Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Thank you. It was a merchant services transaction so I had to reverse the charge via my merchant account and create a credit memo.

I'll walk you through on how to process a refund of a credit card payment, jdrpllc.

Here's how :

If you subscribe to QuickBooks Payments, there is a different way of processing a refund to your customers. To see them, please see this article for your guide: How to void or refund a credit card payment.

I'd be right here to help you if you have more questions. Just leave a reply below.

Thank you. It was a merchant services transaction so I had to reverse the charge via my merchant account and create a credit memo.

Thank you. It was a merchant account transaction so I had to reverse via my merchant account. I also created a credit memo in QBO.

When you click the "refund credit card" button, where is the money going to come from on my end? Will it automatically come from the checking account that the credit card payment was deposited into?

You're right, MLH114.

The amount will be taken from the deposit to account on your payments settings.

You might want to check this article about the fees on refund transactions: Am I charged a fee on refund or void transactions?

Let me know if there's anything else I can be of help.

I refunded a clients credit card using the above steps. However when I look at the client's record they are showing a 0 balance. If they paid the invoice by credit card and then it was refunded, wouldn't the client have an Open Balance?

Hello there, totaltesting.

The original poster's client paid the invoice twice, thus we suggested to create a refund receipt to zero out the customer's balance. An open balance will show in your customer's profile if you recorded a refund receipt though the invoice was only paid once.

You might want to check your bank's register to review the payments made. I've also linked an article on how to manage your customer's payments.

Mention my name if you have other questions. I'll keep an eye on it.

Hello, I have processed a credit card refund per your directions. I need to run a new card for the same invoice, although, QB's does not open the invoice to receive a payment again. I do not want to void because it was settled, I want to keep the transactions as posted. How do I run the new card, and apply it to the original invoice?

Thanks.

Welcome to the thread, RTLcreativeaccounting.

Since the invoice has settled, then you'll need to create a new one to apply it to the new card.

For additional reference, you may find below articles helpful:

You're always welcome to come by the Community. Any time you need assistance, we're always here to help. Take care and enjoy the rest of your day!

Hello. I want to do a credit back to a credit card sales receipt, but not for the entire amount.

There was an overcharge and i want to credit back the difference but link it back to the original sales receipt. Please Help ??!!

[email address removed]

Hey there, @lydamaree63.

Thanks for reaching out to the Community.

The ability to create a partial refund and link it to the sales receipt is currently unavailable. I can see how this would be beneficial to you and your business, if you'd like, I can submit product feedback to our engineer team, so this could be considered in a future update.

Please let me know if you have further questions or concerns. You can always reach out to us here in the Community anytime you need assistance. Take care!

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"

Hi @Tori B , do you have any update regarding a partial refund via QBO merchant? Does qbo allow this already?

Thanks for following on this thread, MCdizon.

I’m unable to provide a defined time frame for when the partial refund for sales receipt via QBO will be available. Alternatively, you can let your customer manually send a wired deposit. Then, record the entry in QBO as a refund receipt.

