Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi Team,

A customer of mine whom I sold her a product and charged her CC decided, to return the product I sold her and asked for refund.

As mentioned, I charged her CC and the money already deposired in my account.

How can I sssue a refund?

Thank you

David

Solved! Go to Solution.

Hello there, @david224. I'm here to help you in refunding your customer's credit card payment.

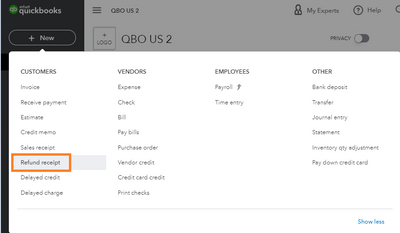

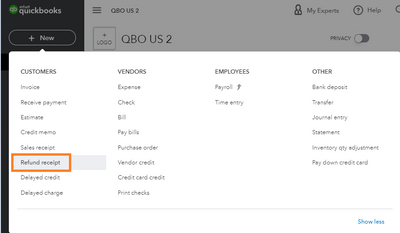

You can use refund receipts if a customer asks for a refund for an item or service.

Here's how to refund a credit card payment for a sales receipt:

If it's a paid invoice you need to refund, follow these steps:

You can visit again this link for more details about the process: Void or refund customer payments in QuickBooks Online.

Moreover, with refunds or return transactions, you may incur a fee depending on your pricing plan and transaction type. For further details, check out this article: Understand fees for refunds or void transactions.

Fill me in should you need further assistance with this refund process. The Community team will always here to help. Have a great day ahead!

Hello there, @david224. I'm here to help you in refunding your customer's credit card payment.

You can use refund receipts if a customer asks for a refund for an item or service.

Here's how to refund a credit card payment for a sales receipt:

If it's a paid invoice you need to refund, follow these steps:

You can visit again this link for more details about the process: Void or refund customer payments in QuickBooks Online.

Moreover, with refunds or return transactions, you may incur a fee depending on your pricing plan and transaction type. For further details, check out this article: Understand fees for refunds or void transactions.

Fill me in should you need further assistance with this refund process. The Community team will always here to help. Have a great day ahead!

This is just awsome LiaraMArie,

Very detailed

Well explained

Clear and easy to follow.

As always - the answers I get form the community are just great.

Thanks a lot.

David

Thanks for following up with the Community, david224.

I'm happy to hear LieraMarie_A was able to help with identifying how you can issue refunds to customers.

I've additionally included a few detailed resources about working with QuickBooks (QBO) and your Merchant Service Center (MSC):

Please feel more than welcome to send a reply if there's any questions. Have a wonderful day!

By doing a refund receipt, does that only record a refund, or actually process the refund and return it into the client's bank or credit card account?

Hi there, @partysaver. I've got the information you're looking for about refunding customer payments.

Entering a refund receipt in QuickBooks Online only records the return. If you have a QuickBooks Payments account, you can reverse a transaction. This will process the refund and return it to the client's bank or credit card account.

Here's how to fully refund a transaction:

Follow these instructions to partially refund or credit a transaction

We also have an awesome guide about this process: Void or refund transactions in QuickBooks Payments.

Moreover, you may incur a fee depending on your pricing plan and transaction type when processing a refund. For further details, check out this article: Understand fees for refunds or void transactions.

If you have any further questions about issuing a refund, I'm always here to help you. Have a great day, @partysaver.

I followed these instruction and the clients account still shows a negative

Hey there, @bezner6214.

Thanks for chiming in on this thread. I appreciate you coming here with your concern.

If you've already tried all the steps above, then I recommend contacting our Customer Support Team for further assistance. Here's how:

It's that easy!

Let us know how it goes. We're always here to lend a helping hand. Take care!

Hello Everyone:

I am following up on our refund status.

I respectfully request so information as soon as possible as it has been 2 weeks since the request.

I believe that this is not easier since this involves money and time, Panachebridalhr.

The nature of your concern requires help from our QuickBooks Care Team. This way, they can open your account in a secure environment and review and trace the status of your refund in QuickBooks.

