Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello there, annette23.

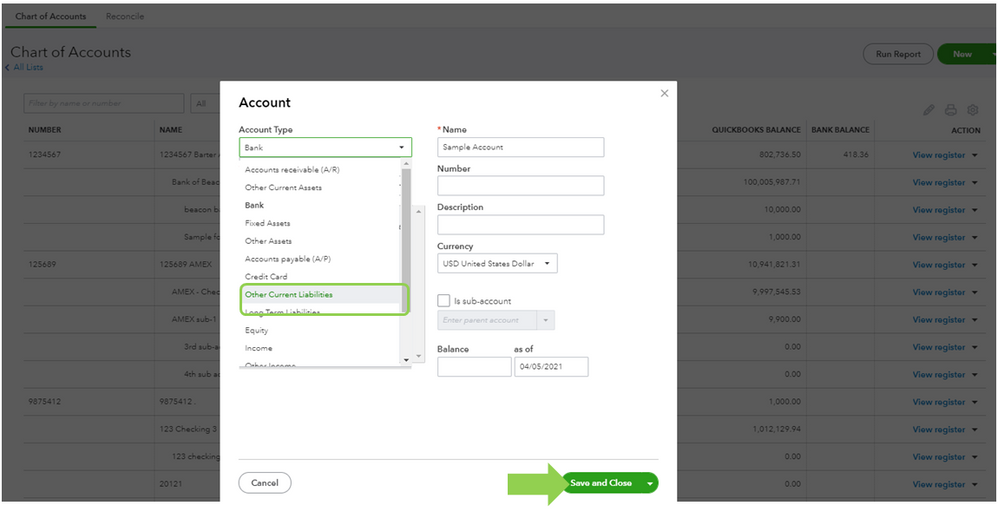

You've got it right. You'll need to make a new account to record a payback to a shareholder in QuickBooks Online. You can set up a liability account for this one. Let me show you how:

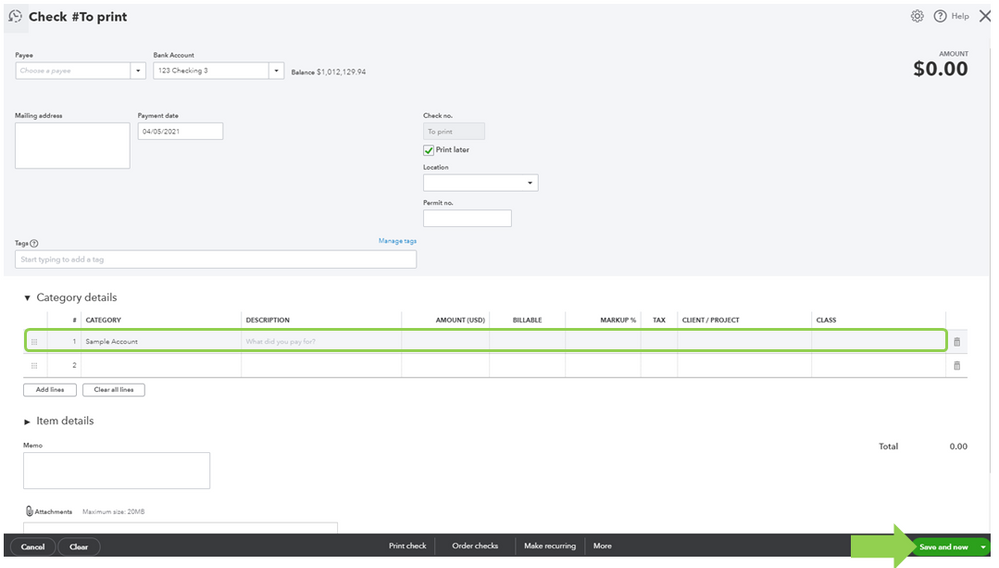

The next step is to create a journal entry for the loan. Make sure to enter the amount of the loan and add it to the appropriate expense accounts. Once done, record the loan payments using a check. Here's how:

For further guidance, I'd recommend reaching out to your accountant to make sure everything is properly set up. They'll ensure to use the correct account when recording a payback to a shareholder. This way, your data won't mess up.

