Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowHey there, @RefundMe. Thanks for joining the Community.

I'm happy to help you with your vendor refund. It's super quick and takes just a moment. Take a look:

Create a vendor credit

Apply vendor credits to a bill

You can apply a vendor credit toward any open or future bill. When you’re ready to use the credit, here’s how to do it.

That's it! If you happen to just enter expenses or write checks to your vendors, you can check out this article: Enter a credit from a vendor

Please touch base with us here if there's anything else you need, I'm determined to ensure your success. Have a great week!

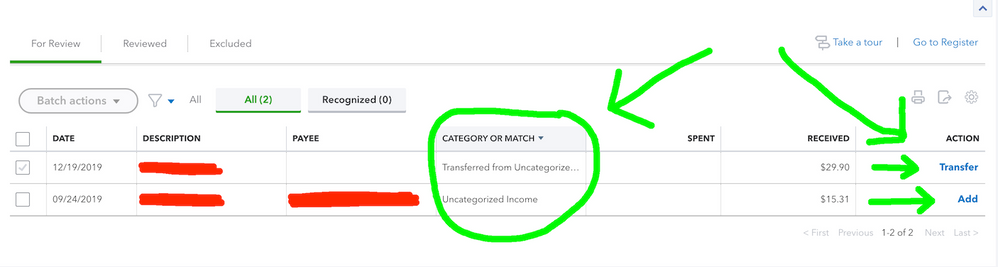

Still completely lost. The two refunds are already on my credit card. How do I categorize them and add them? There are no "new" buttons, where would they be located?

This is the third time I've had to re-type my response. There is no add button. I received a credit card refund from a vendor, they are currently sitting in my credit card account. How do I categorize that and add them?

Hey there, @RefundMe.

The + New button is located in your left side menu, as seen below. As to what to categorize it under, you'd want to speak to an accountant to ensure everything is entered correctly.

I hope this clarifies things for you! Wishing you and your business continued success in all that you do.

Thanks.

I appreciate you for coming back, RefundMe.

You can simply click the downloaded transaction from your Banking page to categorize the items. I'll walk you through the steps below:

However, I'd suggest consulting an accountant to make sure you're using the correct category.

For more information about adding and matching bank transactions in QBO, check out this article: Add and Match Downloaded Banking Transactions.

Feel free to reach back to me if there's anything else you need to know about QuickBooks. Have a wonderful day ahead!

@Charies_M thank you for the information, but this is for a refund received not given. The refund is from two different companies. The category I used when made the purchase from one company was "Expense: Advertising & Marketing" and the other was "Expense: Equipment". So what category would I use when they return "refund" the money back to me?

I received a refund from a hotel that we made a reservation at and then had to cancel so I received the deposit back on my credit card that I had used to pay it. I am wondering if your question ever got answered? It is the exact same thing in mine, it is showing up and waiting to be categorized. I am sorry I can't help answer yours, but hopefully we can both get clarification!

Thanks!

Has anyone found a solution to this? I am in a similar situation. A parts company that has our credit card on file had mistakenly charged us for a different company's orders. They are now crediting our card for 11 transactions spanning from Oct 2019 to Oct 2020. The credits are showing up in the downloaded transactions and defaulting to "Record as Transfer" with the transfer account being "Uncategorized Asset." I know this will surely mess up the books. How do I record these credits? (They are all Cost of Goods Sold made with the same credit card.) Receiving credit now for transactions from 2019 has me nervous, too. Thanks for any help.

I can share some tips on how to record them, catface.

You can exclude these transactions from the Banking page to avoid discrepancies in your books. Once done, you'll have to enter the credits as a bank deposit since they're refunds from incorrect charges. Here's how to do it:

I also encourage reading these articles to help better manage your downloaded bank transactions in QuickBooks Online:

I'll be right here to continue helping if you have any other concerns or follow-up questions. As always, assistance is just a post away.

Hi KlentB,

Thanks for your response yesterday. I followed your instructions and excluded the transactions then proceeded to this step:

Unfortunately, the account is not available for a bank deposit because it is a credit card and not a bank account. Thus, this method did not work for me. Do you have any suggestions on how to handle refunds to a credit card?

Thanks,

Erin (catface)

Thank you for getting back, @catface.

You can enter a credit card credit transaction for the refund. I can guide you on how.

I've added these screenshots for your visual references.

Just in case you need to process customer refunds in the future, you can also use this article as your guide: Void or refund customer payments in QuickBooks Online.

I'll be right here to help if you have any other questions. Just add a comment below. Have a good day!

Hi,

I opened a bill

Paid half of the bill with a credit card and applied the bank feed towards the bill. Obviously tie bill amount was reduced by half.

The item for that payment was returned and the vendor issued a refund on the same credit card for the full amount of payment.

How do I record the bank feed credit I received so it’s connected to the bill which should offset the original credit card payment and bring the balance of the bill to the initial amount when I opened it?

Thanks for joining in this conversation, @Alseku. You can create a journal entry for the credit you received to offset the amount of credit card payment. Here's how:

To make sure your books are accurate, I'd suggest consulting your accountant for further assistance with the process.

