Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm not sure if you got this working or not, but for anyone reading having issues. You need to remap all of your accounts to one form or the other (NEC or MISC). Once you do this you will see the report functioning properly.

I have a slightly different problem. When I try to print a 1099, I get a message, Before you prepare and print 1099 you need to backup your data. I backed up the date online nd keep getting the message so I cannot proceed to print my 1099s. Can someone help me?

How do you remap the accounts?

Hi there, @JWM321.

I'd be glad to help you print your 1099 in QuickBooks Desktop (QBDT).

I appreciate the details you've shared about the things you've done. Since you're able to save it through online backup. I'd suggest creating a local back up so check if you're still going to get this issue. You may refer to the screenshots below:

Once done, try to print your 1099 forms again to see if you're still getting the same error. If it's still the same I'd recommend updating the QBDT program to get the latest data. When the update finishes, close and reopen QBDT. Then, restart your computer to refresh the program and apply all the patches.

Open the QBDT program and check if you're now able to print the 1099 forms.

If you're still not able to do that, you may check out this article to help you on the next troubleshooting method you can perform: Verify and Rebuild Data in QuickBooks Desktop.

Also, you may consider checking this article from the IRS to know more details on how to map the 1099 accounts: Instructions for Forms 1099-MISC and 1099-NEC (2021).

You're always welcome to tag my name in the comment section if you have other questions. I'll be ready to back you up. Take care.

Hello everyone,

I do not need any more responses to this thread. I solved the problem. My complaint is that QB changed the way to process 1099-MISC and it is very different and difficult. You can not save the entry of vendors each time you go into the process among other things. I hope QB addresses this issue and makes it easier and makes the process much more like it was in previous years.

One more issue, I DO need to file MISC, not NEC forms. I pay land rent, not workers.

i will give a link for download the software QB premier 2020 with R7. Maybe solve the problem.

https://drive.google.com/file/d/1Kto4alCgB98ceaGuAYFrKnwWGRK5Tytq/view?usp=sharing

i will give a link for download the software QB premier 2020 with R7. Maybe solve the problem.

https://drive.google.com/file/d/1Kto4alCgB98ceaGuAYFrKnwWGRK5Tytq/view?usp=sharing

How do you remap your accounts????

Look no further, @JAR2021.

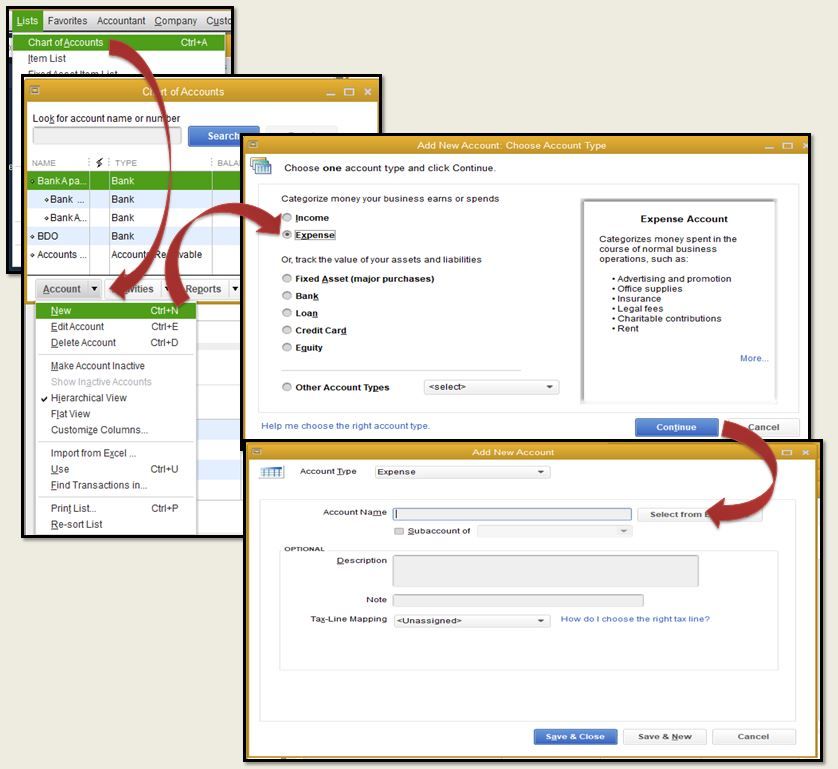

You will need to create a new expense account for all the accounts that will be reported on the 1099-NEC or 1099-MISC if you need to file both forms. You can only use one account for each form. Then, once the set-up is done, you'll need to use a journal entry to move the amounts from one account to another. Before doing some changes, it's recommended to create a backup copy of your file to ensure you'll have an original copy that you can restore anytime.

Here's how to create a new account to track the payments separately:

Once done, proceed to Step 4 of this article to move the payments to the new account: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

Also, check it here to know which type of boxes you need to select when creating 1099's in QuickBooks: Understanding payment categories for the 1099-MISC and 1099-NEC.

