Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

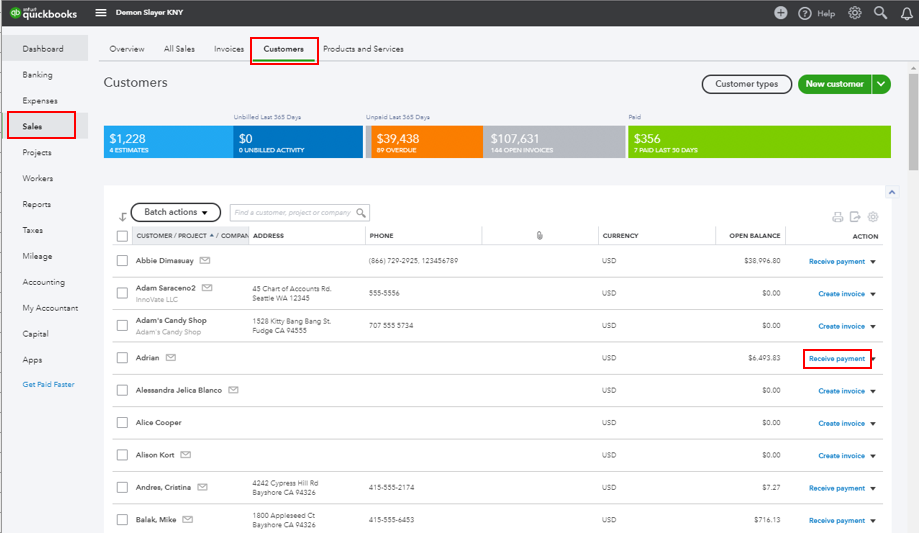

Buy nowI used the methods described and the customer balances went to zero. However, the AR 30/60/90 report now shows the customer as having an account balance due equal to the amount of the check. How do I get the AR report and the customer record to match?

I can get the customer account to balance OK using the method, but the AR 30/60/90 report will now show the customer has having a balance due equal to the amount of the refund (or check). How does one get the AR report to accurately show the correct balance. Yes, I did refresh the report.

"How do I get the AR report and the customer record to match?"

If you have an overpayment from a Payment, you link the Refund by using opening their original payment and applying it to the Check, which is listed as if that is an open invoice.

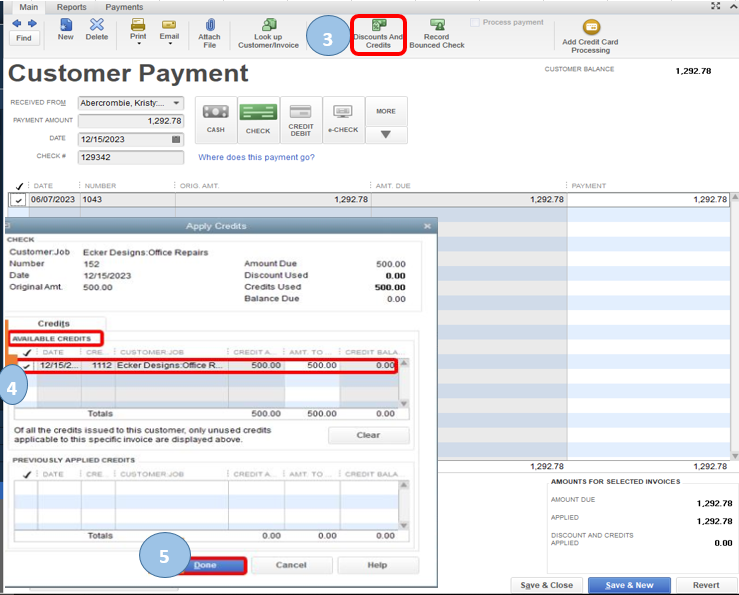

If you have an overpayment from a Credit Memo but you created the check manually, and the check lists AR, the use the Receive Payment screen. Do not enter an amount; there is no New Money to enter. Here you see their Refund Check listed, and the amount that is an Available Credit; use the Icon on the ribbon at the top to Apply Credits.

Thank you!

This has made life so much easier for our not-for-profit.

Now here's a follow-up:

So, a "customer" purchased something on behalf of the organization.

We have reimbursed them by issuing a credit and writing a check, linking them per your advice.