Here's how you can reach us:

Please know that the availability of support depends on which type of subscription you're using. You can check out this article for our contact information. Click on the QuickBooks Online drop-down to see the most updated support schedule: Support hours and types.

I'm all ears if you do have other questions aside from refund, and I'll help you out. Stay safe!

I followed these instructions and it seemed to work, but when I do my deposit, the refund amount isn't on there. Therefore, my deposit amount isn't correct without that refund amount on there. How do I fix this?

I'll be sharing details on how depositing your transaction works. Then, to ensure that all entries will show in the Deposit screen, KylieTippen.

If you followed the steps provided by my colleague, then there's no need to make deposits. We make deposits for invoice payments and sales receipts. To properly record a refund, you can check out this article for the steps and details: Record a customer refund in QuickBooks Online. From there, you'll how to handle a refund based on various scenarios to ensure your books are up-to-date.

Then, we can pull up and customize your Transaction Detail by Account report to see the list of refunds you've given to your customers. Here's how:

To learn more about how you can save a report after customizing it this article: How to memorize a report in QuickBooks Online. Additionally, I've also included this reference for a compilation of articles you can use to get a better view of your business's financial status: Financial Report for QuickBooks Online.

If you need to record bank deposits in QuickBooks Online (QBO), put the transactions you need to combine into your Undeposited Funds account. Then use the bank deposit feature to combine them:

Here's an article you can refer to for more details about recording and making bank deposits in QuickBooks Online. Feel free to visit our Banking page for more insights about managing your bank feeds and reconciling accounts.

You can always update us on the result after performing the recommended solutions as I'd like to ensure this is resolved for you. Just leave a comment below and I'll get back to you. Have a great day weekend.

I had a customer who overpaid an invoice by $118.83. I followed all of the above steps to refund but the customer's account still shows that he has a $-118.83 balance.

I appreciate you following the steps so you can process a refund in QuickBooks, BeaconBooks.

Let me provide the right step to clear out the balance showing up on the customer's account.

In QuickBooks Online, you need to record the refund using Check or Expense in QuickBooks. This offsets the customer's open credit, overpayment or prepayment.

Here's how to record the refund to the customer.

The steps of recording refunds will vary depending on whether you use QuickBooks Online or QuickBooks Payments. You can browse these articles to learn the different ways of processing a refund.

Get back to me if you have follow-up questions about issuing a refund in QuickBooks. I'll be right here to help you.

No, that doesn't work. The customer still shows a credit on his account of $118.83, whether I do a refund receipt or an expense. And what do you mean delete the refund receipt? This payment hits the checking account, so deleting this will cause the bank account to not balance.

Thanks for your prompt response, @BeaconBooks.

I understand how much you want to resolve the customer overpayment, and follow all the steps above to refund your client.

Normally, following the steps recommended by my colleagues will help resolve customer refunds. Specifically, when you follow the steps shared by @MaryLandT to record the refund for your customer as an expense or check.

In addition to the steps, you will have to use the Receive payment feature to link the refund to the customer's overpayment written in this article: Record a customer refund in QuickBooks Online.

If it continuously shows customer credit on his account, I recommend contacting our Customer Support Team for further assistance. Here's how:

If you have other QuickBooks-related concerns, please don't hesitate to get back here. We're always here to help. Keep well!

How loong does it take usually for the customer to see the refund on their credit card?

Thanks for joining in on this conversation, @mzibelman79.

I can see that you've posted to another thread with a similar concern, and one of my colleagues already shared information to answer your question.

To see her response, you may go to this link: https://quickbooks.intuit.com/learn-support/en-us/payments/re-how-long-does-it-take-normally-for-a-r...

Keep in touch if you have other queries regarding refunds. We're always available to assist you. Take care, and have a great day!

My quikbooks does not even give me the option to do a refund receipt? I pay for the highest subscription in quikbooks.

I'm here to help you, @morgannec.

I recognize you are using the QuickBooks Online Advanced version.

Before we start sharing for possible resolution, may I ask a screenshot for the error you've encountered in QuickBooks Online. This way, I'd be able to identify further and provide remedies to the issue.

I'm looking forward to see you again here in the Community. I will wait for your reply.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here