Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThank you for reaching back out, @pccsing.

I want to ensure you get the support you need with the undeposited funds. You’ll need to check the bank register to see if you have the transactions already in there that are also still showing in the Undeposited Funds. If you find matches, then you’ll need to check and see if you linked the deposit in the bank account to the ones that are still in Undeposited Funds. If you didn’t, you’ll need to create the link between them so it will move the money. This can be done with the steps posted above by @JamesDuanT.

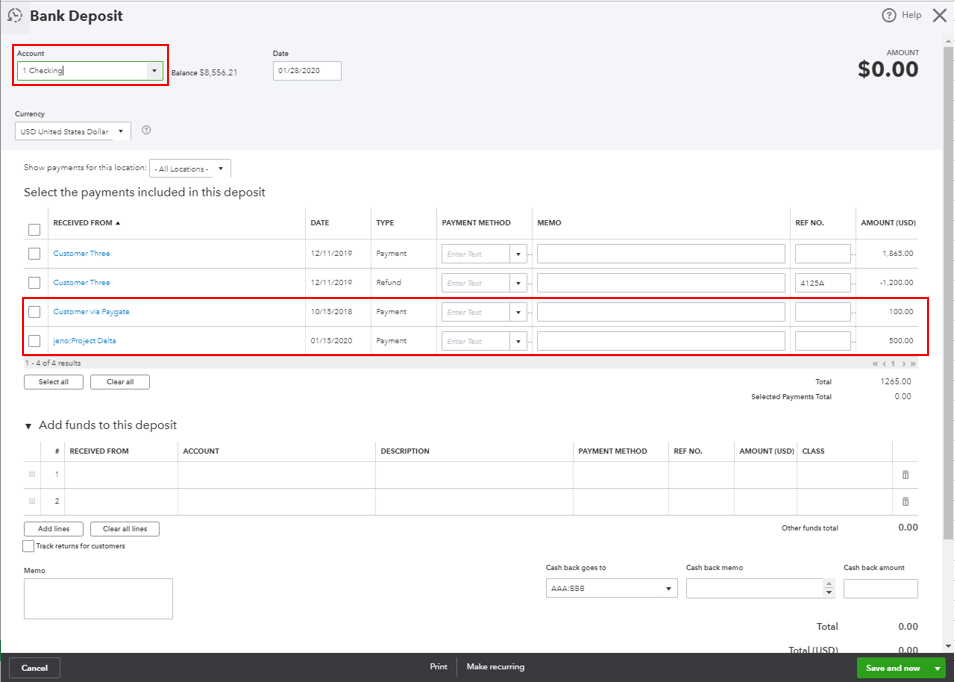

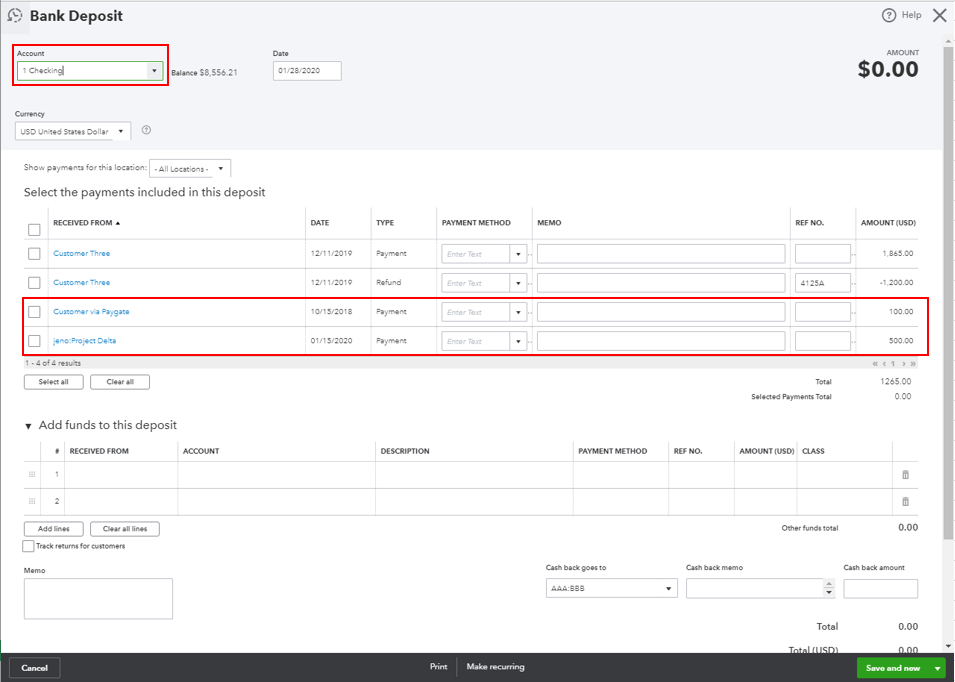

Then you’d want to make one bank deposit and select all 25 of the payments still in Undeposited Funds so you’ll be able to have only one deposit to move the money from that account over to the bank.

If you have any other questions or concerns, don’t hesitate to let me know.

Thank you for responding. Would it be possible for me to call someone briefly about this for final clarification?

Many thanks.

On a completely different note, is there a way I can return a bad magstripe card reader?

You're always welcome, @pccsing.