How do we now setup and pay a bill showing the original purchase from the original vendor?

Meaning: we need to record the line items correctly (product added to equity, shipping, etc.) and although the bill was paid, the organization did not send any money to the vendor.

Of course, if this whole process is backwards, please do let me know!

We're trying to stop our members spending on behalf of the org, but sometimes they just go ahead and do it anyway.

Thank you :)

Greetings, @ DunedinMusicSociety.

I can share some information on how you can set up billable expense in QuickBooks Desktop.

Depending on the set up or agreement you have with your vendor, here's how you can process and record vendor refund in QuickBooks Desktop.

Keep in touch with us here in the Community if you have other question about creating credit memo for your customers and processing vendor refunds. I’ll be here should you need further assistance.

Hi there,

Thanks for sharing this. I am using QBO and cannot resolve this issue. Can you please assist?

Hello there, @SHarrisFinancial,

I'd be glad to provide you the steps on how to write a refund check in QuickBooks Online.

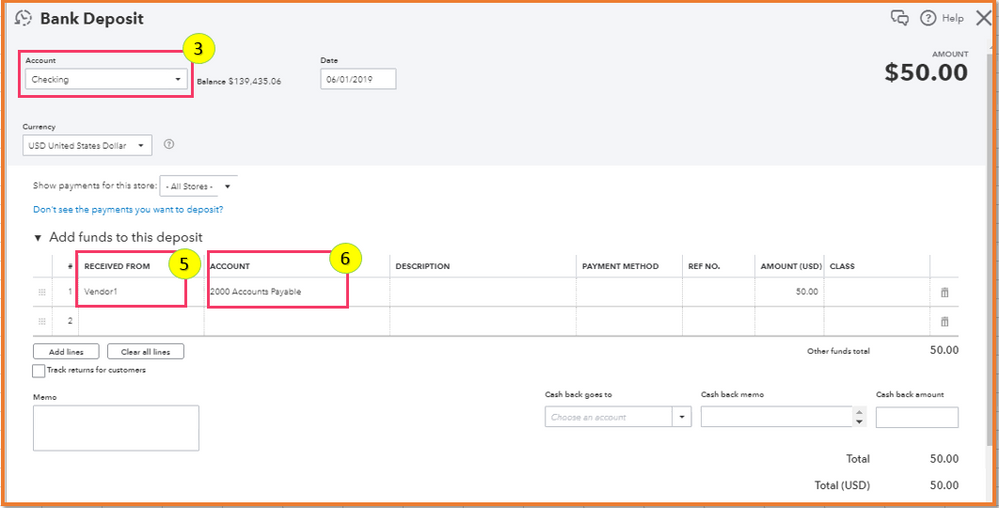

You'll first need to create a bank deposit using the Accounts Payable so you can link the vendor credit to the deposit.

Here's how:

Then, link the deposit with the vendor credit.

For your guidance with the solution above, you can go through this article: Manage vendor credits.

To learn more about printing checks, please check this out: How to print checks.

If you need assistance with this, just leave a comment below. I'd be glad to lend a hand.

Changing the account, on the check I'd written, from sales to receivables did the trick, thanks!

It's weird. Many things that are talked about in this thread are simply not on my screen. What I want should be way simpler:

1. Customer A: bought several products for 5000 USD.

2. It is decided that part of their purchase will be reimbursed, 1000 USD.

3. I create a Credit Note for 1000 USD and sent it to them. They decide they want a refund.

4. There is now -1000 USD on the customer account.

5. I transfer them 1000 USD.

6. Why does Quickbooks refuse to give the option to connect the bank transaction of 1000 USD to the Credit note that was written. It even says in the top right 'Amount to refund'. That single step would get their balance correct again. Why is it that only Refund Checks can be connected with Bank Transactions.

I've tried getting it back to 0 by also writing a Refund Receipt and subtracting the refund amount from the original payment of 5000 USD. The problem is that than the amount of 1000 USD is subtracted twice (or even thrice?) from the Product Account. Besides it is not really a truthful representation.

In the past I have circumvented this problem by just writing Refund Checks, which result in correct bookings, but now a customer wants a document that states 'Credit Note'. So now I just want to do it correctly.

If I use the original tutorial it falls apart with Step 3: From the Received from drop-down, select the Customer. Then, select the Discounts and Credits Icon.

