Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI created an invoice on march 21, 2020 with Net 45 as Terms, however, when I save it, a Past Due mark shows

What can be the reason.

The error continues when I run an A/R Aging report, in which the invoice shows a wrong Due Date. It shows the creation date instead.

I'll help you get this sorted out, EBFinancials.

It's possible that the payment term selected was not recognized by the program. Let's open the invoice and toggle the payment term. This helps update the correct transaction date.

Once done, runt eh A/R Aging report and check if you have the correct information.

Please let me know how it goes. Thanks.

OK - I am having the same issue. I just upgraded to 2020 this weekend.

I tried to apply your fix. The terms SHOULD be credit card - but even with today's date, it is showing past due. So I changed the terms. starting with net 10 and working up. I have found that if I change the terms at least 4 times, the system will get rid of the Past Due. While this is a solution it is not really workable - I have 20 invoices showing past due, even if they are on Net 30 or 45 days.

Looking for a solution that doesn't take so much time perhaps? Because this is an ugly bug to deal with on an ongoing basis. Thanks!

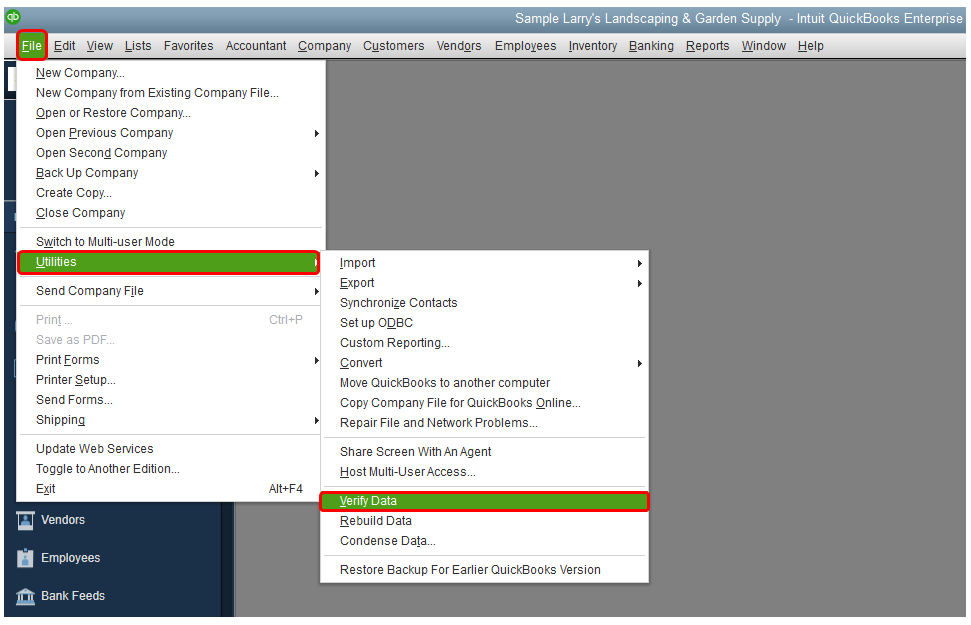

Hey Lise46. it sounds like you may have corrupted data. I recommend you run a verify on your file to ensure this isn't what's causing your issue. Here's our article on verifying your company file. The steps are pretty simple though so I'll list them below for you.

If the verify happens to find any problems, you will be prompted to run a Rebuild. It may take a few minutes to finish running the rebuild but you should be good to go after that. Reach out to me if you have any other questions.

@RenjolynC wrote:I'll help you get this sorted out, EBFinancials.

It's possible that the payment term selected was not recognized by the program. Let's open the invoice and toggle the payment term. This helps update the correct transaction date.

- Go to Customers > Customer Center.

- Select the customer's name and open the invoice.

- Choose a different payment term from the Terms drop-down list.

- Click Save and Close.

- Open the invoice again, and select the correct term. Hit the Save and Close button.

Once done, runt eh A/R Aging report and check if you have the correct information.

Please let me know how it goes. Thanks.

It worked partially. It saved the Terms only when I changed it to the temporary one (step 3 in your list), however, when I changed again, back to what I need (Net 45), again, it shows Past Due and wrong date in the Aging report.

On that note: How do I delete a specific Terms entry from the drop-down list?

Thanks for getting back to us, @EBFinancials.

Also, I appreciate the details you've shared. Let's repair your QuickBooks Dekstop (QBDT) and fix any errors and issues in your company file. Let me show you how.

