Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowNeed help in transferring money that's sitting in an account

Thanks for joining the Community and getting involved with this thread, Victor Vitali.

When you move money from one account to another, you'll need to record the transaction as a transfer in QuickBooks. To keep your books in good shape, you should enter the transfer as a single transaction that affects both accounts.

Here's how to record a transfer:

You'll be able to find your transfer by checking each account register from the Chart of Accounts screen.

I've also included a detailed resource about transferring funds which may come in handy moving forward: Transfer funds between accounts

Please don't hesitate to send a reply if there's any additional questions. Have an awesome Thursday!

Hi I have the wrong bank account on my QuickBooks are you able to help me put the right account on there?

My customer sent a payment and I can’t receive it.

Yes I have the wrong account setup through quickbooks

Welcome to the Community space, Dominique!

Before we begin, can you please confirm if your customer’s payment already been processed, or is it still pending within QuickBooks Payments?

If pending, we can update your bank account to make sure the pending and future payments are sent to the correct account. Here's how:

If your customer’s payment has already been processed into the wrong bank account, I recommend contacting our Live Support Team for help in moving the funds to your updated account. Here's how:

Phone support is available on weekdays from 8:00 AM to 7:00 PM. You can request a callback during weekdays from 8:00 AM to 6:00 PM, and a support expert will contact you as soon as possible. Chat support is available weekdays from 8:00 AM to 10:00 PM and weekends from 8:00 AM to 6:00 PM.

Let us know if you have additional concerns, don't hesitate to reach out. The Community space is available 24/7.

I currently have a payment delayed. Over $5000. I have been using QB for YEARS and this is a return client. I NEED MY MONEY.

I NEED MY MONEY.

I NEED MY MONEY.

I NEED MY MONEY.

I NEED MY MONEY.

I NEED MY MONEY.

I NEED MY MONEY.

I NEED MY MONEY.

I NEED MY MONEY.

I NEED MY MONEY.

I NEED MY MONEY.

I NEED MY MONEY.

I hear your urgency loud and clear, and your frustration is valid, @nnassif, especially regarding this significant amount from a returning client. Let's resolve this issue as quickly as possible.

Funds typically arrive in your account within two to three business days. However, exact timing depends on transaction entry time, your chosen bank, and its processing speed for electronic deposits. Delayed funds may be due to several factors, including the following:

To verify the status of your deposit, sign in to your Merchant Service Center. If you see the word "Withheld" in the METHOD column, that payment is on hold and we're reviewing it. With this, you'll be notified through the email you used as your contact email when you signed up for QuickBooks Payments.

It contains specific instructions to fix any issues with your account. Check out this article to get more details about this process: Why are my funds on hold?

We value your long-standing relationship with QuickBooks and appreciate your patience during this situation, @nnassif. We're doing everything in our power to resolve any delays. Please don't hesitate to post here again. We'll be ready to ensure your business continues to thrive.

Will print checks. And if Icould see the bottom green arrow then I could print from them on my phone but now that doesn’t come up in the window the white save box is even cut off

Joining this conversation to help you print your checks, Metalman.

Before anything else, could you clarify your concern? Are you printing your checks using the QuickBooks Online (QBO) mobile app or a web browser on your phone?

If you're accessing your QBO account through a web browser, let’s go through some troubleshooting steps to check if this is a browser-related issue.

Start by clearing your browser cache to refresh the system and remove outdated files. Next, make sure to use a supported browser for optimal performance with QuickBooks.

On the other hand, if you're using the QBO mobile application, can you share further details about it? Any additional information or a screenshot would be greatly appreciated.

Leave a comment below if you have follow-up questions about printing checks.

I want to pause my account starting September 30, 2025. Please advise. Thank you. [PII Removed]

I hope everything is going well, Janet.

I completely understand that you’re considering pausing your QuickBooks Online subscription starting September 30, 2025. I want you to know that we truly value you as a customer and appreciate the trust you’ve placed in QuickBooks to manage your business finances.

