Apply for a QuickBooks Line of Credit to bridge cash flow gaps and keep business on track. You decide when and how to use it—draw cash or get advances on your eligible unpaid invoices.¹

Explore the features

No fees, no hassle

You won’t pay origination fees, late fees, or prepayment penalties.²

Get started in minutes

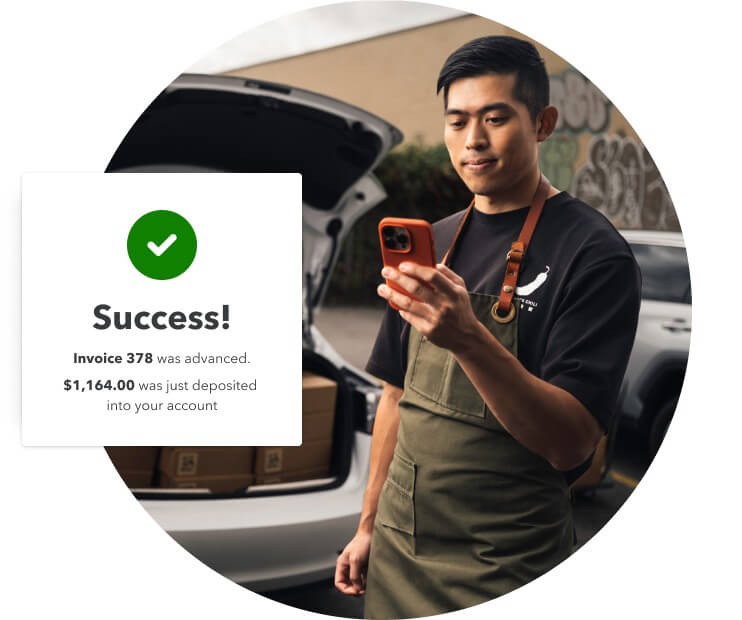

Apply right in QuickBooks, have a decision in a few short minutes, and see your cash fast.³

Borrow up to $50,000

Get a credit limit from $1,000–$50,000, and only pay interest on the amount you use.

Money on hand when you need it

A QuickBooks Line of Credit can help you cover unexpected expenses or keep your business moving while you wait for a customer payment.

Time is on your side

Apply right in QuickBooks and get a decision in minutes. If approved, funds are typically deposited in just 1-2 business days.³ Set up autopay to make repayment a breeze.