Try QuickBooks Online for free

Get instant access to the tools and features you need to drive your business forward with deeper insights, custom workflows, easy collaboration, and more.

Try QuickBooks Essentials, Free for 30 Days

Reviews that speak volumes

Discover why 88% of customers say QuickBooks helps their business be more successful.3

★★★★★

Having the online version just makes sense. There are apps that integrate with it, you can log in on your phone, [and] the data is easily accessible to both the client and the accounting team.

★★★★★

The software is very easy to use, even for people who do not have an accounting background.

★★★★★

Solves the tedious process of accessing data for you and your clients. Everyone has constant access that is shared.

★★★★★

Everything is organized in its place the way it should be. I appreciate how it tracks clients/customers, tracks payments, [and] keeps running calculations of what is due and when.

★★★★★

QuickBooks gives us real-time insight into our business operations and I appreciate that as it allows us to be more productive.

★★★★★

The software works very smoothly and is very intuitive. One of the most straightforward accounting software I have used.

★★★★★

I love the structure of the software. It's intuitive, well-organized, and accurate to my needs.

★★★★★

Keeps our books clean and up-to-date.

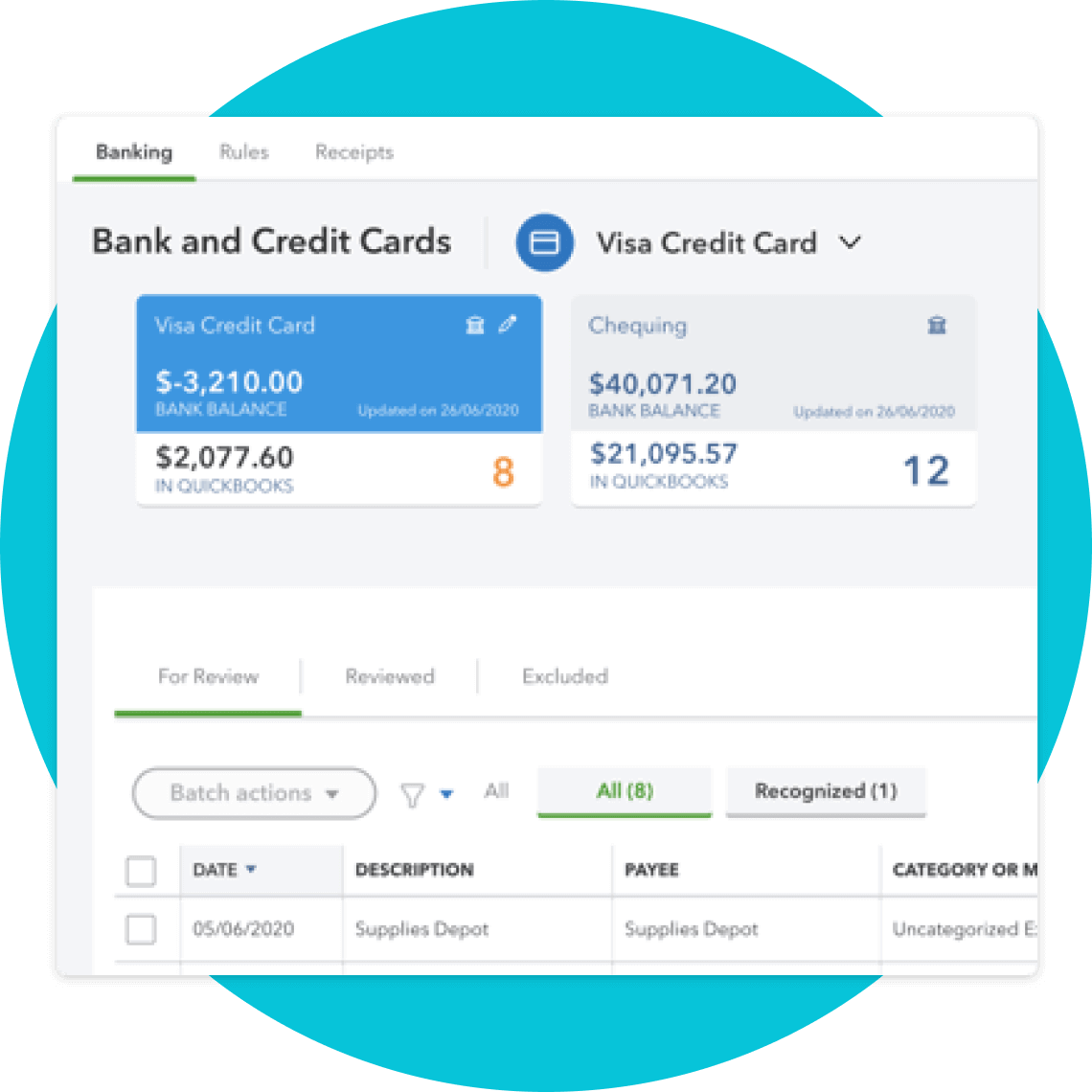

Balance the books with confidence

Connect bank accounts to automatically download and categorize your bank and credit card transactions. Plus, easily separate business and personal expenses.

