QuickBooks Desktop Pro and Premier are no longer available to new subscribers

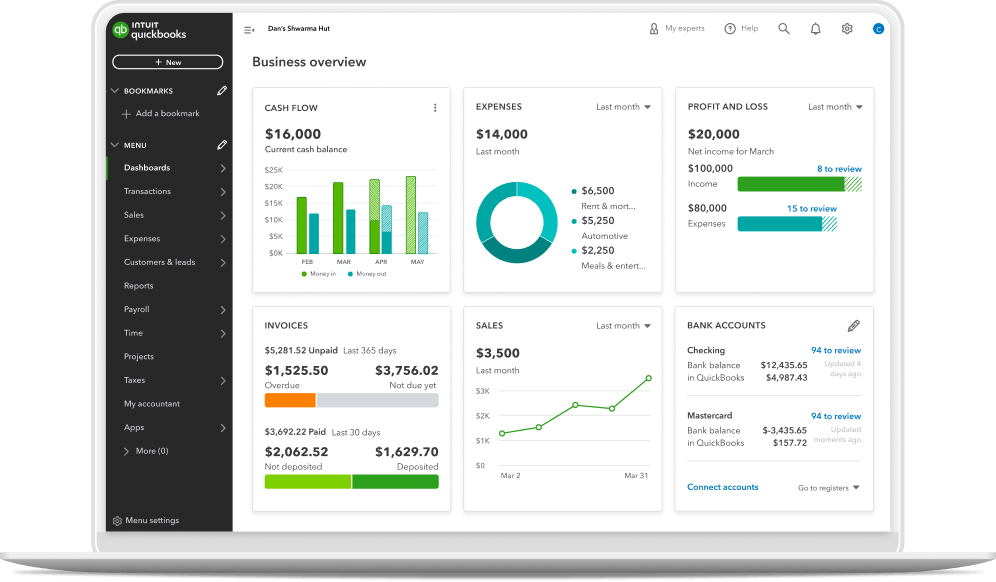

Business is better in the cloud

QuickBooks Desktop is no longer available to new customers, but QuickBooks Online gives you the flexibility you need to work, collaborate, and run your business from anywhere.**

Need help picking a plan?

Answer a few questions about your business and we’ll tell you which QuickBooks plan is the best match.

Free yourself from the desk

Save time with smart collaboration tools that let you work with your team across offices and across the world.**

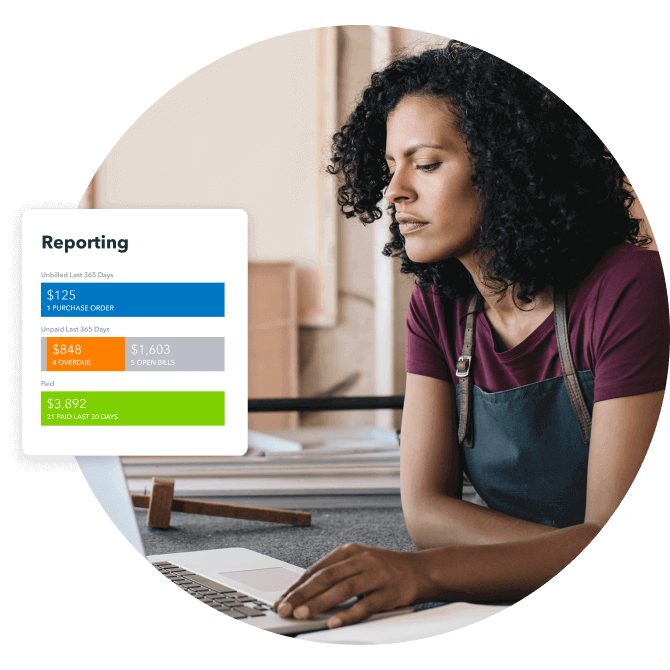

Create comprehensive tracking and run custom reports anytime, for a quick and complete view of your business, anytime, anywhere.

Onboard to online with ease with a free 45-minute session with a QuickBooks Online expert.**

Know that your data is always automatically backed up as you work and protected by rigorous encryption standards.**

It’s your move

With greater collaboration, automation, and business insights than desktop, QuickBooks Online gives you the power to take your business everywhere.

Frequently asked questions

Not quite. While they offer similar services and outcomes, there are some key differences between the two.

QuickBooks Desktop is accounting software that needs to be installed on your office computer’s desktop and is built for mid-sized companies, including manufacturers and other businesses with large inventory needs.

QuickBooks Online, on the other hand, is a cloud-based subscription service that can be used on any device — anytime, anywhere. It’s designed for smaller businesses, with 25 users or fewer, who need flexibility. Internet connection required.

Yes! Migration is simple and we offer handy webinars and guides to help you through the process. And we’re here to help if and when you need it, with phone and chat support at no additional cost. Or want us to take care of it all for you? No problem.

