Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Welcome and thanks for reaching out to the Community, @iain-simpsonpc-c.

You can download 1099 in QuickBooks Self-Employed (QBSE) once your employer or client submits your 1099-MISC to the IRS. You'll get an email link that allows you to download it.

Clicking the link will route to the QBSE sign-in page. Please refer to these steps once logged in:

For more information about managing 1099s in QBSE, check out this article: Fill out a W-9 and view your 1099-MISC in QuickBooks Self-Employed.

If you're ready to file your taxes, refer to this article for further guidance: QuickBooks Self-Employed annual tax guide.

Don't hesitate to leave a comment below if you have any additional questions or concerns. I'm always here to help. Have a good one!

There IS NO "CLIENT" MENU. There IS NO "FORMS" TAB.

I'm going to be telling my clients that this platform just doesn't work.

Thanks for coming back to us and letting us know about this issue, @iain-simpsonpc-c. This isn't what we want you and your client to experience.

We can take a closer look at this issue by contacting our Customer Care team. That way, they can submit a request to investigate this problem whenever necessary.

Here's how to contact us:

I've got you an article that contains answers to frequently asked questions such as how to file another set of 1099s, what to do after filing the form, etc.: Prepare and file 1099s using QuickBooks Online. It also includes a video tutorial for visual reference.

Feel free to visit the Community if you have other concerns. I'll be around to listen and help.

Sorry, but I'm not your beta tester. You work out your own problems. I'm out.

Sorry, but I'm not your customer, and I'm not your beta tester. You work out your own problems.

I'm having the same issue. I received a QB email on behalf of my client stating that I can view, print or download my 1099.

Once logged in the "Client" option is not listed on the left-side menu. Please advise.

I had to sign up for another QB account (because the invitation was sent to a different email and would not allow me to use my QB email address). Is there a way to merge the 2 accounts?

Let me show you how your clients get their 1099s from their QuickBooks Self-Employed (QBSE) account, @tccoleman

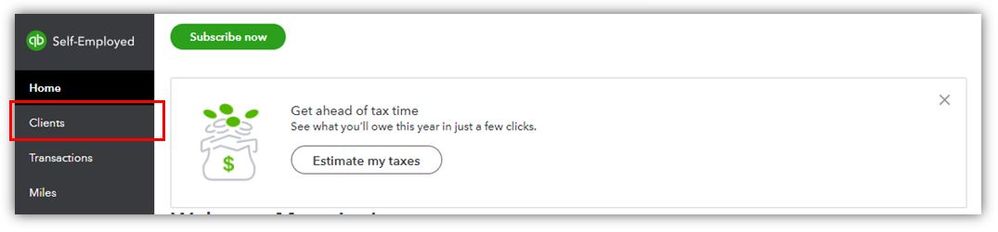

Only your client will get to have that Clients tab from his/her QuickBooks Self-Employed account. This account is the one they've created when you fill them out a Form W-9. They can sign for their QBSE account to download their 1099s.

To view or print your 1099-MISC:

Just make them sure to use the credentials they use when they've filled out your Form W-9. The option to merge QBSE accounts is currently unavailable. If you already have a QuickBooks Self-Employed account, ask them to send the invite to the email address you use to sign in.

Here's more information on how to fill out a W-9 and view your 1099-MISC in QuickBooks Self-Employed.

Let me know if you still have questions about getting access to view your 1099s. I'm always here to answer them for you. Take care and have a great rest of the

Thank you for replying.

Where is the Client menu? To be clear, I'm not the client that is looking to create a form. I'm trying to retrieve a 1099 from a customer that also uses QB.

Thanks! (see my menu below)

I don't have "client" on my menu.

I am having the same issue and can't figure it out. No client menu whatsoever....

Hello there, abaran268.

It looks like you've manually subscribed to our QBSE free trial. The option to see the Clients tab is when your employers send an invitation to fill-out your W-9s. Also, after your employer or client submits your 1099-MISC to the IRS, you'll get an email that it's ready for download. Just select the link in the email to sign in to QuickBooks Self-Employed. You can use this link for more details: Fill out a W-9 and view your 1099-MISC in QuickBooks Self-Employed.

On the other hand, if you're unable to receive an email, you can directly ask your client for a copy of your 1099s.

Let me know if you have other questions. Take care and have a great day!

I never created an account manually. Everything was done via the following email link.

I then received a message stating that I could not use my current QB account because it's a different email.

I then went back to the email clicked the link again and created a new account. No "client" was listed on the menu. I then went back to the email to try the link again and got the following message;

Since yesterday by clicking on the "Assistant" link, it results in the following error;

Please help, I need to resolve this 1099 issue.

Hello there, tccoleman. I appreciate you for including screenshots.

It looks like the link is already expired. I'd recommend reaching out to your employer and ask to resend the link. This way, you'll be able to access the email without getting an expiration note. Once your employer sends an invitation, you'll have an option for the Clients tab.

