Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, @rrobertson72.

Welcome to the Community. I can share some insights why your Profit and Loss report is recording both the invoices and Intuit deposits.

Did you download and add your transactions into QuickBooks? If you've already created invoices, you will no longer have to add the deposits, rather, you will have to match them. Adding them will result in doubling of your income report.

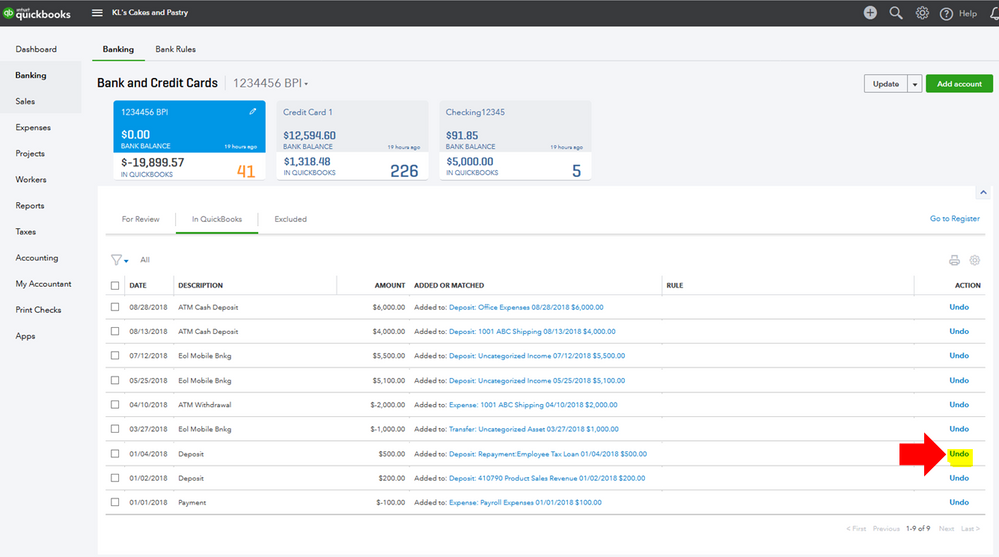

To resolve this, you will have to undo the added transactions and match them instead. Here's how to undo:

I'm more than happy to jump back on if you have any other concerns about QuickBooks, please let me know by adding a comment. Have a good one!

How would this be corrected if the accounts are already reconciled?

Hi @ajselectric777,

I'd suggest for you to undo your reconciliation period with the duplicate income.

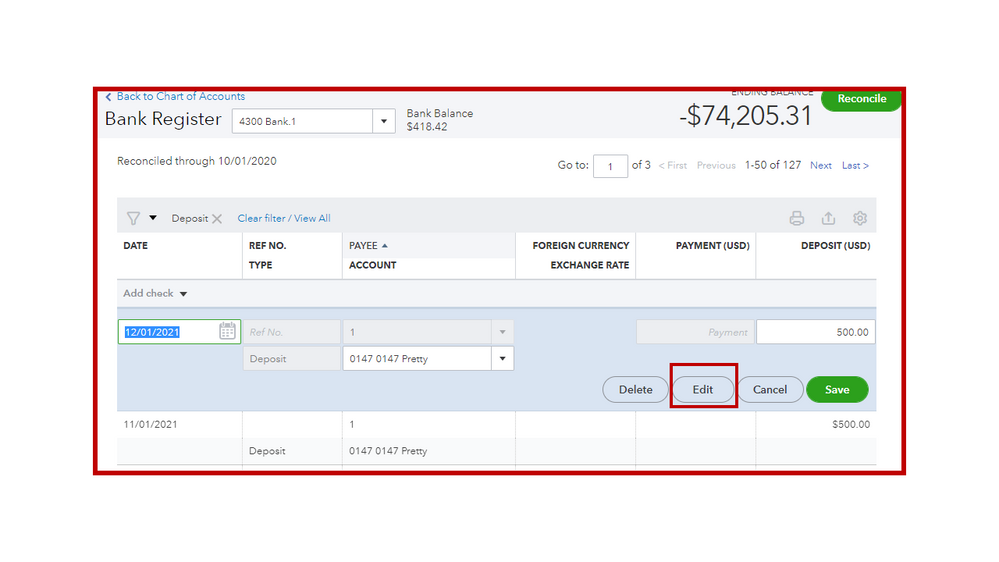

Let me show you how:

Once done, you can redo the same reconciliation period and ensure all the correct transactions are accounted for. You can print a copy of your bank statement of that same period to be sure you're not missing anything.

