Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowToday is January 14, 2021. I'm using Desktop Quickbooks 2017 with all of the latest updates installed. It does not support the 1099-NEC forms. I am aware that this version was retired on May 31, 2020, but the Quickbooks statement said that it would continue to work. "If you don't use any of the add-on services in Quickbooks Desktop 2017, your product will continue to work for you." The add-on services are payroll, live technical support, etc. It also said that we would not receive critical security updates. The ability to print the proper forms at the end of the year is not a security update. It's a basic function of Quickbooks and it is not working this year.

@DixieBoss If you had previously used the 1099-MISC to report non-employee compensation in Box 7, then they would have paid self-employment tax on it as well. Compensation is taxable.

Employee bonuses should be reported through payroll. You would only issue a 1099 and a W-2 to the same person if their duties were substantially different. The IRS uses an example of a janitor who also provides plowing services after-hours. His regular work would be W-2, and it would be acceptable, though not necessary, to pay him separately as a contractor.

(Note: I am not a tax advisor. Any tax information should not be construed as advice and should be verified by reference to IRS documentation or your tax advisor.)

@VRago Please see my reply above to @kathyhettick about working with an Accountant's Copy. If your clients updated QB after 01/01 and BEFORE sending you the Accountant's Copy, then you can proceed with the steps detailed in this thread. If they did not, you will need to have them update and get a new Accountant's Copy.

The message PDF you posted is the first step of updating QB. Do NOT do this if your clients haven't already updated or you will not be able to import the Accountant's Change File.

If they have already updated before sending you the file, then click on UPDATE NOW to be taken through the process. Read the thread for directions.

Hello Valprice1,

My accountant has the accountant copy. I am working with our company's quickbook while waiting for my accountant to give us the file back to update changes she has made.

But at the moment I can't efile or print the 1099's for this year.

I am not sure what to do.

pablo

@TreeDown You don't need to change your Chart of Accounts. You need to re-map them to the correct box on the NEC. So once you upgrade to a newer version of QuickBooks, you'll need to go through the process of telling QB which of your accounts should show up in Box 1 of the 1099-MISC (Rents) or Box 2 (Royalties), or Box 1 of the 1099-NEC (non-employee compensation).

Thank you for the much needed clarification, the best I have seen, now if I can just get QB to upgrade with what I need without trying to sell me what I do not need.

I am understanding from your reply if I upgrade the availability to do 1099NEC’s will be there.

Thanks

Thank you. It worked.

Pablo

You must not update your QB while there is an Accountant's Copy outstanding or you will not be able to import the Accountant Change file and any changes will have to be entered manually. I would contact the Accountant and explain the problem. They can send the change file back and you can import those changes, if there are any. Then you can run the update, work on your 1099s, then create a new Accountant's Copy to return to them.

Is it true you want us to send back our accountants copy to our client, then have them update their payroll system, then send it back to us so we can prepare their 1099's. Why do you waste our time. Do you think we have plenty of time on our hands to continue to send back accountants copies and wait for them to send it back.

I am using QB Pro 2014 and the update did not provide ability to utilize 1099-NEC, which we not need to do. Please advise. Thank you.

I've got information to share about what versions of QuickBooks can have the 1099-NEC form, @tbliss52.

The 1099-NEC form will be available to the supported version of QuickBooks (2018-2021). You may update your QuickBooks to the latest version so you can utilize the form within QuickBooks.

If you wish not to update the program and you want to process the form through QuickBooks, I suggest utilizing the standalone 1099 processor. This is an application that allows you to process your 1099 forms.

To learn more on how it works together, please see this link: E-file 1099s on time.

Moreover, you can also download and fill out the form from the website then file it manually.

To give you more insight regarding the discontinuation policy of the old QBDT versions together with what to do if you wish to upgrade your plan in the future, feel free to check out this link: QuickBooks Desktop service discontinuation policy and upgrade information.

You can always get back to me here if you have any other concerns with QuickBooks. Have a good one!

Iam running Premiere contractor 2021 and still cant map 1099 nec >>> i have updated and still unable to map to box 1

Thanks for joining us here today, @needtoknow20.

I have some more steps we can try to get this resolved. Let's run the Verify Data tool. So we can identify if your file has data issues. Let me walk you through how.

