Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Is the worksheet 3 available for the 2nd quarter? My Sick leave paid in May is populating in Worksheet 1 and on line 11b that is specifically for wages paid before April 1.

Hi LindaFCinci,

The system will automatically populate the data for the 941 Tax Forms based on the paychecks you've entered. We can review the details by running the Payroll Summary report. Let me guide you with these steps:

If you're still unable to view the worksheet 3, let's ensure that you have the updated tax table.

Then, review the total of the Federal Withholding for the quarter.

For the discussion about the data on each lines, you can check this guide: How QuickBooks populates the 941.

Keep me posted if you have questions about the data on the 941 forms. Keep safe!

I ran a payroll update, says we are using payroll version 06282221 and the 941 is still using the wrong before April 1 line and worksheet 1 instead of 3.

Thanks for keeping in touch with us, LindaFCinci.

Let me share additional troubleshooting steps to get Worksheet 3 for 941 in QuickBooks Desktop (QBDT).

Aside from getting the latest payroll version, I suggest updating your QuickBooks Desktop to its latest release version as well. This can fix the possible errors within the software.

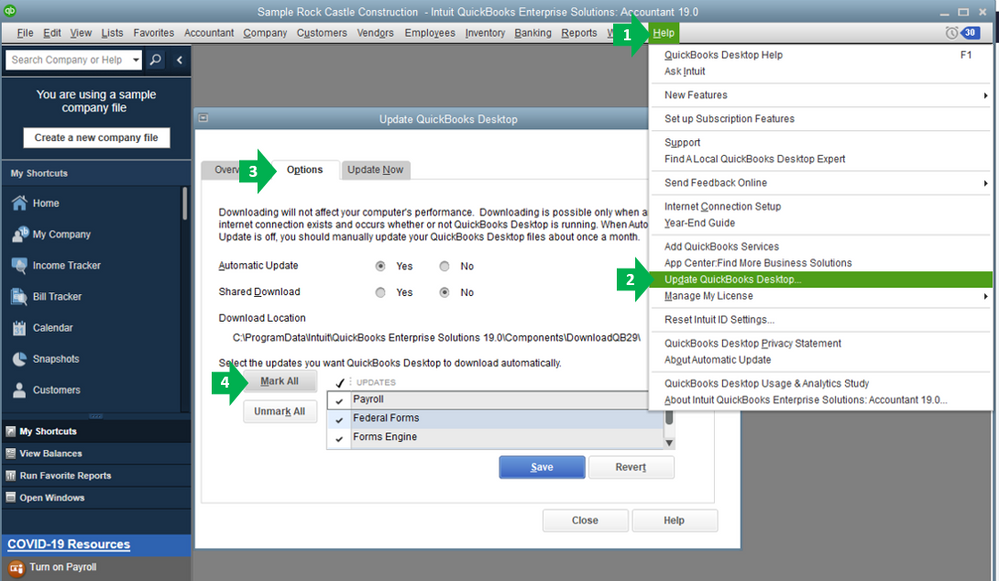

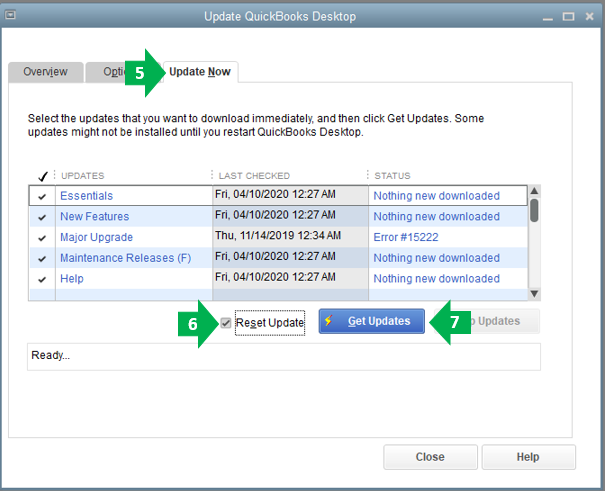

Here's how to manually update your software:

To give you more insight and a visual guide on how to update QuickBooks Desktop, please check out this article: Update QuickBooks Desktop to the latest release.

If the issue persists, I recommend contacting our QuickBooks Care Support. I know that you've already reached us for the same issue. However, our phone support has the tools to conduct a thorough investigation to identify the reason why you're getting the error and come up with a fix.

Here are the steps to contact support:

Please take note our operating hours for chat support depend on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

Keep me posted for additional questions while working with payroll forms or other concerns. Wishing you the best of luck.

I am experiencing the same problem. I ran a payroll summary with verifies qualified sick time posted to the second quarter. However, Worksheet 1 is populated but Worksheet 3 should be populated. Tech support ran through all updates and the problem still exist. Worksheet 1 and 3 do not allow override. There is no way to file a correct 941 with this bug. Please Help!! Case# 566 680 615

I submitted a bug report.

Thank you for submitting a bug report, Jeff.

I understand that you've already called our Support about this. Did the agent mention that this will be investigated? If not, please contact them again and request it since the issue persists even after doing the troubleshooting steps.

Feel free to go back to this thread if you have other questions in mind.

Same issue here - everything is on Worksheet 1. I've done all the updates too. I just posted the question as I searched the forum and could not find any other posts on it and then I came across this one.

