94% of customers are satisfied with the overall experience of getting a loan through QuickBooks.²

Explore the features

Apply in QuickBooks

Save time—it only takes minutes to apply and get a decision.

Flexible terms

Loans from $1.5K–$200K with terms from 6–24 months.

Competitive rates³

Business loans with no origination fees or prepayment penalties.

Quick decisions, fast funding.

QuickBooks customers can apply right in QuickBooks and get a decision in minutes. Approved loans typically fund in as fast as 1–2 business days.1

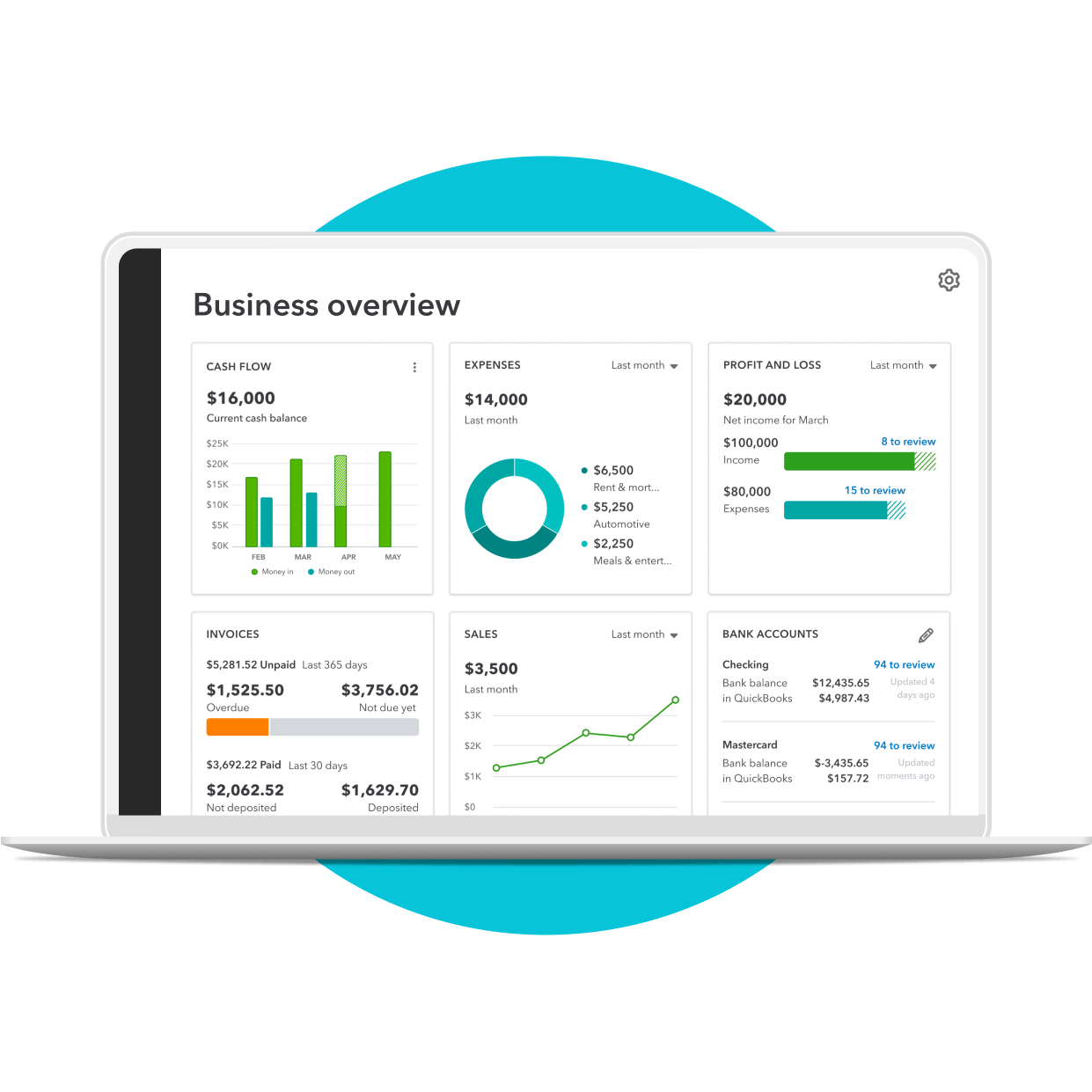

A seamless lending experience

Your QuickBooks account gives you a head start on applying because data can be pulled from your account, such as:

- Sales trends and seasonality

- Profitability over time

- Invoices and cash flow forecast

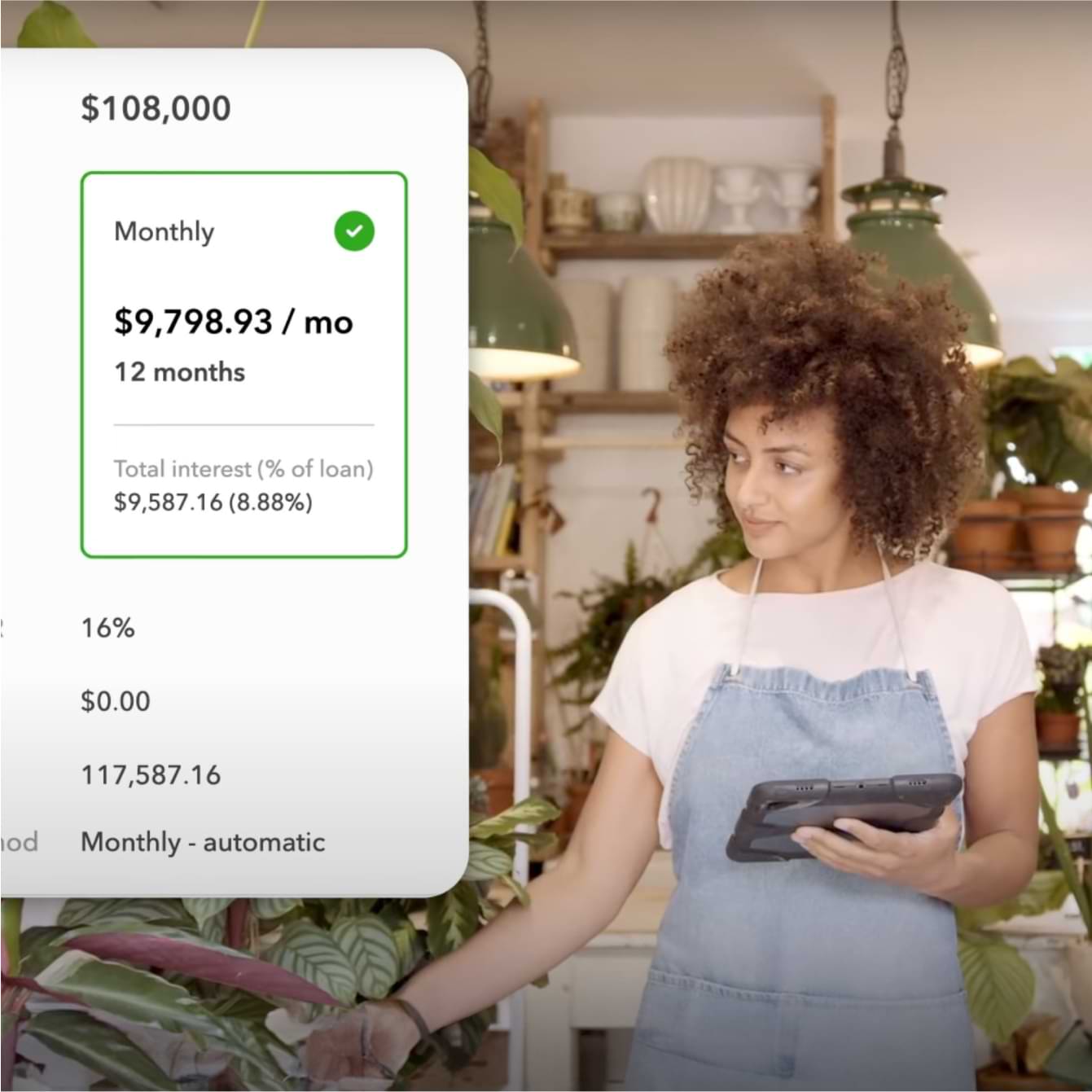

Upfront transparency

Terms are clear from the start so you can avoid surprises and stay in control.

- Payment terms from 6 to 24 months

- No origination fees

- No prepayment penalties

- Won’t affect your personal credit score

98% of customers are satisfied with the speed of the credit decision2

Ready? Here’s some things you may need

- Up-to-date and accurate business data in QuickBooks

- Primary business bank accounts connected through QuickBooks (not required)

- Generally, revenue of at least $50,000 over the past 12 months

Why small businesses rely on QuickBooks for access to capital

“I really liked how simple the application process was and how quickly we received an answer. I received funding the very next day.”

Caralyn Valdeman

Integrated NW Construction, LLC

January 2024

“QuickBooks Capital is a great opportunity to build credit and have a cushion for business expansion needs.”

Shane Tassin

Tassin Consulting LLC

January 2024