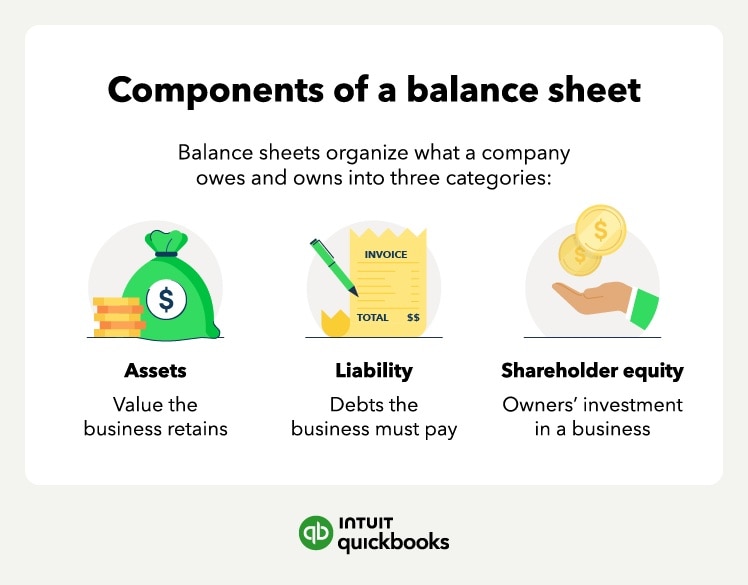

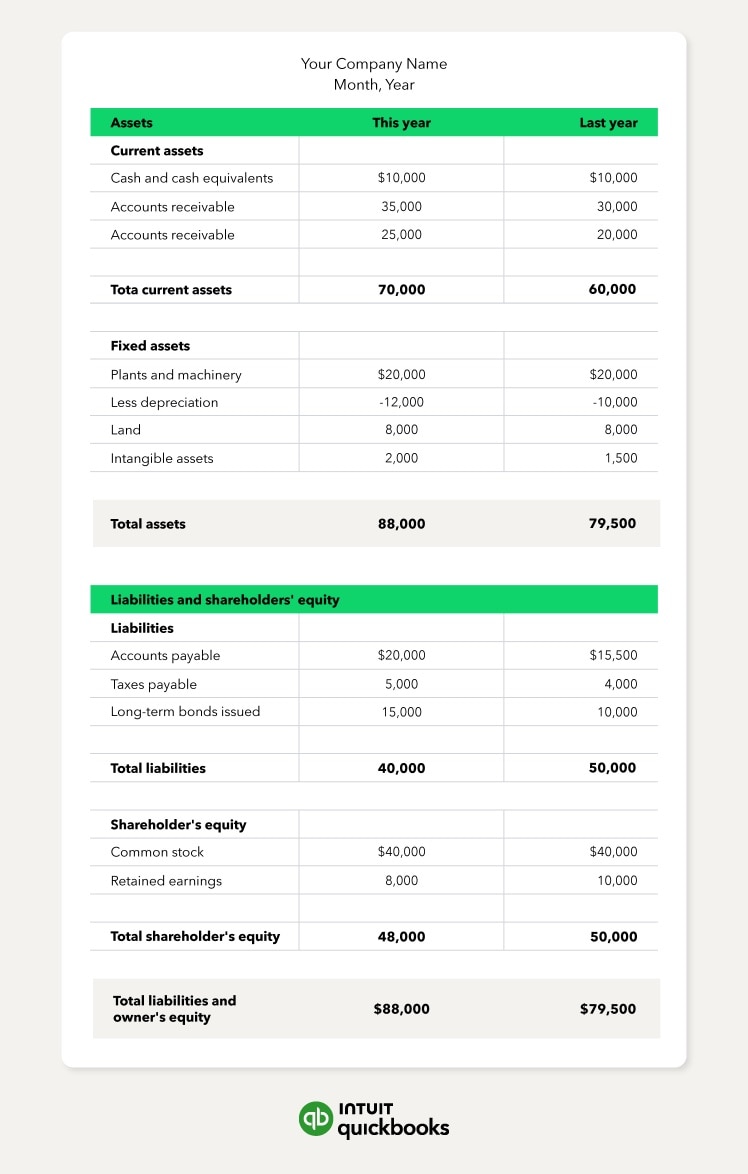

Assets

Assets refer to anything a business owns that offers current or future value. The assets section on a balance sheet lists everything your company retains with value. Balance sheets organize assets by liquidity or how easily they convert to cash.

Accountants divide assets into several categories based on their convertibility, physicality, and usage. For example, short-term assets refer to assets a business can quickly cash in. On the other hand, long-term assets cannot easily convert into cash. Others, like operating and tangible assets, help perform vital tasks.

Examples of assets include:

- Liquid cash

- Securities

- Accounts receivable

- Inventory

- Prepaid expenses

- Property

- Job equipment and tools

Convertibility

Convertibility is the ability of an asset to convert into cash. Based on their convertibility, assets fit into two categories: current and fixed (long-term) assets.

Current assets are assets you can convert into cash or a cash equivalent in less than a year — e.g., marketable securities, short-term deposits, and stock. Fixed assets are assets you cannot easily convert into cash — e.g., trademarks, job equipment, and buildings.

Some assets, like cars and property, take physical form (tangible assets.) On the other hand, assets like stocks, brands, and trademarks don’t physically exist (intangible assets).

Businesses may rely on certain assets for daily operations. You can categorize assets based on their daily use as operating or non-operating assets. You need operating assets to perform core business operations — e.g., machinery, tools, and physical locations. Non-operating assets exist as short-term investments and securities that add value outside of regular operations.

Liabilities

Liabilities refer to debts a company owes to other people and businesses. If assets add value to a firm, liabilities subtract value. Balance sheets list current liabilities in order of their payment due date. Here are a few examples of liabilities:

- Bills

- Rent on property

- Utilities

- Salaries

- Insurance

- Taxes

- Long-term debts.

Like assets, you organize liabilities based on their due date. You can organize them into two categories: current and noncurrent liabilities. Current liabilities are debts and obligations you have to fulfill within a year, while noncurrent liabilities are debts you must repay at any point after one year.

Shareholder equity

Shareholder's equity, also called owner's equity, refers to a company's net worth. You can calculate equity in a business by subtracting a business's liabilities from its assets. Balance sheets exist, in part, to calculate equity and share a firm's worth with investors. So, if a business liquidates its assets, owners know how much they will receive.

Shareholder equity falls into three general categories: monetary contributions, generated earnings, and donated capital.

Businesses earn a lot of their money through monetary contributions and investments. Typical contributions include common stock (securities indicating investment in and ownership of a business) and preferred shares (stocks offering a guaranteed dividend instead of rights).

Earnings, or the amount of money a business generates on its own, contribute to shareholder equity. Examples of earnings include retained earnings (business income not paid to shareholders as dividends) and treasury stock (company stock bought back from owners).

Shareholder’s equity comes from its own components. The types include donated income (donations contributing to equity on financial statements like balance sheets and cash flows) and contributed surplus (excess equity capital investors pay when buying stock over the shares' par value).