Did you know that nearly 1 in 4 small businesses face cash flow challenges each year? This common struggle often stems from not having a clear picture of short-term financial health, making it harder to pay bills on time or cover unexpected expenses. That’s why understanding and managing liquidity is crucial for maintaining financial stability.

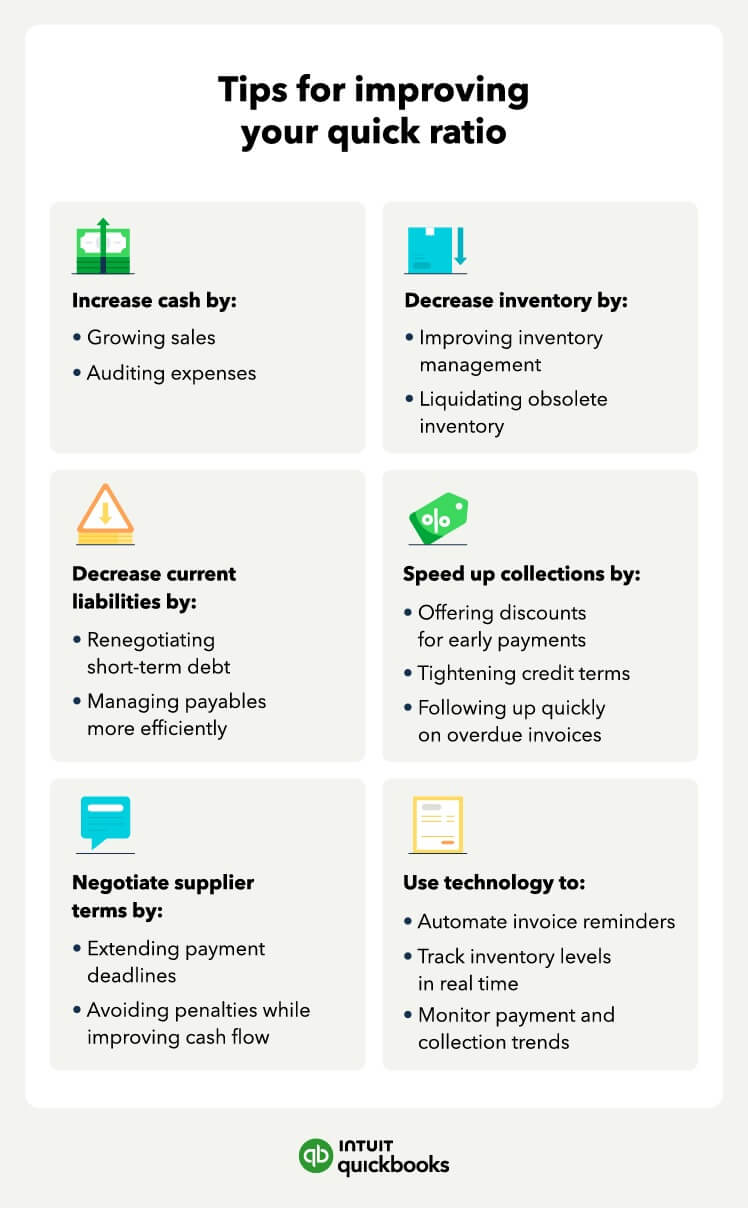

The quick ratio formula is quick assets divided by current liabilities. It’s also known as the acid-test ratio and is worth learning—no matter your industry. The quick ratio helps you track your liquidity, which is your ability to pay bills in the short term. The quick ratio can help you avoid cash flow problems and maintain good relationships with creditors and suppliers.

This article will explain how to calculate the quick ratio and provide tips on improving liquidity.