Announcements

- US QuickBooks Community

- :

- Business Discussions

- :

- Talk about your business

- :

- Ask Your QuickBooks Questions | Community Drop-In Session

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

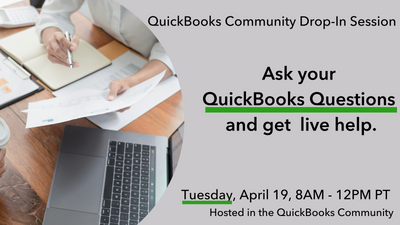

Ask Your QuickBooks Questions | Community Drop-In Session

Do you have a question about QuickBooks but haven't gotten around to reaching out to us yet? Join us for a Live QuickBooks Community Drop-In Session where QuickBooks Experts will be online to answer your questions live.

Topics include, but aren't limited to: Invoicing, Payroll, Account Management, Product Features, and more.

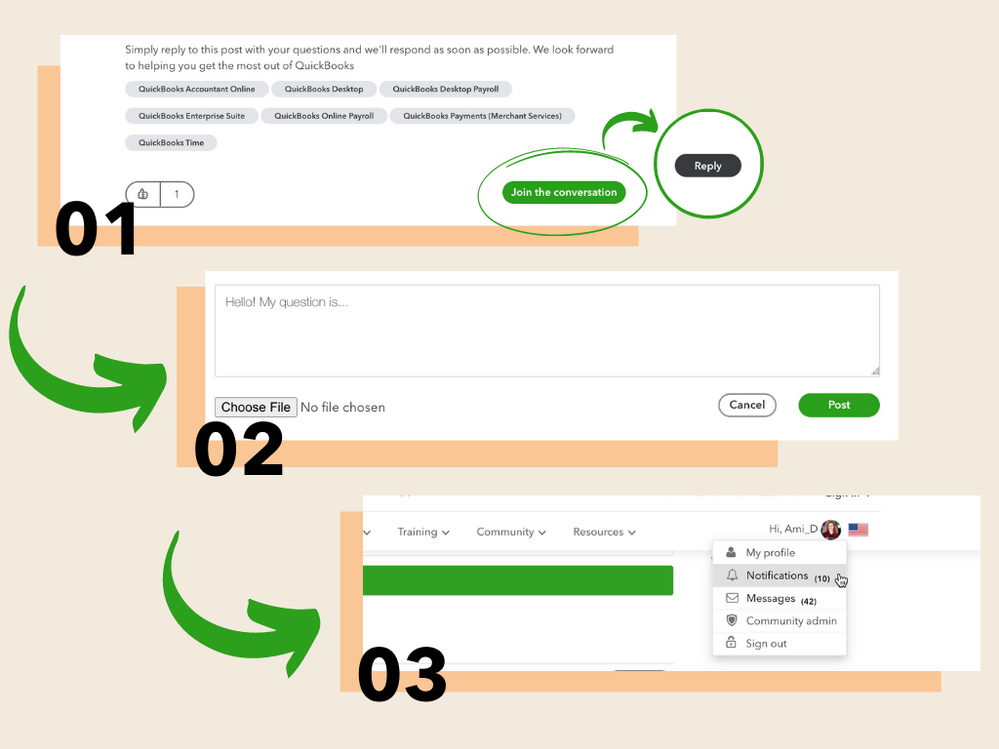

To participate:

- Press Join the Conversation to log in to the community. Once logged in, press Reply.

- Write your question as your reply to the post. Don't forget to let us know what product you're using! Press Post to submit.

- Keep an eye on your notifications for a response from one of our QuickBooks experts!

We look forward to helping you get the most out of QuickBooks

Labels:

24 Comments 24

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Which QuickBook program would be the best for me to use, I am using it to log client expenses and expenditures, money in and money out.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Hi @Mauimona

Welcome to the Community!

All QuickBooks products will keep track of income and expenses. The best product for your client will depend on what type of business they have and what level of detail you want to track.

