Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there. @andy8.

Thank you for reaching out to us. Allow me to help share some information about the W-9 request feature.

Are you referring to an email notice to your contractor about completing the W-9 information? If so, when you add a contractor to QuickBooks Online, they'll receive an invitation to add their own details. Your contractors will get their free version of QuickBooks Self-Employed to access their information and view 1099s online.

I've added an article about this for reference: Invite a contractor to add their own 1099 tax info.

Additionally, if the system detects that the contractor's details have been completed, but the contractors don’t have a QuickBooks Self-Employed account yet, they'll keep getting the email notice. To fix this, I'll need you to contact our QuickBooks Customer Care team to send the invitation email to your contractors. This way, they'll be able to sign up for their QBSE account and see their 1099's online.

Here's how you can reach them:

Also, I invite you to share your ideas and submit it as a suggestion to our product engineers. Feedback like this empowers us to make QuickBooks the best software it can be. To send one, go to the Gear icon and select Feedback.

These resources should help to get you back on track.

Feel free to let me know if you get to try the steps or if you're referring to something else. Any other details you can provide about the W-9 request feature would be helpful too.

One of my vendors spent 3 hours on the phone with QB customer care in an attempt to do this. I'm not having any of them repeat this process. Something is clearly broken with account creation, and I'm not about to ask them to be beta testers. As long as they get their 1099s in the mail, they won't need their to create an account. I'm also not about to spend another hour with customer service on the phone, in addition to the 2 hours I spent on chat. Intuit needs to take responsibility for the glaring bugs it creates and clean up the resulting data mess. It's totally unacceptable for QB to spam vendors asking them to use a feature that doesn't even work correctly. Please stop asking me to repeat the same steps over and over when I've already pointed out that the error is on your part.

Hi andy8,

Right now, our engineers are still gathering more details for their investigation. We'll let you know as soon as this is fixed.

If there's anything else I can help you with, please let me know.

Yeah this is very inconvenient. If you send the request via the contractor section and then the contractor doesn't create an account but they send you the info - once you enter all the info in it should stop the emails from going to the contractor.

I feel like this is a gimmick to get my vendors to sign up for a QBO account and it's lame.

Once you enter the info it should stop the system from requesting the vendor to make an account.

Thank you for joining this thread, @DetroitGirlFriday.

I can share some insights about the email request when setting up your vendor's account.

The automated email is generated to ensure that the W-9 Form information is safely submitted, and your contractors can view the form online. There's no additional fee for this since they're using the free version of QuickBooks Self-Employed.

The only way for the automatic email request to stop sending is by letting your vendors click the Add your details now link on the email. Manually entering your contractor's information will not allow them to view and access the form on the online website.

For additional insights, please refer to this article: 1099s in QuickBooks Self-Employed.

Keep me posted if there's anything else you need or you have additional questions about W-9. I'm always here to offer help.

I understand how it works, the point is that some vendors don't use QB and have no desire to sign up. So once the information has been entered ..even if I manually enter it from the w9 they emailed this should stop the request since the information has been received.

At the very least you should have the option to cancel the request.

Appreciate your prompt response, DetroitGirlFriday,

Let me get the help you need so your vendors will no longer receive email notifications.

If I may ask, does your vendor able to open the email, then click the Enter W-9 info button? If yes, then your vendor must follow the steps provided by my colleague HoneyLynn_G.

If no, then you can delete the email address of your contractor in order for QuickBooks to stop email notifications. Here's what you'll have to do:

By following the steps above, your contractor will no longer receive email notifications from QuickBooks.

If you have further questions, please let me know. I'm always here to help. Have a great day!

Thanks for confirming that! I actually did that this morning after my vendor got irritated at the continual emails so I am happy to know that will stop them.

I

Hi there, DetroitGirlFriday,

You are most welcome!

For future reference, I'm attaching a great resource that you can check: How to set up customer or vendor opening balance.

If you have any other concerns in your QuickBooks Online account, feel free to visit us again. Take care.

