Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThe error message actually occurred after the update because the ability to pay electronically disappeared. Since the MD SUTA was previously scheduled to be paid electronically, the system didn't know what to do with it once that disappeared. So managing your payment options (yes the flavortext is wrong in the pop-up, but the link at the bottom of the page allows you to do this), should reset your liability link in the Pay Taxes & Liabilities box at the top. As long as the Payment method is set with a payment method, filing frequency, payee, etc. - you will get a liability amount in your pay liabilities box.

Added note: I have two clients with MD SUTA in Desktop 2019. One of them is on release R13P (_27). MD SUTA epayment is not available. The other is still on release R12P (_78). They still have the option to enable epay. Both of them have the latest payroll updates. It seems pretty clear to me that the latest update broke something.

@valprice1 The State of MD no longer accepts Quarterly Filings & Electronic Payments from QB or other 3rd party agents as of 9/11/2020; everything must be completed on the BEACON site, including electronic payments, but there is an option in BEACON to submit a check payment.

I was able to remove the "One or more scheduled liability payments..." message, by selecting "Change Payment Method" in the Other Activities box on the Pay Liabilities tab and that took me to the QB Payroll Setup. Currently, my Pay Liabilities box is cleared, but this will change when I process payroll next week.

@dfitch01 I'd be interested to see your reference material on that. The MD DLLR has specific instructions for 3rd party agents on setting up the efile of the DLLR 15 (quarterly wage report), and I have successfully filed the form through QuickBooks desktop since the change. I couldn't find any reference to them discontinuing 3rd party payments.

Their Instructions for Third Party Agents publication details how to set up the new format for e-filing the forms, but the only reference I found to payments simply says this:

Q: Will modernization require reimbursing billing payments to be made electronically?

A: The preference would be to receive payment electronically. However, payments can also be made by check and a P.O. Box has been established for reimbursable payments.

I've got an email out to the MD DLLR asking that very question, but they haven't responded yet.

And regardless of whether we have to do this extra step (of logging onto the Beacon site to pay), I (and all my Maryland clients) need QuickBooks to NOT abort every time we try to look at the epayment history within any company file.

For what it's worth, I'm having the same problem with Quickbooks crashing when I click the E-Payments tab within Pay Liabilities. In my case, my Maryland Witholding and Maryland Unemployment are both inactive (don't live in Maryland anymore), but it still crashes - possibly because of historical MD E-payments? I would greatly appreciate a fix from Intuit for this issue.

I am not sure if there was an update to Quickbooks that is causing this problem, but I am having it in all versions of Quickbooks. Error, One or more scheduled liability payments is missing..... And I do not have the Related Payment Activities button. What is going on?

The correct link either says Manage Payment Methods, Change Payment Methods, Start Paying Electronically, or something similar. It is in the middle of the screen near the bottom of the Pay Liabilities tab in the Payroll module. That will clear your flag, but it won't actually fix the problem.

@valprice1 I am running on QB21; when I submitted my quarterly form & payment to MD UI they were both rejected by the agency. I received a message immediately that the agency I was trying to pay would no longer accept payment and to contact the agency directly.

I contacted MD UI & the rep I spoke with explained that everything would need to be processed in the BEACON site.

I need someone to walk me through this, I do not understand why all of a sudden my liability has changed.

Please give me a call {Removed by Moderator}

I'd be delighted to get you moving in the right direction with this scheduled payment liability error, @mb51.

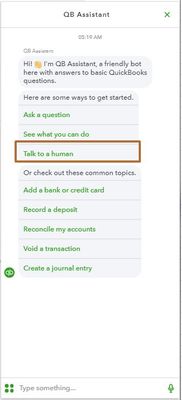

You can schedule a callback from the Phone Support Team using the In-Product Help menu. This way, you can get in touch with someone to assist you with anything you need at a time that's most convenient for you. This team can walk you through the steps in fixing this liability issue without a moment's delay.

Here's how:

These instructions are also available from our guide on contacting QuickBooks Online Payroll support for your convenience. Additionally, please do refrain from posting any posting any personal details here in the Community or any public forum for security purposes.

Please know you can always find me here for all of your QuickBooks needs. Thanks for coming to the Community and take care.

@LieraMarie_A I have spent several hours (more than 6) on the phone with varying levels of support, using several different customer files and several different versions of QB desktop, trying all the same things over and over again. They can't fix it.

The bottom line is that Maryland DLLR stopped accepting the type of e-payment that QB desktop payroll sends, and that broke the e-payment history screen and causes QB to abort with an unrecoverable error.

The workaround to pay your taxes is to either go to the Beacon site and e-pay them directly there, or print and mail a check to the Maryland Unemployment office.

As of Tuesday, we were still waiting for a fix on the unrecoverable error. I'd love to know if they are going to reach out to us and let us know that it is fixed, or if I simply have to keep testing it each time.

I have the same problem. When I look into it - Payment History "All Payments" payment history for tax payments made (both check and E-Payments) prior to May 2020 have disappeared. I should have payment histories all the back to 2006/7

When I click the E-payments tab - it kicks me out of quickbooks "fatal error".

Don't know what is going on -

Quickbooks support team should investigate and come up with an answer.

RR

.

Thanks for adding your concern in this thread, @RR2448.

There may be an issue with your company file that's causing the payment history to disappear. Let me share with you the steps on how you can troubleshoot this kind of error in QuickBooks Desktop to fix it.

First, update QuickBooks Desktop to its latest release. This will help you fix some minor issues within your company file. Here's how:

Once done, run the Desktop Tool Hub on your computer. Then, select the Company File Issues tab if you’re having error messages opening your company file or missing or blank lists. This will open the Quick Fix my file and the QuickBooks File Doctor tool. If you need additional assistance, select File Dr Help on the company file tab.

