Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I am unable to get the 943 to populate the FFCRA credits for qualified sick leave correctly. The items are set up correctly in the payroll item list and I am able to run a 941 (as a test) with the credits populating correctly and with Worksheet 1 coming up. When I try to do this in the 943 form (my client is Ag), the sick leave wages do not pull into Line2a, nor does the non refundable portion of the credit pull into line 12b. Worksheet 1 does not follow either. I can manually override Line 2a, but cannot override line 12b, and cannot get into Worksheet 1 to override, since it's not there! Yes, I have installed the latest payroll update! What is so

If the form isn't going to populate correctly, at least give us the ability to override!

I do appreciate your time and effort to correct your payroll forms, BHKCPAS.

Good job for updating your payroll tax table. That's the first thing to ensure that your forms overrides and populates correctly. You can also try running the payroll check up to fix tax amount discrepancies and it will offer suggestions on how to fix the problem.

Let me show you how:

Feel free to look at this link for more details: Run payroll checkup. For future reference, I've added an article that provides an overview of the Form 943 in QuickBooks Desktop.

Keep me posted on how this works. I'd be glad to help. Take care!

Still no change with running the payroll check up. The article you sent is also a year old. The problem I am having is due to the new COVID related credits not appearing, so that is new. Like I said, the 941 works properly, but the 943 is not populating correctly. I have had to download the form from the IRS website & manually type it up.

I am having the same issue with 943. Called QBs with the problem and was asked if I had this issue last year....um, no, it's related to Covid, so didn't have covid

Hi there, Tracieo.

Let me first welcome you here in the Community.

It's best to get in touch with our QuickBooks Support Team again. This way, they'll be able to further investigate the root cause of the issue about 943. They also have tools to securely pull up your account and check your file via screen-sharing.

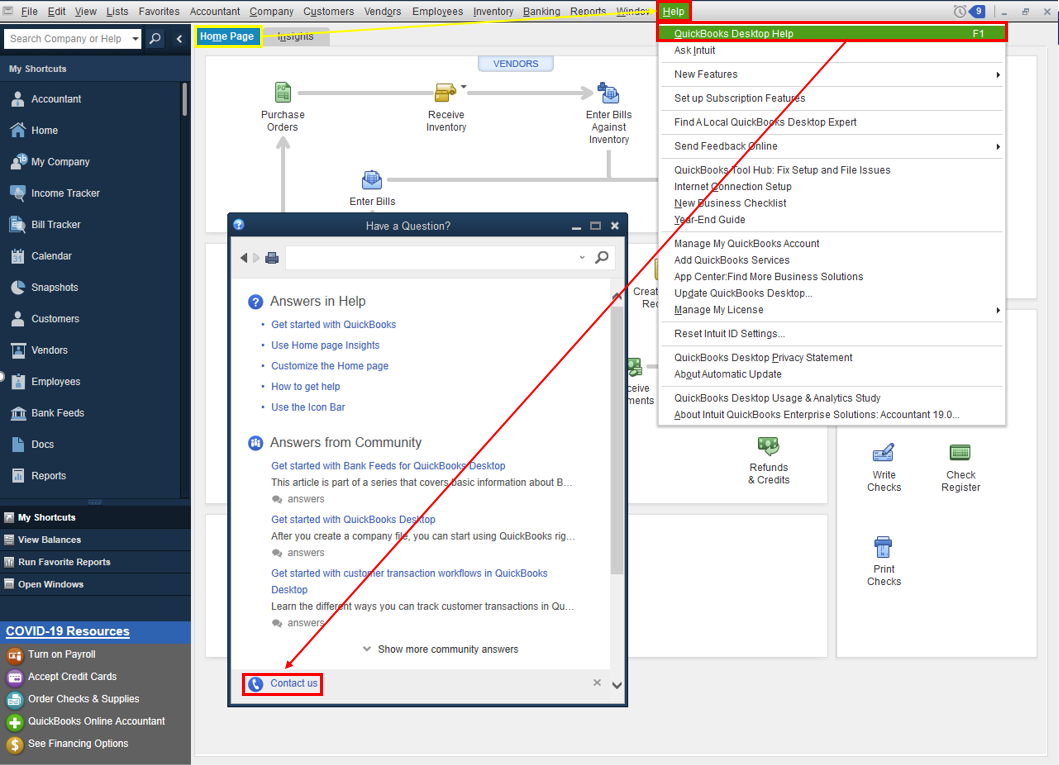

Here's how to get a representative:

For a detailed explanation of each line on Form 943, I suggest referring to the General Instructions for Form 943.

Additionally, I've added an article that'll provide troubleshooting and QuickBooks Desktop information about lines on Form 943. This helps you learn about 943: QuickBooks Desktop Behavior: 943.

You can always count on me if you have other payroll concerns. I recommend clicking the Reply to share your concern.

I am having the same issue. All items are set up correctly. Everything flows to the 941 correctly, but is not reporting correctly on the 943. Qualified sick is blank. Both forms were produced in the same client desktop file to confirm Covid related payroll items were set up. Something isn't programmed right.

Thanks for joining the conversation, dbryson-isler.

Since all items are set up correctly, yet the amount isn't showing on the 943, I'd highly recommend reaching out to our Payroll Support Team. One of our specialists can pull up your account and further check on this.