For your future reference, you may open this helpful source that will guide you in accessing and printing your other tax forms.

Feel free to get back here if you have further questions about mapping your 1099's in QuickBooks. I'm just a post away and willing to help you in any way I can. Have a good one.

I need to know how to map accounts too!

Thanks for joining in this thread, @JAR2021.

Let me walk you through the steps on how to map your 1099s in QuickBooks Desktop (QBDT). This way, you can print or e-file it to the IRS.

Here's how:

Please take note that there are changes to the 1099 forms and boxes in 2021 for the tax year 2020, so choose your forms carefully. You can check with your accountant if you think you might have made other types of payments.

You can also review your payment information for exclusions. For more information on what can be excluded see What payments are excluded from a 1099-NEC and 1099-MISC?

I'm just a reply away if you have other questions with the QBDT Payroll. Just add the details of your concerns in this thread and I'll help you out.

That fixed it for me as well. Thank you for sharing!

Hi - I read all the suggestions and I went through all of them with a support team person on the phone. while we were waiting for someone to get back to him, we were disconnected and he didn't call me back. we troubleshooted for 2 hours... I have QBs 21. I checked to see if the QBs data was okay; I updated QBs; I mapped; But I still get black on my 1099 reports. When I am in the 1099 QuickBooks, my included list and exceeded list are the exact opposite - what would be included is excluded and visa versa.

Did your IT fix this.

Im having the same problem

Thanks for the info. We already had multiple accounts However they were mapped wrong because of the October update that created 2 forms. Used the edit preferences tax option to separate the NEC from the MISC box 1 problem

Jim T

Thanks for joining in on the thread, nancy225 and kt18.

We know that the payments to 1099 vendors made via credit card, debit card, or third party system, such as PayPal, are excluded from the 1099-MISC and 1099-NEC calculations. With that said, we'll need to review each transactions. From there, we can change what transactions need to be included or excluded when filing the 1099s.

To pull up the excluded payments, you can follow the steps under the QuickBooks Desktop section of this article: What payments are excluded from a 1099-NEC and 1099-MISC?.

You'll have to open each transaction and update the payment methods.

To pull up the included payments report, you can use this reference: Excluding nonreportable payments from Form 1099-MISC.

You can do the same thing which is to update the payment methods.

I'd also recommend keeping your QuickBooks release and the Payroll Tax Table versions updated. This'll remove unexpected issues when managing forms in QuickBooks Desktop.

Keep us posted so we can also review other options to correct the data.

I need to be able to print 1099 summary reports from previous years. When I try to bring it up, I get an error message. How can I access these reports?

Hi, @Ann35.

At the moment, QuickBooks Desktop can no longer be generated last year's 1099 report. This is due to the IRS updates made to the 1099MISC/1099NEC for the tax year 2020. In addition, standard reports 1099 are also affected by these changes as well.

However, if you e-filed via the 1099 E-file service, you should be able to see the copies of the prior 1099s. In case, you didn't E-file through Intuit and unable to save a PDF of your 1099 form, you'll have to manually fill it out.

Here's how:

You can also refer to this link for more details about customizing reports in your QBDT software.

Once done, you can memorize the report to save its current settings. This way, you won’t have to customize it in case you need to run it again in the future.

Notify me if you have any other questions by posting a comment below. I'll be sure to get back to you.

It’s an account mapping problem caused by the new 1099 forms. You are making this too hard folks. Edit preferences tax 1099 remap your NESC AND MISC payments to the correct account and bingo the report runs fine.

MDRobin

You can also do it by way of edit preferences tax 1099 map the MISC and the NEC to the correct expense accounts.

I've done the mapping, I've followed everyone's instructions and this is what I got. I cannot not get my rents to show as MISC for 1099

I've done that, nothing changed.

Thanks for joining this thread, Mobile Music Unlimited.

