Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowOn the most recent payroll for this week, federal taxes do not seem to have calculated correctly. Higher paid employees have a tiny bit deducted, and lower paid employees have nothing deducted. I had all payroll updates installed, what could have caused this?

Solved! Go to Solution.

Hi there, Sunburst,

I can help check why the federal taxes are deducted incorrectly. I want to ensure correct taxes are calculated so accurate amounts are paid and filed to the IRS.

It's great that you've already installed the latest payroll updates. That knocks one step off of what we need to try next.

If it's the federal withholding that's not deducting correctly, you'll need to confirm the employees' profiles are set up correctly. QuickBooks calculates the federal withholding based on these factors:

Please follow the steps below to check the employees' profiles:

1. Click the Employees menu.

2. Select Employee Center.

3. Double-click the employee’s name, one at a time.

4. Click Payroll Info on the left.

5. Please make sure the Pay Frequency is correct.

6. Click the Taxes button.

7. In the Federal tab, review the Filing Status and Allowances fields. Make the necessary corrections.

8. Click OK.

9. Click OK again.

You can also try manually calculating one of the employee's paychecks to see if it matches QuickBooks. To help figure out the exact withholding amount, please go through the IRS 2018 Publication 15.

You can use the Percentage Method (page 44-45). It's the same method used by QuickBooks to calculate federal withholding.

If you need further assistance calculating federal withholding, you can contact me directly. I'll be here to help in any way I can.

Hi there, Sunburst,

I can help check why the federal taxes are deducted incorrectly. I want to ensure correct taxes are calculated so accurate amounts are paid and filed to the IRS.

It's great that you've already installed the latest payroll updates. That knocks one step off of what we need to try next.

If it's the federal withholding that's not deducting correctly, you'll need to confirm the employees' profiles are set up correctly. QuickBooks calculates the federal withholding based on these factors:

Please follow the steps below to check the employees' profiles:

1. Click the Employees menu.

2. Select Employee Center.

3. Double-click the employee’s name, one at a time.

4. Click Payroll Info on the left.

5. Please make sure the Pay Frequency is correct.

6. Click the Taxes button.

7. In the Federal tab, review the Filing Status and Allowances fields. Make the necessary corrections.

8. Click OK.

9. Click OK again.

You can also try manually calculating one of the employee's paychecks to see if it matches QuickBooks. To help figure out the exact withholding amount, please go through the IRS 2018 Publication 15.

You can use the Percentage Method (page 44-45). It's the same method used by QuickBooks to calculate federal withholding.

If you need further assistance calculating federal withholding, you can contact me directly. I'll be here to help in any way I can.

What can I do if taxes are not deducted at all?

Hello there, jgmigracion,

I can share a bit more about correcting your payroll taxes.

May I know if you're using the QuickBooks Desktop Payroll Service? If so, we'll need to identify when did the taxes stop calculating for us to make necessary corrections.

If the unexpected behavior only affects the most recent payroll checks, QuickBooks Desktop has an auto-calculation feature that carries over the underpaid taxes for the next payroll run. However, this feature only applies to rate based taxes like Social Security, Medicare or unemployment taxes and does not include withholding taxes.

In this case, you'll need to calculate the Federal Withholding manually. You can follow what my colleague MichelleT has advised in her answer above to calculate withholding taxes.

However, if the issue happened to several pay periods, we'll need to do a payroll liability adjustment to fix your taxes. Here's an article to help you with the process: Adjust Payroll Liabilities

Please keep me posted on how this goes, jgmigracion. I'm here to get things sorted out for you.

I am having the same issue, but quickbooks help had to escalate the ticket and no response yet. Did you get this fixed (how if so)?

Hey there, @dananwalters.

Thanks for joining us here in the Community. I can help get this taken care of, but I have some questions about your concern first.

So that I'm able to provide you with the most accurate information, what QuickBooks version and Payroll subscription are you currently using right now? You can leave a comment below to add more details. This can be done by clicking the Reply (green) button.

Looking forward to your response and providing further help. Have a good one.

I'm having the same issue. It seems as if the federal income tax is double what it should be.

Any help?

Thanks for joining this thread, @nreber.

I'm here to help share additional information about incorrect federal income tax calculation in QuickBooks.

Have you tried checking your Payroll reports to compare your previous federal income tax?

