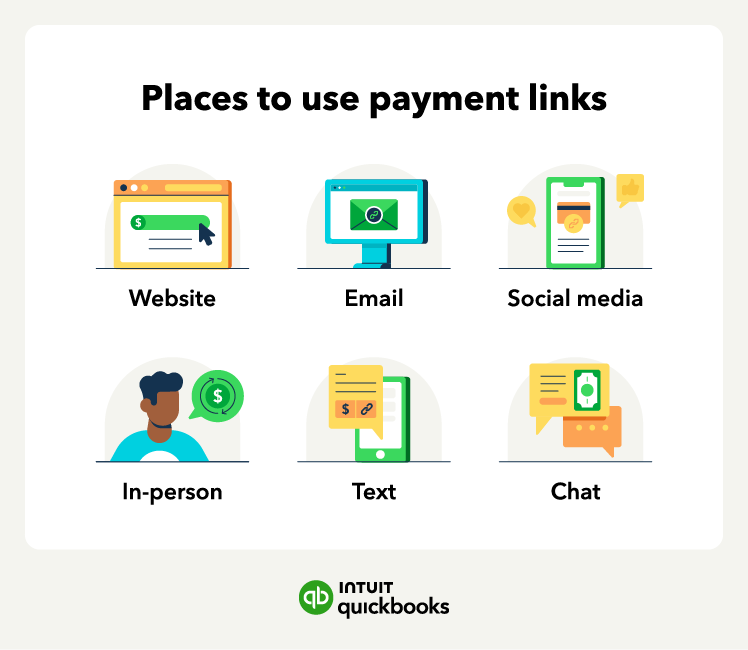

Email

You can add payment links to your email campaigns with a call-to-action hyperlink or button to help customers easily purchase your offerings and drive conversions. For example, you may include "Complete your purchase now" to help fight shopping cart abandonment. You can also emphasize the ease of the payment process and highlight any incentives, such as discounts or limited-time offers.

Text messages

In addition to using payment links in emails, you can also utilize them in text messages. By sending payment links directly to a customer's cellphone via text, you can create custom in-person pricing—or charge customers for add-on services.

Social media

An effective way to direct customers to your online checkout page is by utilizing payment links on social media. These links provide a direct and convenient way for customers to make purchases without navigating through multiple pages.

To use payment links on social media, generate a unique URL that directs customers to your checkout page. Then, you can share the link in your social media posts, stories, or bios—or even to your social media marketing ads. Customers can click on the payment link, which will take them to the checkout page.

Chat

Customer service chats are a convenient way to assist customers. Integrating payment links into these chat conversations can streamline the purchasing process and provide an exceptional customer experience.

You can use payment links in chat to help direct customers to specific items, but also for cross-selling and upselling. During customer service chats, you can suggest additional products or related services that may complement their initial request. Payment links for these opportunities make it easy for customers to explore and add more items to their purchases.