Check this article for more details: Record a company loan from a company officer or owner.

Please let me know if you still need my help. I'd be glad to help you further. Stay safe and have a great day!

Hi annette23,

Hope you’re doing great. I wanted to see how everything is going about recording a payback to a shareholder in your QuickBooks Online account. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

Thank you so much Sarahann

I will try it today and come back to you again

Hi, again Sarahann!

So I set the Account Type to Long Term Liabilities and when I was doing the drop-down for Detail Type we had as you said Long term Liabilities but instead of the Other current Liabilities, we have Shareholders notes payable. Is that what I am using?

How would you record a payback to a shareholder when I only have an account called "loan to Shareholder" in desktop?

Good day, @TerryR25.

Thanks for joining this conversation. Allow me to chime in and help record your payback to a shareholder in your QuickBooks Desktop (QBDT).

The process will be the same as what my colleague Sarah shared above for the Online version of QuickBooks. For QBDT, please refer to these steps.

To set up a liability account, here's how:

Once done, create an expense account so you can track interest payments or fees/charges. Here's how:

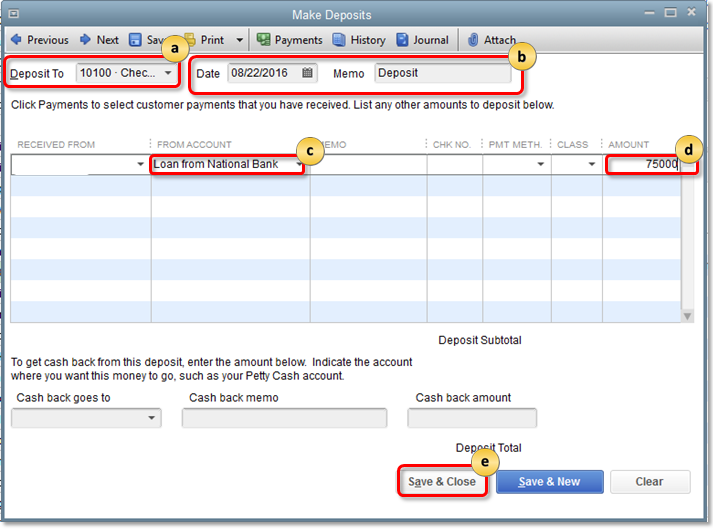

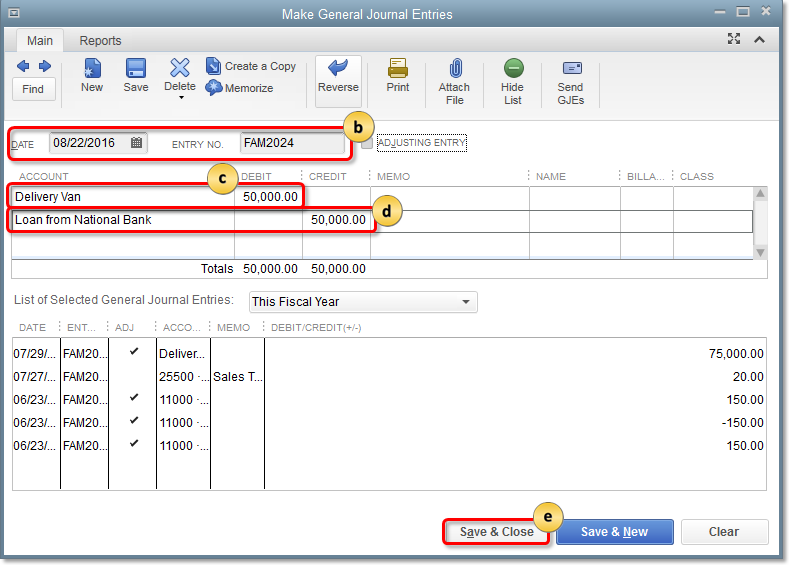

Now that you have a liability account for the loan, here’s how to record the loan amount. Here's how:

Cash loans

Non-cash loans

Finally, here's how to record the payment:

You can also check out this article for detailed information about the process: Manually track loans in QuickBooks Desktop.

