Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI processed our payroll for this Friday just now and after it was completed, the payroll for this week is still showing up as "Due" in the Create Paychecks area of the Pay Employees screen. The payroll for this week is also listed as complete under the Recent Payroll section. Why would this happen and what do I need to do to fix it?

Solved! Go to Solution.

Let me help you with the overdue payroll in QuickBooks, CariDCNC.

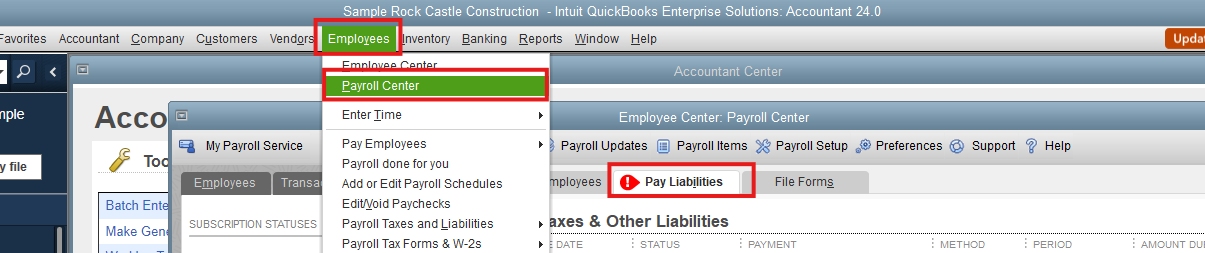

It's possible the Create Paychecks status did not update and that is why the Payroll Schedule status for the Pay Period still shows as Overdue. We can change the status of your payroll schedule without creating duplicate paychecks in QuickBooks. Here's how:

To learn more about setting up payroll schedules, see the Set up and manage payroll schedules article. You can also edit the pay period dates on paychecks that you've created incorrectly. Refer to the Incorrect pay period dates in the QuickBooks Desktop Payroll article. Just in case the scheduled liabilities show as overdue or appear in red in QuickBooks Desktop, follow the steps and details in the Scheduled liabilities payroll show as an overdue or red article.

If it is a manual paycheck and the same thing happens, we can delete and recreate the paychecks. Just create a backup copy first before doing it. If not, please contact our Technical Support Team. They'll pull up your account in a secure environment and help you with this one. You may send a message via chat, call us at a time convenient to you, or we’ll get in touch with you instead. To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. See our support hours and types for more details about this one.

Feel free to visit our Payroll page for more insights about managing your payroll in QuickBooks.

You can always update us on the result after performing the steps or reaching out ur support in the comment below. I'd like to ensure this is resolved for you. Take care always.

Let me help you with the overdue payroll in QuickBooks, CariDCNC.

It's possible the Create Paychecks status did not update and that is why the Payroll Schedule status for the Pay Period still shows as Overdue. We can change the status of your payroll schedule without creating duplicate paychecks in QuickBooks. Here's how:

To learn more about setting up payroll schedules, see the Set up and manage payroll schedules article. You can also edit the pay period dates on paychecks that you've created incorrectly. Refer to the Incorrect pay period dates in the QuickBooks Desktop Payroll article. Just in case the scheduled liabilities show as overdue or appear in red in QuickBooks Desktop, follow the steps and details in the Scheduled liabilities payroll show as an overdue or red article.

If it is a manual paycheck and the same thing happens, we can delete and recreate the paychecks. Just create a backup copy first before doing it. If not, please contact our Technical Support Team. They'll pull up your account in a secure environment and help you with this one. You may send a message via chat, call us at a time convenient to you, or we’ll get in touch with you instead. To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. See our support hours and types for more details about this one.

Feel free to visit our Payroll page for more insights about managing your payroll in QuickBooks.

You can always update us on the result after performing the steps or reaching out ur support in the comment below. I'd like to ensure this is resolved for you. Take care always.

Thank you, @RCV, for the quick response. I've updated my payroll schedule. I'd still like to know why this would happen in the first place. At least I now know to keep an eye on it to be sure and catch it if it happens again.

Thanks for keeping in touch, CariDCNC.

I know that being able to know the possible reason behind this issue with payroll showing due is important. So aside from the one mentioned by RCVI which is the Create Paycheck status did not update, it's possible that your payroll release version needs to be updated too.

I'll show you the steps below in case you need it:

For more details about updating payroll, just visit this article: Get the latest payroll tax table update.

Here's an article that provides a list of common payroll errors and how to fix it: How to fix common Payroll errors in QuickBooks.

You may find the following articles helpful. It provides an overview in case payroll items/taxes are calculating incorrectly:

Let me know in the comment section if you have other payroll questions or concerns. I’ll get back to answer them for you. Have a good one.

I did April's payroll in May 2025 and now May's payroll in June and it is still showing April's is overdue in status box, the only thing due for April is the state tax. How do I fix the overdue status for April 2025

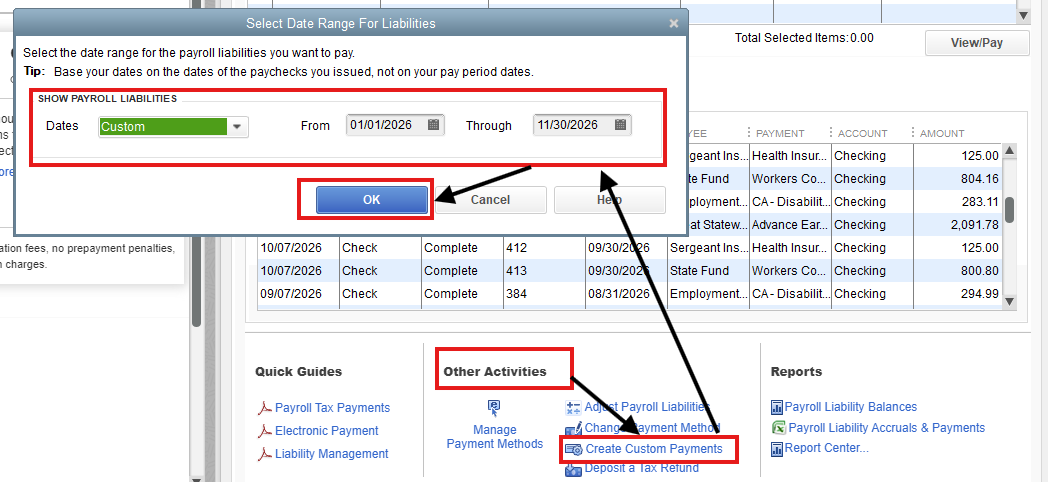

Since your April state tax is unpaid and knowing it's part of the obligations that need to be settled, it will always show as overdue in the following month's payroll. To fix the current status shown, you'll need to clear this by paying it and creating a liability payment in QuickBooks Desktop (QBDT), @ma491.

Let's begin by generating a Payroll Liability Balance report to be sure that the only unpaid tax is in April. Next is, to create a custom payment of it in QBDT. Here's how:

In some cases, you need to create changes to correct employee's year or quarter-to-date (YTD) (QTD) payroll details. You can visit this article for more information: Adjust payroll liabilities in QuickBooks Desktop Payroll.

Let us know if you have additional questions about overdue taxes on your payroll. I'll be sure to assist you promptly.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here