You can use our Callback feature to reach our Customer Care Team. Let me guide you how:

Check out our support hours and contact us at a time convenient to you: Support hours and types.

In regards to the magstripe card reader, I suggest contacting the support team. They have the power to tell you if you can return card reader.

Let me know if you have other concerns in your account. I'm glad to help. Take good care!

Hi, did you find a solution to this? I have been trying to get to the bottom of this but no one can give me a clear answer on how to zero out the undeposited funds account. I am using QB online payments to generate Sales Receipts and invoices. I use the Match feature once the money clears the bank. My bank name is selected as the deposit entity when I save but the entry still remains in Undeposited Account. Match feature also greys out the drop-down to change the account in the Register because its a "System recorded Deposit"that its a so no manual way to force it either.

Hello there, @malikden.

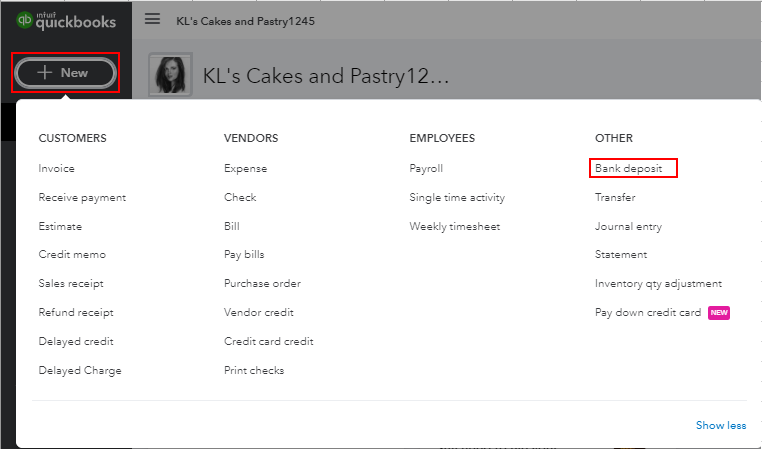

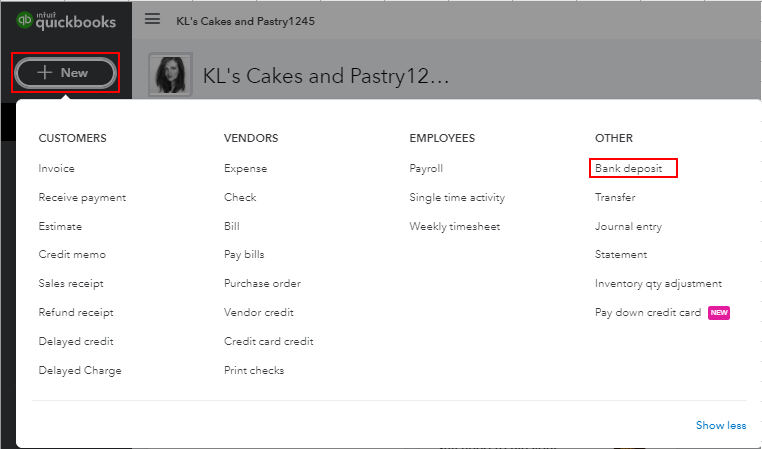

You'll want to create a bank deposit to offset the Undeposited Funds account's balance as zero. Let me guide you through the steps.