Currently, QuickBooks Online does not offer an option to pause subscriptions, but we can assist you with canceling your account if that’s what you’d like to do. Before moving forward, could you confirm if canceling is the option you’d like to proceed with, or if there’s something specific you’re looking for so we can explore alternative solutions?

To ensure you get the best assistance with this process, I recommend contacting our Customer Support Team for personalized guidance, as they can verify and finalize the changes.

Here's how you can connect with them:

I would also recommend reviewing the support hours to ensure you can reach out at a time that is most convenient for you.

If there's anything else I can assist you with or clarify, please don’t hesitate to let me know. Thank you for using QuickBooks Online.

Hello sir and ma'am I want to do an advance level course please help me

You can look into our QuickBooks and self-paced courses, @advance level.

Are you an accountant or bookkeeper interested in QuickBooks certification courses, or are you a new user who is also a business owner?

QuickBooks offers the ProAdvisor Program for accountants and bookkeepers, providing training, resources, and certifications to enhance expertise and grow professional practices. Advanced courses are available for those pursuing QuickBooks Online Advanced Certification.

On the other hand, if you are a business owner or a new user who simply wants to master the software for your own business, the advanced topics you're looking for might be different.

You can visit the pages below and identify which one better suits your needs :

If you're referring to a different topic, please click the Reply button.

Where is the freakin number? I've fixed a problem with the payroll taxes not being taken out at least three times since migrating to Enterprise, and it's failed to do so again. This is costing me money to keep doing this over and over, and I'm thinking of getting my attorney involved and suing the hell outta QB. One would think that as much as we spend on the software, it would work flawlessly, yet it has many glitches, and I, as a long-time user, am fed up with it.

Good afternoon Gary,

Thanks for chiming in on the thread. I truly understand your frustration. Here's how you can connect with us so we can investigate or even possibly escalate this issue, since we are unable to go over account details in this forum.

You could also call 1-800-INTUIT as well to speak to an agent if you prefer this way.

Please keep me updated, and if you were able to get through! See you soon.

I'm trying to verify my payroll subscription. It's coming up with message number [PS036].

QB Desktop or QB Online?

Hello there, @Mark9000.

The PS036 error appears when QuickBooks Desktop can't download the necessary payroll updates. This issue is often caused by:

To resolve the error, follow the steps outlined below.

First, let's make sure your payroll service is correctly activated. This will force QuickBooks to download the latest updates.

Here's how:

This process will download the entire payroll update.

If the error persists, proceed to Step 2. Register and update your QuickBooks Desktop. It is essential to have the most up-to-date security measures and software.

Here's how to check if your software is registered:

If the error persists after these steps, refer to the detailed guide: Fix PSXXX errors when downloading payroll updates.

Let us know if you have any further concerns regarding error PS036 in QuickBooks Desktop. We'll be here to lend a hand.

I’d like help with QuickBooks’s online and switching over to it. Allowing phone and computer to use the same program

Welcome to this thread, Marco.

QuickBooks Online is designed to work perfectly on both your computer and your phone, allowing you to access the same program simultaneously. Your data is stored securely in the cloud, so any changes you make on your mobile device will automatically sync with your computer.

If you’re unsure which QuickBooks Online plan is best for your business, I recommend visiting our subscription page to explore options based on your business needs.

If you’re currently using QuickBooks Desktop, we provide tools and guides to help you transfer your data securely. You can follow our data migration guide for assistance.

If you’re using QuickBooks Self-Employed (QBSE), please check out this helpful article on switching from QBSE to QBO.

For those using other software, please check with your provider for guidance. If your current software does not offer migration tools, you can manually import your data into QuickBooks Online.