I've also added our resource for your future reference. Read through this article to learn more about getting a report with vendor totals.

I'm always around here to help if you have additional concerns about recording your transactions in QuickBooks.

Hi Katherine,

Let me clarify that the credit (refund) on the credit card I received is a bank feed “For review “.

I need to properly record that transaction. A new journey entry will not take care of “For review” bank feed.

We can create a vendor credit, Alseku.

This way, we can offset the payment and change the status of the bill to Open. Let me guide you how:

For more information about the process, you can check this reference: Enter vendor credits and refunds in QuickBooks Online.

I'll be around if there's anything that I can help. Keep safe!

Let’s say my bill is $800.

I pay $400 with credit card and apply the bank feed towards the bill.

Balance from unpaid bill is $400.

So far so good.

Item received wasn’t correct. We return. Vendor issues full refund of $400 on credit card.

My end result should be an open bill for $800 because the credit card charge and refund offset each other.

This is so simple but it appears to be undoable in QBO.

If I apply the bank feed of credit as Credit card credit, it will come negative (just like the charge) and the balance on the bill will be $0 ($800-$400 charge-$400 credit)

Vendor credit will not work either because it will also come as negative and make the balance $0 just like credit card credit.

I’m perplexed. It should be a common scenario. Hasn’t anyone encountered this?

Thank you for your assistance

Let’s say my bill is $800.

I pay $400 with credit card and apply the bank feed towards the bill.

Balance from unpaid bill is $400.

So far so good.

Item received wasn’t correct. We return. Vendor issues full refund of $400 on credit card.

My end result should be an open bill for $800 because the credit card charge and refund offset each other.

This is so simple but it appears to be undoable in QBO.

If I apply the bank feed of credit as Credit card credit, it will come negative (just like the charge) and the balance on the bill will be $0 ($800-$400 charge-$400 credit)

Vendor credit will not work either because it will also come as negative and make the balance $0 just like credit card credit.

Thanks for providing detailed information about the process that you performed, @Alseku.

Creating a journal entry is one way to resolve/ offset your credit card payment. You can follow the steps shared by katherinejoyceO, make sure to verify the accounts you used so they will be posted correctly.

Before doing so, I suggest reaching out to an accountant for expert advice about which accounts to debit and credit. This way, we'll be able to ensure your books are accurate and error-free. If you don't have one, we'll help you look for an expert through our Find-an-Accountant tool.

Once you're ready to add it to your bank, you can proceed with making a deposit (the JE should reflect as a transaction you can add to your bank). The option is available when you press on the + New option from the left side. Here's how:

You can check this article for detailed steps: Record the vendor refund check.

Moreover, I'd recommend reconciling your accounts every month to early detect errors and monitor the growth of your business. For more details, you can check out this article: Reconcile an account in QuickBooks Online. It also contains information on how to edit completed reconciliations.

Also, to help you with your task in QuickBooks, just go to this link: QuickBooks Basics. Then, click + More Topics to view related articles about managing your sales, expenses, inventory, taxes, and running reports.

Please know that I'm just a post away if you have any other questions. I'll be happy to help you out.

Bank deposit is not available for credit cards. Unfortunately QBO didn’t add it into the drop down menu, only Bank account and pretty cash or physical asset

I hope some user can chime in and explain.

So frustrating to pay the fee and still struggle with smth which should be common and intuitive to do but it isn’t

Thanks for getting back to us, @Alseku.

Allow me to chime in and guide you on how to record your credit card payments in QuickBooks Online (QBO).

The option to make a credit card (CC) bank deposit isn't possible in QBO. CC is a liability account that needs to be paid. You can only record a bank deposit if it's an asset account.

For more details about this, you can refer to these links:

Moreover, here's how to record your credit card payments:

You can also check this article for more details about the process: Record your payments to credit cards.

Once you're all set, you might want to use this resource for guidance in reconciling your account seamlessly.

Tag me in your reply if you have other questions recording your CC payments. I'm more than happy to work with you again. Keep safe!

I’m getting replies that not only are different from each other but some in contradiction to each other.

JasroV my issue isn’t cc payment but cc refund!

QBO with bank feeds:

1- Bill $800

2- Downloaded CC payment of $400 applied towards the bill

3- Downloaded $400 CC refund needs to be categorized and applied towards the bill. This should bring the balance of bill back to $800.

How???????

Please show this to me step by step

Hello @Alseku,

Thank you for getting back to us, sharing an outline of your concern, and how you want to accomplish it. I'm here to offer help and share how you can enter a credit card refund you received from your vendor.

To start with, you can create a credit card credit for the actual refund and apply it to your original bill. This way, you can bring back the actual balance of your bill and categorize the downloaded refund accordingly. Let me show you how.

From here, you can go ahead and apply the refund to the original bill. Once done, you can go back and categorize the downloaded credit card refund from the list of your bank feed transactions.

Additionally, I've also included this reference helpful with a compilation of articles you can use while working with us: Browse all articles for your QuickBooks product.

Don't hesitate to post again here if you have other questions or concerns with QuickBooks tasks and navigations. I'm always around happy to help. Stay safe and have a good one!

... but how do I apply the credit card credit I just created to the open bill?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here