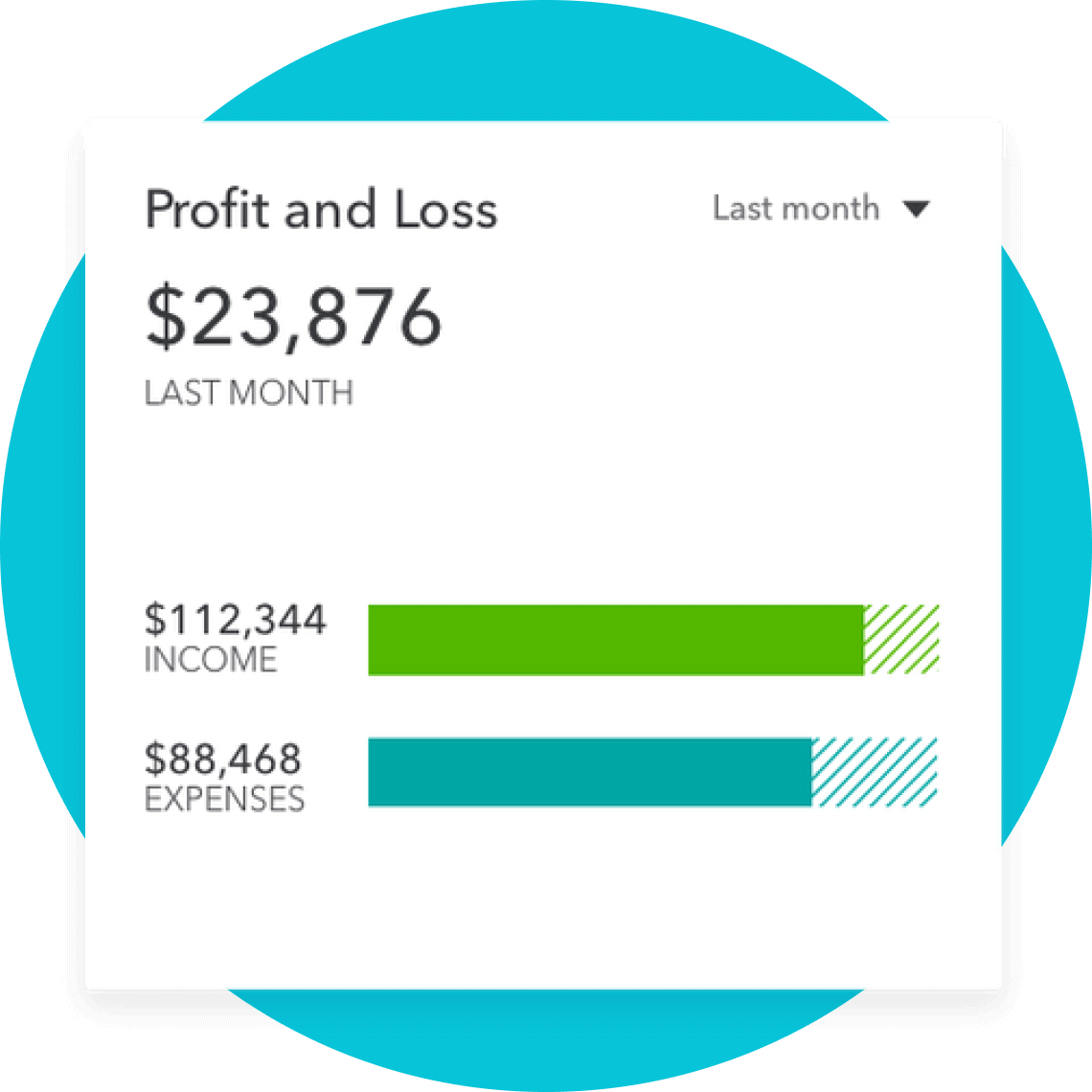

Instantly see how your business is performing with valuable reports including profit & loss, expenses, and balance sheets.