If you have an accountant user in your QuickBooks Online company, then it would be easier. You can forward them this article: Undo your client’s reconciliations with QuickBooks Online Accountant. Accountant users have the feature to undo their client's reconciliation period.

In case you have any other questions regarding reconciliation, post a comment below. I'll get back to you as soon as I can.

I have QB Desktop 2019. I don't have the same options as QB Online. I am having the same issue with my profit and loss recording double income. Please advise.

Thank you!!!!

Welcome to this thread, @PRWeld.

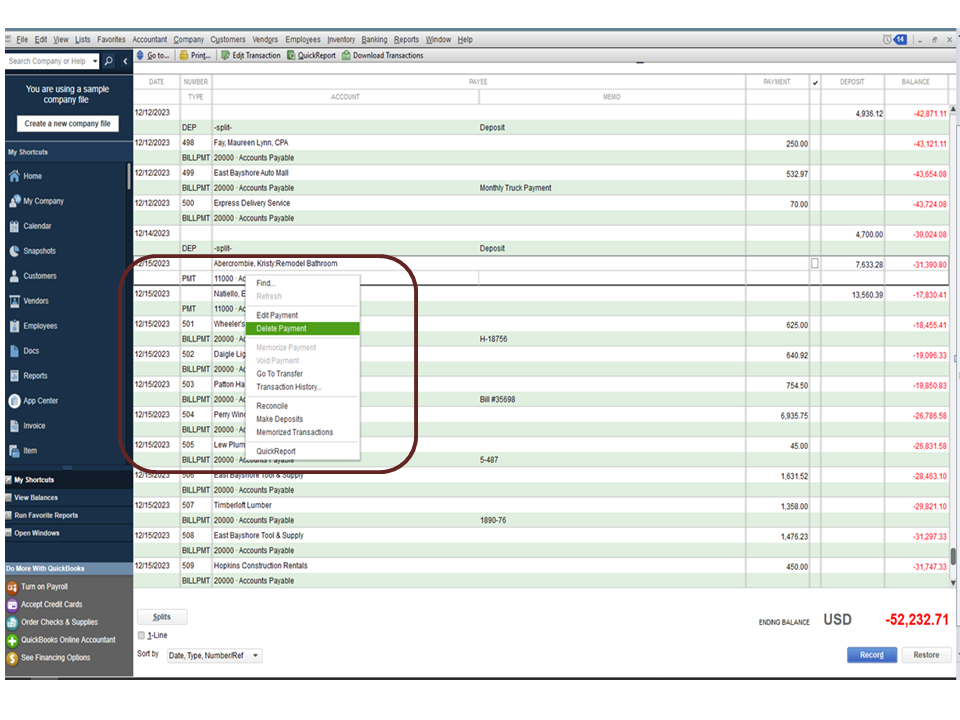

The Profit and Loss Report will show a double income when there are duplicate entries recorded. Let’s open the register and drill down each transaction.

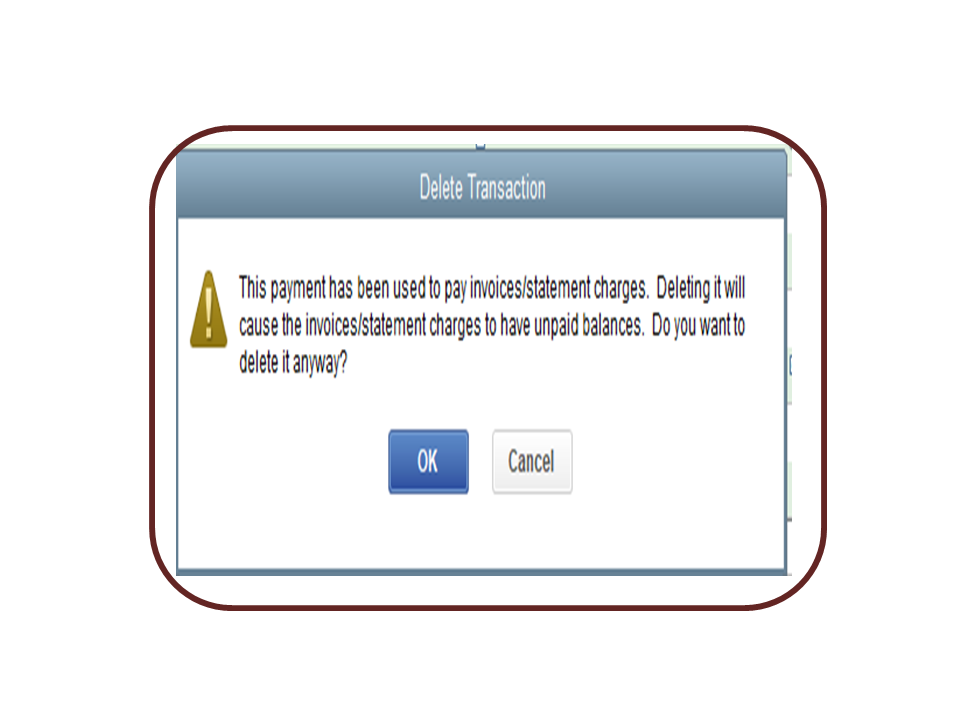

From there, delete the identical transactions to correct your records. I suggest you get a copy of the bank statement and use it to compare the data entered in the chart of accounts.

