Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We received a PPP loan in 2020 that should get 100% forgiven.

With the new changes to the ERTC eligibility we should now be able to get those credits for periods we were shut down and had already exhausted the PPP loan for payroll. We are a hospitality business ordered shut down by the governor several times due to covid.

I have already filed all 2020 941s and 940.I am holding off on my W2s trying to figure out how the heck to deal with this. I am finding no guidance from Quickbooks payroll anywhere.

I cannot find how to retroactively claim this credit for 2020. Has anyone succeeded??

Hi there, jamiedickenson. Thanks for reaching out to us.

Let me route you to the best support available so this gets addressed right away.

Please know we have a dedicated team that answers Paycheck Protection Program-related inquiries. To know the processes in claiming the credits for ERTC eligibility, I recommend contacting our representatives. You can connect with us by going to the PPP Center area of your QuickBooks account and selecting Live Chat.

I also encourage our Microsite to stay current with our latest news and updates about PPP. When you're all set up and ready, you can read this article to be guided in filing your W-2s: E-file Federal W-2 Forms.

Do let me know if you have any other concerns or questions by adding a comment below. Have a great rest of the day.

This is not a PPP loan question. It is a question about the Employee retention tax credit to be claimed on form 941. The PPP people can still help me with payroll tax forms though? I am sorry I don't see a PPP section anywhere under my account either.

Allow me to share some insights on how you can claim the employee credit, @CMoore3,

If you already done the steps to track the COVID-19 items in QuickBooks, it will be easier for us to determine the claimable amount. Please refer to this article for the steps: How to set up and track the Employee Retention Credit under the CARES Act

If you are a manual filer and uses QuickBooks to print forms, you can manually override the data in the form. Here's how:

Check this article for more details: Prepare and print Form 941, Schedule B, and Form 940.

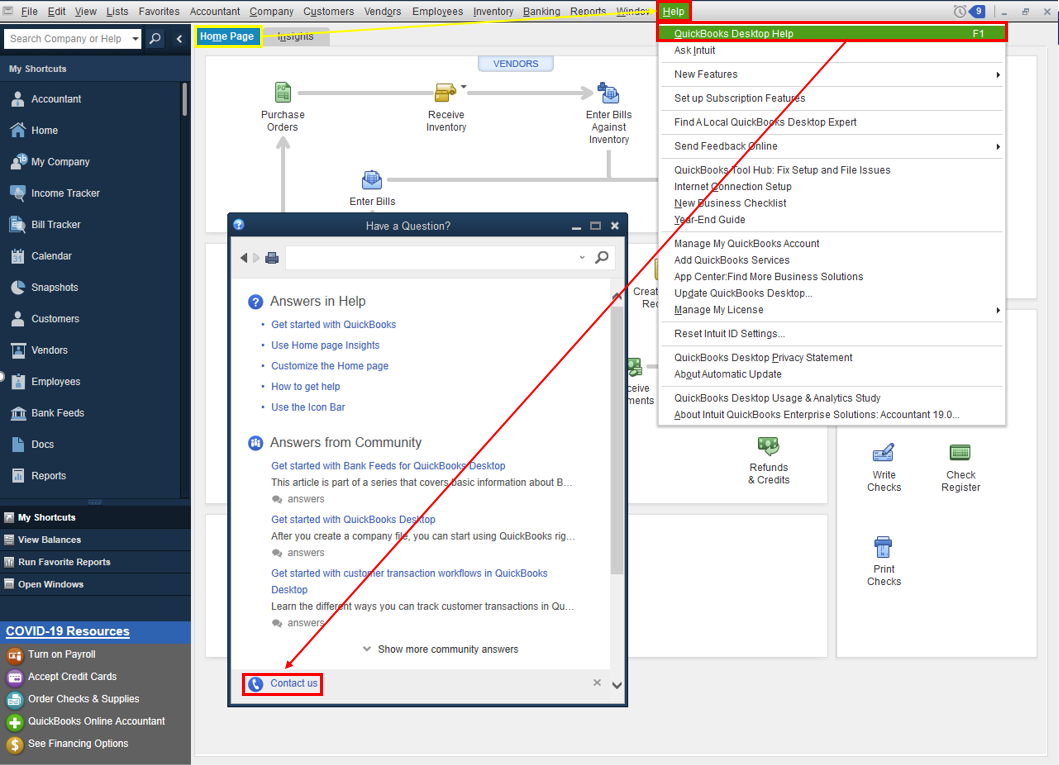

If you need someone to assist you on the line, I recommend reaching out to our Support Team. They can initiate a viewing session with you and can help further with your 941 report.