As mentioned by my colleague JonpriL, the Undeposited Funds account holds invoice payments and sales receipts. Also, the generated sales receipts and invoices from Online Payments will be associated to the Undeposited Funds account.

Here's how:

Here are some articles you can read for more details:

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Keep in touch if you need further assistance with this, or if there's anything else I can do for you. I've got your back. Have a good day.

in QBO I can see the items that are undeposited by opening the balance sheet and clicking undeposited funds.

In the chart of account report of Undeposited Funds I can see the Payments and the Deposits that offset them but there is no check mark in the CLR column. If I use the report filter to select on the uncleared items- all records show because none of them are cleared.

Should the matching payments and deposits show cleared (I would think so?) Shouldn't I able to run the report from chart of accounts using the filter not-cleared and see the Payments that do not show as deposited?

Thanks

Let me explain how the report works, kirkesonoma.

The reports will show all transactions from the Undeposited Funds regardless if it's cleared or not. Though, there's a different way to review and check the uncleared/undeposited transactions. We can export them into an Excel file and filter it from there.

On the file, all transactions that has no data on the Reconciliation Status column means it's uncleared.

Comment again if you need more help. I'm always here to assist you.

My issue is I just picked up a new client which hadn't reconciled their books ever. So, I had to artificially enter a starting balance other than zero and reconcile from a date they selected to save them money. The issue is with the undeposited funds account, because there are literally hundreds of unmatched payments which have not been moved to the bank deposit function. Since I am only looking for a few more months of payments to match to the bank deposits, is there a way I can search for a time period and create a list in QuickBooks for the undeposited funds? It will take too long to read through 500 undeposited fund accounts for every month I have to reconcile. Need a short cut.

Hello, @REW1.

You can generate a report for the payments you've receive that weren't deposited yet into your bank account.

Here's how:

You have the option to customize this report to show only the list of Undeposited Funds for a certain date range and only the uncleared ones.

Let us know if you have other questions. I'm always here to help.

I already reconciled the whole year...but some transactions are from undeposited funds. Can a make a lump deposit into checking to make it accurate? Or do u have to re reconcile everything and make the deposit first?

I'm here to help share information so you'll be able to track/handle your transactions correctly, Alyssa08.

You can lump sum the deposit and then reconcile it in QuickBooks Online. Also, If the payments are showing as a lump sum on your bank, you need to record the same way in QuickBooks so that it will be easier to reconcile.

Here's how:

However, it would be best to consult your accountant for the category or account to use.

To know more about how QuickBooks handles deposits, you can check out: Record and make Bank Deposits in QuickBooks Online.

Also, I can see this will be handy for future use in reconciling.

Please let me know if there is anything else I can do to help by clicking the Reply button below. Take care.

idk what QB software team doing, you guy cant even do a simple task to clear off the transaction under undeposited fund once it is matched up with a deposit under bank feed. i speak it out for many many accountants. If there is another choice beside QB, i will recommend my clients to change. Too many craps in QB.

I want to zero out my undeposited account. In my Chart of accounts in the undeposited funds account it shows a balance of $3847.23. But my deposit account is empty.

Good to see your post today, Tom Jurasinski.

There may be some adjustments made causing a balance in your undeposited account and leaving your deposit account empty. To sort this out, you'll want to review the transactions under the Undeposited account and to see the details of the amount.

To do that:

If you're not sure how to handle the transactions that are causing the balance, you can consult your accountant for more expert tips regarding the matter. You can also find an on here: Find an accountant.

You might want to visit this article for more information about Undeposited Funds in QBO: What’s the Undeposited Funds account?

All you need to know about managing Chart of Accounts in QuickBooks can be found in this article: Learn about the chart of accounts in QuickBooks

If there's anything I can help you with, feel free to drop me a reply below. Hope you have a good one.

Yep, it’s a QBO problem that show up in 2020 for us. Never changed the way we process things but now have huge undeposited funds balances on the cash basis income and balance sheets, but not on the accural basis reports.