The process is a breeze, and I’m here to help. Here’s how:

If you have a merchant account, make sure to match the payments to the invoices. This is to avoid duplication of transactions.

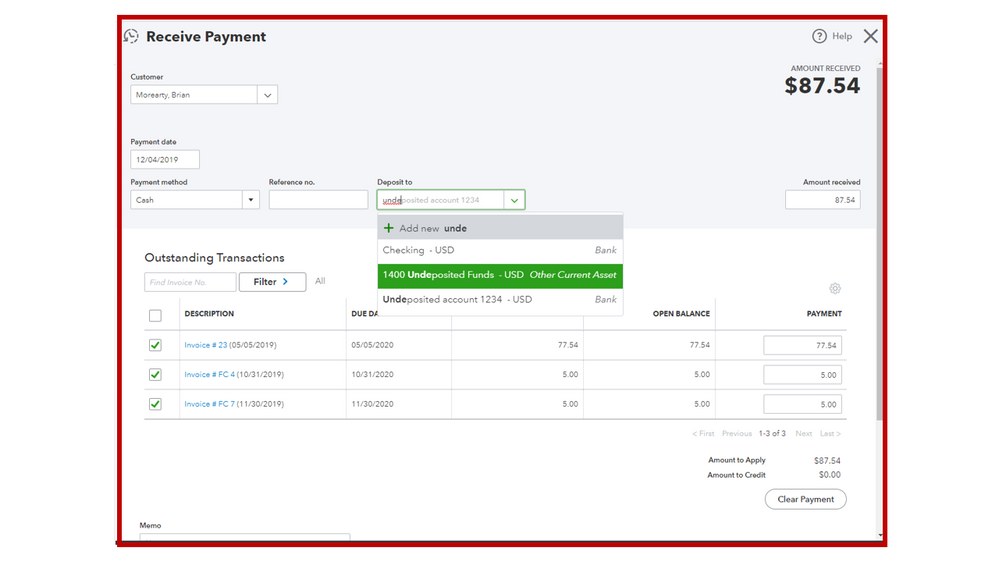

Follow the same steps to remove duplicate transactions. To keep your records in tip-top share, you can consider using the Undeposited Funds account to hold your customer payments.

Here’s an article that provides an overview of entering bank deposits. It also contains instructions on how to review payments and screenshots for visual reference: Deposit payments into the Undeposited Funds account.

By following these steps, the Profit and Loss Report will display the correct income information.

Keep me posted if you need further assistance while working in QuickBooks. I’m here to help and make sure you’re taken care of. Have a good one.

why does my profit and loss add both my invoices and deposits? This is making it look like I made double the money? I us the Undeposited funds account, and it is showing a zero balance.

Hi there, rmgallegos.

Thank you for posting here in QuickBooks Community. I'll provide different information on why the Profit and loss report add both and deposits and steps on how to fix this.