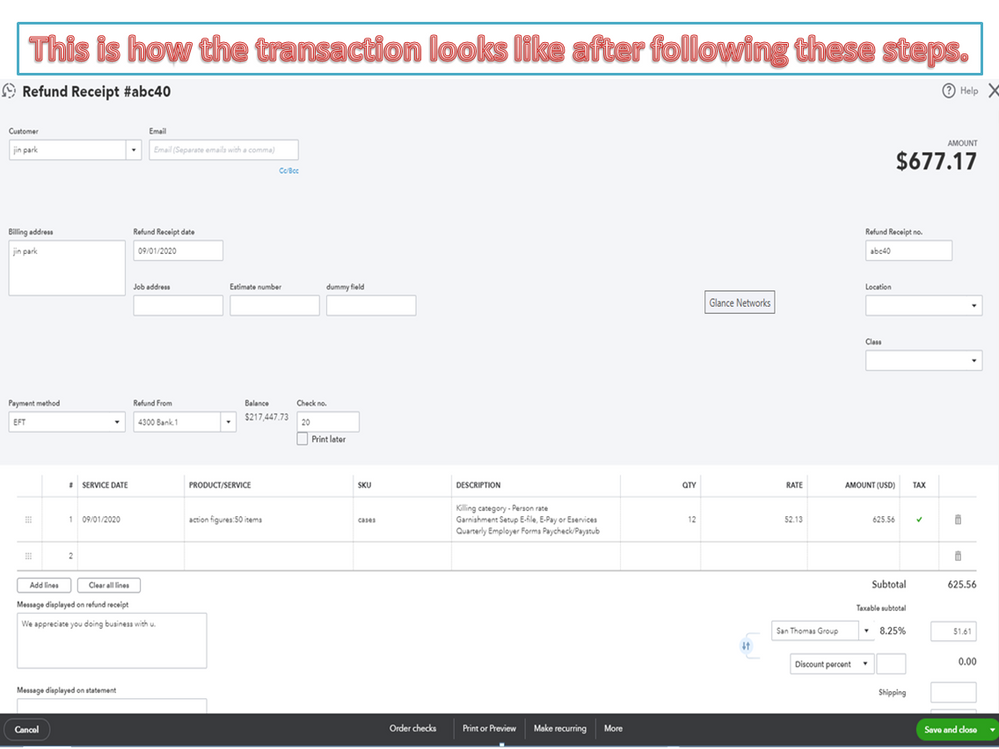

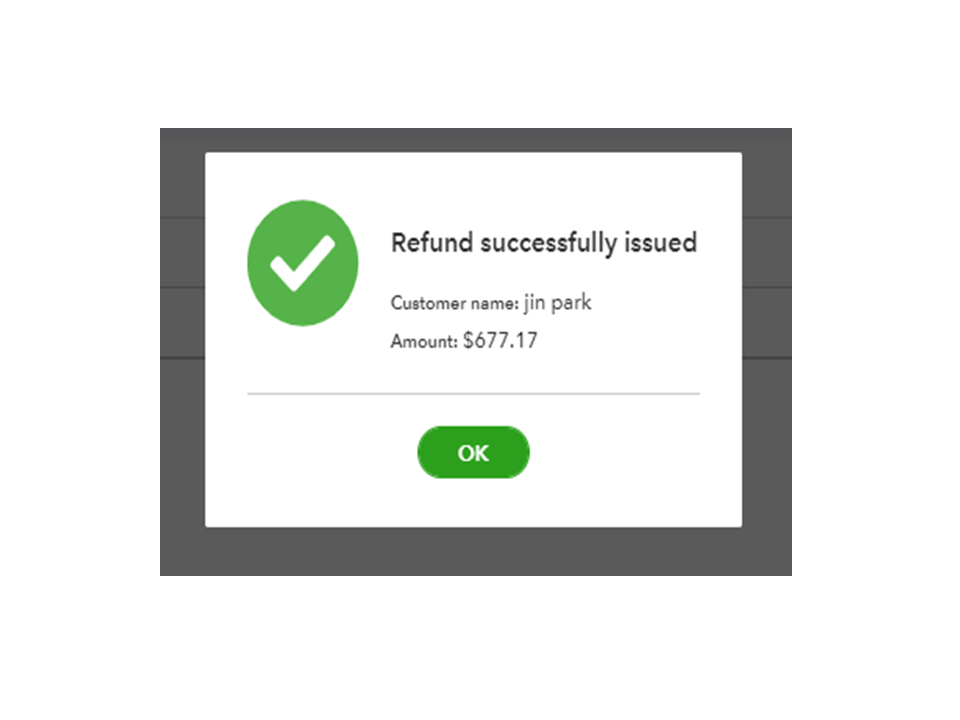

Here's how:

Here’s an article that provides more insights when to use refund receipts or expense to reimburse your client: Create and apply credit memos or delayed credits in QuickBooks Online.

I invite you to visit the QuickBooks Blog site to keep you in the loop about the latest enhancements and features being rolled out. You’ll also find resources to help effectively handle the business using the online system.