Hello @Dismukes,

Welcome to the Community. Let me help you figure out why there's a large difference in the balance when on a cash basis.

The Undeposited Funds (UF) account balance will only show if payments aren't deposited yet. I recommend you run your cash basis income and balance sheet report again, then take note of the transactions showing under UF.

Try to compare them with the data showing when in accrual. It may be possible that the payments aren't linked. Also, please consider checking the dates to ensure they match.

For additional reference, you can use the following articles to learn how to find missing payments, as well as creating a report for UF:

Drop me a comment below if you have any other questions regarding the balances in QuickBooks. I'll be happy to help you some more.

I too have this same problem with undeposited items staying in the bank deposit screen. How do I clear them out? I have called the phone center multiple times but they are ignorant even with what would seem a simple question or procedure. I have been more successful in answers from the community rather than the phone center. Any solution to being able to talk to smarter people in the phone center. Im continually disappointed in them. Ellen

This is not the service we want you to experience, @ellen.

Let me walk you through in clearing out the balance in your Undeposited Funds account.

First, let's generate a report to see the transactions that weren't deposited yet into your bank account. Here's how:

You have the option to customize this report to show only the list of Undeposited Funds for a certain date range and only the uncleared ones.

Once completed, you can now create a bank deposit to post the payments to the correct bank register. Here's how:

On the other hand, you can open each transactions recorded in the Undeposited Funds. Then, change the account from the Deposit To field. This removes the transaction that shows up in the bank deposit section.

When you go back to the Bank Deposit page, you will no longer see the payment. You can read through these articles to learn more about the process:

Keep in touch with us here if there's anything else I can do to help you succeed with QuickBooks Online. I've got your back!

This is happening in the desktop version as well. I have contact support but was told they have never seen this issue before and had no solution.

I have selected batch items to be deposited from undeposited funds. Those deposits have been reconciled. Now in March of 2021, I have May 2020 and August 2020 showing back up in my undeposited funds and the deposits are no longer posted in my bank register. All as if it was never batch deposited.

Hello there, @JWLeeFinancial.

The other way to check it is to confirm if you're using the correct file. It may be a different file that's why we see it still on the Undeposited Funds when you've already deposited it in the bank account's register.

You can go to the File menu and then select Close Company to choose the right company file on the No Company Open window.

You can also utilize the verify and rebuild tool to fix unexpected behavior in your company file's bank register. It can help you see the errors in the system and rebuilding it will self-resolve errors.

When you have reviewed and ensure that you're using the exact file, it would be best reporting this to our Care Support team. From there, they can create a case and submit a ticket to our Product Development team. They will be the ones to investigate this hurdle and look for the reasons behind this and send you notifications via email once they resolve the issue.

Feel free to tag me in this thread if you have other questions about managing QuickBooks banking records. I'll be there to help anytime. Take care and have a nice day!

How do you clear out negative balances in the undeposited funds on desktop QuickBooks that so it does not affect your banking register

I'll gladly show you the way to clear the negative balance in the Undeposited Funds account, Teresa59.

QuickBooks Desktop automatically holds the payment in the Undeposited Funds account. To clear the negative amount, let's create a journal entry. Then, we'll have to make deposits to zero out the balance.

Here's how to create a journal entry:

For more details, please this article: Create a Journal Entry in QuickBooks Desktop.

Once done, we can now deposit the payment.

Additionally, I've added these articles that'll help you learn more about how the Undeposited Funds account works in QuickBooks:

I'm only a few clicks away if you need assistance with your other QuickBooks tasks, Teresa59. It's always my pleasure to help you out again.

Why when you make a journal entry for the negative amounts in undeposited fund, it impacts the bank register and takes the negative amount away from balance register?

Good to see you in this thread, @plapp431-.

If the bank register is part of the Journal entry created, then it'll be affected. To ensure it will not be impacted, you'll need to use a different account from the bank register when correcting the Undeposited funds account.

You may consider reaching out to your accountant for further assistance. If you don't have an accountant yet, you can have one. You can find an accountant near your place through this link: https://quickbooks.intuit.com/find-an-accountant/.

If you have further questions about QuickBooks, feel free to reach out to me again. I'll be here to help you out. Have a great day.

So now that account shows negative, how do I fix that?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here