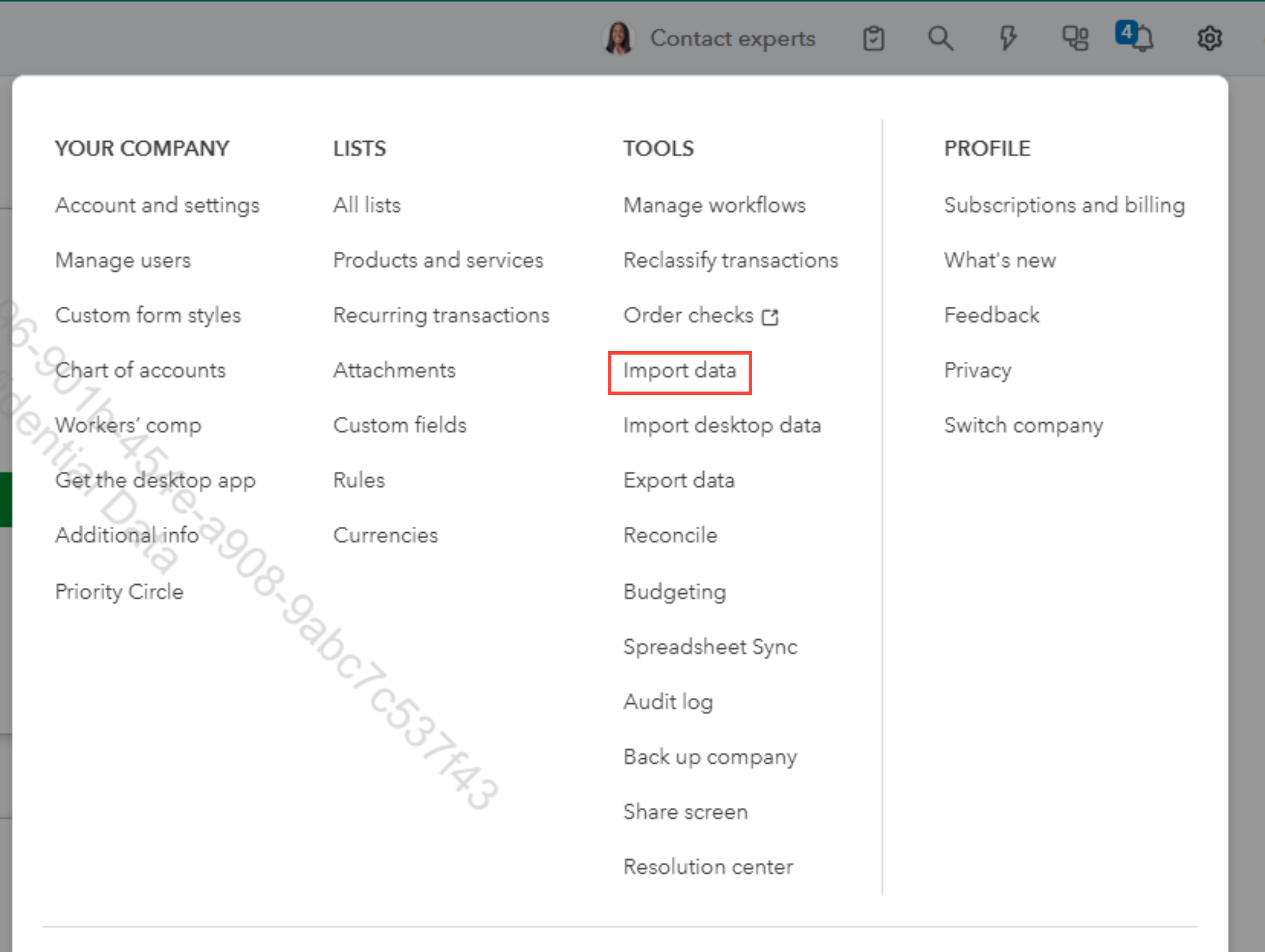

Please see the screenshot below:

Once your account is set up, log in via your web browser on your computer. You can download the QuickBooks Online mobile app from the App Store or Google Play to access your account on the go.

