Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe have our employees attached to an item and the number of hours sync with the job QBO, however, the amounts are all zero. How can it pick up the employee's pay rate? Or does every employee need to have an item with their own rate? Also, some employees have OT, how can the job costing pickup the different rates?

So in theory, we did set up items for everyone, how would it know to pickup that this is time and a half? Payroll knows... so this should be possible.

This seems like a lot of items having over 50 employees.

Hello there, @JLR9.

At the moment, there isn’t a way for job costing to pick up employees pay rates. While this option is not yet available in QBO, I encourage you send this as a suggestion to our Product Development Team through your feedback feature and I'll do the same thing from my side.

We'll want to have new features based on the value they'll add to the most users possible. Your suggestions will be kept in mind for future development plans.

To send feedback, here's how:

Click on the Gear icon.

Click Feedback.

Type in your feedback or feature request.

Click Send Message.

You may also want to submit feature requests through this link: http://feedback.qbo.intuit.com/forums/168199.

Stay tuned for now. If there's anything else I can do to help, just let me know by leaving a comment below.

So to be clear I need to create a line item for each employee/subcontractor that is in Tsheets and enter their rate of pay for the amount so that I can get effective job costing? Does their name need to be their user name or their full name as it is seen in Tsheets in order for the sync to pick it up?

Hi, alexisn1.

Allow me to provide additional information about Tsheets and job costing in QuickBooks Online.

Yes, you'll need to create a line item for each employee/contractor if they have different rates. Make sure to use the full employee/contractors name to ensure the information records properly after importing.

For additional help. feel free to reach out to our QuickBooks Online Support:

I'll be around to help if there's anything else you need.

Hi RoseMarjorieA,

Most of our employees have only one rate, but it seems that we're having the same issue. Employee time is shown as hours on the project page, but doesn't show up as dollar amounts on project expense reports. Is there any way to do that?

Thanks for looping in, sgf292.

Allow me to provide additional information about employee's time and projects in QuickBooks Online.

To show the dollar amounts on the project expense report, you'll need to create an expense transaction or wages for the employee's time. There should be expense transactions to show the dollar amounts in the report since you're recording time on the project page.

You may find these articles helpful:

For additional help, you can also reach out to our QuickBooks Online Support. To reach us, please follow these steps:

Fill me in if you have other concerns about projects in QuickBooks Online. Have a good one.

You can run the payroll based on the timesheets, sgf292.

We'll need to turn on this feature first. To do so, you can follow these steps:

Then, let's create timesheets for your employees.

Once done, you can now run the payroll. You'll notice that when you select the correct pay period, the total hours are already there.

Also, as long as you've selected a certain project while creating the timesheets, it will be part of that project after creating the payroll. Open the project and go to the Transactions tab. You'll see a Payroll Check transaction type. Just click on it to see the details.

Let me know if you have other concerns about Time Sheets.

Hi there, @sgf292,

If you've processed payroll manually, you can delete and recreate it. By doing so, you'll be able to use the timesheet and get rid of duplicate paychecks. Just make sure the information is the same to avoid discrepancies on payroll amounts.

However, If the payroll was created through direct deposit, you can void and recreate it as paper checks using the entries on your timesheet.

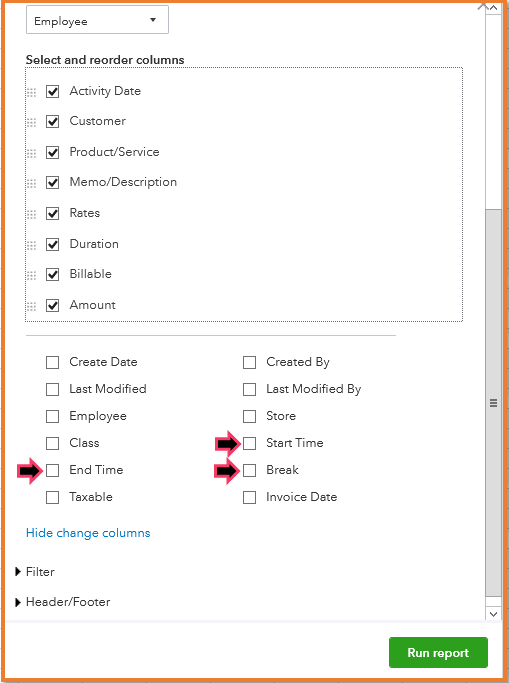

If you need to print time sheets, please follow the steps listed below:

Should you need anything else concerning payroll, please let me know. I'm always around whenever you need assistance.

@Teri Could we hire you to sort out this Quickbooks Payroll mess and get everything into the right accounts? ;)

@Teri wrote:

Just saw this in her post above yours, but I see link did not copy here. "However, If the payroll was created through direct deposit, I recommend contacting our QBO Payroll Team. They can void your payroll for you to be able to reprocess it." Can't believe they want you to void a payroll! Be careful with that. Also just FYI that Direct Deposit does not create payroll, that is just how it is paid vs. paper check.

Hello @sgf292,

I've already updated my answer above about voiding your payroll.

The article you've found is for QuickBooks Desktop, and that's why you're unable to see the Send Payroll Data option.

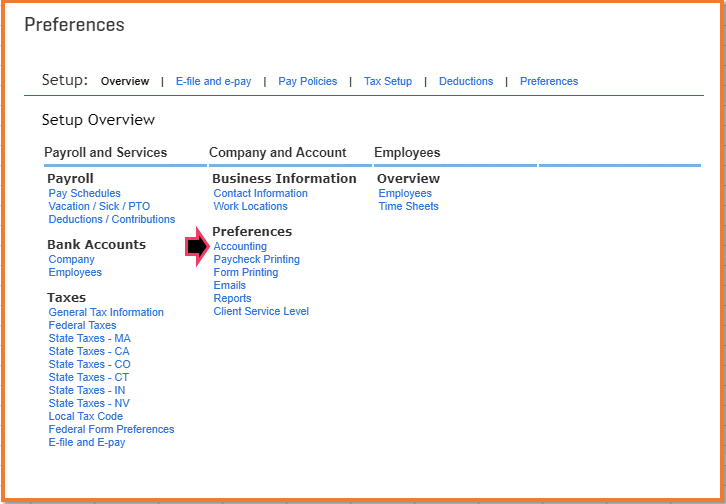

Let me guide you on how to change the posting account for your payroll expenses.

Here's how:

Changing the settings will only affect for future transactions. If you need to apply these changes to your past transactions, you can backdate previous transactions. This will update all accounts except the selected bank account.

Keep me posted if you have follow-up questions concerning payroll. I'd be glad to provide the information you need.

Hi there, sgf292,

Allow me to help share information on how to handle this situation.

Right now, QuickBooks Online doesn't have an option to assign paychecks to a Project or Customer.

In your case, if you'd want to track time, you can record the Time activity with the correct customer or projects and cost for the service item by entering the Cost rate.

To give you a better view about this process, you can refer this articles:

If you have any follow up questions, please let me know by leaving a comment below.

Hello Teri,

A cost rate is the amount incurred by an individual when working for a period of time on an activity. It's the employee's pay or the total overhead cost.

Keep up posted if you need anything else.

Hi there, @Teri.

Yes, you're correct. The cost rate is the total cost for an employee to do work for your business. This typically includes wages (“pay rate”), benefits, overhead, and taxes.

There's a designated field where you decide for the Cost Rate on the Timesheet window.

For future help and to learn more about how pay rates, cost rates, and billable rates impact profitability, you can check the link. It gives you an overview and calculation of the rates.

Additionally, here are some other related articles:

I'm still here to help you if you have more questions. Just leave a comment or mention my name. Wishing you all the best!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here