If you're still getting the same issue, I recommend reaching out to our customer support. This way, they can check your company file and trace the cause of this concern.

If you have follow-up questions, feel free to leave a message in the comment section. I'll be happier to help. Take care, and have a good day.

Hello!

I had to chime in on this -

It is not an issue with the company file. I know this because I have several clients across different editions and years of QuickBooks that are having this issue. I did basic troubleshooting (making sure QuickBooks is up to date, resetting QuickBooks update, verifying data file, rebuilding data file, QuickBooks File Doctor found no issues with any of the company files, got payroll updates, ran QuickBooks in Admin, just to name a few!)

It is an issue with QuickBooks recalling Maryland Unemployment payments that were previously made. I did notice that my payroll clients that do not have Maryland Unemployment payments that were E-Paid do not have this issue. So, I think it's a problem with QuickBooks trying to recall data specifically related to Maryland Unemployment.

We're in MD also, and experienced the Beacon-QB interface breakdown. In my several phone calls to Intuit, I was told that Intuit/QB has significant issues with many state unemployment systems, and they were strategically moving away from supporting e-filing and e-payment for all. I find this hard to believe, but it does fit with our experience at the end of Q3.

Thank you for your response/suggestion

Sadly, it did not fix the problem. Need to get hold of Qucikbooks

Thank you

RR

I'll help make sure you can get in touch with one of our representatives, @RR2448.

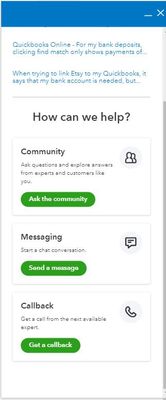

Since you've already performed the needed troubleshooting steps, I recommend contacting our support team for further assistance. They have the necessary tools to check your account in a secure space and perform a viewing session to investigate this more.

Before diving in, please review our support hours guide to ensure they can assist you on time. Also, please note that we've made some changes to our support options. Our representatives are available via messaging or chat to accommodate all our customer's concerns effectively.

Here's how to contact our support team:

In case you have prior or historical tax payments, you can record them in QuickBooks to ensure that your future tax deposits and filings are accurate. For more tips, please see this article: Enter historical tax payments in Desktop Payroll.

Then, you can start filing your forms to stay compliant with the state regulations. This way, you can also access and print them to keep a copy for future use.

Just comment down and I'll do my best to answer your tax payment concerns in QuickBooks. Have a good one.

I also am having the same CRASH issue when clicking on E-payments under Pay Liabilities. Has been going on for over a week. Quickbooks - WHAT'S THE RESOLUTION?

Ditto, having the same issue. QUICKBOOKS this doesn't build confidence in your product when practitioners continually have the same repeated UNRESOLVED issues.

I understand the impact of any delay in resolving this issue, @JAC2. To get this issue resolve right away, let me route you to the best available support. Since the Community forum is a public space, I'd suggest contacting our Technical Support team. They have the tools to securely perform remote access session to identify the root cause.

Here's how to contact them:

You may also refer to the screenshots above given by my colleague ReyJohn_D.

You can also check out these payroll liability related articles for additional reference:

Keep me posted on how your call goes by clicking the Reply button below. I'm always here to help.

Quickbooks team -

Rather than direct each individual user to support, it seems clear that there is a core software issue with the product crashing in the scenario mentioned by several users. What would be most useful is for Intuit to acknowledge that there is an issue that they have reproduced, provide an ETA when Intuit plans to resolve the issue, and to let us know when the software update is available once it has been resolved.

Thanks.

The engineers are working on a resolution.

Now it has become critical. Two clients (different company files) have had their EFTPS payments rejected and there is no way to view the audit trail to figure out why.

Today, I spent couple of hours of screen sharing on this issue. When-click Epayment tab - it kick me out.

During the two huors, ran all tests, reinstalled QB -

Finally sent my Quickbooks file QBW files to them. Hopefully the engineers will look into it

Now as I investigate EFTPS payment are rejected -Email says - "Password reset required by IRS" - Then went to EFTPS website - No issues - It did not require any reset. Voided EFTPS payment - then tried again - Same problem.

Next went to EFTPS website - changes Password - and tried EFPTS payment from QB - This time - email rejection - "Not enrolled in EFTPS or password error" - This is frustrating.

Since, I am on deadline - went to EFPTS website made a manual payment - so my client will not late.

Went to previous IRS tax payment from 10/26 - Quickbooks still has stamped "Submitted" - Checked EFTPS website - Thank god, payment has been settled. Other state electronic payments have been made they all show "PAID" - I hope it was paid - I will know only when I check bank statements -

Hope they find the problem quickly -

Additional update:

Installed QB Enterprise version to see it will work.

Opened QBW files. When i click E-Payment, it worked .

Now here is the rest of the story - Since it was new download, it forced me update the with new maint. release - Well what would you know - I opened QBW file and went to E Payment -

SAME ERROR AND KICKED ME OUT OF IT.

It looks like the maintenance / update has something to do with it.

QB Support read and get this fixed immediately - We have the end of the year coming - we dont tax payment/ forms filing all messed up.

RR

Hello!

I actually had the same issue with some clients. For me, the reason was because the EFTPS password expired (I think that QuickBooks is forcing people to regularly update their EFTPS password, maybe?)

So, I just logged in on EFTPS, updated the password, then resubmitted and it went through successfully.

I hope that helps!

I also really hope that QuickBooks fixes this issue with the E-Payments for Employers that used to E-Pay Maryland Unemployment liability... This has been an issue for over a month, now.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here