To get our Support, follow the steps below:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

Let me know how it goes in the comment, I want to make sure this is resolved for you. I'm also here to provide further assistance with your payroll.

I did this- contacted Intuit- I waited one hour on chat to be told that since I have full-service payroll they couldn't help me and then waited on the phone two hours just for a person to tell me that 'they are working on it' and someone will call me. No one has called me. Meanwhile, my peers who use GUSTO just have to click a button to file 941X. Please help us!

We also did not set up our payroll in 2020 for the ERTC because we had the PPP - and we're about to file amended 941's for 2nd, 3rd and 4th quarter.

There is no way I'm going back to do all of that coding when I can just run it on a spreadsheet.

For this year, I guess we'll retroactively tag and use the ERTC part of QB?

I'm not too worried because we're asking for the refund as part of the 941 and we can do all the maths.

Still, wish QB was up and running!

This is not the impression we want you to have, @larceme.

This happens when our customer support team is encountering a high volume of chats and calls. While waiting, you can always post your questions here in the Community. You can also, visit this link source from the US Department of Treasury about the Employee Retention Credit: How to calculate Employee Retention Credit.

To learn more about the Employee Retention Credit, please see this article:

COVID-19-Related Employee Retention Credits: How to Claim the Employee Retention Credit FAQs.

If you need further assistance with the process, you can initiate a chat or a call back request again. Once a representative receives your call, you can provide them your previous case number. This way they can review your case history and help you further in preparing the form.

I also encourage you to visit our QBO Help page. From there, you can browse articles or get some ideas from other QuickBooks users and experts. This way, you'll get more insights that can help you with your QuickBooks tasks.

Let me know how this goes and leave a reply below if you have further questions about this. I'm always around to help. Have a good one.

There is currently no way to track WORKED HOURS under the new December 27th Federal Covid Act that is retroactive for 2020 ERTC.

For those of us who qualify (income declined more than 50% one quarter), have less than 100 employees, etc - we get to claim the ERTC for worked hours for our staff.

Currently, as far as I am aware, there is no way to code these wages.

I have a larger question. Will QB be allowing those of us who file an amended 941 x to be able to enter those at a later date? I ask because I'm not seeing you pull up a module in time, and it really doesn't impact the books in our case (we're an LLC) so it is just a straight up tax credit that rolls forward to the member owners.

Why are you giving me all these instructions to do this myself when I have full service payroll with you and you should be doing it all for me?

@larceme. - be careful of the advice here. It is my understanding from reading the Forbes article by Tony Nitti that came out about the retroactively available 2020 ERTC for those of us who had PPP and still qualify - that we must FILE THE FORMS before a date in February. The link the quickbooks team provided is not accurate - it is likely accurate for a typical amendment to a 940 or a 941 x.

Be very careful, Quickbooks team, when posting links for filing 940's and 941's in relation to the ERTC. There is a faster deadline to claim this credit!

Last Night, the IRS updated their instructions for the 940's due on MONDAY in two days. They say to list the Q2,3,and 4 ERTC Eligible Wages and Health Care Expenses directly on the 940.

Here is the Question for Quickbooks: For a firm that typically efiles our 940, how do we amend lines 11 c, 11 d, etc that are listed in the attached instructions?

Here is the link for you and the rest of us who need these refunds to maintain our employees.

Hello there, @BurgeonKids.

You'll have to manually amend lines 11c and all other required details listed based on the IRS instructions for ERTC Eligible Wages and Health Care Expenses in QuickBooks Desktop (QBDT) Payroll. When you e-filed Form 940, you must use a paper return to amend it.

Before creating an amended return, make sure to enter the necessary liability adjustments in QuickBooks. Once ready, I'd recommend checking out this article for the step-by-step guide: Correct or Amend Forms 941 and 940.

To learn more about Employee Retention Credit, you can refer to this article: COVID-19-Related Employee Retention Credits. It answers the most frequently asked questions about the said topic.

Let me know if you have other concerns about amending payroll forms in QuickBooks. I'm just around to help. Take care always.

Thanks. I had a typo. We're supposed to include it on our 4th quarter 941, not 940 for the firm. I still have to manually make those changes on the form correct? There is no way to modify the lines and have QB submit?

I can manually change and file, but our tiny team wants to know how to turn off all of the alerts and auto-file notices in quickbooks if that is the case.

Those mess with my business manager's sense of order and decorum.

