Certified QuickBooks ProAdvisor Marnie Stretch guides you through how you can optimize your payroll

A helpful eBook to make you a payroll pro

Chapter 1: Payroll Essentials

Get a 101 on how payroll works in Canada, including payroll basics and information on deductions and remittances.

Did you know?

39% of small business owners who plan to hire are not sure what their payroll responsibilities are when hiring a new employee.†

Chapter 2: Payroll Compliance & Technology

Discover how to select the right payroll system and use it to manage data securely and avoid penalties from the CRA.

Did you know?

It takes Canadian small business owners who manage payroll themselves an average of 3.5 days to resolve payroll errors.†

Chapter 3: How Accounting Professionals Can Help with Payroll

See how outsourcing payroll can help save time, ensure data security, and assist with regulatory compliance.

Did you know?

42% of small business owners say payroll keeps them up at night.†

See why QuickBooks Payroll could be right for your business

Run payroll easily and accurately in QuickBooks

- We’ll do the math and stay on top of tax rates to help keep your payroll accurate and on time.

- You have the ability to set up multiple pay schedules and frequencies.

- Set up vacation and sick leave policies, plus easily track the accrued balances for each employee.

Easily track time for your employees

- Enter your employee hours in timesheets and sync with payroll.*

- TSheets integration to QuickBooks Online timesheet available for Standard Payroll.

- Pull in complete labour costs automatically with Standard Payroll when you sync up with the Projects feature.†

*Only available in Standard Payroll.

†Projects feature requires QuickBooks Online Plus.

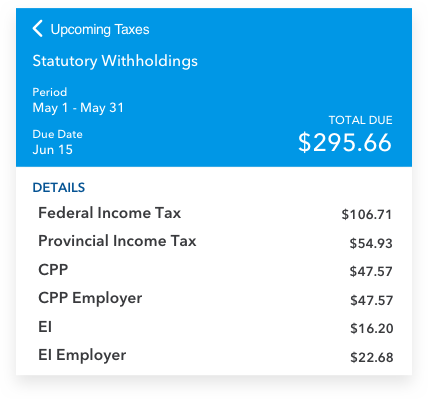

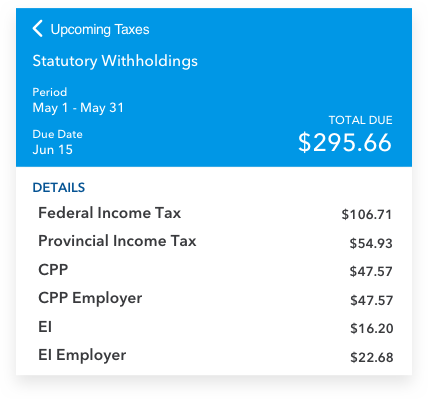

Prepare and file your taxes in a flash

Users find an average of $7,393 in potential mileage deductions per year.

- File and remit your payroll taxes with the CRA or Revenu Québec.

- We help you prepare PD7A and TPZ-1015 remittance forms to print and file.

- We file and remit your payroll taxes automatically every time they are due.*

*Automatic tax remittance feature only available for Advanced Payroll product.

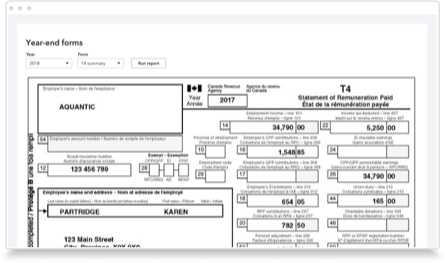

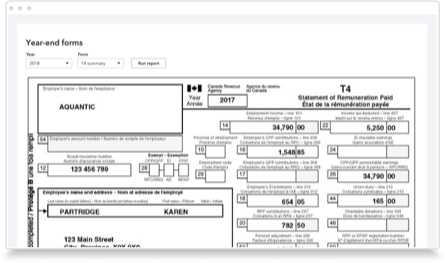

Year end forms made simple

- We assist or automatically prepare and file T4s, T4As, and Relevé 1s for your employees and contractors.*

- We assist or automatically file forms for your employees at year end.*

- We make it easy to get all the info you need to complete a Record of Employment, or automatically file it with Service Canada for you.*

