Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGreetings, @lfenner.

Thanks for posting here in the Community. I can help walk you through submitting your State W-2 forms electronically through QuickBooks Online (QBO).

Here's how:

1. Go to Taxes menu at the left panel, then Payroll Tax.

2. In the Forms section, select Annual Forms, then choose the Iowa W-2 form.

3. Select Continue to proceed and double-check the details on the form.

4. When you're ready, click Submit.

5. On the status page, the current status will be Submitted.

For your reference, you can also check these articles for more information:

That's it! Please let me know how it goes by leaving a comment below. I'm only a post away should you have any follow-up questions or concerns. Take care and have a great rest of the day.

When I follow the process you outlined above, the Iowa W-2 is not an available option for me to choose under Taxes<Payroll Tax< Annual Tax Forms.

How else do I go about submitting my Iowa W-2 electronically?

Thanks for joining us here, mfrost13.

The tax forms under the Annual Tax Forms are for those states that require employers additional forms or worksheet that'll be filed with state W-2s. QuickBooks Online provides signature-ready versions of W-2s or PDF copies of the worksheets.

If you're referring to the .txt file to be uploaded to the state website, this option is not available in the QBO for now. You might want to use the PDF copies of the Federal W-2 and convert it to a .txt format using a third-party app.

I'm just around the corner if you have other questions. Thanks for dropping by.

How are we suppose to submit this if it isn't an option.

Hi there, 3asdf12.

Thanks for joining us in this thread. I've got some information to share about mailing W-2 Forms in QuickBooks Online (QBO).

All forms should be filed electronically as mandated and encouraged by the IRS. To determine your state requirement, you can check out this article: States that require Electronic W-2 Filing.

If you're authorized to print and mail the W-2 Form, please follow these steps:

To help you with the process, I've attached some screenshots below.

Here's a great article for further guidance: Print W-2 forms. Then, mail the form to the IRS and your state agency.

This should help you print and mail the form. Leave a comment below if there's anything else you need. I'll be around. Have a great weekend.

Is this process the same for the state of Utah?

It's nice to have you in the Community again, @nathan. I'd be glad to provide information on filing in your state.

The process for Utah is going to be very much the same as other states. For further insight into this process, such as which states require additional forms to accompany W-2's, I recommend the following articles:

Please let me know if I can be of further assistance by commenting below. Have a good one.

QBO Team - Has this feature been added?

Hi there, @jpiccard.

You can generate your state W-2 copies and other forms required by the state in QuickBooks Online Payroll. However, the tax forms available in the Annual Tax Forms are signature-ready versions of W-2s or PDF copies of the worksheets. The option to submit it electronically to the state's website is currently unavailable.

I'll personally forward this feature request to our product engineers. We always appreciate our users sharing their thoughts on what features they want to see within the product, as it allows us to provide a better experience.

As a workaround, convert it to PDF copies or print and manually upload it to the state website. You can follow the steps provided by my colleague JaneD above.

To learn more about how to fill each box in W-2 forms, you can check this article for your future reference: W2 form boxes explained.

Please come back if you have other concerns in your account. I'm always here to help. Have a nice day!

Same problem occurring in the Desktop Version

Unable to create the Electronic .txt file for the State of ND

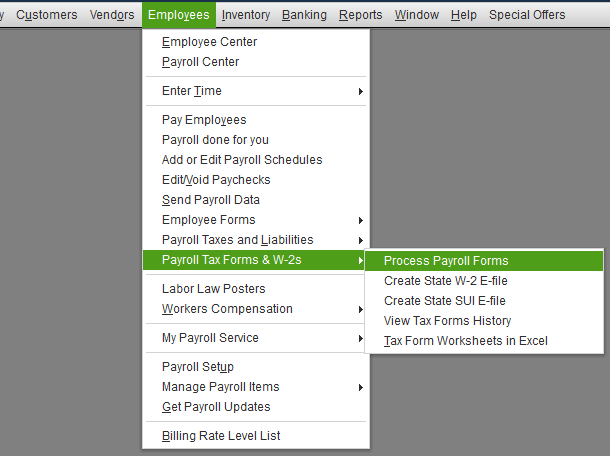

Previously use the following method

Other Activities (option at bottom center of the payroll processing - file forms screen)

Select Efile State W-2

Select State - ND is no longer an option on the screen

other states are listed and did successfully complete for MN but ND is missing on screen.

ND requires W2 file to be in .txt format

after creating file from this screen & save file -

then upload to state of ND as an attachment but unable to create file in QB

Intuit has obviously missed deadlines for many tax requirements this year!!!

Wow...to many on covid time working at home....