If you want to keep track of your loans and be reminded about upcoming payments, you can track and manage your loans with the QuickBooks Loan Manager.

I also recommend consulting your accountant for further guidance. They'll be able to provide you with the best accounting advice for your unique business. If you don't have an accountant, you can check out this link to find one near you.

For tips and other resources, check out our website for future reference: Self-help articles.

Please leave a comment in this thread if you have additional questions about recording paybacks or anything else in QBDT. I'll be more than happy to help. Have a great day.

Hi @SarahannC

I am trying to payback a shareholder loan in quickbooks online and when I go to create a cheque, I cannot find the "To/from shareholder loan" that I have created to in step 1 suggested by you.

Please help.

Thanks

Pranab

I appreciate you for joining this conversation. Let's work together to understand why the accounts you've set up aren't appearing when creating a check. We'll then go through a few steps to resolve the issue, pranab.

First, manually enter the name of the account in the Category column of the check. if it's not showing, it could be that that account status is in inactive. Follow these steps to reactivate it:

If everything is correct, but the account still doesn't appear in the category column when you create a check, we can proceed with troubleshooting steps. Sometimes, browser-cached data can interfere with the functionality of websites. Thus, I recommend accessing your QBO account in an incognito window to ensure that cached data are causing the problem.

If it works, you can clear your browser's cache to resolve issues related to stored data. Lastly, you can use other supported and up-to-date web browsers.

Additionally, you'll want to learn about the difference between bills, checks, and expenses: Handle bills to be paid later and bills to be paid immediately using bills, checks, or expenses.

If you need further assistance, please don't hesitate to post again, and I'll be around to help you.

Hi Sarahann,

Did all the trouble shooting steps and still cannot find the "To/from shareholder loan" in the drop down menu.

Just to confirm this should show up necxt to the payee tab and on the "Bank account" drop down menu.

regards,

Pranab

I appreciate you for sharing your concern and providing additional details, Pranab. Let me help you create a check in QuickBooks Online (QBO).

The liability accounts you created will appear in the Category column when you record transactions. It's where you choose the correct expense or liability account to categorize the transaction.

In the Check window, the Bank Account field selects the account from which funds will be withdrawn, typically your checking or savings account.

For more details, see this link: Create and record check.

Additionally, run these custom reports in QuickBooks Online to see your company's income and expenses.

We value your business and are committed to ensuring you record the loan correctly. Let me know if you have other questions. I'm here to support you on your journey to financial success.

Hi Maybelle,

thanks for clarifying. It seems I am doing all that right, so the question is will the principal portion of the loan come in as an expense in the profit and loss statement?

regards

Pranab

Hi Maybelle,

thanks for clarifying. It seems I am doing all that right, so the question is will the principal portion of the loan come in as an expense in the profit and loss statement?

regards

Pranab

Thanks for getting back to us, @pranab. I'm glad you're on the right track with the loan payments.

To clarify, the principal portion of the loan won't appear as an expense in the Profit and Loss statement. Instead, it reduces your loan liability on the Balance Sheet, representing a return of borrowed funds. Only the interest portion is recorded as an expense, reflecting the cost of borrowing. This recurring expense directly impacts your business's profitability.

In case you need to compare your income and expenses for different periods, check out this article for more guidance: Run a Profit and Loss Comparison Report in QuickBooks Online and Online Accountant.

If you have any more questions or if there’s anything else I can help with, please don’t hesitate to get in touch. I'm here to assist. Have a productive day ahead, pranab!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here