Snap photos of your receipts and link them to expenses right from your phone, so you don’t miss any deductions.* Come tax time, you’re organized and ready to file.

Support when you need it

QuickBooks has built-in guidance to get you up and running. Questions along the way? Get your answers from our live support team or connect with your accountant directly through QuickBooks.*

Ease in with a Free Trial of QuickBooks Online

Take control of your business by saving time on bookkeeping and paperwork with QuickBooks.

You’re in good company

You’re in good company

Frequently asked questions

There is no need to download QuickBooks Online because it is connected to the cloud, which means you can access online accounting from any device with an internet connection. You can download the QuickBooks Online mobile app from the Google Play Store or Apple App Store.

Yes, you can upgrade to another plan from any version of QuickBooks Online.

QuickBooks Online is great for businesses who need access to their business data from anywhere and real-time collaboration. Move your accounting online to take advantage of automatic data backup, live insights from your accountant, automated workflows to reduce errors and increase efficiency, and reports that are tailored to your business. Sign up for QuickBooks Online on this page or call 800-595-4219 to hear about a limited-time offer.

We’re here to make migrating your desktop data and getting to know QuickBooks Online as seamless as possible. Easily do it yourself, or get help from a specialist if you have questions. We also offer expert-led webinars, easy-to-use guides, and free phone and chat support. Sign up for QuickBooks Online on this page or call 800-595-4219 to hear about a limited-time offer.

No. QuickBooks comes with free mobile apps that help you run your business on the go—anytime, anywhere.

QuickBooks Online offers a free 30-day trial. Registration required to activate. After the trial you will need to subscribe to continue to use the service. Alternatively, you can also choose to purchase a plan now and save on your first three months.* Sign up now and start enjoying the benefits of QuickBooks! Terms apply and are subject to change without notice.

Your QuickBooks Online free trial gives you 30 days of full access to all the popular accounting features and benefits included in your chosen plan (Simple Start, Essentials, Plus, or Advanced). It's the perfect opportunity to experience firsthand how QuickBooks Online can simplify your bookkeeping.

While the QuickBooks Online free trial offers all the features included in your chosen plan, it does not include optional add-on features, such as Payroll, Payments, Bill Pay, or Live Expert Services.

Intuit is a technology company, not a bank. Banking services provided by our partner, Green Dot Bank, Member FDIC.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Guarantees

Payroll Accuracy Guaranteed: Available with QuickBooks Online Payroll Core, Premium, and Elite. We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

Tax penalty protection: Only QuickBooks Online Payroll Elite users are eligible to receive the tax penalty protection. If you receive a tax notice and send it to us within 15 days of the tax notice, we will cover the payroll tax penalty, up to $25,000. Intuit cannot help resolve notices for customers in Collections with the IRS because IRS Collections will only work with businesses directly. Additional conditions and restrictions apply. Learn more about tax penalty protection.

*Offer terms

QuickBooks Live Expert Assisted Free 30-day Trial Offer Terms: Access an expert when you add the thirty (30) day trial of QuickBooks Live Expert Assisted services (“Live Expert Assisted”) to your purchase of QuickBooks Online Simple Start, Essentials, Plus, or Advanced (“QBO”) subscription. You must be a new QBO customer to be eligible. To continue using Expert Assisted after your 30-day trial, you’ll be asked to present a valid credit card for authorization, and you’ll be charged on a monthly basis at the then-current fee until you cancel. Sales tax may be applied where applicable. To cancel your Expert Assisted subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period. Expert Assisted is a monthly subscription service that requires a QBO subscription and provides expert help to answer your questions related to the books that you maintain full ownership and control. An expert can guide you through QBO setup and answer questions based on the information you provide; some bookkeeping services may not be included and determined by the expert. For more information about Expert Assisted, refer to the QuickBooks Terms of Service.

Bundle may include (1) a QuickBooks Online subscription and/or (2) a QuickBooks Live Bookkeeping plan and/or (3) QuickBooks Online Payroll, at your option.

QuickBooks Products: Offer available for QuickBooks Online and/or QuickBooks Online Payroll Core, Premium, or Elite (collectively, the "QuickBooks Products"). The offer includes either a free trial for 30 days ("Free Trial for 30 Days") or a discount for 3 months of service ("Discount") (collectively, the "QuickBooks Offer"). QuickBooks Live Bookkeeping is not included in the QuickBooks Offer.

