QuickBooks Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

¹Guarantees

Accuracy Guaranteed: available with QuickBooks Online Payroll Core, Premium, & Elite: We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

Tax penalty protection: Only QuickBooks Online Payroll Elite users are eligible to receive the tax penalty protection. If you receive a tax notice and send it to us within 15 days of the tax notice, we will cover the payroll tax penalty, up to $25,000. Intuit cannot help resolve notices for customers in Collections with the IRS because IRS Collections will only work with businesses directly. Additional conditions and restrictions apply. Learn more about tax penalty protection.

²Claims

Based on an Intuit survey of 2040 QuickBooks Online Payroll customers in February 2023.

**Features

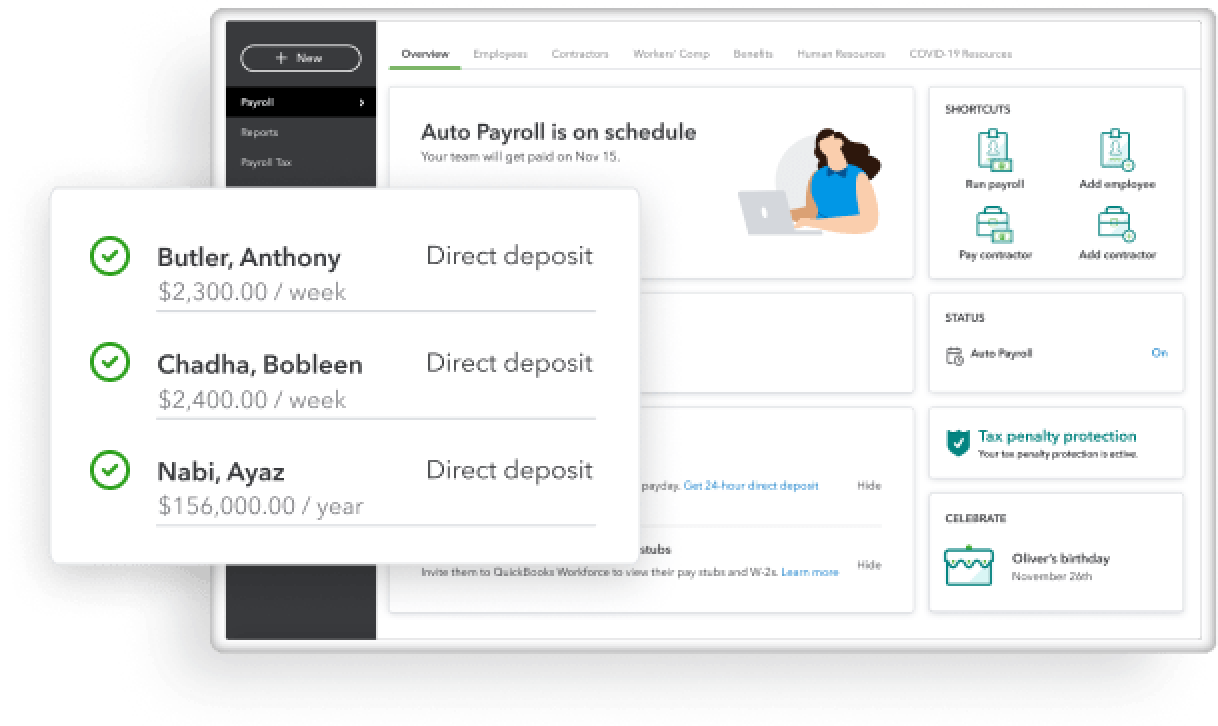

Auto Payroll: Available if setup for the company is complete. At least one employee has completed setup and has consistent payroll that qualifies for automation (i.e. salaried or hourly with default). Company must complete bank verification if employee has direct deposit as the payment method, and the first payroll must run successfully. The account must not have a hold.

Automated tax payments and filings: Automated tax payments and filing available for state and federal taxes. Enrollment in e-services is required for tax payments and filings only. Automated tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.

1099 e-file & Pay: Prepare your 1099s in QuickBooks at no extra charge. If you choose the 1099 E-File Service, Intuit will e-file your Federal 1099 information with the IRS, and then print and mail a copy directly to your contractors; fees apply. As part of the paid 1099 E-File Service, we also give your contractors online access to their 1099s. State filing not included. You should check with your state agency on any state filing requirements.

Health benefits: Health Insurance benefits are provided by Intuit Insurance Services Inc., (IISI) a licensed insurance broker, through a partnership partnering with Allstate Health Solutions. Requires acceptance of Allstate's Terms of Use and Privacy Policy. Intuit Insurance Services is owned and operated by Intuit Inc. and is paid a percentage fee of insurance policy premiums by Allstate Health Solutions in connection with the services described on this page. Product registration needed. Devices and data plan not included. Some features may not be available on mobile. Data access depends on network availability and may be interrupted.