Here's how to reach out to them:

I would also recommend the following articles shared by my colleague to learn more information about Form 943:

You can always tag me in a comment below if you have anything else to add concerning 943 in QBDT. I'll be happy to help you.

There is a problem with the National Paid Leave EE processing correctly on the Form 943. Could someone please answer our question. All of the solutions you have given us do not work.

Thanks for joining in this conversation, @Deha0564. I appreciate you for trying all the steps provided here in this thread.

However, since it didn't work for you, I'd recommend contacting our Customer Care team by following the steps provided by my peer @GlinetteC. They can take a closer look at the issue and help you fix it.

For future reference, read through this article: Adjust payroll liabilities in QuickBooks Desktop. it helps you learn about how to correct payroll in case you'll need to.

Let me know if you have additional questions, @Deha0564. I'm always around here to help.

Is there any update on this problem? I have contacted support as suggested and they are unable to help...

Hi there, donnawalker456. I appreciate you for reaching our Phone Support.

I have some additional troubleshooting steps for you to perform to help resolve the issue.

To start, let's ensure that QuickBooks release and the payroll tax table is updated:

Then, to ensure that your company file is in good condition, you can also do the Verify and Rebuild process. Doing so would fix components on your company file that were damaged.

Once done, check to see if 943 populates correctly. But if you get the same results, run a payroll checkup. It would help us determine which is causing the issue. Before doing so, create and save a backup of your company file first before running it.

For more information about 943, see these articles:

For future reference, here's some resource to help you get ready during tax season:

Please let me know how things go on your end. I want to ensure this gets resolve for you. Take care and have a great day.

I have enhanced payroll and I don't see this option when I click on employees

Hey there, nvw.

Thanks for joining this thread. The steps mentioned above are referring to QuickBooks Desktop Payroll. I'd be glad to provide info about the 943 form in your Enhanced Payroll account.

The 943 form isn't currently available within Enhanced Online Payroll, however there's another option. You can download the form from the IRS website and then run the Tax Liability Report in QuickBooks. Here's how:

I recommend the following linked articles for more helpful info:

Don't hesitate to reach back out if you have other questions. Myself and the rest of the Community have your back!

Hi Morgan

The 943 does populate but not correctly and you can't override all the lines

Hi again

I spent 4 hours on Friday using chat on QB. The person trying to help me didn't have a clue about payroll.

I suggested several times to have someone call me but to no avail. If you can have someone call me I would be happy to give you my number.

+

Hello, nvw.

As mentioned by my colleague @MorganB, 943 forms are currently not supported in QuickBooks Online (QBO).

To verify your payroll subscription, check out these links:

You may also send us a screenshot of your page for me to have a better view and help identify your subscription. Before attaching, ensure to cover sensitive information.

I look forward to hearing from you again. Have a great day.

Hi Miriam

I have QB desktop

I need to know if I have the paid leave credit set up correctly. Pic attached

@MirriamM wrote:Hello, nvw.

As mentioned by my colleague @MorganB, 943 forms are currently not supported in QuickBooks Online (QBO).

To verify your payroll subscription, check out these links:

You may also send us a screenshot of your page for me to have a better view and help identify your subscription. Before attaching, ensure to cover sensitive information.

I look forward to hearing from you again. Have a great day.

Hi Miriam

I think I need to clarify. I work for a CPA firm and we do various clients payroll using QB Desktop 2019 and 2020. Our clients expect us to know how to fix their QB payroll. They all do their own payroll thru QB and I am trying to help them. This is why I need your help.

Also each one of the articles say to run Payroll Checkup - this is not available.

I also have all the articles - Desktop behavior 943

The issue is QB doesn't separate the paid leave on line 2a. Does this mean there is a problem with how the paid leave was set up? Based on the payroll summary QB is lumping the paid leave into Gross wages

Can you tell me how to correct?

Thanks for sharing the screenshot, Nvw. Let me help you.

Once you're in the Taxable Compensation window, you'll have to click Next immediately. We don't have to check or exclude any items from there. As long as you've selected the right accounts, then the national paid leave credit is set up correctly.

You can refer to this article to guide you better: How to track paid leave and sick time for the coronavirus.

If you have additional questions, feel free to get back to this thread. We'll reply as soon as we can. Take care!

QB has done another update this morning and it has fixed the 943. Woohoo!

Can you tell me why the hours for the Covid pmts aren't showing up on the payroll summary?

Hi Miriam

The update this morning fixed the 943

But why aren't the hours showing on the payroll summary?

Thanks for posting here, @nvw,

I wanted to make sure this is thoroughly checked. I know how important it is to review and complete your tax filings in this busy season.

If all items are set up correctly and the data won't show up on the reports, please get in touch with our Support Team. Our representative can do a viewing session to check on this.

To get a representative, follow the steps below:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

Post here again after contacting our support. I'll be right here to help you further. Have a nice day.

Hi Morgan

Thank you for responding. I DON'T HAVE QB ONLINE. I have QB desktop. The problem with trying to call support is they won't help me because I am an accountant. They claim I have no authority to deal with all our clients. Which of course is not true

My question is why aren't the hours for covid payment not showing up? When you do a payroll summary only the wages paid are showing.

Thank you for your continued help

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here