There is no such thing as a Discounts and Credits Icon?

It's weird. Many things that are talked about in this thread are simply not on my screen. What I want should be way simpler:

1. Customer A: bought several products for 5000 USD.

2. It is decided that part of their purchase will be reimbursed, 1000 USD.

3. I create a Credit Note for 1000 USD and sent it to them. They decide they want a refund.

4. There is now -1000 USD on the customer account.

5. I transfer them 1000 USD.

6. Why does Quickbooks refuse to give the option to connect the bank transaction of 1000 USD to the Credit note that was written. It even says in the top right 'Amount to refund'. That single step would get their balance correct again. Why is it that only Refund Checks can be connected with Bank Transactions.

I've tried getting it back to 0 by also writing a Refund Receipt and subtracting the refund amount from the original payment of 5000 USD. The problem is that than the amount of 1000 USD is subtracted twice (or even thrice?) from the Product Account. Besides it is not really a truthful representation.

In the past I have circumvented this problem by just writing Refund Checks, which result in correct bookings, but now a customer wants a document that states 'Credit Note'. So now I just want to do it correctly.

If I use the original tutorial it falls apart with Step 3: From the Received from drop-down, select the Customer. Then, select the Discounts and Credits Icon.

There is no such thing as a Discounts and Credits Icon?

Hello, @LaurensPP.

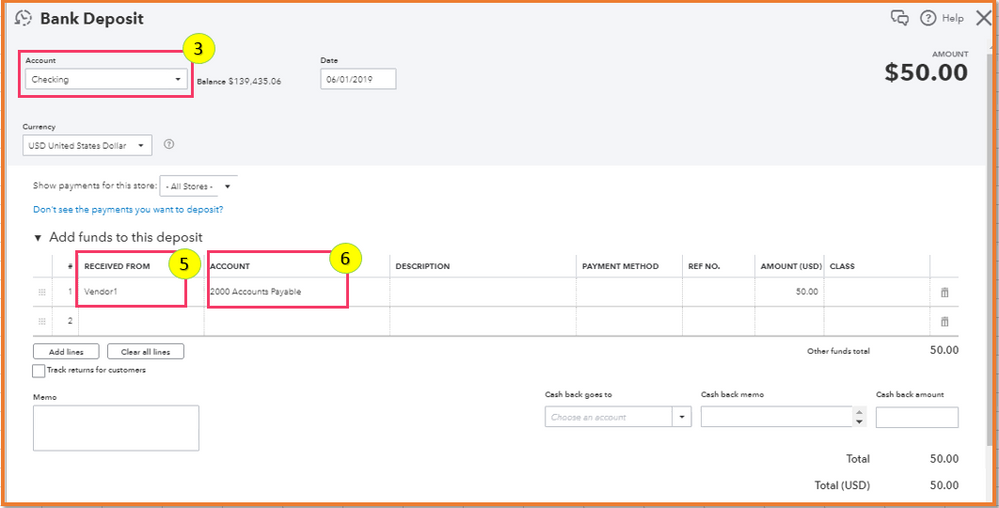

When you create a credit memo, you have the option to apply it to an invoice or give a refund. Let me guide you on how it works.

Here's how to create credit memo:

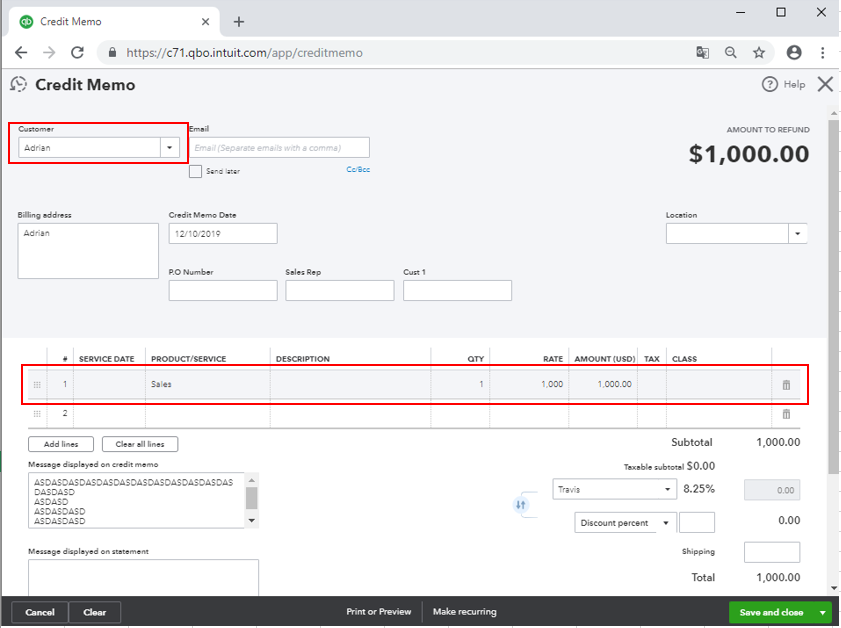

Once the credit memo is created, you can now write a check with the total amount of the refund.

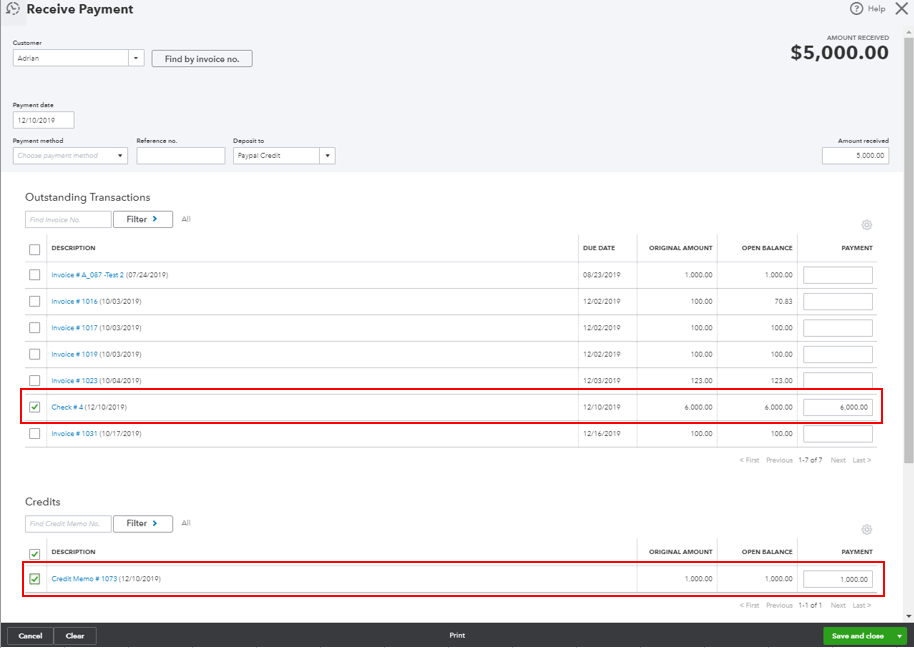

Lastly, to avoid getting open credit memos and unapplied refund checks, let's link the credit memo to the check.

You can refer to this article for more detailed steps: Give your customer credit or refund in QuickBooks Desktop for Windows.

Fill me in if you have other questions. I'm always here to help.

Thanks for the reply. Problem is that my Quickbooks looks nothing like yours and many options are not available on my client. We're running the Quickbooks Essentials. I presumed the software is generally the same?

I appreciate you getting back to us, @LaurensPP.

The steps provided by my colleague above is for QuickBooks Desktop (QBDT). And I'd be happy to walk you through the steps on how to get this done in QuickBooks Online (QBO).

To create a credit memo, here's how:

Once done, please follow the steps below to create a check with the total amount of the refund:

Then, here's how to link the credit memo to the check:

As always, you can visit our QuickBooks Community help website in case you need tips and related articles in the future.

Feel free to leave a comment below if you have any other questions with QuickBooks. We're always here to help.

I created a CM and did a refund check from this CM but it's showing "open balance" on the customers transaction screen. It is not showing on the AR report or balance for the customer. I tried to go to the customer - receive payments but there is nothing there to apply.

How do I get rid of the "open balance" credit showing on the transactions screen?

Thanks for the prompt response, annmareeprestonannmareepreston.

I'd like to help get this sorted out. To be able to do so, I may need additional details about your concern.

I would appreciate if you can share a screenshot of this to help me better understand the situation.