I recommend checking out our QuickBooks Product and Pricing page for details on each product. Take a look and let me know if you have any additional questions. I'll be here to help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

I had already submitted my question, have not had an answer or response of any kind so wanted to know how long does it take to get a question answered?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Never mind my question about how long it would take to answer a question. I see that my responses are coming via my email account. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

I'm sorry to send so many questions, will all other attendees questions be posted so we'd all be able to see what the answers are, so that we gain some knowledge from the responses.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

I used Chase bank online to send a rent check. Incorrect payee so they cancelled it. The refund came back. QB auto set as "transfer from uncategorized asset" and gave me option to "record transfer". Does that seem correct or should I categorize it some other way, like "bank refund"?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Hello @Mauimona

All questions and replies will be in this thread. You will have to refresh the page periodically to see any new posts. The page won't automatically update/refresh.

I answered your original post:

Hi @Mauimona

Welcome to the Community!

All QuickBooks products will keep track of income and expenses. The best product for your client will depend on what type of business they have and what level of detail you want to track.

I recommend checking out our QuickBooks Product and Pricing page for details on each product. Take a look and let me know if you have any additional questions. I'll be here to help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

I just purchased a restaurant and the current inventory. How do I record the current inventory for food, alcohol and non-alcohol in order to align COGS at the end of the month?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

I want to send bulk invoices to the customer..which subscription should I go for,QBO or QBD..

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Hi there, @HudG2022.

Thanks for swinging by our drop-in. It's great having you here with us.

Before we begin with some steps, would you mind sharing which product you're using?

I look forward to your reply. Chat with you soon!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

I have tried Quick book free 30 days trial version but was not able to send the invoices....it was showing delivery failure..

Have consulted the customer care too for this but they were not able to address my concern.. what could be the reason for it.

I have tried all best possibilities vto send the invoices but it was not delivered..

Kindly need your valuable guidance for it....

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

We use QuickBooks Essentials.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

@whitejulian69221 wrote:I want to send bulk invoices to the customer..which subscription should I go for,QBO or QBD..

Do you need this feature?

https:// quickbooks.intuit.com/learn-support/en-us/help-article/sales-taxes/create-send-multiple-invoices-quickbooks-online/L46eRjDDv_US_en_US?uid=l26f5k3p

Consider using QBO Advanced. You can use a lower plan but you will need additional manual work later.

https:// quickbooks.grsm.io/US

https:// quickbooks.grsm.io/us-promo

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

We is QB Essentials

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Hey @whitejulian69221,

Thank you for dropping by today! Some reasons that an invoice does not deliver could be that the email address was entered incorrectly or there is an issue with the recipient's email server. If you haven't already, I encourage you to double-check. You can use this article as a reference for more information about undelivered invoices in QuickBooks.

However, there is an active investigation dealing with issues with undeliverable invoices with certain users, and our engineering team is working diligently to get this resolved as soon as possible. If you have any other questions, leave a reply below! We are here to help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Thank you, but that wasn’t the question I had asked..mine was in reference to recording existing inventory value when purchasing a restaurant.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Thanks for the quick reply, @HudG2022.

At this time, QuickBooks Online Essentials doesn't have the Inventory feature. You would need to upgrade to QuickBooks Online Plus or Advanced to have this feature.

If you'd like to check out some side-by-side subscription prices and features, you can visit QuickBooks Online Pricing for further information.

If you decide that you want to upgrade your current subscription, here's how you can do that:

- Go to the Gear icon at the top-right of the page, then Account and Settings.

- Navigate to the Billing & Subscription tab.

- In the QuickBooks Online section, select Upgrade.

- Choose the plan you want, and press Upgrade.

- Confirm your payment information and hit Save.

Please let me know if you have any questions or concerns. I'll be here every step of the way. Take care!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Thanks for joining our Drop-In Session, Stincil.

When working with rejected or failed bank transfer payments, you'll initially need to confirm where the failed payment is in your books.

Here's how:

- In the left navigation bar, use your + New button.

- Choose Bank deposit or Record bank deposit.

- Review the QuickBooks Payments section.

- Locate the payment on your list. If you see it, it isn't deposited yet. If you don't, it's been deposited.

Next, you'll want to create a service item to track the rejected transfer:

- Use the Gear (⚙️) icon, then go to Products and services.

- Choose New, then service, and enter "Rejected bank transfer" for its name.

- In your description, enter "Bank transfer payment received rejected by the bank".

- If the deposit is already deposited, pick which bank account you deposited into for your Income account. Or if you haven't made the deposit yet, use your Undeposited Funds for its Income account.

- Select Save and close.

Next, you'll need to create an invoice and remove the original payment from the prior invoice.