Once you’re set up online, we will arrange a 45 minute personalized call during which we will check your setup, give you a tour of QuickBooks Online, and ensure you’re good to go!

Your data is secure with QuickBooks Online’s advanced, industry-recognised security safeguards to keep all of your financial data private and protected.**

We’ve created a step-by-step process so that you can switch to QuickBooks Online from either Pro or Premier. Go to Migrating from QuickBooks Desktop to learn more.

QuickBooks Online is suitable for most QuickBooks Desktop users. It has many unique features designed to support users who need anywhere, anytime access as well as multiple user access. However, in streamlining the feature set to make QuickBooks Online even faster and easier to use than QuickBooks Desktop, we limited some of the more advanced features.

QuickBooks Online is a great choice if you want:

With QuickBooks Online you get collaboration, automation, and better insights plus:

- Access to your data anytime, anywhere from your PC, Mac, or on your mobile device with our free mobile app

- Ability to send estimates and invoices on the go

- Access for 5+ users users and 2 Accountants—at no extra cost5

- Automatic updates and upgrades that don’t require any action

- Free support to help with setup or to answer “how-to” questions

QuickBooks Desktop may be more suitable if you need:

- Robust inventory, payroll, job costing, or custom reporting capabilities

- Detailed back orders, work orders, or sales orders

- Progress invoicing or ability to receive partial POs

As of April 15, 2025, QuickBooks Desktop Pro, Premier, and associated Payroll services are no longer available for new subscribers.

However, existing subscribers can continue using their current version as long as their subscription remains active.

QuickBooks Enterprise is not impacted by this change and remains available for purchase.

If you're looking for a cloud-based solution, QuickBooks Online offers powerful features, automatic updates, and the flexibility to work from anywhere. Our team is here to help you find the best option for your business.

Make the switch to QuickBooks Online

Give us a call at 1-888-829-8589 to get started.

QuickBooks Online Discount Offer: Discount applied to the monthly price for QuickBooks Online (“QBO”) as stated above, starting from the date of enrollment, followed by the then-current [monthly/annual] list price. Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the “Buy Now” option. This offer can't be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Online Free 30-day Trial Offer Terms: First thirty (30) days of the QuickBooks Online (“QBO”) subscription, starting from the date of enrolment is free. At the end of the free trial, you’ll automatically be charged and you’ll be charged on a monthly basis thereafter at the then-current price for the service(s) you’ve selected until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the “Free 30-Day Trial'' option. This offer can't be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. If you cancel within the first 30 days you will not be charged. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Online Payroll Discount Offer: QuickBooks Online Payroll Core, Premium or Elite services (“Payroll”) is sold separately. Discount offer (“Offer”) is available only in Canada to new Payroll subscribers, starting from the date of enrollment through the number of months stated above and followed by the then-current monthly Payroll list price. Your account will automatically be charged on a monthly basis until you cancel. Offer is not valid for employee monthly fees and discount will not be applied to any employee or other fees attached to the Payroll subscription. Subscription price excludes HST/GST. Offer valid for a limited time only. You must select the Choose Plan option. Offer not applicable with free trial. Following expiration of the Offer discount, you will be automatically charged the then-current monthly Payroll base fee and the-then current per employee fee, plus applicable taxes, until you cancel. To cancel your subscription, learn more here. Your Payroll cancellation will become effective at the end of the monthly billing period. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period. Discount cannot be combined with any other QuickBooks offer. Terms, conditions, pricing, features, service and support are subject to change without notice.

Work anytime, anywhere: QuickBooks Online requires a computer with a supported Internet browser and an Internet connection (a high-speed connection is recommended). Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond our control.

Onboarding Call: We currently offer one 45-minute session per customer, subject to change at any time. QuickBooks Self-Employed plans are not eligible for a free onboarding session.

Protecting your data: QuickBooks Online uses technical and administrative security measures such as, but not limited to, firewalls, encryption techniques, and authentication procedures, among others, to work to maintain the security of your online session and information.

Migration Services: Data migration to QuickBooks Online using Dataswitcher is provided at no cost to the user and is available for a limited time only. As part of the migration the following may be transferred to your QuickBooks Online account : Opening balances, customers & suppliers, Chart of Accounts, invoices, transactional histories, and journal entries, up to two years.

Migrating Additional Years of Data: Any additional journal years selected past the initial two years will be subject to a cost of $70 per additional year. There is an additional cost for the migration of company information, and classes and locations. Data types ineligible to convert at this time are: Budgets, memorized transactions, Invoice template and other templates, sales orders, payroll records, projects, attachments, non-posting entries (estimates). All additional limitations are listed in our support article.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call Sales: 1-888-829-8589

© 2026 Intuit, Inc. All rights reserved

Intuit, QuickBooks, QB, TurboTax, Profile, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

By accessing and using this page you agree to the Terms and Conditions.