This process is still broken

I am a contractor, Someone sent me an invite to fill out w9 info. I click the link, it takes me to an account creation page. I ALREADY HAVE AN ACCOUNT. It will not let me create one, and when I attempt to log in with the same email to me existing account, I go through the two factor auth successfully and get a page that says Oops something went wrong, under which is a green "sign in" button WHICH MAKES NO SENSE AND TAKES ME BACK TO THE START SO I GO IN A USELESS CIRCLE. I can't even attach a photo because your system says the file is too big. Does anything you make work? I went to the website and logged in from there, but cannot for the LIFE of me find anything or anywhere to add w-9 info. This is INFURIATING. Also your system is erroring out when i try to post this too. My God.

Thank you for providing me the complete details of your concern, Forcedme to make this.

When you receive an email inviting you to fill out and submit your W-9 info, you should be able to sign in to your account and continue adding the details.

The invitation sent by the employer expires after 24 hours. To make sure you won't get an error, please ask them to resend it. Then, try signing in and enter the W-9 info.

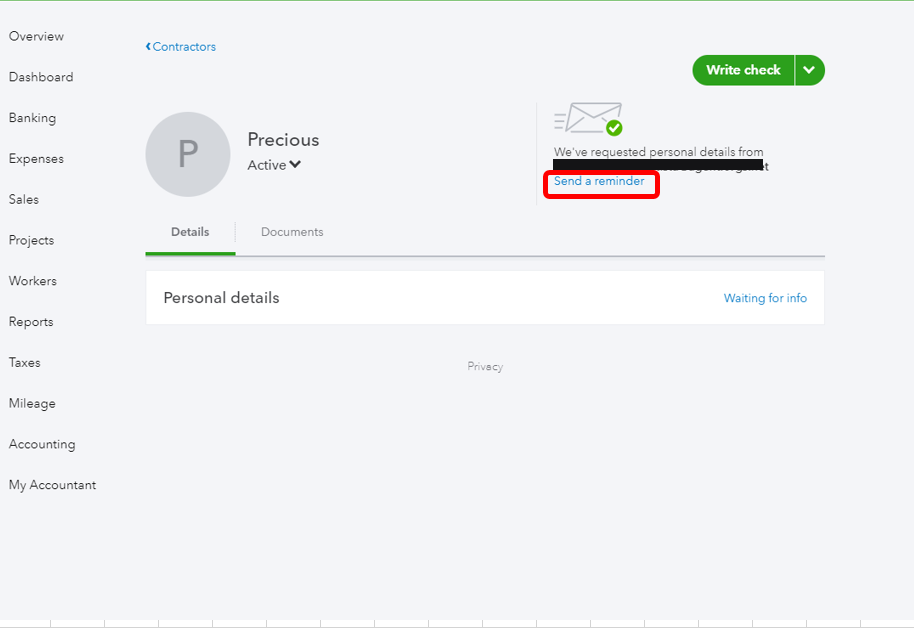

Please let the employer send a reminder by following the steps below :

For additional reference about inviting contractors to securely enter their tax info, please refer to this article: Invite a contractor to add their own 1099 tax details.

I'll be here if you need additional support in QuickBooks or if you need anything else. I'm always ready to help. Have a great day.

Hi there,

When I try to complete the w-9 wizard IN CHROME I fill out my info (address, name, etc) and I press submit and then it hangs on a page saying QB is saving my info ("this may take up to 1 minute"). The dumbest part is that the animation doesn't ever time out so you cannot tell if the page is truly hanging or if servers are just slow. In IE, the saving process works but the UI glitches out. It shows a weird, see-through window with nothing in it...

I appreciate the complete details about your concern, @whyyyyy.

Let me share some troubleshooting steps to isolate the latency issues you've experience when adding your W-9 details.

To learn more about resolving browser-related errors in QuickBooks, you can check these articles:

Keep me posted if you have other questions. I'm always here to help.

This feature is still broken. How's that engineer investigation going?

This is still broken. I just asked my contractor to send me their W9 info using this procedure, and it doesn't work at all. I sent the request from my quickbooks online account to their e-mail. They ALREADY HAVE a quickbooks self-employed account from 2018 when a different company asked them to do this. So they click on the link I sent them and it takes them to the log in for their already-existing quickbooks self-employed account, and ... nothing. There's no indication whatsoever that I've requested anything from them. There's no option to send a W9 to anybody. Updating their existing W9 info from the last time they tried to do this sends nothing whatsoever to me. On my quickbooks online account it just shows that I'm "waiting for info". THIS DOES NOT WORK.