I'd also recommend working with an accounting professional to make sure everything's being entered correctly. If you're in need of one, there's an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

Please feel welcome to send a reply if there's any additional questions. Have a lovely day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Thank you for the response. To clarify, I do not intend to track detailed inventory, rather, the value of each category. With that, is the upgrade still necessary or is there an alternative solution?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

I work for a construction company, and we have several jobs per customer. In QB desktop, I used to add the jobs as subcustomers, since you could look at the customer list and see what each customer owed per job and a list of the jobs. Should I put those jobs as projects in QB online? Can I link projects to the subcustomer? Also is there a way to pull up a customer and get the same view I used to before- tells me which jobs are owing and which are paid? Is there a view that I can search for a customer and see all of the projects or subcustomers? I have over a 100 customers and some of those customers have over 30 jobs, or subcustomers.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Thank you for that clarification, @HudG2022.

Since you're not looking to track detailed inventory, upgrading wouldn't be necessary.

You can create a Cost of Goods Sold (COGS) account in your Chart of Accounts. A COGS account will help you calculate your business's profits. I've included some steps to create the account below.

- Go to the Gear icon.

- Select Chart of Accounts.

- Click New.

- Choose Cost of Goods Sold from the Account Type dropdown.

- Select the closest type of Cost of Goods Sold that matches your preference from the Detail Type dropdown.

- Hit Save and close.

You can learn more about how QBO calculates COGS through this article: Cost of goods sold: How to calculate and record COGS.

However, please understand that this account will be limited compared to having the inventory feature.

Please send me a reply if you have further questions. I'll be right here. Have a great day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Does this apply to a payment we've made that was returned or only to a payment made to us and returned?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Hi there @Stincil ,

To record a payment you made that was returned, check out this article. It outlines the process if a check was returned from your bank. Although it specifies the NSF scenario, the steps are the same for a rejected ACH payment. If there was no fee associated with the rejected payment, you can omit the final steps.

- Go to Get paid & pay and select Vendors (Take me there).

- Select the vendor you paid.

- Find and select the bounced check.

- Select More, then select Void from the pop-up menu.

- Confirm you want to void the check, then select OK.

- Record the bank fee.

- Select + New.

- Select Expense.

- From the Payee ▼ dropdown menu:

- Select the vendor if they bank charged it to them.

- Select the bank if they charged it to your account.

- From the Payment account ▼ dropdown menu, select the account you use to pay expenses.

- To distinguish it from other expenses, enter “NSF fee” in the Ref no. field.

- Under the Category column, select Bank Charges.

- Enter the amount you were charged for.

- Select Save.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask Your QuickBooks Questions | Community Drop-In Session

Hey @Notauserid,

Thank you for joining our drop-in session! Once you have QuickBooks Online Plus or Advance, you can convert your sub-customers to track customer jobs by switching them into projects and using the job cost feature. You would need to turn on the project feature first to do so. This article list step by step how to convert a sub-customer into a project. There are also instructions on making a sub-customer with an existing project and moving specific transactions to a project as well.

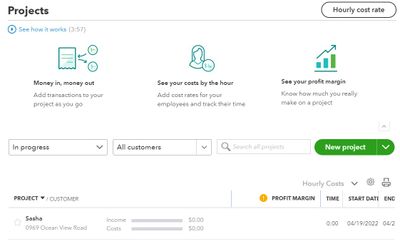

To answer your other questions, once you open the Project tab from the left menu, you will be able to search for the different jobs or customers with the dropdowns as seen below.

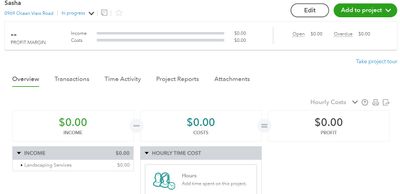

If you need to see a report, you can select one of the projects, and the next page will highlight an overview, and there is a Project Reports section that will share more information, as seen here.

Here is a handy article that shares common Projects FAQ to learn more about Projects in QuickBooks Online. If you have any questions, dont hesitate to let us know! Take care for now.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

Featured

Ready to transform your QuickBooks data into powerful financial insight?

Th...

Spring is the perfect time to refresh, and that shouldn't stop at your

home...

Join us today on SmallBizSmallTalk as we discuss practical strategies

for d...