How Intuit Enterprise Suite can help manage a revenue-sharing program

Effectively managing revenue sharing agreements often stretches basic accounting software or manual processes to their breaking point, requiring robust financial management tools capable of handling complex tracking, accurate calculations, timely payments, and transparent reporting.

A comprehensive financial solution like Intuit Enterprise Suite offers capabilities designed to address these specific needs, streamlining the administration of your revenue-sharing programs.

Accurate revenue tracking across complex structures

Is fragmented data making it difficult to determine the correct revenue base for sharing?

Intuit Enterprise Suite helps consolidate revenue tracking, offering clarity even when dealing with multiple projects, product lines, or business entities through features like multi-entity accounting.

Real-time data access ensures you have the up-to-date, verified information needed to apply agreement terms fairly and accurately.

Automated calculation and allocation

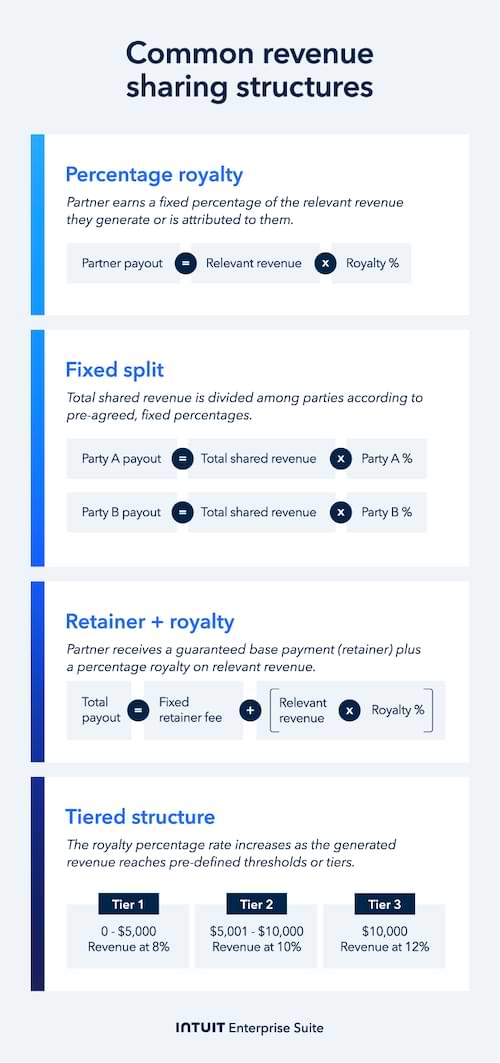

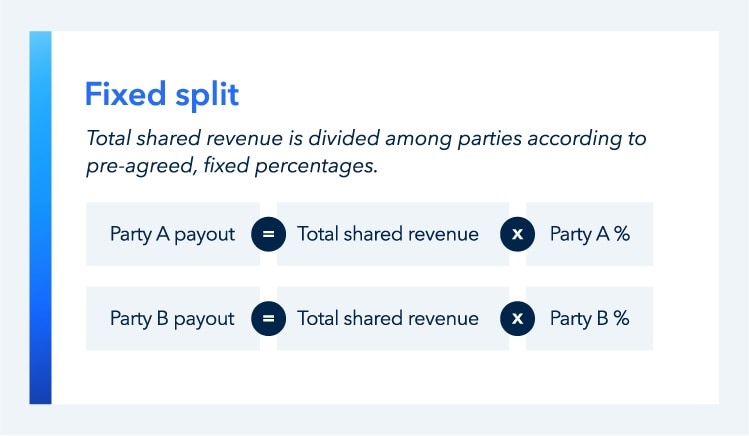

Manual calculations based on complex percentage splits or tiered structures are not only time-consuming but also a common source of costly errors that can damage partner trust.

You can configure Intuit Enterprise Suite to automatically apply your specific, agreed-upon sharing rules directly to the accurately tracked revenue data.

This automation significantly reduces manual workload and minimizes calculation errors.

Leveraging this type of workforce automation frees up your team to focus on data analysis and program improvement rather than tedious computation.

Streamlined partner payout management

Paying partners correctly and on schedule is fundamental to maintaining strong, positive relationships. Delayed or inaccurate payments can quickly sour a partnership.

Intuit Enterprise Suite streamlines the accounts payable process specifically for partner payouts.

It provides tools to help manage payment schedules according to agreement terms and can incorporate approval workflows, contributing to partners receiving their proper share reliably and promptly.

Customizable reporting for transparency and insight

Generic financial reports often lack the specific detail needed to manage revenue-sharing programs effectively and provide necessary transparency to partners.

Intuit Enterprise Suite allows you to create customized, multi-dimensional reports and track key performance indicators (KPIs).

Monitor your program's overall performance, drill down into shared revenue details, and generate the clear, professional statements partners need, fostering transparency and enabling better data-driven decisions about your partnerships.

Implementing the robust tracking necessary for revenue sharing often yields a valuable side benefit—granular performance data across partners or channels that can inform broader business strategies.

Implementing the robust tracking necessary for revenue sharing often yields a valuable side benefit—granular performance data across partners or channels that can inform broader business strategies.

Look beyond internal admin features and evaluate tools from your partners' perspective. A clunky interface or confusing reports can hinder their engagement, regardless of how well the tool works for you.

Look beyond internal admin features and evaluate tools from your partners' perspective. A clunky interface or confusing reports can hinder their engagement, regardless of how well the tool works for you.