There are some possible reasons why your payroll taxes are calculating incorrectly. To ensure accurate calculation, your employees and payroll items should be set up correctly. It's also recommended to run a payroll report to verify if there are any discrepancies in your payroll data.

If you've already verified the taxes setup on your employee's profile, please refer to this article for other steps in fixing wrong tax calculation: QuickBooks Desktop calculates wages and/or payroll taxes incorrectly.

As always, you can contact our Desktop Payroll support if you need assistance in going through the steps. They can also help you locate if there are any discrepancies in your payroll report.

Let me know if you have additional questions about your Federal taxes. I'll be here to help however I can.

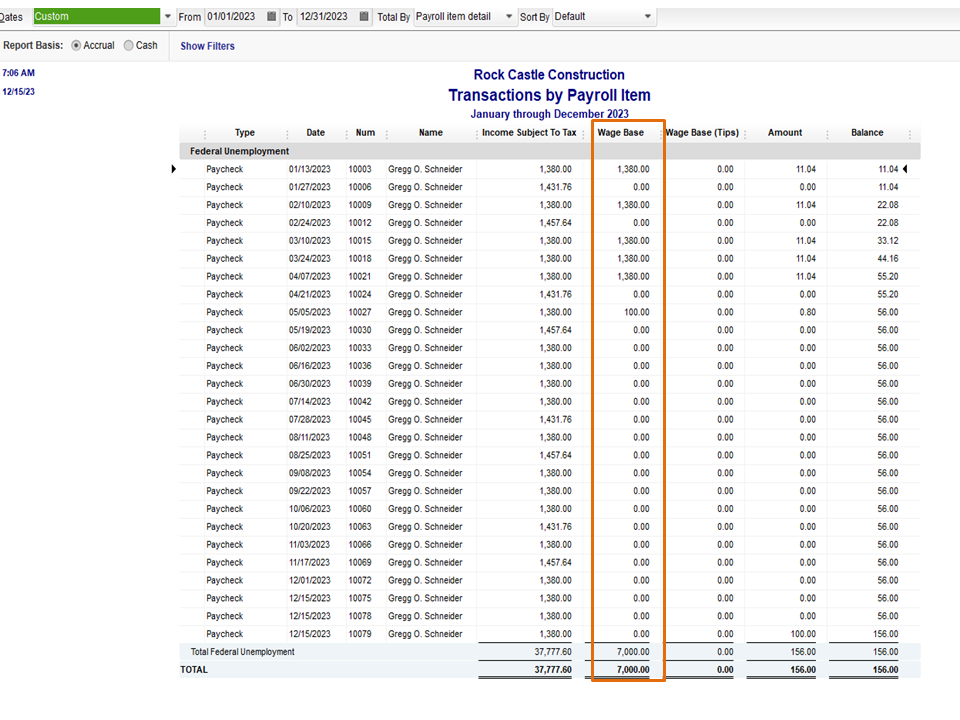

Its the employer portion of the federal unemployment it charged each employee 349.00 for the employer portion of the taxes

I already checked the employees, some did calculate right others didn't. It did however calculate right on the last 3 pay runs but not this one and no one has been added or deleted, nothing changed from last payroll 2 weeks ago

Thanks for following on this thread, @DPumpkin.

Taxes will not calculate correctly if the tax table is not updated, or if QuickBooks is doing an auto-correction. To fix the issue, let’s download the latest tax table version and perform a liability adjustment.

The previous process will provide the most current and accurate rates and calculations for supported state and federal tax tables. Here’s how:

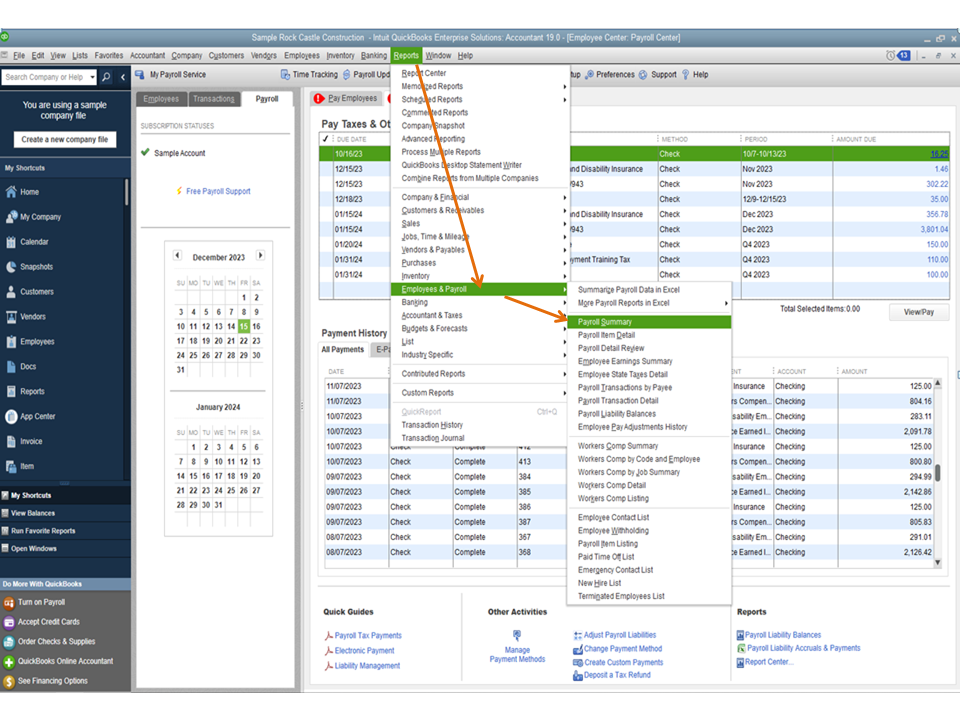

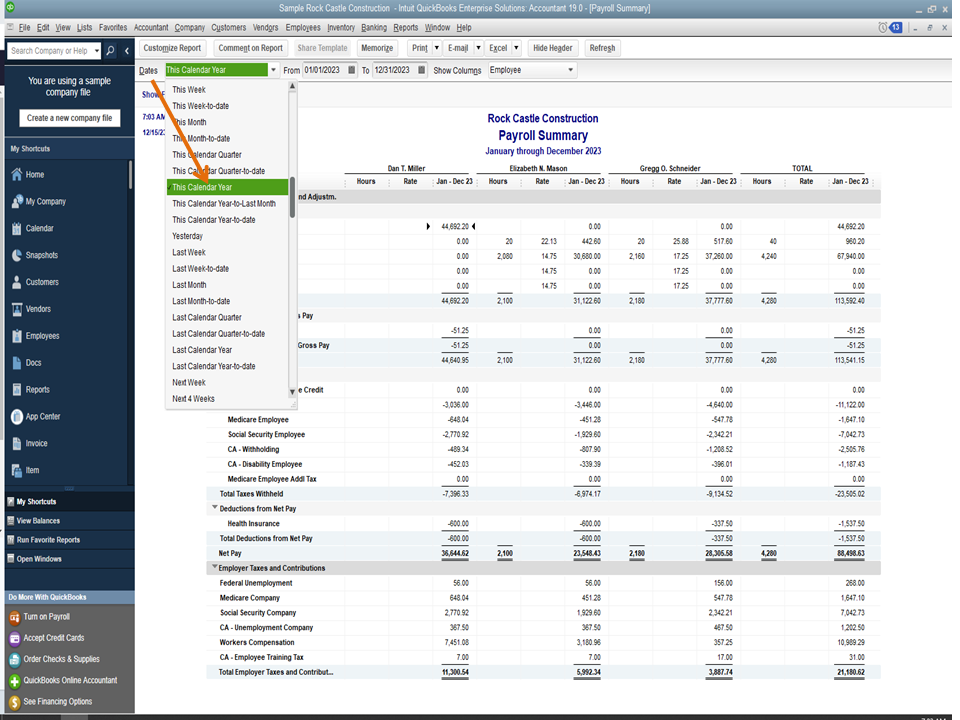

Next, pull up the Payroll Summary Report and then change the reporting period to This Calendar Year to see the up to date payroll data.

Once you have it handy, enter a liability adjustment. The following article provides an overview of how to find the payroll discrepancies as well as for instructions to fix incorrect taxes: Adjust payroll liabilities.

Keep me posted if you need further assistance when working in QuickBooks. I’m more than happy to help. Have a good one.

I am having the same issue. Payroll taxes are not be withheld correctly and some employees are having $0 withheld. I have QB Online, so shouldn't that automatically update?

Hello there, jenhofstad.

