Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowSolved! Go to Solution.

Hello there, @patti2.

Thank for posting in the QuickBooks Community. I'd be happy to help share on how you enter the deposit in QuickBooks Online for the sales tax refund.

You can use bank deposit and use the expense account used when you pay your taxes.

Here's how:

For more information about this process, I recommend checking this article: How to record bank deposits.

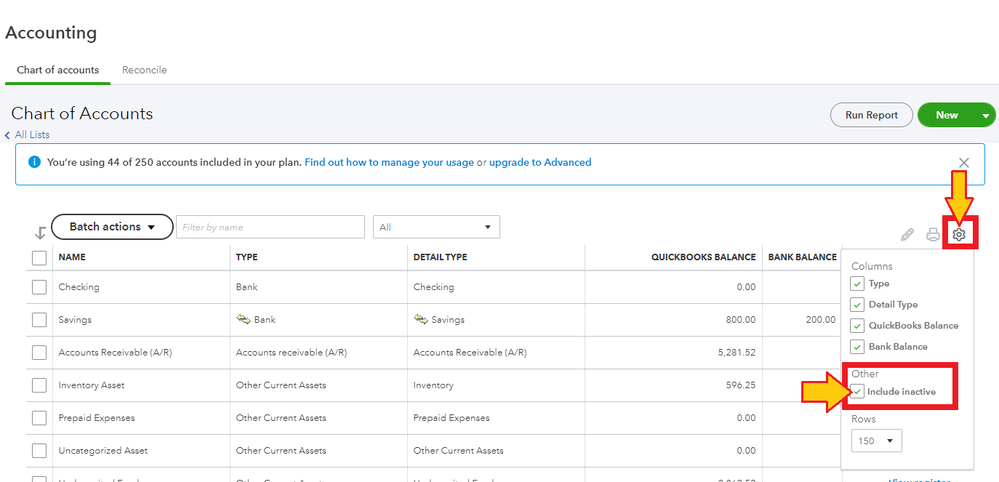

I've added some screenshots for your reference. However, if you need additional help in recording the deposit, feel free to call our phone support. They have the tools that can help you get to the resolution quickly.

That should do it. I'm just a post away if you have any other questions about recording the sales tax refund. I'll be happy to help you out.

Hello there, @patti2.

Thank for posting in the QuickBooks Community. I'd be happy to help share on how you enter the deposit in QuickBooks Online for the sales tax refund.

You can use bank deposit and use the expense account used when you pay your taxes.

Here's how:

For more information about this process, I recommend checking this article: How to record bank deposits.

I've added some screenshots for your reference. However, if you need additional help in recording the deposit, feel free to call our phone support. They have the tools that can help you get to the resolution quickly.

That should do it. I'm just a post away if you have any other questions about recording the sales tax refund. I'll be happy to help you out.

How do i do this in quickbooks desktop?

Hello there, @cdlac.

Thanks for joining this thread. Allow me to help and guide you on how to record deposit in QuickBooks Desktop for the sales tax refund.

Let me walk you through the steps:

For future reference, you may also check this article: Process sales tax adjustment.

If you need further assistance with the steps, I recommend calling our QuickBooks Desktop Support Team. They have additional tools to pull up your account and do a viewing session.

Here's how to contact our phone support:

That should do it! If you have any other concerns about make deposit don't hesitate to leave a comment below. Wishing you and your business continued success.

I tried this and it didn't work. Had a chat log with Franklin B from QB and couldn't figure it out. When I make a journal entry to record the sales tax refund check being received, it does funny things to the sales tax liability account. Why is this so difficult on the online platform?

Thanks for joining this thread, Port City.

I can help you record the sales tax refund in QuickBooks Online.

You can enter it as a deposit and select the liability account used when paying your taxes.

Here's how:

Check out this link for more details: How to record bank deposits.

The Community always has your back, so don't hesitate to let me know if you have any questions. Have a good one.