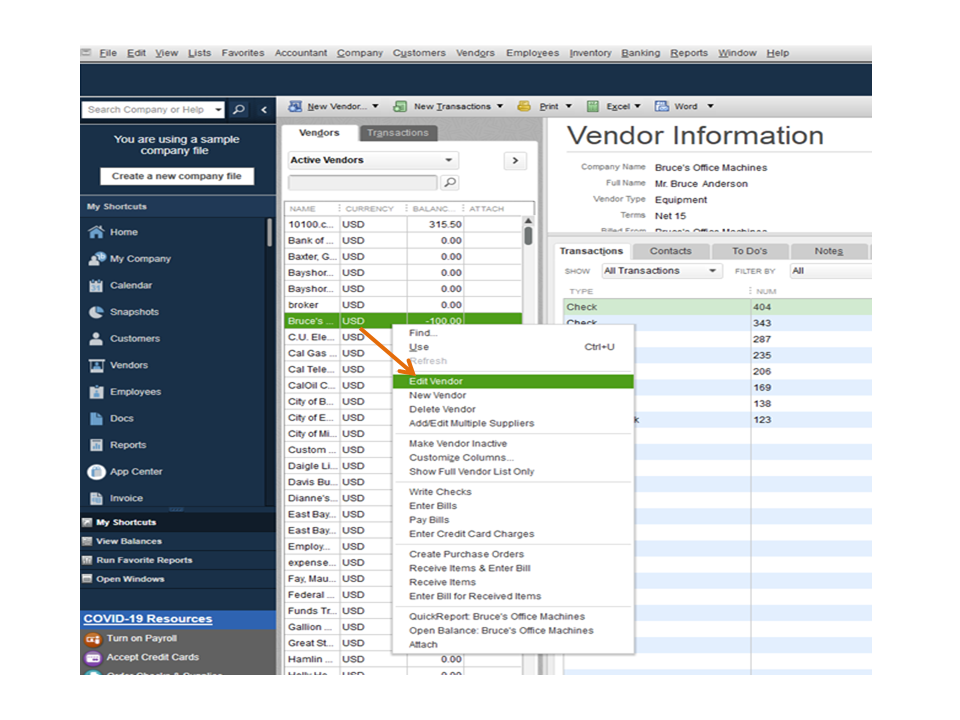

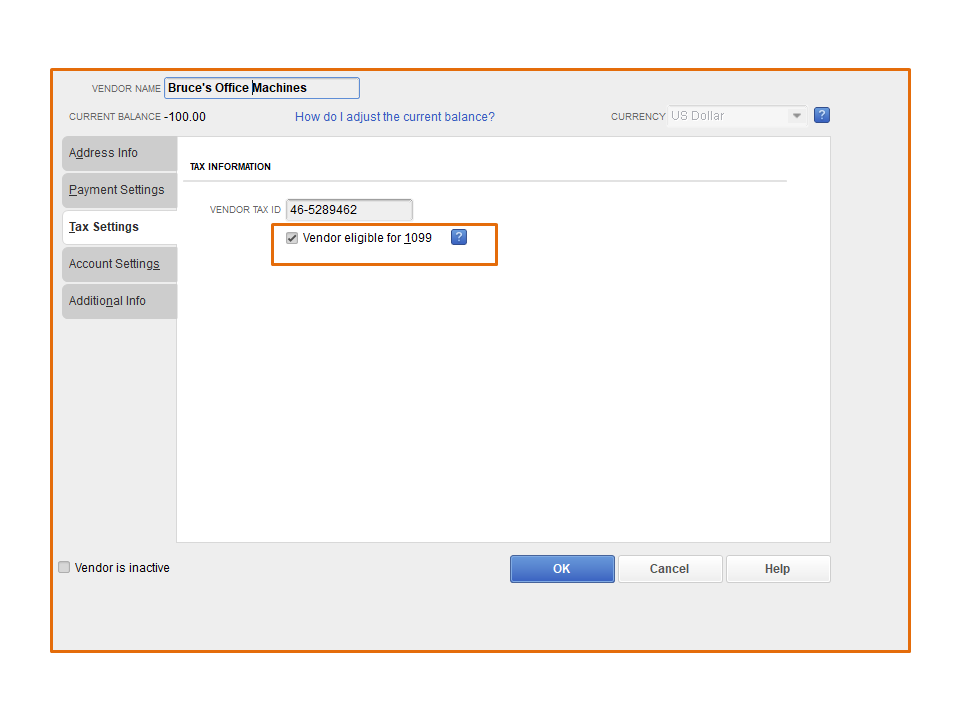

I appreciate all your efforts in trying to resolve the issue. Let’s perform another step for the rent to show on the 1099-MISC.

We’ll have to review the vendor’s information and make sure it’s set up to track 1099. Aside from that, check the payment method used for the transactions. Only those contractors you paid above the annual $600 cash threshold will receive 1099.

The IRS doesn't allow electronic payments to be reported on Form 1099-MISC or 1099-NEC. For example, credit card, debit card, gift card, or PayPal payments.

The desktop program automatically excludes them. For more information, check out this article: What payments are excluded from a 1099-NEC and 1099-MISC?

To open the vendor’s profile:

Once done, open the 1099 Summary to check if the contractor meets the threshold. Perform Step 2 in this article and choose QuickBooks Desktop: Fix missing contractors or wrong amounts on 1099s.

Additionally, these resources contain solutions on how to fix 1099 issues and steps to file the form.

Feel free to visit the Community again for any other QuickBooks concerns. I’ll be around to answer them for you. Have a good one.

Hi there. Have you found a fix to this? Here it is March 10th and it is still not working. I have called QB support because I have Enterprise through right networks and have been given the wrong information and finally just hung up on the last person because it was the same information that just did not work.

If you have a work around I would greatly appreciate it.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here