Before doing so, ensure to back up your company file. Once done:

Here's an article you can read for more details: Repair your QuickBooks Desktop for Windows.

Nonetheless, here's how to remove/delete terms entry in your QBDT:

You can also check this article for more details about payment terms: Set up payment terms.

In case you need to refund a credit card payments, you can refer to this for the details: Void or refund credit card payments in QuickBooks Desktop.

You're always welcome to post here anytime. I'm more than happy to help. Stay safe and healthy! EBFinancials

@RenjolynC wrote:I'll help you get this sorted out, EBFinancials.

It's possible that the payment term selected was not recognized by the program. Let's open the invoice and toggle the payment term. This helps update the correct transaction date.

- Go to Customers > Customer Center.

- Select the customer's name and open the invoice.

- Choose a different payment term from the Terms drop-down list.

- Click Save and Close.

- Open the invoice again, and select the correct term. Hit the Save and Close button.

Once done, runt eh A/R Aging report and check if you have the correct information.

Please let me know how it goes. Thanks.

Your solution worked partially. It worked only when changing to the temporary Terms, however, when then changing again to the original Terms the problem persists.

So it worked in step 3 above but not in 4

Thanks for bumping up to this thread, EBFinancials.

I appreciate you for letting me know additional information and sharing how the steps provided by my colleague above work for you. In QuickBooks Desktop, we can create a new payment term.

Below are the steps that will guide you through creating a new one. Afterwards, let's use it in the invoice.

You may want to check this article to get further information about the terms in QBDT: https://quickbooks.intuit.com/learn-support/en-us/set-up-payments/set-up-payment-terms/00/203687

Please let us know how things go. I'll be around together with my colleagues to help you. Thanks. Take care!

OK. So

My data is not corrupted. This is not an issue with my data. After 23 years using QB I cannot tell you how 100% positive I am about this.

This problems happens with NEW invoices as well as old. If I set terms to net 60, there is no problem. ANY other terms setting shows as Past Due, even if it is credit card and the invoice date is today. This problem started when I upgraded to 2020.

Is there a way to turn off this feature?

Hi there, @Lise46.

I hope you're having a great day. You can customize templates for your Invoices and turn off the set terms option. I'll include the steps below to show you how:

3. Uncheck the Terms box and press OK.

Now you can create an Invoice without net terms. You may also find this article about customizing form templates helpful too.

Please don't hesitate to touch base with me here if you need any additional assistance. I look forward to hearing from you again.

HI Anna, thanks for the reply.

Unfortunately, this does not solve my problem. I WANT and NEED to be able to set terms. The problem is that ANY term other than net 60 days shows up immediately as past due. Is there a way to solve THAT?

Hi there, Lise46.

It seems that all of the possible troubleshooting steps are already given through this thread. Since you've mentioned this issue started when you upgraded to QuickBooks 2020, I recommend getting in touch with our technical supports. This way, we'll be able to pull up your account and conduct a series of tests to rectify the underlying issue.

Here's how to connect with us:

Please check out our support hours below to ensure that we address your concerns on time.

I've included an article that will help you in personalizing your sales forms like invoices, sales receipts, estimates, statements, and purchase orders: Use and customize form templates.

Our doors are open 24/7 to help you in completing your task with QuickBooks. As always, assistance is just one post away. Stay safe and healthy.

Thanks Klent... I was desperately hoping to avoid that, but looks like it is the only option. Unfortunately contacting support is never less than a 2 hour event, and with no staff in my office, that is hard to come by. I may just live with this for a while.

Thanks for the link on personalizing forms - as I said, I have been with QB for over 20 years. I am really good at customizing my templates. :-)

Wishing you well.

@Lise46 wrote:OK - I am having the same issue. I just upgraded to 2020 this weekend.

I tried to apply your fix. The terms SHOULD be credit card - but even with today's date, it is showing past due. So I changed the terms. starting with net 10 and working up. I have found that if I change the terms at least 4 times, the system will get rid of the Past Due. While this is a solution it is not really workable - I have 20 invoices showing past due, even if they are on Net 30 or 45 days.

Looking for a solution that doesn't take so much time perhaps? Because this is an ugly bug to deal with on an ongoing basis. Thanks!

@lisa Even when you set up credit card, you still need to define terms as credit card is the method not the terms. Even when paying with card there should be terms. Therefore, what do you mean when you say that even with today's date, it is showing past due?

I mean if you set today's date as the terms then it should be due today, not Past Due yet.

Am I right?

Yes. Even with today's date, if terms are credit card, it is showing past due immediately.