Also, you can refresh your browser when utilizing the Assistant option in Quickbooks Self-Employed account. If it persists, you can log in to an incognito window or use another supported browser. From there, click on QB Assistant. You'll need to enter talk to a human twice and click on I still need a human. You can then message an agent or get a callback from our specialists.

Here's a couple articles that you can check for additional details:

Let me know if you have other concerns or need further help with this matter. Take care and stay safe always.

You can't download when you receive a message the invitation has expired. The client doesn't know how to resend. So, now you have to offer technical support to help them them resend. That piece of the platform needs much improvement. Receiving a 1099 should not be that difficult.

The workaround I found is to google QBSE login and try to login from there instead of using the link. Hope this helps someone.

Yes WE are having the same issue.

We did not use the account to fill in the W9 so now the link asks to set up a new QBO account?

I just want to download the 1099..

Why do I have to set up a new self employed QBO account to view the 1099 ?

Hi @ryork. Allow me to share more details regarding the invitation feature of the QuickBooks Self-Employed (QBSE) limited account and the QuickBooks Online feature.

You can submit your W-9 details to your customer so that they can enter them into the system if you prefer not to signup for a QBSE limited account. Then, ask them to email your 1099-MISC directly.

The QBSE limited account is different from the QuickBooks Online (QBO) account when comparing the features offered and the subscription plan. QBSE is a free account for viewing and downloading your 1099 form from your customers with a QuickBooks Online subscription. On the other hand, QBO is a paid subscription and has robust function than QBSE.

To know more about the process of creating a QBSE limited account, you can visit this article: Fill out a W-9 and view your 1099-MISC in QuickBooks Self-Employed.

Please don't hesitate to get back to this thread if you need further assistance or other questions. I'd be happy to help. Take care!

More data mining?? Come on. This is not a service. My clients have QBO accounts and are calling me because they cant find their 1099 on their account, which is what they should expect, not that they have to set up another account!!! I have been advising them to ask the issuer of the 1099 to just send it in an encrypted email. This "service" is causing a huge headache for your clients sending out 1099s, your clients getting them and your clients who provide accounting services to both. It has been come a HUGE WASTE OF MY TIME BECAUSE YOUR COMPANY DID NOT ENGINEER THIS CORRECTLY. If you cannot do it well, just outsource it!

I hear your sentiments, AccountabilityPro.

Let me help share where your clients can find their 1099 form in QuickBooks Self-Employed.

To start with, they'll receive an email invitation once their employer has filed your form successfully. When it is ready, you can view your 1099 form on the Forms section under the Clients menu in QuickBooks Self-Employed.

On that same page, here's an article they can read to learn more about how you can view your form: Fill out a W-9 and view your 1099-MISC in QuickBooks Self-Employed.

In the same manner, I've also included this reference for a compilation of articles you can use while working with us: QuickBooks Self-Employed Overview.

If there's anything else that I can help you with, please let me know in the comments below. I'll be here to lend a hand.

Here's the thing: I don't want to create yet another useless "free account"! I just want to download my 1099 from my client. But there's apparently absolutely NO way to do this without giving yet another nosy company my name and email address. So thank you very much, Intuit, but you have just alienated me away from ever considering using your program.

Absolute BS the USPS works fine. Forcing someone to create an account to access the form the client is legally obligated to provide is flat wrong. So sick of Intuit!

@All Hands On Decks wrote:Here's the thing: I don't want to create yet another useless "free account"! I just want to download my 1099 from my client. But there's apparently absolutely NO way to do this without giving yet another nosy company my name and email address. So thank you very much, Intuit, but you have just alienated me away from ever considering using your program.

I am fairly certain that the IRS requires written consent from the receiver to accept an electronic copy of a 1099. Having to sign up for this small business QB's account is cumbersome and not easy to find your 1099's and messes with the other 6 login's and passwords one may have with Intuit.

Intuit should really just send the 1099 to the recipient instead of placing them hiding behind a login, data collection and subsequent marketing emails from QB's to receive and view a document that the IRS requires being sent.

I have not found or viewed any of ours and will not since we have never given written consent to receive them electronically and there is no requirement that personal information must be given to a 3rd party to receive legally required documents.

Intuit should really re-think this.

IN QBSE when I make a profile and sign in there is a Client tab but no 'forms' tab and after several tries there is NO WAY to see the 1099 that apprently was sent by my employer. Can I contact the IRS and report the employer as negligent for not sending me an actual form ? I believe sending the QB link to sign up new users is egregious , disrespectful and possibly illegal ! - Gary

I think we should all complain to the IRS about this INTUIT data grab that must certainly be against the tax law of the IRS. I cannot see a 1099 and tried a couple times to set up INTUIT QBSE accounts : still NO luck seeing the 1099 ! Employers who try to use QB to send their employees a 1099 should be held to account with the IRS for failing to send required gov't documents ! I for 1 will take this to the IRS to see if they can pressure Intuit to stop this practice.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here