I just sat on the phone with tech support from quickbooks online while texting with support from quickbooks self-employed people (because of course the two groups can't talk to each other, and of course they don't use the same system). I my contractor let me log into their account to try to solve this, and even with access to both my account and their account, and tech support from both departments of quickbooks trying to help, I made zero progress. This has cost me hours. THIS DOES NOT WORK. FIX IT. IT'S BEEN A YEAR.

Hi there, @patrickivy.

I know that you've already reached out to our Customer Care Team. However, to determine why the option to send W9 isn't available, it's recommended to contact them again. They can run a remote-viewing session that can help narrow down this issue.

For now, to get your work done, I suggest entering your contractor's profile manually on your QuickBooks Online.

To give you more details about editing contractors information, please see these resources below:

I got you covered if you have any other questions. I'll make sure you're taken care of. Have a good one!

NOPE! There is no send a reminder. I did not send the request the first time. I wanted to notify the contractor before sending w9 request. Now I can't send a request?

Hello there, jvh3641,

If you've already followed the step provided above and still unable to send a request, I recommend contacting our QuickBooks Online support. This will help us check why you can;t send it. Our product engineers might open an investigation if this remains unresolved.

Here's how:

Note that it may take longer to get in touch with our support due to high volume of calls. You can check the support hours and types.

I'll be here if you have other questions.

This is still broken. I sent two contractors a request for their w9 info. One contractor worked perfectly fine. The other contractor it filled out their details information but on the document tab it still says waiting for info, even though the contractor signed and submitted.

I spent 1 hour on the phone the other day, was told someone would call me back.

I spent another 2 hours on support chat while they walked me through useless cue cards with someone you could tell was outsourced and knew nothing about quickbooks. They provided web links to pages that had nothing to do with what I needed, and couldn't even answer the simplest of questions.

Bottom line I should be able to click and download my contractor's w9 and its not working. 3 hours of my life wasted especially with how much money I'm spending on this product, I'm seriously thinking about switching my business to another product like Xero

I've this same problem. Contractor ignored the email until it expired. No way to re-send, have entered their information manually but QBO still says "Waiting for info" instead of Download. However the expired link says "This invitation has expired. It appears that the invitation has either already been accepted or is no longer valid. If you require a new invitation, please contact the company administrator." I'm assuming so we can laugh at the contractor since there is no way to resend this :-)

Hey there, @YFinder.

You can resend the invite using your QuickBooks account.

You need to verify first, if your contractor's email addresses are updated . After, you can now resend the invite.

Here's how:

Confirm with your contractors if they were able to receive 1099 invites again.

You can also read through this article for more information about sending 1099 forms: Invite a contractor to add their own 1099 tax info.

Feel me in if you have additional questions about 1099. I'm always here to help.

I have this same problem. WHY IS THIS NOT FIXED YET. CAN SOMEONE ESCALATE THIS PLEASE TO QUICKBOOKS ENGINEERING TEAM?

I have had to manually enter W-9 info for contractors but they are still getting emails.

-Why can't I see who was emailed and when?

-Why can't I cancel the W-9 request and have Intuit stop sending reminders to my contractors now that I have manually input their information?

-Why can't I download the W-9 now that I've entered the information myself? QBO still says "Waiting for info" instead of Download.

WHY IS THIS PROCESS NOT WORKING. THIS IS VERY IMPORTANT

Thank you for reaching out to the Community. As much as I love to help you, dosx, but this is a public forum, and we don't have access to pull up your account for security purposes.

I will route you to the right Customer Support Team for further assistance. As they have the tools to pull up your account in a secure environment and answering any questions you may have.

Before doing so, please check out our support hours to ensure that we address your concerns on time. Here's how to connect with our Customer teams:

Just a heads up, we have limited staffing and have reduced our support hours to 6 AM-6 PM PT Monday-Friday due to COVID-19. We will resume normal hours as soon as possible.

You can always visit us anytime soon if you have any questions. We're here to help. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here