It could be that they did not meet the taxable wage base, or your employee's setup was set to Don't Withhold for federal and state income taxes. Let's double-check your employee's filing status. Here's how:

For additional information, you can check this article: Federal and State Income Tax are Withheld in Accordance with IRS Publication. Also, you can read the articles below to learn more about employee tax exemptions and filing status:

Please comment again if you have other concerns. I'll be around to guide and help you out. Take care and have a good one!

@MichelleT wrote:

Hi there, Sunburst,

I can help check why the federal taxes are deducted incorrectly. I want to ensure correct taxes are calculated so accurate amounts are paid and filed to the IRS.

It's great that you've already installed the latest payroll updates. That knocks one step off of what we need to try next.

If it's the federal withholding that's not deducting correctly, you'll need to confirm the employees' profiles are set up correctly. QuickBooks calculates the federal withholding based on these factors:

- Taxable wages

- Number of allowances/dependents

- Pay frequency

- Filing status

Please follow the steps below to check the employees' profiles:

1. Click the Employees menu.

2. Select Employee Center.

3. Double-click the employee’s name, one at a time.

4. Click Payroll Info on the left.

5. Please make sure the Pay Frequency is correct.

6. Click the Taxes button.

7. In the Federal tab, review the Filing Status and Allowances fields. Make the necessary corrections.

8. Click OK.

9. Click OK again.

You can also try manually calculating one of the employee's paychecks to see if it matches QuickBooks. To help figure out the exact withholding amount, please go through the IRS 2018 Publication 15.

You can use the Percentage Method (page 44-45). It's the same method used by QuickBooks to calculate federal withholding.

If you need further assistance calculating federal withholding, you can contact me directly. I'll be here to help in any way I can.

All my paid taxes do not show and i received email something was due nut it not there anymore plus everthing is out of the place

Hello there, @all my tax iformation is gone.

I'm here to help you check out why you're tax info is not there. Before that, I'd like to know if you've already paid your taxes. This is because the task or notification will not show if it has been paid.

Since you're not able to see the tax on due, I'd suggest performing the browser troubleshooting method. This is done to avoid saving the data in your browser when surfing the internet. There might have outdated data that needs to be refreshed.

First, log in to your QuickBooks company using a private browser. If you're now able to see the taxes being paid and the tax to be paid, you can go back to your regular browser and clear the cache. An alternative way is to use another QuickBooks supported browser.

Here are the keyboard shortcuts to access an incognito browser:

However, if it's still the same, I'd recommend contacting our QuickBooks Online Care Team. They have the tools to verify your account and get to the bottom of this.

I've added this article for your future reference in case you want to track the wages in your business: Run payroll reports.

Please don't hesitate to let me know if you have other questions in QuickBooks. I'd be happy to answer them for you.

I have a new employee that is saying Quickbooks is not taking out enough federal taxes. She is single, no dependents, paid weekly, paid hourly. She works 40 hours and is paid $13.00 an hour. Please help.

Thanks for joining in the thread, sheila48.

I can provide information on why federal taxes are deducted incorrectly.

May I know if you're using QuickBooks Desktop Payroll Service or QuickBooks Online Payroll? This helps me provide the best action to take to resolve your issue.

The federal withholding is calculated by QuickBooks using the following factors:

You'll have to double-check your employees' profiles if they are set up correctly. If you're using QuickBooks Desktop Payroll, you can follow the procedures outlined by my colleague MichelleT above.

Here are the steps for QuickBooks Online Payroll:

I've included the following articles below for more insights:

If your employee is set up correctly, you can contact our Payroll Support Team. They have the tools to help you via secure remote access sessions.

Leave a comment below if you have further questions or you need further assistance with taxes. We're always here to help you.

Can you please provide screen shots of this process? I have quickbooks online and am having the same issue (not withholding federal taxes) and do not have the options you listed here.

Hi there, @LewCol4.

Thanks for joining the thread. Let me share with you the steps on how to check your employee's profile and make sure they're not tax exempt.

Here's how:

For additional reference, please see this article: Federal and State Income Tax are Withheld in Accordance with IRS Publication.

Moreover, you can check the articles below to know more about employee tax exemptions and filing status:

Should you have any follow-up questions or concerns about federal taxes, don't hesitate to post again here in the Community or leave a comment on this thread. Take care and have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here