Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have a client with a regular service business, but he also has 6-8 individual rental properties. I think we will set up separate LLCs for each property. What is best way to hande in QB Online? I have not dealt with rentals before. Should each property be set up as a separate company with it's own asset (the rental), income, and expenses to get an income statement for each? Or is there a way to set them up in one company in QB. Is Online the right product to use? I can't find anywhere online, but I think QBO charges per company setup, so having 8 different companies could get expensive. Thanks.

Solved! Go to Solution.

The prevaling rhetoric on the net is one LLC per property, which per the IRS means one accounting file for each, so yes in QBO that is one subscription per company. You can get by with essentials if it is one property per llc.

desktop is one purchase price and as many companies as you wish (as your hard drive will hold).

He needs to consult with a couple of business lawyers as to whether or not multiple llc's is the way to go.

If all the rentals are kept in one company, then QBO Plus is needed, only one subscription though.

a single subscription to QBO is 3-4 times as expensive as desktop over the 3 year support life of desktop, see this comparison, the cost is toward the bottom of the article. a non partisan comparison of QBO vs QB desktop

http://onsale-apparel.com/Rustler/qbo-or-qbdt

The prevaling rhetoric on the net is one LLC per property, which per the IRS means one accounting file for each, so yes in QBO that is one subscription per company. You can get by with essentials if it is one property per llc.

desktop is one purchase price and as many companies as you wish (as your hard drive will hold).

He needs to consult with a couple of business lawyers as to whether or not multiple llc's is the way to go.

If all the rentals are kept in one company, then QBO Plus is needed, only one subscription though.

a single subscription to QBO is 3-4 times as expensive as desktop over the 3 year support life of desktop, see this comparison, the cost is toward the bottom of the article. a non partisan comparison of QBO vs QB desktop

http://onsale-apparel.com/Rustler/qbo-or-qbdt

I have the exact same issue but am constantly travelling. Our bookkeeper is in one place, but I need access to Quickbooks as well, which makes it difficult if only one computer is licensed for Quickbooks Desktop. One work around could be to purchase two copies of Quickbooks Desktop and constantly update with a backup file from myself and our bookkeeper, but this seems ripe for mistakes to occur. Is it possible to set up multiple properties within Quickbooks Online Plus? I've heard talks of setting up different classes for the different LLCs, but am not sure if this will actually work. In summary, we'd like to manage all of the LLCs online with the least expensive option possible. Ideally, the solution would allow for creating consolidated financial statements of all the properties or a select number of the properties (properties 1 - 5 in a consolidated financial report, properties 1 & 4 only in a consolidated financial report, etc.).

What did you end up doing? I am in the same situation.

@AlkisV wrote:

What did you end up doing? I am in the same situation.

If you file all the LLCs in one tax return with separate Schedules for each one, and they all use the same accounting method, then you can use one QBO Plus subscription, and use a Class for each LLC. This is for tax purposes. The risk is liability protection may be jeopardized

I have new client with 5 rental properties. CPA files a 1040 with 5 Sch E's attached. No invoicing. Owner deposits rental income for each property separately and expenses separately all to one bank account. Obviously, I need to provide the CPA with P&L for each property. expenses can be set up for Maintenance etc paid from the same bank account. SO I am in process of setting up COA and was setting up each property separately. I did not use "class" and want to have the report as simple as possible without setting up Customer, etc. I can enter deposits directly by going to DEPOSITS and then using property to whatever one t goes into and the same with expenses. I am going to see how this setup works for the P&L per Property... Any input is welcome. Thanks in advance

I am also interested in this topic; however, I am more interested in the finer details. I have one LLC with one property but 4 units in each. I am at the company setup dialog for Desktop Premier 2019 (I know, I don't need Premier - but that goes off the topic.... lets just suffice it to say that is what I have). Do I add the rental units as products, services, or leave the products and services empty? I have a property manager that collects the rents and forwards them to me itemizing the collections in an income spreadsheet, itemizing the rents received from each unit. I am just not sure how to setup the company file most efficiently.

