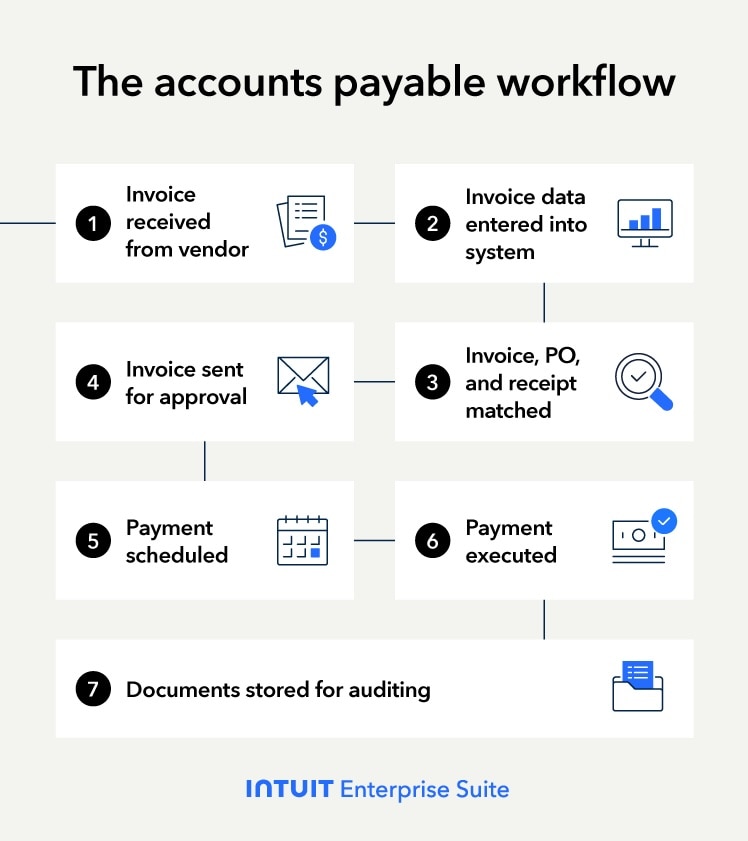

Approval bottlenecks

Even if an invoice is received and entered correctly, it can still get stuck in the approval process. This often happens when approval workflows are poorly defined, overly complicated, or simply not followed.

Imagine an invoice sitting on someone's desk (or in their inbox) for days or weeks while the payment due date looms closer. Chasing down approvers and managing exceptions becomes a full-time job in itself, pulling AP staff away from other critical tasks.

Inconsistent information

Three-way matching—comparing the invoice, purchase order, and receiving report—is essential for accuracy. But what happens when those three documents don't agree?

Discrepancies in quantity, price, or even item description can derail the entire process. Resolving these issues often requires manual investigation, back-and-forth communication with vendors, and a significant time investment.

Lack of visibility

Without a clear, real-time view of the entire accounts payable process, it's like flying blind. You can't easily track where invoices are in the workflow, identify bottlenecks, or monitor key performance indicators.

This lack of visibility makes it difficult to manage cash flow effectively, proactively address potential problems, and make informed decisions about your spending.

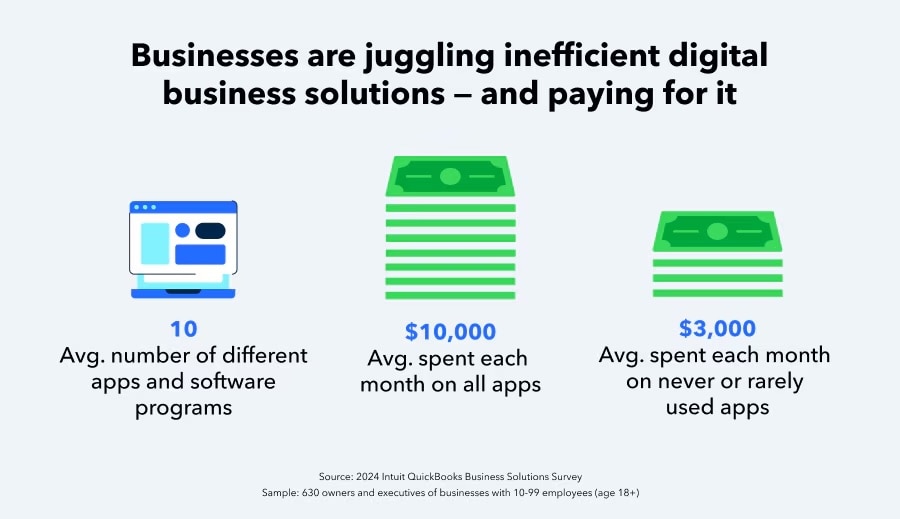

Too many apps

Many businesses today suffer from "app overload" because they’re using a multitude of separate software applications for different aspects of their operations.

This can be particularly problematic for the accounts payable workflow.

You might have one app for invoice scanning, another for approvals, a separate accounting system, and yet another for payment processing. This fragmented approach leads to:

- Data silos: Information is scattered across different systems, making it difficult to get a complete picture of your AP process.

- Manual data transfers: Data often needs to be manually exported and imported between apps, increasing the risk of errors and wasting valuable time.

- Integration headaches: Getting different apps to "talk" to each other can be a complex and costly undertaking.

- Increased costs: Paying for multiple software subscriptions can add up quickly.

- Unused software: You may have unused subscriptions that you forgot about.

Optical Character Recognition (OCR) technology can scan invoices and automatically extract this data, significantly speeding up the process and improving accuracy.

Optical Character Recognition (OCR) technology can scan invoices and automatically extract this data, significantly speeding up the process and improving accuracy.

The QuickBooks Business Solutions Survey revealed that 85% of business owners think data entry and reconciliation hurts growth.

The QuickBooks Business Solutions Survey revealed that 85% of business owners think data entry and reconciliation hurts growth.

40% of respondents in a recent

40% of respondents in a recent