Please know the Community has your back. If you need assistance when working in QuickBooks, post a comment below. I’ll be right here to help. Have a great day ahead.

How do you process this with Desktop Quickbooks Pro 2020?

Hello @dailycardinal,

Let's create a credit memo and manually enter the credit card account of your customer to give a refund. Let me show you how.

Additionally, here's an article you can read to learn more about giving a refund to your customer (online or not): Void or refund customer payments in QuickBooks Desktop.

After giving a refund to your customer, consider reading through the steps outlined in this helpful article in creating a list of transactions made by your customers to identify their remaining balance: Customize customer, job, and sales reports in QuickBooks Desktop.

You can always leave a comment below or start a new if you have any other questions aside from creating a customer refund. Stay safe!

I checked and when you issue refund in QBO it actually debits income, so reverses invoice. Therefore you'd have to enter invoice again. More details can be found here.

When QBO merchant account refund is issued, QBO creates a journal entry reversing sales and corresponding sales tax. Therefore invoice needs to be reentered again.

I tried processing the refund as mentioned below but it said there was an error card declined because the amount was incorrect but it’s the exact amount of transaction...what can be going wrong? Customer wants a refund on his CC paid through QB Online Payment Link but already processed

I'm here to help you get past this error and process the refund right away, @Adri10.

The most common cause of this error is when you enter a dollar ($) sign as part of the amount. Simply enter the actual amount, e.g. 111.25. Also, as per Payment Card Industry (PCI) regulations, a refund processed through a credit card must have an original offsetting sale prior to being issued. QuickBooks Payments allows you to process the refund within six months from the date of the sale. After this period, you can provide a refund using cash or check. This is addressed in this write-up: Void or refund transactions in QuickBooks Payments.

Furthermore, there are other factors that can result in this error message. You can read through this article for more info: Error: Invalid Amount.

If no scenario is applicable for you, I'd recommend contacting our Payments Support Team. They have the tools to verify your account and check further what has caused the error.

Please let me know if you have further questions or concerns. You can always reach out to us here in the Community anytime you need assistance. Take care!

I sent an invoice to the wrong customer and she paid it without looking at the bill to:

I issued a return receipt and it said the refund was successful. the invoice still shows paid. What do I do now to clear that payment in quickbooks.

QuickBooks Online (QBO) retains the invoice along with its payment to keep your books accurate, @Joanne38.

These two transactions show that your customer paid an invoice. Without them, you'll have a difference in amounts when reconciling your bank account.

Speaking of reconciliation, I suggest you keep these articles for future reference:

You can follow the steps in these articles to resolve any issues you might encounter during and after a reconciliation in QBO.

Feel free to post a reply if you have other questions about recording refunds in QBO. I'll get back to you as soon as I can. Have a nice day ahead!

This keeps happening to me, please help...

When I do a Refund Receipt this pops up. I have no idea why this is happening.

Thank you for any help!

I'll help you get rid of that error, BlaineSupply.

QuickBooks Online utilizes browser cache and cookies to load the pages faster. At times, these files accumulate and become corrupted causing runtime errors in the program. To rule this out, you can open your QBO account in a private window. You may use these shortcut keys:

Once you're in, create a refund receipt again. If you're now the error is now gone, go back to your regular browser and then clear its cache to improve your browsing experience. You may also use other supported browsers as an alternative.

I'm also adding this article to learn the different ways of issuing a refund to a customer in QBO: Record a customer refund.

Keep me posted if you need more help in managing your other customer transactions. Have a good one.

Hi there,

I am trying to refund a client credit card payment and seem to be having difficulties with the process. I have tried the Refund Receipt way, which allowed me to process one refund but, I have not been able to process any other one. I keep getting an error message telling me the amount I am trying to refund does not match, even though it does?

I have heard about being also able to reverse the transaction through my Quickbooks Payment or Merchant Services Account but, I can't seem to be able to access this on my end? I am using QB Online in Canada.

Thanks

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here