Hello, TheDoctor165,

Welcome to the Community and thanks for joining the thread.

Let me share information about the Item types available in QuickBooks Desktop.

The items set up into your account shows up as a line on an invoice or other sales forms. Upon adding items, QuickBooks provides different item types that you can choose. For guidance in setting up, you can check out this article: Add, edit, and delete items.

As for your question if you'd add rental units as products, services or leave the products and services empty, I'd recommend reaching out to your Accountant to ensure that this items will be track and accounted properly.

For future reference, I'm attaching a great resource that you can check: Create a property management company.

If you have further questions, please feel free to visit the Community again. Have a great day!

If you have multiple LLC's, then you will have multiple bank accounts, multiple tax ID numbers, etc. The problem is not with the income/expense side, which can be easily split across several tax returns. The problem is with the balance sheet. It would be difficult or impossible to know exactly which assets/liabilities relate to which LLC. This is called "comingling" and it generally should be avoided as it can lead to errors when a property is sold or disposed and an incomplete or incorrect set of assets/liabilities are removed from the books.

So I would say one QB company file per entity.

I would recommend a consultation with an atty regarding a single or multiple LLC's. LLC is an asset protection strategy, and it can be void if you don't run the LLC correctly and/or comingle. I've seen some bad outcomes.

If you choose to use a single entity for multiple properties, then using the class feature is the way to go to simplify the profit/loss reporting. You will also need to pay careful attention to the balance sheet fixed asset section to keep the asset cost basis straight.

Holler if questions.

Mark Wagner, CPA

Is there a definitive discussion, or white paper or tutorial on how to use CLASS most effectvely in QB.

It in increasingly obvious that QBO is simply Intuit's attempt to compete with QUICKEN, (which works fine) and is not truly meant to replace the very good functionality of the DESKTOP.

Way to go Intuit. . . claim they are equal but leave out fuctionaliity.

I can provide information about the class tracking feature in QuickBooks Online, TN-landlord.

This feature helps you track income, expenses, and profitability by segments.

Using this feature helps you organize your customer and vendor transactions by class. You can also run reports by class to check the sales and expenses. Then, you can also create a budget for each class. This lets you plan and set goal for each segment in your company. I've got the article for more information.

If there's anything else you need, please let us know. We'd be happy to help you.

Does this not work in the Desktop version? I only have three properties, all duplexes. An I use Rentalutions for accepting my rents, and keeping track of my tenants, leases, payments, etc and they are attached to my bank accounts; so all I want to do is input the information of rents received per unit and fixes per unit and bills per building/property. How do I set this up? I just want a place to put in all my reciepts and have a nice simple ledger to send to my accountant every year.

Thanks for joining us here, @Michelka.

I'm here to help share some insights on how you can track rents and handle your tenants transactions in QuickBooks Desktop.

To record your transaction in QuickBooks Desktop, you'll need to enter it by property and process it manually. To do that, you'll need to set up the tenant's as jobs and categorize them afterward.

Right after the setup, you can now receive payments and make a deposit. Below are the steps to follow.

To receive payments by property:

To make deposits in QuickBooks:

To give you the complete details of this process, please check out this link: Create a property management company.

However, you also have the option to connect Rentalutions with QuickBooks Desktop to sync your transactions automatically. In doing that, you'll need to reach out to our Intuit Developer. This team is the best avenue to visit when it comes to apps integration in QuickBooks.

This should get you moving today.

I'm just a reply away should you have any other questions about this. I'm always up to provide further assistance. Thanks for coming and have a good one!

How can I get a vacancy report? I am going to use Class for Building #, Customer for Unit # and Customer Job for tenant.

Thanks for joining this conversation, @Millers Lane.