If I create an invoice today, and I set the terms to anything less than Net 30, the invoice immediately shows past due. And sometimes, even at Net 30, it shows past due. Net 60 is the only terms that doesn't ever do this.

Now I have discovered that at least for credit card invoices that after I run the credit card, that goes away, so I can send those paid invoices to my clients without an issue. But my Net 30 clients are still a problem. Right now I am sending them the invoice along with a note that the latest update to QB has caused a problem and they are clearly NOT past due.

Hello there, @Lise46.

You’ll want to add a payment term that is due within 30 days from the invoice date.

Here's how to do it:

Check the following article for more information about this: Set up payment terms.

Please let me know if you have any other issues or concerns, and I'll get back to you as quickly as possible. Have a great rest of the day!

Thanks Grace, but I am confused.

Why do I need to create a NEW term, when in theory the terms that exist should work? I can do this, but what I want to use is Net 30.... which is there already, so why does creating a new term of Net 30 work? And if I call it "standard" when my clients see that, how do they know when their invoice is due? I have different clients with different Nets, so this really matters in my world.

Or are you telling me to disable (is that a thing?) all the existing terms and recreate them? I'm sorry if I am sounding thick, I am just missing something clearly. Gotta be trying to do my job and all my staff's jobs at the same time AND deciding to upgrade now... what was I thinking?

There's no need to disable and recreate a new term, Lise46.

I'm here to ensure your Net 30 terms will work accordingly. This way, you'll be able to let your clients know when will be their invoice is due.

Let's check your payment terms' Net due in days field. This will identify if the condition is set to the right number of days that it should be due.

After you verify, create an invoice to view the update.

I know you're already an expert in using QuickBooks Desktop, however, if you wish to know what are the available reports that you can pull up for your customers and receivables, kindly refer to this article for the detailed information: Understand reports. It also contains other related articles such as Set up and modify Scheduled Reports and Combine reports from two or more company data files.

Please let me know if you have other concerns. I'm just around to help.

I am having the same issue as Lisa. I have read every entry in this thread and have done the things suggested and none of them work, even changing the payment terms 4 times and even changing the payment terms to net 60. An invoice dated today is showing past due with the payment terms of net 60 selected. I have made sure the Net 30 terms are correct by going to the terms list, right clicking net 30 and making sure 30 is in the Net due in... box. Nothing seems to fix this issue.

Hi @Mary Nic,

Thank you for joining the thread, as well as sharing the details of the steps you've taken so far.

Since you already went through the troubleshooting steps provided by my peers above, it's best to speak with our Technical Support team for further assistance. They can pull up your account information within a secure environment, and investigate why you have this issue.

See this article for the steps: Contact QuickBooks Desktop support. Please take note of our Technical Support team's operating hours, so you know when they're available.

If you want to apply discounts to early payments towards an invoice, see this article: Record an invoice payment. Scroll down and look for the To apply a discount for early payment section.

Post a reply if you need further help with net terms on your invoices in QuickBooks Desktop. I'll be around to help you out.

I had the same problem. I had not indicated the Terms of Payment when I initially created the invoice. Even after I fixed it in the Customer tab, it still showed that invoice as Past Due. I found a quick work-around - this is not a fix, but it worked for me. After fixing the terms of payment under the Client, I opened the invoice and made a copy of it (keep in mind it will give your copy a new invoice number). Then I clicked Save and Close. Then I opened the old invoice that kept showing Past Due and I deleted it. Now I only have the new one and it looks fine.

Same issue. Fix does not work. I have customer set up with 45 day term. Invoice shows 45 days, but says past due. I have changed the 45 to something else temporarily and saved, went back in and set 45, same issue. I'm on 2022 desktop pro.

I have same issue in 2022 Desktop Pro. Set at 45 days, says past due. It's only a week old. I reset to another and saved, went back and set to 45. Still says past due.

Let's try some steps to fix that, chinckley

First, update to the latest release of QuickBooks Desktop.

Then, run the Verify and Rebuild Data within your company file to fix odd behavior and other issues you're experiencing in QBDT.

If the same thing happens, please contact us. We'll need to check your account in detail to further review and figure out why it's happening. Within your QuickBooks Company file, select QuickBooks Desktop Help from the Help menu.

You can refer to these articles for more insights:

Let me know how everything goes. You can post more if you have other questions related to QuickBooks. Take care.

I ran all updates, I even deleted the old invoice and created a new one and it's great until I go to 45 days. Then it's overdue every time, even though it's only a week old.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here