Working capital management is an accounting strategy that helps businesses maintain a healthy balance between current assets and liabilities.

There are a few working capital management tactics that you can use to improve your working capital, increase efficiencies, and ultimately improve earnings. Here are a few tips to manage working capital:

1. Create a cash flow roll-forward

Find out where you stand in terms of your financial status. Forecast your cash inflows from sales and your required cash outflows by month. Each month’s beginning cash balance plus cash inflows, minus cash outflows equals your ending cash balance.

If your plan for the next six months reveals negative cash balances, you’ll need to collect cash faster. Once you know the extent of the problem, you can take action.

2. Monitor accounts receivable

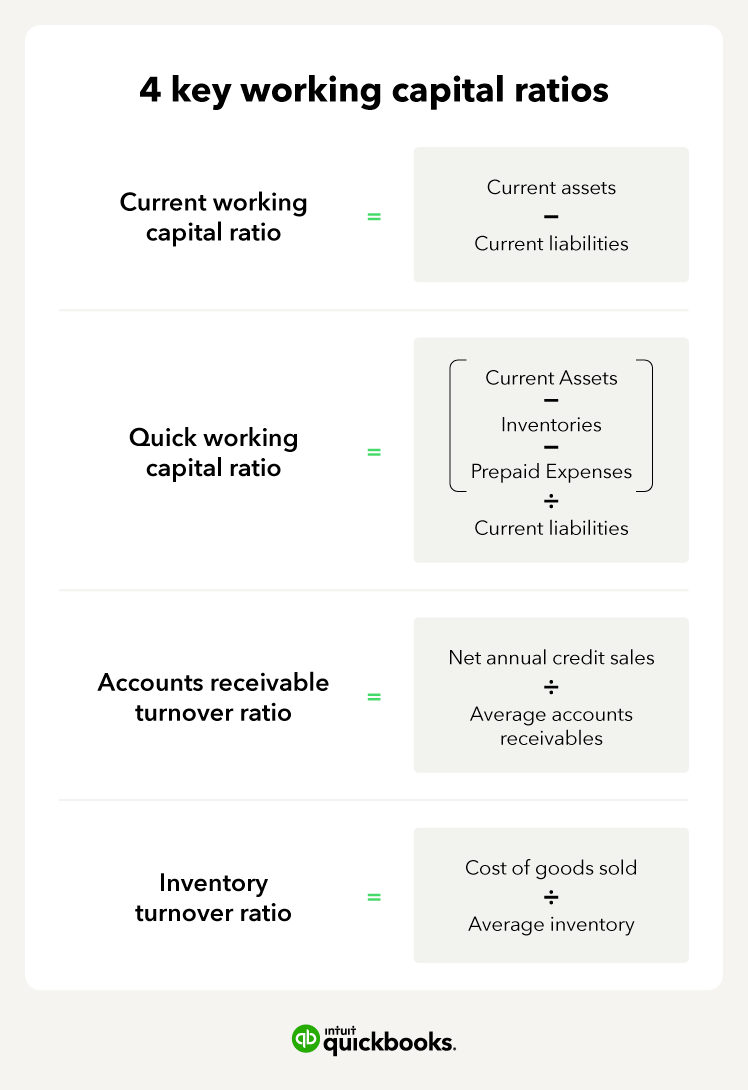

Generate an accounts receivable aging schedule each month. The report lists the dollar amounts you’re owed based on the date of the invoice.

Aging reports typically group invoices based on 0 to 30 days old, 31 to 60 days old, and so on. Older invoices present a higher risk of not being paid.

3. Enforce a collections policy

You should have a written policy for collecting money, and the policy must be enforced to increase cash inflows. Decide on payment terms that encourage early payments.

For example, you might email a client once an invoice is 30 days old and call on invoices once they reach 60 days old. If a customer pays late on every sale, consider whether you should do business with the client moving forward. Consistent late payments impact your cash inflows.

4. Manage inventory purchases

If inventory is a large component of your cash outflows, monitor your purchases closely. Buy enough inventory to fill customer orders but not so much that you deplete your bank account—less inventory leads to more cash flow that’s freed up.

Implementing effective inventory management can have a positive impact on accounts payable, receivable, operations, and the overall growth of a business.

5. Offer discounts

Offer customers a discount (1% to 2%) if they pay within five days of receiving the invoice. You’ll collect money faster, which may be more valuable than the 1% to 2% you lose when the customer takes the discount.

6. Accept multiple payment methods

Make it easy for customers to pay you by offering electronic payment methods on your website. Accept credit and debit cards, and email customers an invoice with a link to make payments.

7. Pay vendors on time

Small business owners can maintain good relationships with vendors by paying them on time. If you can speed up your cash inflows, you can make timely payments and maintain a sufficient cash balance.

If you implement these changes, you’ll convert current assets into cash much faster. Increasing working capital requires focusing on current assets, which are easier to change than current liabilities.

8. Leverage technology for better cash management

Utilize modern accounting software or enterprise resource planning (ERP) systems to get real-time insights into your financials. These tools can help you track cash flow more accurately, predict future cash needs, and make informed decisions quickly.

9. Negotiate better payment terms

Work with both suppliers and customers to negotiate payment terms that favor your cash flow needs. For suppliers, try to extend payment terms. For customers, reduce the credit period. This will help you keep more cash on hand.

10. Regularly review overhead costs

Periodically review your fixed and variable costs to identify areas where you can cut expenses without compromising business efficiency. Reducing unnecessary expenditures can free up more cash for critical operations and investments.