After rebuilding, go back to setting up your 1099-NEC again. Learn more about the data tools in this guide: Verify and Rebuild Data in QuickBooks Desktop.

I've also added this link to help you along the way. It has information about fixing QuickBooks data damage.

Please let me know how it goes or if you still have questions or concerns with 1099s. I'm always here for you. Take care and have a good one.

THANKS for that ! but i did that and it verified and said all was good >> went thru the print/1099 wizard and my vendors are there , but it wont let me click down to put it in the nec( its grayed out) ... and when go to print there is no amounts there , it is still in the 1099 misc

having trouble mapping nec , i have 2021 version of premiere , have done all and ,updated , verified data and still cannot map it into the nec form, any ideas ? would be appreciated

i did all and still doesnt work . Guess iam going to go online and use another software ! wow have paid quite alot for this to work .

I appreciate you for following the steps presented by my colleague above, @needtoknow20.

This is not the experience we want you to undergo in running forms in QuickBooks Desktop. I'm here to share other procedures to resolve your 1099-NEC concern in your account.

Let's make sure to finish the mapping of your accounts for both the NEC and the MISC. So, you'll able to click the 1099-NEC option in the drop-down arrow. Also, your reports will work correctly.

In mapping the accounts, you'll need to create new expense accounts for all the accounts that the 1099-NEC reported. Then after that, transfer the amounts from one account to another using a Journal Entry.

But before doing that, please create a backup first, so you have a copy of your old data. Once done, run a 1099 report to recognize the amounts paid and to which accounts.

Here's how:

After that, you can now create a different account. Please follow the steps below.

Once done, you can now move the amounts to the new one. Please go to the Company tab, pick Make General Journal Entries, then tap Save and close.

The last step is to re-check the summary report to review the changes you've made.

Once everything is good, go back to the 1099 wizard, and you'll be able to toggle the NEC. For the complete instructions, visit this article: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

If the issue persists, I'd suggest communicating with our QuickBooks Expert. They can do a deeper dive and investigate the main cause of the problem.

Also, ensure to contact them within business hours to cater to your concern immediately.

Please browse these articles below for your future reference. This contains steps in managing the contractor's information, taxes, forms, and other relevant matters.

Don't hesitate to leave a comment below if you have other concerns. I'm happy to provide details or explanations.

I have Desktop Pro 2017 and believe we are updated to the latest version (IT department updated yeserday). Stall can't find the 1099-NEC menu. What am I missing?

Hello, I have QB Pro 2019 Desktop. There is no 'Wizard' that I can find to set up the 1099-NEC. I've updated our software. I've gone into printing the 1099's and it gives you the choice of 1099-NEC or 1099-MISC so it knows there's the NEC option out there....but I can't change any of the accounts, like 'professional fees', to be assigned to Box 1. I had 'printed' the 1099 Misc in order to proof the list before realizing it was the wrong form and now I can't change those vendors to show up in the NEC list of 1099's....I'm at a total loss and ready to handwrite the 1099's. I only have 5 of them and I've literally spent a few hours trying to figure this out. Is there an answer I can use?

Thank you

Trish

@MichelleBh wrote:Hi there, @Waples.

I'll share with you some information about 1099-NEC in QuickBooks Desktop (QBDT).

Yes, the revived form will incorporate the within the Payroll module in QBDT. Also, we're making sure that QuickBooks is compliant with all the IRS regulations when it comes to filing tax forms. Rest assured, we'll keep you updated with its availability through email or in-app notifications. Ensure you're payroll is on the latest release. This way, you'll have uninterrupted access to our latest payroll updates and other services.

Yes, you're able to file the 1099-NEC/1096 forms in QBDT. Please note that Form 1099-NEC due date is February 1, 2021. Make sure to submit the form before due dates to avoid penalties. You may refer to this link, for more guidance: Tax year due dates.

Once the form is available in the system, you print the forms by going to the File menu, then choose Print Forms, and select 1099's/1096. For more information about the process, go through this article: How do I print my 1099 forms?.

After that, check these articles for detailed directions on how to file the said form.

I'm adding these articles for further details about the 1099-NEC FAQ and various updates in QBDT.

Let me know if you have other questions. I'm happy to serve you. Keep safe!