Feel free to revisit this thread if you have any additional questions.

The tech help has been down for 3 days now.

I NEED to contact customer support via a phone call .I cannot search many of my invoices.

We understand how important it is to connect with our Live Support team easily when assistance is needed, @lbodker-apg.

Before reaching out to them again, we recommend logging out and back into QuickBooks Online to refresh your session and help resolve issues with searching for invoices. Note that glitches occur if the account becomes outdated or corrupted, which can cause some transactions to be hidden or inaccessible.

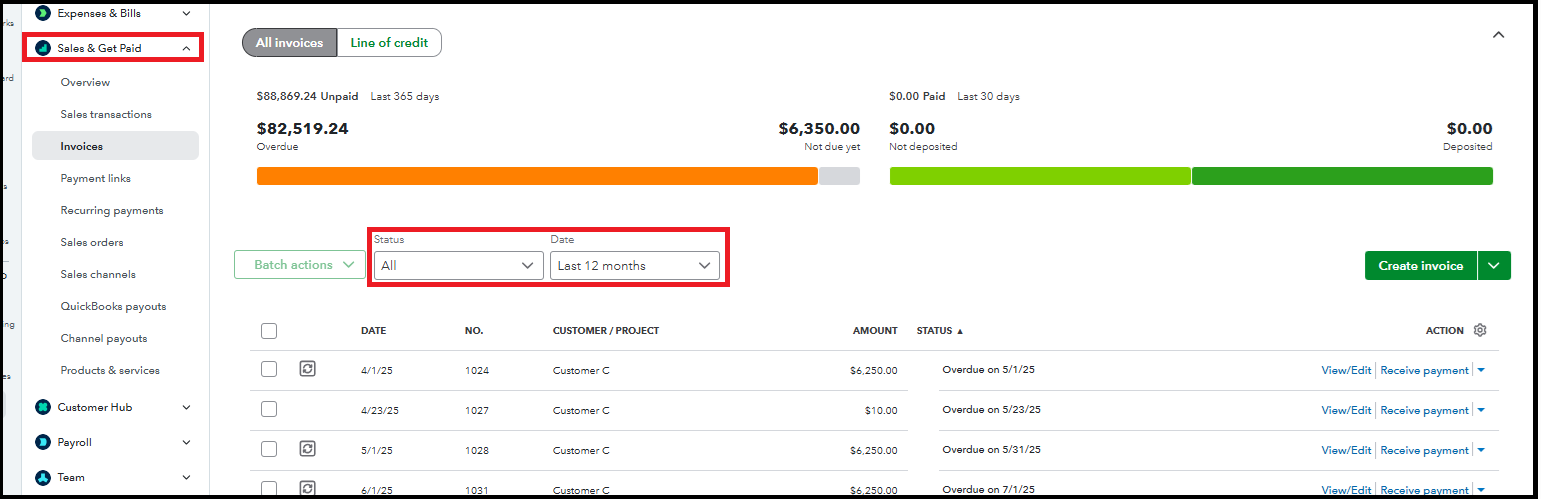

You can also check your invoices in the Sales & Get Paid tab. Ensure to update the status and date filters to find all entries.

If you still need our Live Support team, I suggest reaching out during their available hours for prompt assistance, or consider using the chat option.

Please let us know if you have any additional questions. The Community forum can also assist you with any inquiries you may have.

What's the phone number?

Hello there, PLUCKER.

We can’t share phone numbers here in the Community, but you can reach our experts through QuickBooks Online (QBO). I can walk you through the steps to contact live support so you get the help you need.

Before we proceed, let us know what specific assistance you require, and we will provide you with the best solution or workaround. You can ask here for information and resources.

Here's how you can contact them:

You can also view support hours and agent availability in this article: Get help with QuickBooks products and services.

If you have any other concerns, please let us know. We're here to help.

Why has the monthly charges gone up? I am not being notified of these changes and I’m considering canceling my subscription

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here