Ok, so this works to deposit the funds. But is there a way to actually change the period taxes? i.e. the refund was for Jan - the actual refund payment came in May. So when I record the payment this way it shows that month underpaid in the system.

Hi @PT-phx,

Currently, there isn't an option to change the liability period of your payroll taxes once you've already recorded it.

In addition, if cases like yours happen again, you'll have to record your sales tax refund on May since you received the actual refund in May.

Thus said, you can follow the detailed steps outlined by my colleague, @PreciousB, above in recording your sales tax refund.

Lastly, you can also read this article which can be your guide for any future tasks: Sales tax in QuickBooks Online.

It'll be always my pleasure to help if you have any other questions. I'll be keeping an eye for your response.

QB will not allow me to choose a liability account for this type of transaction. Is our only option an expense account? Thanks!

Hope you're good today, The_Accountant.

If you're referring to the deposit page, we can try a few basic troubleshooting steps since QB will allow you to choose a liability account.

You can try using a private browser. It doesn't store local files or cache we'll know if it is a browsers related issue.

You can follow these shortcut keys for the private browsers:

If you're able to choose a liability account, you can now go back to your original browser and let's clear the cache. It allows your browser to function more efficiently. You can check out this article: Clear my browser cache.

You can also use a compatible browser with QBO. Alternatively, you can create a Journal Entry to record this transaction.

Let me know how it goes for you. I'll be right here to help you out.

I had overpaid state payroll tax (California) during 2019 and I did not receive a refund until this was discovered and received my refund check in May 2020. The amount I was refunded included overpaid sales tax as well as penalties that were charged on it in June 2019. What would be the appropriate way to book this entry?

Did you ever get a fix to this? I am curious too.

Welcome to the Community, Crane_2020.

You can record a deposit by using your Plus (+) icon, selecting Bank deposit, then entering the appropriate information in each available field.

You'll be able to find detailed steps for recording these types of transactions in MaryGraceS's post.

Additionally, many helpful resources about using QuickBooks Online can be found in our help article archives.

I'll be here to assist if there's any other questions. Have a lovely day!

I would also like to know how to book an entry like this.

Greetings, @Questioner22.

Can you provide more details on your concern on which entry you want to book? Also, may I know what QuickBooks version you are using? Any additional information would help us provide the best resolution for your inquiry.

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Please touch base with me here for all of your QuickBooks needs. I'm always happy to help. Wishing you all the best for this year!

When trying to deposit my sales tax refund check, QB online won't let me select the CA Tax Liability acct; which account should I use?

Google Chrome: press Ctrl + Shift + N

Mozilla Firefox: press Ctrl + Shift + P

Safari: press Command + Shift + N

If it works, you can return to your regular browser and clear your browser's cache. Then you may see if the option is available and get started on the tasks at hand. However, if incognito window didn't work, you can use other supported browser.

Please refer to this article for more details: Troubleshooting browser problems.

Furthermore, if you want to use another account, I'd suggest consulting your accountant. This way they can advice you with the right account to use in order to keep your books accurate. Since they know what's best for your business.

Once, you accounts are already settled, you're now ready to reconcile your account. Here's an article for you guide: Reconcile an account in QuickBooks Online.

You can count on me if you have any other concerns related to QuickBooks. Have a good one!

This has happened to me as well. We use QB Enterprise (on prem). We had to amend our October 23 sales and use tax (we overpaid). Once corrected (invoices and customer corrections), when I run "manage sales tax", it shows a negative balance is due...makes sense. I received the refund in 1/24. After depositing the check as described in this string, it is NOT positively or negatively impacting my Sales Tax liability balance when trying to record our December 2023 Sales and Use tax in the 'manage sales tax' screen, so I'm thinking I need to either choose a different account in the deposit or make a journal entry to cause an offset, but I'm not sure what accounts to use to cause the offset. The account I'm depositing to is Sales Tax Payable, which is an 'other current liability' account. Any suggestions?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here