@MichelleBh wrote:Hi there, @Waples.

I'll share with you some information about 1099-NEC in QuickBooks Desktop (QBDT).

Yes, the revived form will incorporate the within the Payroll module in QBDT. Also, we're making sure that QuickBooks is compliant with all the IRS regulations when it comes to filing tax forms. Rest assured, we'll keep you updated with its availability through email or in-app notifications. Ensure you're payroll is on the latest release. This way, you'll have uninterrupted access to our latest payroll updates and other services.

Yes, you're able to file the 1099-NEC/1096 forms in QBDT. Please note that Form 1099-NEC due date is February 1, 2021. Make sure to submit the form before due dates to avoid penalties. You may refer to this link, for more guidance: Tax year due dates.

Once the form is available in the system, you print the forms by going to the File menu, then choose Print Forms, and select 1099's/1096. For more information about the process, go through this article: How do I print my 1099 forms?.

After that, check these articles for detailed directions on how to file the said form.

I'm adding these articles for further details about the 1099-NEC FAQ and various updates in QBDT.

Let me know if you have other questions. I'm happy to serve you. Keep safe!

I was told in a chat with QuickBooks support this morning that I would have to have a payroll subscription to run 1099-NECs this year. QuickBooks is going to great lengths to avoid pointing this out if true.

WOW ! so I have create new expense accts then transfer data via a journal entry ? you do understand this will take a very long time to do >>>? my version is 2021 , why is this not supported ? its much easier and quicker to use ANOTHER software online to print , thanks but no thanks ! Also , i stayed on phone with a tech for about 1 hour and she did not know this >>> may be less frustrating if you pass that along >>

I am curious, I am using QB 2016 Pro. Will an update provide me with the option to use the 1099-NEC form?

Carol

Appreciate the info but I have since learned Intuit no longer supports 2014 version. That's my problem, not a corrupt file, etc.

Hi all,

Let me take a moment to address all your concerns about the 1099-NEC form.

Know that the 1099-NEC update is only available to the supported version of QuickBooks (2018-2021). To those users that are using the older version, you may consider updating your program, utilize the 1099 processor, or file it manually. Please check out the complete details that I've shared above regarding these options.

On the other hand, there's no need for you to have a payroll service to prepare your 1099-NEC form. The payroll service is just necessary if you're paying your contractors through a direct deposit or file their forms electronically in the system.

You'll just need to update your QuickBooks to the latest release so it will show up. Make sure that you're using the QBDT versions from 2018-2021.

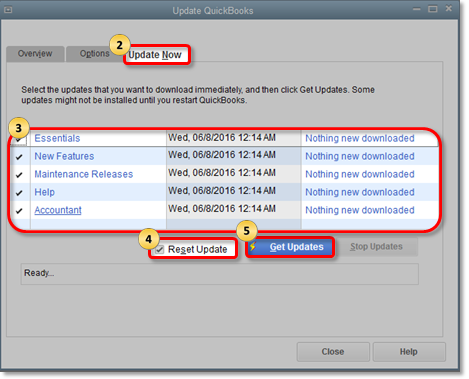

Here's how you can update your QuickBooks:

For complete details about this process, please see this link: Update QuickBooks Desktop to the latest release.

On the other hand, if you're using the supported versions of QuickBooks and updated the program, but the form is not available, I recommend contacting our Customer Care Team. They have the tools that can help check the root cause of this matter.

Here's how you can contact them:

1. Open QuickBooks.

2. From the Help menu, choose QuickBooks Desktop Help.

3. Type Contact Us in the search box. Then, click on Contact Us at the bottom.

4. Select the way you wish to connect with support (Chat, Call back, Etc.).

Let me know if you have any other questions. I'd be glad to help you out. Keep safe!

@needtoknow20 No, you do NOT need to create new accounts unless you mix non-reportable things in the same account as reportable, or MISC -reportable things in the same account as NEC-reportable things. If your vendor's payments are still showing up on the 1099-MISC, it is because the account you paid them from is still mapped to the 1099-MISC and not the 1099-NEC. I have an account for rent and an account for subcontracted services. The rent account is mapped to the 1099-MISC and the services account is mapped to the 1099-NEC. You need to run both set-up processes.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here