I'll be on the look out of your response. I'll be around to help you out. Have a good one.

Please see attached print screens. I can't clear the "open balance" on the transaction part of the customer tile. The AR doesn't reflect a balance and I can't use the "receive payments" to offset.

Thanks for attaching a screenshot, annmareepreston.

As I look into your screenshot, I've noticed that the account associated with the check was Total Cash and Cash Equivalent. This is the reason why there's an overpayment on your records. In creating a refund, we'll have to take note that we need to select Accounts Receivable as the account so that we'll be able to successfully offset the available credits.

We can simply edit the refund then choose AR as the account to fix this. I'll guide you how:

I've added an article that will guide you in creating a credit memo or refund check in QuickBooks Desktop for Windows.

I also encourage checking out this link to know more about the AR account works in QuickBooks: Accounts Receivable workflows.

Do you have other questions in mind? Feel free to leave them below. I'll make sure to get back to you as quickly as I can.

Hello,

Thank you for your reply. I do have the Accounts Receivable as the account on the check. Please see the snip attached :).

Any other ideas?

Thank you!

Thanks for providing a screenshot and following the steps provided by my colleague @annmareepreston.

Aside from making sure that the Credit memo and the Check use Accounts Receivable as the account, you'll also need to ensure to associate and apply them to avoid having an open balance.

I'll walk you through how:

Once done, go back again to that customer then select All Sales Transactions under the Transactions tab and set the Filter by to All.

Hit View as Report under the Run Report drop-down. This will show you a zero amount for the Open Balance column.

That should do it!

I've also included articles to know more about how to give refunds or credit, manage checks and accounts receivable workflows in QuickBooks Desktop:

Get back here again in the Community if you need further assistance. I'll be here to help. Take care and have a good one!

Maybe I am misunderstanding but when I select the "payment transaction", which is a check created from the CM, it doesn't give me a Discounts and Credits option. I have tried going to the receive payments screen and it doesn't show any balances to record a discount or credit to. See attached.

Thanks for the screenshot, @annmareepreston.

Let's open the Transaction list of your customers and check if the credit memo was not closed. It could be the credit memo is still open, thus, it show a negative amount in your open balance. Let me guide you how.

In your QuickBooks Desktop (QBDT):

Let me know in the comment section if there's anything I can help you with. Take care!

I appreciate all your efforts in performing all the troubleshooting steps provided by my colleagues, annmareepreston.

I can see that status of the credit memo is refunded yet there's still a negative balance showing. Also, it seems that all of the possible troubleshooting steps have already been given above. I'd recommend contacting our technical supports. This way, we'll be able to pull up your data and conduct a series of tests to rectify the underlying issue.

You can follow the steps below to get in touch with us:

You can also use this link to connect with us: https://help.quickbooks.intuit.com.

I encourage checking out our support hours to ensure that we address your concerns on time.

To learn more about the AR account works in QuickBooks, you can visit this article: Accounts Receivable workflows.

Should you have any other concerns or questions about QuickBooks, you can always find me here. Assistance is just one comment away.

Working on DESKTOP - having a hsrd time finding help for QBDT

We occasionally have customers rescind their jobs and have to repay their deposit. Essentially we've taken $XX and posted it to their account as a sales receipt, but then the contract is voided and we issue them a refund for that money. No problem thus far. The refunded (check or CC or finance) is sitting there and needs to be resolved against something?? The boss has had me making an invoice for the amount and paying it, but that artificially inflates our sales income. I saw something that said to enter the sales receipt as a negative, but QB won't accept a negative there. We had the money, we gave back the money - how do we record that so the amount isn't showing up on any reports?

Good afternoon, @Susan Mooses.

Thanks for joining in on this thread. I hope your day is going well so far. I'd be glad to offer my assistance with your problem about a refund for your customers.

If you want to get rid of the credit, you'll need to make a refund check to apply the credit to. Don't worry. It's a simple process. Here's how:

For additional details on these steps, check out this guide: Give your customer a credit or refund in QuickBooks Desktop. In the end, if the issue persists, I recommend contacting our Customer Support Team. They have more advanced tools to help walk you through some additional steps.

This steps should do the trick to fix your problem. If you have any other questions or concerns, don't hesitate to ask. I value you and the success of your business. I'm only a few clicks away if you need me. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here