Hello @dfdx20, welcome to the Community, I'm glad you popped in for help!

Let's see what we can do to fix this for you;

Since you are in North Dakota you can electronically file your W-2s through QuickBooks;

You can find additional answers to more W-2 questions here.

If you need anything else I'm happy to assist you further, just reply to this thread and I'll come back and answer any other questions you may have!

Our payroll is too large to submit W-2 in one batch so for the Federal I split the list in half. The W-2 efile for North Dakota doesn't give me that option and thus the file is too large. Any work arounds?

Thanks!

Peggy

I'm here to help ensure you're able to file your W-2 for North Dakota, Peggy27.

Updating your payroll tax table is a good start before e-filing your W-2 forms in QuickBooks Desktop. This is to ensure that your data is accurate and ready to use.

Once done, you can follow the steps below to file the forms:

You can split the lists in half like what you did for the Federal, just make sure to notify the state agency. However, if you're not able to break it into two, I'd suggest preparing the forms outside the system.

For your reference, you can visit this article: E-file Federal W-2 Forms. This will provide you details about the filing deadlines. Also, this will give you a link on how to print a copy of the form.

Let me know how it goes by leaving a reply below. I want to make sure you're able to file the form before its deadline. Feel free to get back to me. Have a good one.

My issue is the North Dakota interview doesn't even happen. I get the message that our payroll is over 9,999,999.99 and QuickBooks can't create the form.

I need to create a file to submit our W-2 info electronically for the State of Hawaii. I've tried all options listed here, but it does not look like this is available for Hawaii filers. Hawaii employers are now mandated to submit documents including W-2/HW-2 electronically when their withholding tax liability exceeds $40,000 annually. Please advise

Greetings, @Allison130.

Welcome to the Community! Thanks for joining in on this thread about submitting your W-2 form electronically.

To clarify, have you tried the instructions on this guide to create and file your W-2s electronically?

I want to ensure that I give you the best solution to this problem. I'll be waiting for your response!

How do I use a third party like notepad to create the txt file from the federal w2s in QBO for state filing of w2s?

Welcome to the Community, @mary1111111. I appreciate you for reaching out to us.

Sending your W2 forms to the appropriate agencies on schedule is an essential payroll task at the end of the year. Depending on your payroll product, we may handle this for you, or you may file electronically.

I recommend reaching out to your agency to determine their instructions for filing the W2s. They may have a specific third-party app to recommend to their taxpayers.

The account, however, may be integrated into a Third-Party program that supports notepad to produce the txt file from the federal W2s in QBO for your state filing of W2s. You can search for available applications on the Intuit Marketplace.

You may want to read the following articles to learn when and how to send your W-2 forms to federal and state agencies, as well as how to complete this year's payroll and plan for the next with QuickBooks Online Payroll:

Let me know if you have further questions about payroll forms in QuickBooks Online. I'm always here to help you. Have a great day!

Did you find a third party app to create a .txt file?

Notepad works but not from qbo. Had to key everything into desktop from qbo. Completely ridiculous for a payroll module by Intuit NOT to have the ability to submit W2s to states without jumping through hoops.

Still looking for an answer on this. But for our city tax. Is there still no way to get a CSV or EFW2 file of all my W2's out of QB?? Let's go QB it is 2024!! Every state/city/county is requiring this.

I'll provide details on how you can get a CSV or EFW2 file of your W2 forms to help you comply with your state/city/county requirements, JLynn23.

When you use QuickBooks Online Payroll (QBOP), your state W2s are filed automatically with your Federal forms. A CSV or EFW2 file type for the forms is currently not an option. However, the system can provide signature-ready versions of your W2s or PDF copies of the worksheets that you can convert to the required format using a third-party application.

Moreover, you can visit your state agency websites to find more details about tax forms, withholdings, unemployment and other tax, e-file, pay information, general state and agency information, and employer registration.

Additionally, I've included this article to assist you in finalizing this year's payroll and preparing for the next using QuickBooks Payroll: Year-end checklist for QuickBooks Payroll.

Feel free to leave a comment below if you have other payroll forms or W2 concerns. I'm always ready to help you out.

I was under the impression that STATE W2's are NOT filed automatically out of QBO payroll, only Federal/SSA.

I also cannot find a different way to get any file type but a PDF out of QBO for W2's.

My state of Oregon requires a TXT file and the pdf doesn't covert to that where the data stays in the document. You would think with how much people pay for these subscriptions, and the laws of many states around this requirement, we wouldn't have to manually enter 100 w2's on a state site

Is that what an employee W-2 look like? My ex- employer gave me a paper just like it, and said that was my W-2 form from QuickBooks??

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here