QuickBooks Online Free 30-day Trial Offer Terms: First thirty (30) days of subscription to the QuickBooks Products, starting from the date of enrollment is free. At the end of the free trial, you’ll automatically be charged and you’ll be charged on a monthly basis thereafter at the then-current price for the service(s) you’ve selected until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the "Free 30-Day Trial" option. This offer can't be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QBO and select "Cancel." Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Discount offer: Discount applied to the monthly price for the QuickBooks Products is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price. To be eligible for this offer you must sign up for the monthly plan using the "Buy Now" option.

Cancellation terms: To cancel your QuickBooks Products subscription at any time go to Account & Settings in QuickBooks and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period.

QuickBooks Online Payroll terms: Each employee (active or on paid leave) is an additional $6.50/month for Core, $10/month for Premium, and $12/month for Elite. Contractor payments via direct deposit are $6.50/month for Core, $10/month for Premium, and $12/month for Elite. The service includes 1 state filing. If your business requires tax calculation and/or filing in more than one state, each additional state is $12/month for Core and Premium. There is no charge for state tax calculation or filing for Elite. The discounts do not apply to additional employees and state tax filing fees.

**QuickBooks features

Beta features have very limited availability and are subject to change. Features may be more broadly available soon.

Annual percentage yield: The annual percentage yield (“APY”) is accurate as of December 31, 2023 and may change at our discretion at any time. The APY is applied to deposit balances within your primary QuickBooks Checking account and each individual envelope. We use the average daily balance method to calculate interest on your account. See Deposit Account Agreement for terms and conditions.

Envelopes: You can create up to 9 Envelopes within your primary QuickBooks Checking account. Money in Envelopes must be moved to the available balance in your primary QuickBooks Checking account before it can be used. Envelopes within your primary QuickBooks Checking account will automatically earn interest once created. At the close of each statement cycle, the interest earned on funds in your Envelopes will be credited to each Envelope in proportion to the average daily balance of each Envelope. See Deposit Account Agreement for terms and conditions.

Receipt capture: Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Collaborate with your accountant: You can connect up to the following for each product: 1 billable user and 2 accounting firms for QuickBooks Online Simple Start, 3 billable users and 2 accounting firms for QuickBooks Online Essentials, 5 billable users and 2 accounting firms for QuickBooks Online Plus, 25 billable users and 3 accounting firms for QuickBooks Online Advanced. Accounting firms must connect using QuickBooks Online Accountant.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit and application approval. Subscription to QuickBooks Online is required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Bill Pay: Subject to eligibility criteria, credit, and application approval prior to first payment. Subscription to QuickBooks Online required. Bill Pay Basic is included with QuickBooks Online when purchased directly from QuickBooks.com or QuickBooks Sales. Not available in U.S. territories or outside the U.S.

QuickBooks Term Loan (“Term Loan”) is issued by WebBank.

Auto-match transactions: Automatic Matching: QuickBooks Online will only match bank withdrawals with transactions processed through QuickBooks Bill Pay. Not all transactions are eligible.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Mileage tracking: Mileage tracking is only available to the master administrator of the QuickBooks Online account. Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

QuickBooks Checking Account opening is subject to identity verification and approval by Green Dot Bank.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

Mobile signatures: Requires QuickBooks Online mobile application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Third party apps: Third party applications available on apps.com. Subject to additional terms, conditions, and fees.

**QuickBooks Payroll Features

Unlimited 1099 e-file: Create and e-file unlimited 1099-MISC and 1099-NEC forms in QuickBooks. 1099 forms are e-filed only for the current filing year and for payments recorded in QuickBooks to your vendors or contractors. Includes state filings for eligible states participating in IRS Combined Federal/State Filing program; please check with your state agency on any additional state filing requirements. Additional fees may apply to print and mail a copy to your vendors and contractors and to other upgrades or add-on services.

QuickBooks Time Mobile: The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Garnishments and deductions: Available for employees only. User is responsible for setting the garnishment amount and making the garnishment payment to the appropriate entity.

QuickBooks Workforce: Available to employees. Requires an Intuit Account and acceptance of the Intuit Terms of Service and Privacy Statement.

**Product information

Mobile apps: The QuickBooks Online mobile and QuickBooks Self-Employed mobile companion apps work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

#Claims

1. Over 40x U.S. average APY: Average interest rate: The average interest rate is based on the Federal Deposit Insurance Corporation's national rate published the week of October 16, 2023. Learn more. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

2. Millions of customers worldwide, based on number of global QuickBooks subscribers.

Call Sales: 1-877-866-5232

© 2026 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For details about our money transmission licenses, or for Texas customers with complaints about our service, please click here.

By accessing and using this page you agree to the Website Terms of Service.