always visit this website: 1099s Overview. This provides answers to the frequently asked questions about the form.

If I can be of any other assistance, please don't hesitate to leave a comment below. I'll be around to assist you.

I do not have a setup tab under payroll settings. Both state taxes are setup but the 1099 is pulling the NJ withholding tax number instead of the GA withholding tax number.

You’re doing the right steps, @ARP.

The reason why you don’t have a Setup tab in the payroll settings is that your 1099 was already set up. You’ll want to click the 1099 NEC then proceed with the steps given by CharleneMae_F to edit your withholding number in QuickBooks Online.

Also, you can contact our support team. A representative will further assist you with the process.

Here’s how:

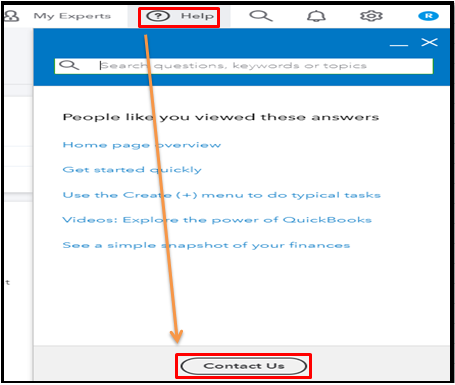

1. Click the Help menu in the upper right-hand corner.

2. Choose Contact Us.

3. Enter a short detail about your concern and hit Continue.

4. Click the Start a chat button.

If you need to know more about the QuickBooks Online support hours type, you can refer to this link: Support hours and types.

You've got me here in the Community if there's anything else you need. Keep safe always, @ARP.

Hi,

When I go to prepare 1099s I can see all the contractors (their records have 1099 checked), but

when I go to process forms in Categories I see both NEC (contractors) and MISC (Rents) as Box 1.

On choose both I assign from dropdown menu the accounts but when I go to the next step it only shows

MISC (Rents) account - none of the contractors for NEC.

When I go to 1099 Transaction Report, none of the contractors show up although they are assigned to

be filed for 1099 on each one.

For contractors I have used a Parent Account CONTRACTED SERVICE (EXPENSE). Should I create a

new account, Cost of Labor? or Cost of Goods?, and move the current contractors from Expense account?

Very confusing ;-)

Thanks for bringing this one to our attention, kulike.

The option to get rent into the 1099 NEC form is unavailable. QuickBooks only lets us report non-employee compensation and will automatically exclude payments that are not part of the 1099-NEC. We can report a payment as NEC if we met the following criteria below:

Also, there are a few steps you can take now to ensure your chart of accounts is properly mapped for both the 1099-MISC and 1099-NEC forms and reports. We can create a 1099 Transaction Detail report to identify amounts paid to which accounts. Here's how:

For more details about this one, see the How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing article. To learn more about the 1099 form and how you can prepare for the 2020 tax season, kindly check out this article: What is a 1099 and do I need to file one?. It includes topics about 1099-NEC, 1099-MISC, and steps on how to e-file your 1099's to name a few.

On the other hand, for contractors who have used a parent account contracted service (expense), we suggest contacting your accountant about this one. They'll guide you on how to best handle this one if there's a need for you to create a new account, cost of labor or cost of good, or move the current contractors from the expense account.

If you need further assistance in preparing your 1099 forms, feel free to reach out to our Customer Support Team. They'll pull up your account in a secure environment and help you with this one. You may send a message via chat, call us at a time convenient to you, or we’ll get in touch with you instead. To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. See our support hours and types for more details about this one. Here's how to reach them:

I'll be right here to continue helping if you have any other concerns or questions about QuickBooks. Assistance is just a post away. Have a great day ahead.

Rent is still reported on Form 1099-Misc

Hello there, @skogensover.

Let me share additional information on how your 1099 transactions are reported.

Form 1099-MISC is for miscellaneous Income, is an information return businesses use to report payments (e.g., rents and royalties) and miscellaneous income. Here are the other types of payments reported under 1099-MISC:

On the other hand, here are the additional payment types that are reported under 1099-NEC form:

Lastly, I'm adding these resources to help you about managing and correcting 1099s you've already submitted:

Get back to us here if you have other questions about here if you have other questions or concerns about preparing your annual tax forms in QuickBooks. I'm always here to help.

Not sure if everyone has found the solution but this worked for me this morning (1/26/21) - now off to make the JEs to recategorize my vendor payments!

The problem seems to be that the company is based in one state but has an independent contractor in another state. The independent contractor works from home and has never worked in the state the company is based. The company has a withholding number in the state the independent contractor is based but does not have a physical address in that state because everyone works from home. QB seems to think the 1099 info needs to be reported to the state the company is based in not the state the independent contractor is working in. I cannot get anyone on the phone from either state's revenue department so I can get clarity. Does anyone know which state the 1099 should be filed?

Hello @ARP,

Ideally, instructions for filing your 1099 form is mandated by your state agency. You can read this article to learn more: Do I need to file 1099 forms with my state?

You're on the right track, I'd still recommend contacting your state agency for clarifications about where should you file your forms especially with your case and your contractor's situation.

On top of that, I've got you this helpful article for guidance in preparation for the 2020 tax season: 2020 Year-End Resources.

If there's anything else that I can help you with, please let me know by leaving any comments below. I'll be here to lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here