Workers’ comp administration (NEXT Insurance):: Benefits are powered by NEXT Insurance and require acceptance of NEXT Insurance's Privacy Policy and Terms of Use. Additional fees will apply. There is a monthly fee (currently, $5 per month) for QuickBooks Online Payroll Core users for the QuickBooks Workers' Comp Payment Service. This non-refundable fee will be automatically added to each monthly Intuit invoice at the then-current price until you cancel. The fee is separate from any workers’ comp insurance policy premium by NEXT Insurance. Workers’ Compensation Service requires an active and paid QuickBooks payroll subscription. Eligibility criteria applies to transfer active insurance policy broker of record, including insurance carrier, policy renewal date, and payment method. Workers compensation insurance is not available in OH, ND, WA and WY.

Expert product support: Included with your paid subscription to QuickBooks Online Payroll Core. Chat and phone support is available Monday through Friday 6 AM to 6 PM PST. Your subscription must be current. Get more information on how to contact support. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service and support are subject to change without notice.

24/7 expert product support: 24/7 customer support by phone or chat is included with your paid subscription to QuickBooks Online Payroll Premium and Elite. Your subscription must be current. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service, and support are subject to change without notice.

HR support (Mineral): HR support is provided by experts at Mineral, Inc. Requires acceptance of Mineral's Privacy Policy and Terms of Use. HR Support Center available only to QuickBooks Online Premium and Elite subscriptions. HR Advisor support only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

401(k) plans (Guideline): 401(k) offerings are provided and administered by Guideline, an independent third party and not provided by Intuit. Intuit is not a 401(k) plan administrator, fiduciary or other provider. Requires acceptance of Guideline's Client Relationship Summary and Privacy Policy. Additional 401(k) plan fees will apply. Employees may manage their contributions directly with Guideline. Admin and Payroll access required to sign up for a 401(k) plan with Guideline. Guideline experts: Guideline expert services are provided by and administered by Guideline, an independent third party and not provided by Intuit. Guideline live US-based support is available M-F, 6 AM-4 PM PT.

Time tracking (QuickBooks Time): The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Data access is subject to cellular/internet provider network availability. GPS tracking requires cell service and that users set their location settings to "Always" in order to click-in and track time using the mobile app. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost.

Expert review: Available upon request for QuickBooks Online Payroll Premium and Elite.

Expert setup: Available to QuickBooks Online Payroll Elite users only. A QuickBooks payroll expert will complete your setup, once you provide necessary information. Your payroll setup will be automatically reviewed to make sure everything is correct before Tax Penalty Protection is enabled.

*Pricing

ProAdvisor Preferred Pricing - ProAdvisor Discount: See Offer Terms

ProAdvisor Preferred Pricing - Direct Discount: See Offer Terms

QuickBooks Online Accountant Rev Share Program Offer Terms

Eligibility: QuickBooks Online Accountant (“QBOA”) firms are eligible to apply to enroll in the “Revenue Share Program” and add and manage only new subscribers through “Add Client” for certain subscriptions (“Revenue Share Subscriptions”) and add-ons (“Revenue Share Add-Ons”).

Rev Share Subscriptions means the following QuickBooks services: QuickBooks Online Simple Start, Essentials, Plus, and Advanced, and QuickBooks Online Payroll Core, Premium, and Elite. The Rev Share Add-Ons means the per employee fee and multi-state charge for QuickBooks Online Payroll. The Rev Share Subscriptions and Add-Ons do not include other optional add-on services for which Intuit charges a fee and is not already included in the base fee for the subscription.

Only one (1) QBOA user may enroll the QBOA firm in the Revenue Share Program. Intuit reserves the right to accept or decline any QBOA firm.

Offer Terms: Each Revenue Share Program participant is eligible to receive a 30% revenue share on the Rev Share Subscriptions and 15% revenue share on the Rev Share Add-Ons for the first 12 months of the paid subscription (“Rev Share Payment(s)”), starting from the date the client starts paying for the subscription. The first month of the Revenue Share Subscriptions and Revenue Share Add-Ons, starting from the date of enrollment in the subscription, is free. After the first month of the Rev Share Subscription, a 50% discount is applied to the then-current monthly list price for three (3) months, followed by the then-current list price. After the first month of the subscription, if the client enters their payment details and pays for the subscription, the firm is eligible to receive Rev Share Payments for the subsequent 12 months only. Each Rev Share Subscription must be client-billed, and cannot be paid for by the QBOA firm. Cannot be combined with any other Intuit offer. Offer valid for a limited time only, only in the U.S., and is non-transferable.

Intuit may terminate these terms or the Revenue Share Program or modify the terms or the Revenue Share Program for any reason and at any time, at Intuit’s sole discretion, without notice. Terms, conditions, pricing, special features, and service and support options are subject to change without notice.