*Automatic services and filing T4As are only available with Advanced Payroll

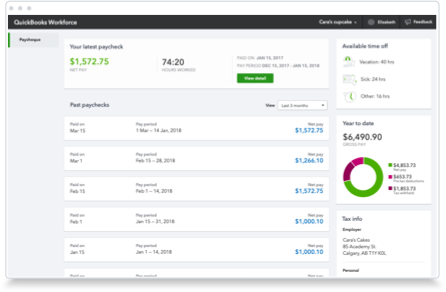

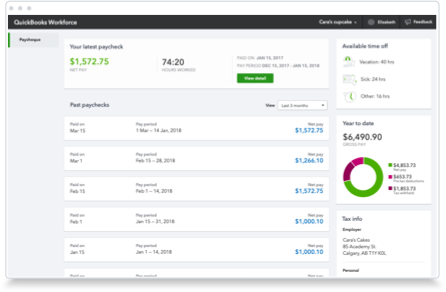

Keep it secure with employee portal access

- Employees can track their vacation days and view their pay stubs online in the new QuickBooks Workforce portal available with Standard payroll.

- Employee access to year end forms (T4/RL1 slips).

- Save time and stay compliant without manually distributing pay stubs.

Free payroll specialists are here for you

- A dedicated payroll specialist will help you set up your payroll.

- We will help you easily run your first payroll.

- Free support throughout the onboarding experience.

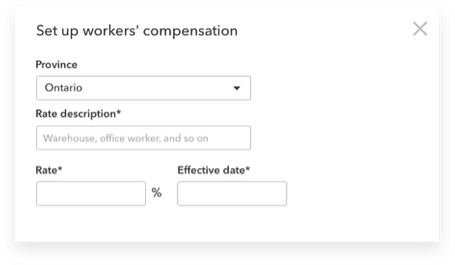

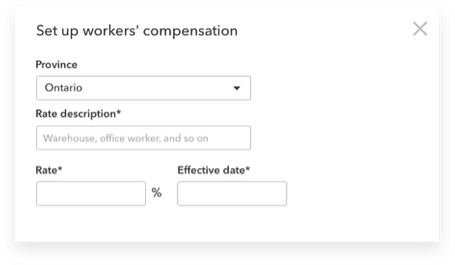

Stay on top of workers’ compensation

- Automatically calculate and track workers’ compensation for employees.

- Get reminders when workers’ compensation payments are due to avoid late fees.

- Currently available in Quebec, Ontario, and BC.

Run payroll easily and accurately in QuickBooks

- We’ll do the math and stay on top of tax rates to help keep your payroll accurate and on time.

- You have the ability to set up multiple pay schedules and frequencies.

- Set up vacation and sick leave policies, plus easily track the accrued balances for each employee.

Easily track time for your employees

- Enter your employee hours in timesheets and sync with payroll.*

- TSheets integration to QuickBooks Online timesheet available for Standard Payroll.

- Pull in complete labour costs automatically with Standard Payroll when you sync up with the Projects feature.†

*Only available in Standard Payroll.

†Projects feature requires QuickBooks Online Plus.

Prepare and file your taxes in a flash

Users find an average of $7,393 in potential mileage deductions per year.

- File and remit your payroll taxes with the CRA or Revenu Québec.

- We help you prepare PD7A and TPZ-1015 remittance forms to print and file.

- We file and remit your payroll taxes automatically every time they are due.*

*Automatic tax remittance feature only available for Advanced Payroll product.

Year end forms made simple

- We assist or automatically prepare and file T4s, T4As, and Relevé 1s for your employees and contractors.*

- We assist or automatically file forms for your employees at year end.*

- We make it easy to get all the info you need to complete a Record of Employment, or automatically file it with Service Canada for you.*

*Automatic services and filing T4As are only available with Advanced Payroll

Keep it secure with employee portal access

- Employees can track their vacation days and view their pay stubs online in the new QuickBooks Workforce portal available with Standard payroll.

- Employee access to year end forms (T4/RL1 slips).

- Save time and stay compliant without manually distributing pay stubs.

Free payroll specialists are here for you

- A dedicated payroll specialist will help you set up your payroll.

- We will help you easily run your first payroll.

- Free support throughout the onboarding experience.

Stay on top of workers’ compensation

- Automatically calculate and track workers’ compensation for employees.

- Get reminders when workers’ compensation payments are due to avoid late fees.

- Currently available in Quebec, Ontario, and BC.

Check out QuickBooks Payroll in action

Watch this short video and get an inside look at how painless QuickBooks can make payroll.

We’re here to help you choose the payroll that fits best. Let’s talk about it: