Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowUPDATE: Please disregard this question, as I just figured it out. I had to go back through the mapping process of 1099-MISC and change the box for that vendor to Omit from 1099 and save. Once I did that it let me add them to the 1099-NEC list. Thank you

While setting up my 1099 vendors, I errored and mapped a vendor to 1099-Misc, when they should of been 1099-NEC. The message that pops up from QB says: "This account is mapped to 1099-MISC. To map it to form 1099-NEC, remove the mapping from Form 1099-MISC or create another account." I don't want to create another account as this account should be 1099-NEC and I don't have any 1099-MISC forms to file this year.

I have been searching the Q&A to see if anyone else has had this issue with filing and see that there is quite a few, but have not found any answers to my specific issue. Filing 1099 forms was never this difficult in the past, and am very surprised that QB has not made this a much smoother process.

Thank you for any help you may give....

NCET

Solved! Go to Solution.

Thanks for updating your post with the solution @NCET!

Posting the resolution may help others in the Community who have the same question. We greatly appreciate you taking the time to let us know that this was solved and how.

Let us know if we can ever help you with any other questions or concerns. We’ve got you!

Thanks for updating your post with the solution @NCET!

Posting the resolution may help others in the Community who have the same question. We greatly appreciate you taking the time to let us know that this was solved and how.

Let us know if we can ever help you with any other questions or concerns. We’ve got you!

I have the same question, but I am unable to change the mapping!

In the "Map Vendor payment accounts" box, there shows the Account name, Account type, Apply payments to this 1099 box-I cannot change the Misc Box 3 to NEC. The drop down doesn't drop down! I have been working at this all day and cannot figure it out! Please help! Thank you

Hey there, @suzymassel17.

Thanks for joining in on this thread. This isn't the impression I want to leave you with. It's my priority that you're able to get your vendor payment accounts mapped.

Using the Verify and Rebuild tool can help eliminate these types of glitches in your product. Don't worry. It only takes a few easy steps.

Here's how:

Verify

Rebuild

Afterward, make sure you're updated to the latest payroll update (22101) and try the steps again to map the vendor payments account. Here are a few articles that can provide some helpful information:

I hope this helps. If you have any other questions, let me know. I want to make sure you're able to get back to running your business. Wishing you and your business continued success!

Thank you but it did not help. I may just have to use from 1099 Misc again. I appreciate your time

Do you have further details on how you corrected this? I am having the same problem and QB support has not been able to help me!

I'm here to help keep the process of removing the account from 1099-MISC to 1099-NEC easy and simple, amyk1.

Downloading the latest tax table is a good start when it comes to fixing 1099-related issues in QuickBooks.

After that, let's update your QuickBooks Desktop to its latest release to synchronize the changes. Here's how:

Once done, go back to your 1099-NEC wizard and remap the accounts. See the steps below:

You can read through this article to know more about the new 1099-NEC form as well as a link on how to file them: Understanding payment categories for the 1099-MISC and 1099-NEC.

If you still need help with mapping your 1099-NEC accounts or need further assistance with QuickBooks, please let me know. I'll be here to keep helping. Have a great rest of your day!

Thank you, this information was very helpful! I followed the steps below but when it leads me back to the mapping vendor accounts page the drop down for that vendor is still "greyed out"/locked from choosing another option. Is there a workaround?

Yes I am having the same problem. Please tell me the work around.

I am having this same issue and have tried the update and still did not work

Hello @amyk1 and @mcint29! Thanks for coming back here for help on this subject. It can definitely be a bit tricky so let me offer some clarification. :)

If the expense is already being mapped in Box 1 for 1099 NEC, it won't let you map it again in Box 7 for 1099 MISC. New or separate accounts are necessary for both NEC and MISC. Here's a great article that explains this: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

If you have any more questions, please don't hesitate to reply to this post. We're all happy to help in any way we can!

I tried the rebuild and it did not work - it found nothing to rebuild.

So now i can not finish my 1099s (Misc and NEC) until you fix this glitch.

How soon might that be; before the forms are due I hope.

This did not work for me either.

I do not even have the Click Here Option under the company preferences.

Watch out too because it will ask you to download new version and it downloaded a WHOLE NEW COMPANY FILE. (2020)

QB please don't release an update with glitches like this - wasting my time!

Hi there, @kathikunkel.

I appreciate you for performing the verify and rebuild tool to isolate the issue. I'm here to help with your 1099s so you can process them in no time.

For the time being, I would also recommend updating your payroll tax table version and QuickBooks Dekstop to the latest release. These help you get the newest tax table version and keep your software up-to-date with the latest features and fixes.

