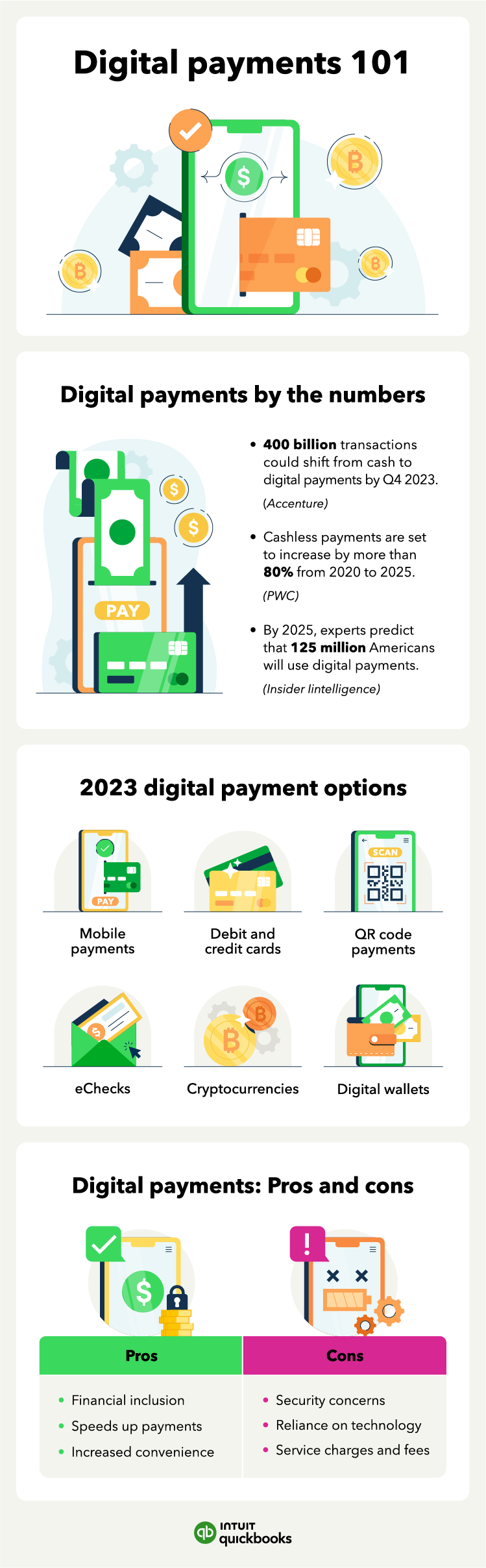

Preparing your small business to process digital payments is more important than ever. Over 40% of Americans say they make none of their purchases using cash in a typical week, according to Pew Research.

Electronic payments are quickly becoming more common and have the potential to make your business more efficient and accessible to customers. Read our small business guide to learn how digital payments work.