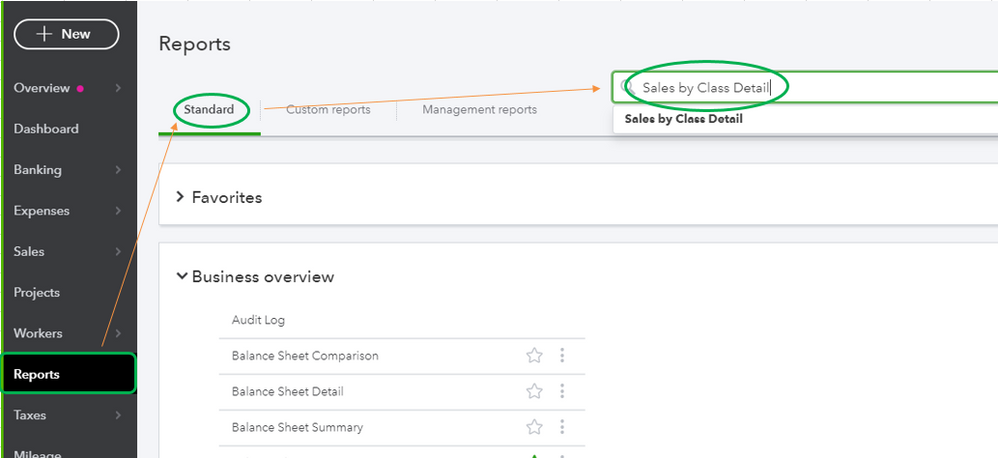

In QuickBooks Online (QBO), the ability to pull up a vacancy report is currently unavailable. As a workaround, you can run the Sales by Class Detail report. However, this will only show the classes (building number) that have transactions entered. You may also consider looking for a third-party app.

Here's how to pull it up:

Just in case, I'll add this article for future reference: Run reports.

I'll pass along your suggestion to our Product Developers. They're always looking for ideas from users to consider how to improve QBO. In the meantime, I recommend visiting our Blog site. This is where we share recent happenings and future developments, such as updates to newly added features.

Let me know if you have any other issues or concerns by leaving a comment below. I'm more than willing to assist. Happy holidays!

I really like the idea of just using classes to identify multiple rental properties in one company. It keeps things simple. Unfortunately, the IRS likes to complicate things and requires each property to be listed separately on Form 8825 (A, B, C, etc). So ideally you would be able to map a class to a tax line instead of having to setup each income and expense category with each of the properties in order to map to a separate tax line. But I'm guessing that type of feature is not supported by Quickbooks. So my question is, will I really need to setup multiple properties under each income and expense item in order to map them to separate properties for IRS reporting?

Let me share a few information, Swillfam.

You will have to set up multiple properties or classes to separate the tracking and mapping. You can also check this article for more information: Turn on class tracking in QuickBooks Online.

For additional guidance in setting up the accounts, you'll want to confer with your accountant or tax adviser.

If there's anything else that you need, feel free to let us know. Take care!

Same problem. QB wants $200/mo for my small LLC that has two buildings one of which has two units. No way can afford!

Intuit/QB ought to find a way QBO can mimic Desktop for a limited number of small companies. Otherwise we all toast.

how do you set up individual rental properties above plus mac

Thanks for taking the time to post in the Community space. I’m here to share information about running a property management business in QuickBooks Desktop for Mac.

I've got some information on setting up your six-building rentals in QuickBooks Desktop. Thus, you'll be guided respectively.

Since you've various buildings, I'd recommend creating separate Rental property company files for each of your rental buildings. This way, you can track and manage your data separately from each other.

Although if you're a property manager, you provide service to property owners and the tenants of those properties. In such a case, you need to create and manage two company files:

Here's how to set up a Rental property company:

After creating a company file for a rental property company, you'll have to set up customer and vendor accounts for your tenants and vendors.

If you haven’t already, here's how to set up the customers and vendors.

Once done, you'll have to set up accounts and items, which you use to track transactions.

Moreover, I'd suggest consulting an accountant to help you choose the most suitable accounts. If you don't have an accountant, we can help find one near you.

If you need further assistance in managing your rental properties, please let me know here in the Community. I'm always here to help. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here