Hi there, @BurgeonKids.

I can share with you some additional information about correcting your forms.

Yes, you can correct your Quarterly Form 941. Moreover, I would recommend referring to the IRS instructions for line-by-line assistance. Then, enter the correction for the quarter.

For additional tips on how to prepare the corrected form, you can open this article and check out the steps under the Prepare Form 941-X section: Correct or Amend Forms 941 and 940.

You can also check out the information from this link for additional references about year-end payroll: Year-end checklist for QuickBooks Desktop Payroll.

If you have any other follow-up questions with payroll or forms, feel free to leave a comment below. I'm more than happy to offer help. Have a good day!

How about for Quicbooks Online Payroll ?

Thanks for joining this conversation, @lufu19741.

If you're also trying to amend or correct your Quarterly Form 941 for Quickbooks Online Payroll (QBOP), I highly suggest contacting our Payroll Support team. They have tools that can pull up your account in a secure environment and help you with the process.

Here's how to reach them:

To learn more about filing quarterly tax forms in QBOP, consider checking out this article: File quarterly tax forms.

For more information about Paycheck Protection Program (PPP) loan and Related Employee Retention Credits, visit these links:

Please post again or leave a comment below if you have any other questions. I'll be here to assist. Have a good one!

I had QB Payroll Full Service for our team in 2020. I switched to Paychex 1/1/21. QB Payroll filed our 941 on the 15th of January 2021. I am looking to file a 941X because I am going to file ERTC. I just had my CPA do it because these employees at QB Payroll don't even have a clue. Reading this thread show why I made a great choice to leave QB Payroll. You can clearly tell by the answers given, that these support reps at QB Payroll have not the slightest ideal what the hell they are doing. Due to the lack of knowledge at QB Payroll, their customers are going to lose tons of money because QB don't have their s**t together. I would never recommend QB Payroll to anyone.

I will be filing 941X's for 2020 to claim the ERTC credit. Does anyone know how to account for this in Quickbooks? How do the credits affect my financial statements for 2020, if I am on an accrual basis? What adjustments do I need to make? I realize that the credits do not count as income. Can anyone confirm that they reduce my payroll expenses by the amount of the credit? If so, what JE's do I need to create, or is this something that has to be done via Payroll, to properly reflect payroll taxes paid in Quickbooks?

I feel like there is so little specific information out there about how to account for these credits retroactively, that I need to request extension for both my business return (1120S) and my personal return, which is impacted by that (1040).

Thanks for reaching out to the Community, SP-Jenn.

I'd be more than happy in guiding you through how to prepare 941-X forms.

Here's how:

Next, you'll need to pick which return you're correcting and confirm your quarter that's being amended is accurate. Once you finish preparing each form, they can be printed and mailed according to the IRS's instructions.

As for your other questions, I'd recommend working with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find an Accountant. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

You'll additionally be able to find detailed information about working with Employee Retention Credits in our Set up & track Employee Retention Credits resource.

Please feel more than welcome in sending a reply if there's any questions. Enjoy the rest of your day!

I use QBO accounting version for myself and the full-service payroll version for my clients and I don't see any of these options.

Hi, @larceme.

The steps provided above are for QuickBooks Desktop Payroll. With QuickBooks Online Payroll, you may connect with our Support Team. This way, a representative can help you with preparing the desired form accordingly.

To get in touch with the right support, you can use this link for the QuickBooks Full Service Payroll: QuickBooks Full Service Payroll Chat Support.

For additional resources about filing forms in QuickBooks Payroll, you can open these articles:

Moreover, here are some of our help articles you can read more about Employee Retention Credit:

Please let me know how else I can help you with QuickBooks or your forms. I'm always here to help. Keep safe!

Angelyn- Can you have someone contact me who can guide me in how to set up to file Q2, Q3, Q4 2020 amended 941s to claim the ERTC? I have my amounts eligible calculated. Working in Quickbooks enterprise desktop-assisted payroll.

So far talked to assisted payroll, ppp team, desktop help-- no one has any answers or knowledge.

Not the 940 Annual FUTA tax return. You mean 941 quarterly report., IRS link refers to ERTC that can be claimed for 2020 can be reported on the q4 941 or file 941X if filing after 2/2 deadline. Most of us didn't get the credits completed in time for 941 q4 much less form 7200 Advance credit - way to much going on and still issues we all need clarity on from the IRS! In addition, the IRS instructions for credits on the 941 and 941X are incredibly vague.

Do you have to file an amended 941-X for all quarters in 2020?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here