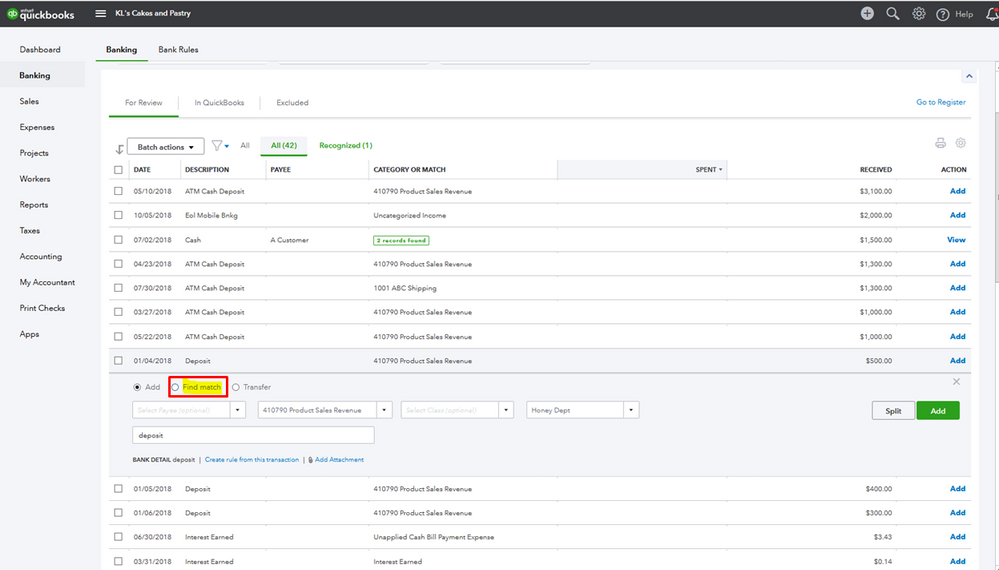

As mentioned above, if you've already created invoices and you download transactions for deposits, you'll need to match them to avoid duplicate. That said, it could be that deposits are being added as a Bank deposit using an income account. That's the reason you have both invoices and deposits in your P&L report. To sort this issue, I'd suggest undoing the added transaction so that the entry will go back to the For Review tab and then, match them.

Here's how to undo:

Once done, you can now match the transactions. Please click this article to see the detailed steps: Categorize and match online bank transactions in QuickBooks Online.

If both invoices and deposits are manually entered in QuickBooks Online, it could be the two entries are not linked. That's the reason it shows both on the report as a double income. With this, I'd recommend linking the deposit to an invoice to ensures that you gave accurate records and helps avoid errors when you reconcile your accounts. To see the details and instructions, you can open this article: How to link a deposit to an invoice.

Please refer to this article on how you can customize your reports to focus on the details that you want to view: Customize reports in QuickBooks Online.

Please stay in touch if you have any other questions about running the P&L report in QuickBooks Online. I'll be happy to help you out. Wishing you and your business continued success.

This doesn't actually work because when I try to match the invoice doesn't appear because it's already been paid via quickbooks - so I can't add it or it will be a duplicate income. So there is nothing to match it to

Thanks for following this thread, amv.

I can see how important for you to be able to match the invoice to the deposit. This will help ensure your financial records are correct including the data shown on the report (Profit and Loss).

When deposits are downloaded via bank feeds, match them to the existing transactions in QuickBooks Online (QBO). Adding them will result in doubling your income.

Also, there are instances where some of the entries are unable to find their match from existing records. Let me share the reasons for this occurrence.

Since the invoice is already paid in QBO, make sure to use the Undeposited Funds as the posting account for your deposit. Let’s go to the Chart of accounts page to edit the information.

Here’s how:

After performing these steps, go to the Bank Deposit page to record the entry. In case there are bank or processing fees, don’t edit the original transaction. Instead, add the fee in the Bank Deposit window. Here’s an article that will guide you through the step-by-step process: Record and make bank deposits in QuickBooks Online.

Once done, you can match the bank deposit to your downloaded entry. Otherwise, exclude the one in your online banking to prevent duplication.

This reference will help in your future tasks. It outlines the complete steps on how to undo or unmatch transactions downloaded into QuickBooks Online. This way, you can categorize them to the correct account. Also, this link contains topics that will guide you on how to efficiently manage your bank activities.

Keep me posted below if you have other questions about managing invoices and deposits. I’ll get back to assist further. Wishing your business continued success.

How do I fix this if the bank I used then (last year) is no longer the bank I use now?

How do I fix it if I no longer use that bank and the account is no longer linked?

Good morning, @BeverlytM.

Thanks for taking the time to follow along with the thread and sharing your concerns. I hope your day is going great so far.

To clarify, are you referring to Rasa-LilaM or Christie-Ann's steps? If you're referring to Rasa-LilaM's response, you can still perform those steps without any issues. You can do this because you can open the transactions through the Chart of Accounts instead of the Banking menu. The Chart of Accounts will bring you to all of your transactions. Whereas the Banking menu will only show your linked bank accounts.

To see more information about the Chart of accounts, check out Learn about the Chart of Accounts in QuickBooks Online.

However, if you're referring to Christie-Ann's steps, you could try relinking your old bank account and undoing the transactions you no longer need. If that doesn't do the trick, you'll need to edit or delete those transactions manually.

For additional details about relinking bank accounts, check out Connect bank and credit card accounts in QuickBooks Online.

Please be sure to consult with your certified accountant before making any changes to your account. Your accountant will know the best process based on your business needs. If you don't have an accountant, don't sweat. You can find one here in our Resource Center.

Don't hesitate to let me know if you have any questions or concerns. I'm always here to lend a hand. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here