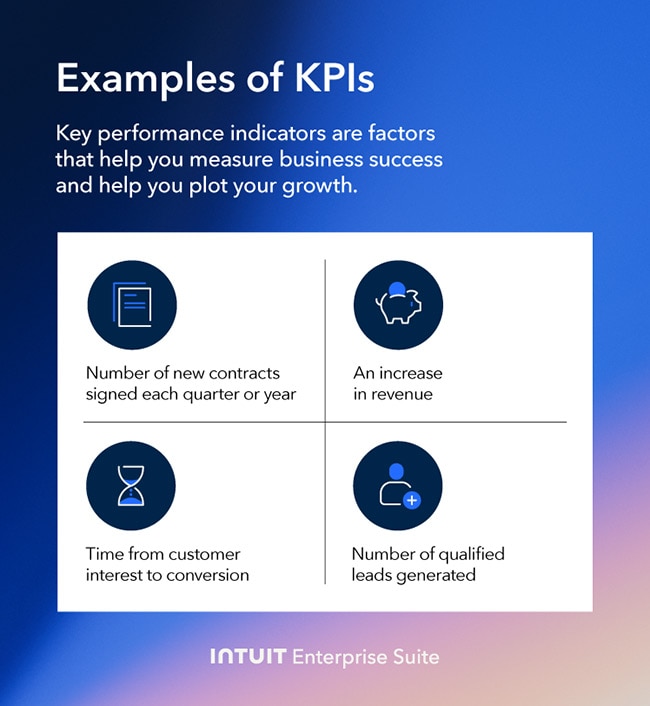

Accurately measuring growth and profitability metrics is essential to ensuring a business’s financial health. But with changing business models and compressed production cycles, traditional metrics like earnings per share (EPS) or revenue growth alone don’t give you a full picture.

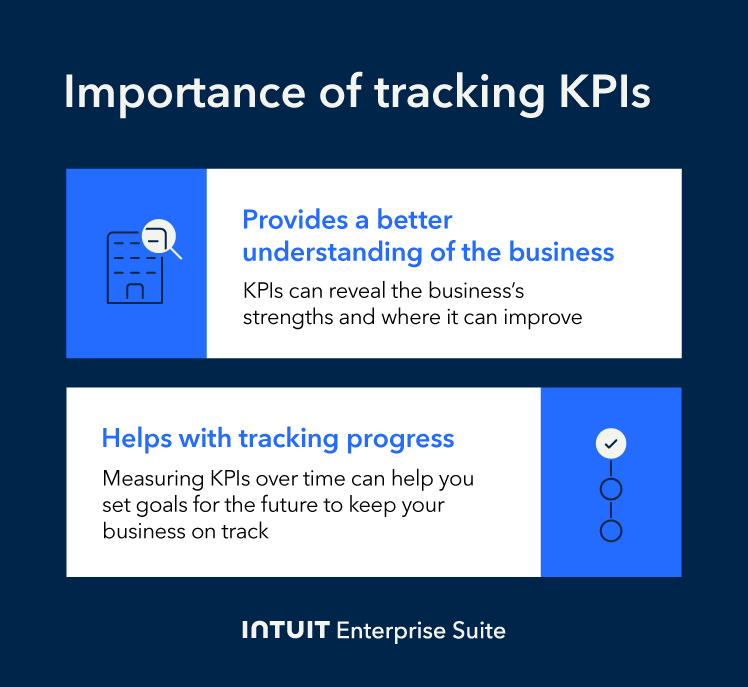

You’ll need to look at other key performance indicators (KPIs) to understand the business’s performance throughout the year, but figuring out which KPIs to measure and how to measure them can be challenging. In this post, we’ll take a closer look at how to measure KPIs unique to your business.

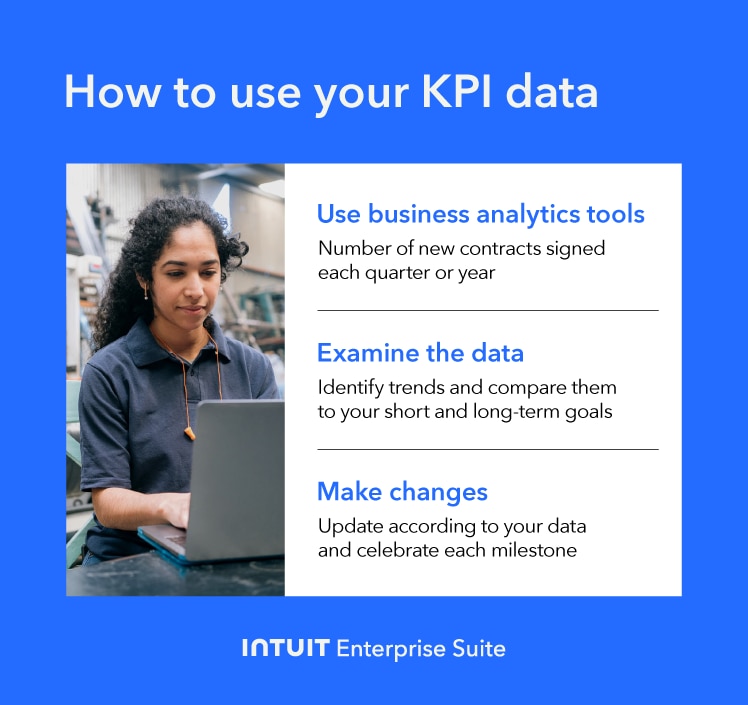

The data you collect should help you gain a deeper insight into your business’s performance. Check your KPIs often, and don’t be afraid to adjust your strategy to ensure that your operations support and align with your long-term goals.

The data you collect should help you gain a deeper insight into your business’s performance. Check your KPIs often, and don’t be afraid to adjust your strategy to ensure that your operations support and align with your long-term goals.