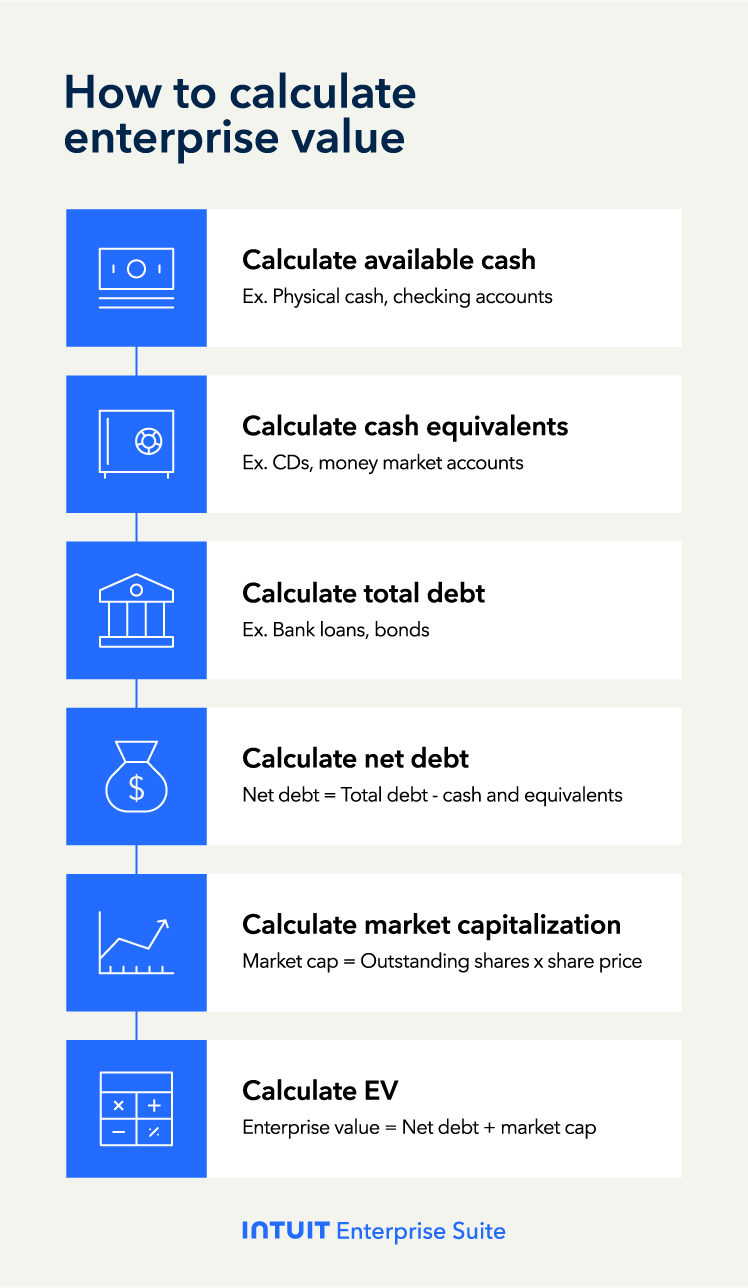

Understanding enterprise value is crucial to understanding the competitive landscape and potential acquisitions. For example, a critical factor in Google’s acquisition of YouTube in 2006 was understanding YouTube’s enterprise value, considering current numbers and future revenue.

Enhancing profitability is important in a growing mid-size business, and knowing how to leverage EV calculations is a part of that. Here, we'll explain what enterprise value is, explore use cases, and run through a real-world example.

Jump to:

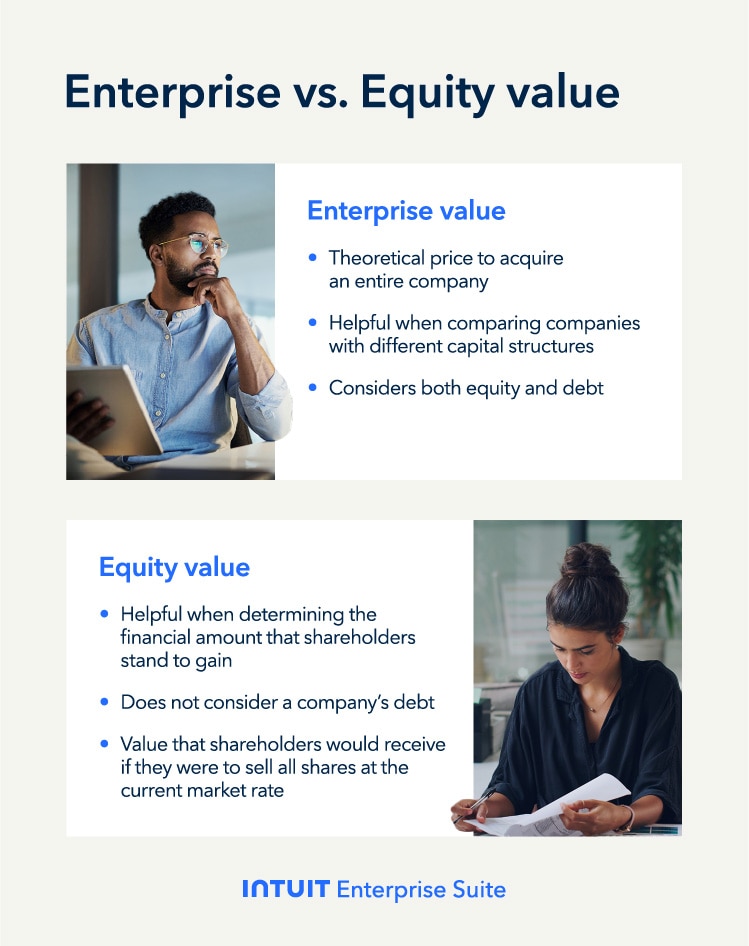

A business must consider all aspects of its finances to produce a full-scope financial health report.

A business must consider all aspects of its finances to produce a full-scope financial health report.