For your guides, I recommend checking out these articles:

Moreover, I would also suggest reaching out to our Support Team so a representative can check and review the 1099s further. To contact support:

For more tips about preparing and filing 1099s in QuickBooks Dekstop, I also suggest opening these links:

If you have any other questions about QuickBooks forms and taxes, please feel free to leave a comment below. I'm always here to help. Have a good day!

I did both updates.

Still unable to remove all dropdowns not needed on the MISC form (I only need 'Rent') and remove Rent from the NEC form.

Angelyn, I don't want to have to contact you guys, I just want you to fix the glitch. I have done all the steps suggested in this chain of discussion, nothing fixes it and numerous folks are having the same problem. I suggest your programmers stop locking us out of the drop downs as a way to protect us from selecting more than one box, and let us be responsible for our own work.

Hi there, @kathikunkel.

I want to make sure this is taken care of, and I'd like to redirect you to the best support group available to get this addressed right away.

Since you aren't able to remove the unattended drop-downs from the 1099-MISC and 1099-NEC, I highly suggest contacting our QuickBooks Support Team. I understand that you don't want to contact them, but they're the right support group to handle this issue. This way, they can further investigate this matter and provide additional troubleshooting steps to remove the unattended drop-downs. They can also create an investigation ticket if other users are experiencing the same.

To reach them, you can follow the detailed steps shared by my peer Angelyn_T above.

You might want to read this article to learn more about the boxes on forms 1099-NEC and 1099-MISC: Understanding payment categories for the 1099-MISC and 1099-NEC.

Please know you can continue to reach me here with any additional questions. I'm always around if you need any help.

HaHaHaHa, no Contact Us comes up on my Desktop 2019 version.

Another suggestion?

I'm here to ensure you can reach out to our support team without any further delay, @kathikunkel.

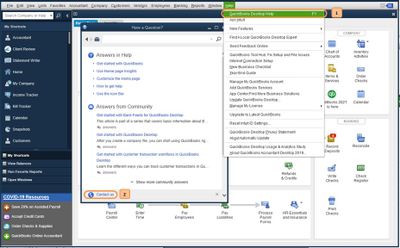

You can find the Contact Us button at the lower part of the pop-up window. Let me share a screenshot for your visual.

Here's how:

For more details about our support availability, refer to this article: Contact Support.

If you're still unable to see the Contact Us option in the Help menu, not to worry. We can check your display settings in QuickBooks Desktop.

Here's how:

Once done, open QuickBooks and follow the steps above to connect to our support. If everything looks good, you're good to go. If you still see issues, move on to Step 2 in this article: Fix screen issues in QuickBooks Desktop.

Please let me know should you need further assistance. I'm here to ensure your success. Have a wonderful day!

Where do I go to review, edit mapping for 1099 MISC

Hello @quiqui,

Let me walk you through the steps on how you can prepare your 1099 form in QuickBooks Desktop.

On that same page, here's an article you can read to learn more about generating your form: Create and file 1099s with QuickBooks Desktop.

In the same manner, I've got you this helpful article for guidance in preparation for the 2020 tax season: QuickBooks Desktop Payroll Year-end Checklist.

If there's anything else that I can help you with, please let me know by leaving any comments below. I'll be here to lend a hand.

It seems that all tech help just repeats the steps without reading our concerns.

We have taken all the actions you suggest.

The problem, once again, is that we are unable to change the mapping; the drop down arrow is greyed out.

I have been on the phone with tech support for hours only to get a case number #[removed] and still no return call from you as promised two days ago.

I would appreciate a call today and hopefully you have worked out the bug and everyone can get past this problem.

Thank you.

This is not what we want you to experience, @kathikunkel.

I want to make sure that this issue will get resolve as early as possible. I suggest contacting again our QuickBooks Support Team. Provide them the case number so they can give you an update about the status of your issue.

I understand that you don't want to contact them, but they have the proper tools to further investigate this matter and identify what’s causing this issue.

Also, you can read through this article to know more about the new 1099-NEC form as well as a link on how to file them: Understanding payment categories for the 1099-MISC and 1099-NEC.

If you have any more questions, please don't hesitate to reply to this post. We're all happy to help in any way we can. Keep safe and stay healthy.

I have the same issue that an account needs to change from a 1099-MISC to a 1099-NEC. The solution of adding another account is inappropriate. Creating extraneous accounts is not a good accounting practice. It will be confusing in the future. What do you tell the readers of the financial statements? QuickBooks couldn't get the IRS forms correct so I had to add another account!

I don't want to create new accounts, I just want to change the ones I have mapped to NEC. change them to MISC. I will not have NEC forms, only MISC. All of my drop down boxes are grayed out

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here