I noticed that most fields cannot be overwritten.

Let's hope it is fixed soon.

Good morning,

Has anyone found a solution to this problem? It is getting close to the deadline. I have the most recent update so it not that. If it would let me override, but it won't allow that. If someone has a work around this issue, I would really appreciate it. At this point, the only thing i can think of is to print out a blank form, enter the numbers and MAIL in the form. It would be nice if Quickbooks would be to date on their forms in a timely manner. PLEASE HELP

Thank you

This isn't the kind of experience we want you to experience when processing your payroll tax forms, Koyc.

I've checked here on our end and there's no reported case about this one. I appreciate you for updating the QucikBooks and tax table to the latest version to get this sorted out. Also, I'll take note of your feedback about the dates of the forms so it properly addresses our product team.

In this case, I'd recommend contacting our Payroll Support Team. They'll pull out your account in a secure environment and investigate what's causing this issue. To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. See our support hours and types for more details about this one. Here's how:

Feel free to visit our Process Payroll page for more insights about managing your payroll in QuickBooks.

You can always update us on the result after contacting our support in the comment below. I'd like to ensure this is resolved for you. Take care always.

We have followed all the recommended steps as far as updates and reboots and still the 2nd Qtr 2021 Qualified Sick Leave Credit is populating incorrectly. We are still seeing the credit on Part 1, Line 11b instead of 11d and also the wrong worksheet as its still using Worksheet 1 (prior to 04/01/21) instead of Worksheet 3 (04/01/21 and forward). I called QuickBooks and the customer service agent asked me how I am generating Form 941 so needless to say no help there either.

Any help resolving this or a work around would be greatly appreciated.

Is there a resolution for this issue? My 2nd qtr 941 is also using worksheet 1 when it should be using worksheet 3. It is causing the 941 to populate incorrectly.

I have the same problem. Any solutions out there yet ?

Hi there, Donata.

We don't receive updates yet about the second quarter worksheet for 941 forms in QuickBooks Desktop (QBDT). Rest assured, our team is working non-stop to deliver the best services for all QuickBooks users and to stay compliant with your taxes and forms.

For now, I recommend reaching out to our Support Team for further assistance. A live representative can check out your account securely and review your payroll forms and taxes. They can also run an investigation to update the second quarter worksheet in no time.

To contact support:

On the other hand, you can learn more about payroll and 941 forms, through these articles:

For more hints and resources while working with other QBDT transactions, you can also check the topics from this link: Help articles, video tutorials, and more.

If you have any other follow-up questions about Form 941 or the second quarter worksheet, please let me know by adding a comment below. I'm more than happy to help. Keep safe!

I am also having the same issue with Worksheet 1 populating on the 941 and it should be Worksheet 3. Why hasn't QuickBooks fixed this? It's causing of lot of stress and seems to be out of our control to do anything about it. Please help!

I did not have qualified sick leave wages in the 2nd quarter so I was not aware there was an issue. But now, I have qualified sick leave wages in the 3rd quarter and noticed that the Form 941 is still not calculating correctly. I have installed the latest payroll updates, etc. Why has Quickbooks not corrected this issue? I know I can probably download form to a pdf and make manual changes, but that should not be necessary? Are other users seeing the same issue with the 3rd quarter also.

Thanks for posting here with this payroll form concern, @DaynaMK89.

We want to make sure this is taken care of by the correct department. The best team to help you out with this is our Payroll Support people. They can help out with any adjustments to make sure your forms are filed with the correct data.

Use these steps to contact us:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

Please update this thread on how the call goes. I want to make sure you're taken care of, and I'll be right here if you need other help with QuickBooks. Have a good one.

Not sure if this helps you or not. I figured out my issue for the 2nd qtr. It was the setup for covid pay. I had been using the 2020 setup not realizing that QB had put out another setup for the March 2021 covid. I followed the setup instructions put out in May 2021 to track paid leave (ARPA). Then I when back to the employees that had covid pay and changed the account to match the new setup. After that everything processed correctly on the 941.

Hope you find the solution to your problem.

Thanks for the heads up. Since COVID pay is now done, I am going to just manually adjust via the pdf file. Not worth researching, etc. to correct.

I did end up taking your advice, so thanks. It was easier to change your way than my proposed way.

Hi,

Can you tell me the steps how you set up to track the paid sick leave?

Appreciated.

Hi,

Can you tell me the steps how you set up to track the paid sick leave?

Thank you for your help.

I can certainly help you track paid sick leave, CVAN1.

Before giving your employees sick leave, you'll need to figure out what pay leave type they fall under and their hourly rate. Then, you can now set up your expense accounts.

Here's how:

Once done, set up payroll items. For the detailed steps, I'd suggest checking out this article: How to Track Paid Leave and Sick Time.

Additionally, I've added these articles that'll help you manage payroll in QuickBooks Desktop.

Please know that I'm just a reply away if you need any further assistance setting up paid sick leave, CVAN1. Wishing you and your business continued success.

Hi CharleneMae,

Thank you so much for your help. I got the form 941 for the 3rd quarter done correctly.

I did not know that "Sick Pay" amount would not flow to the proper place on Form 941 if we want to claim the sick leave and family leave credit. It looks like the system would flow the claim amount to 941 after we enter the $ amount on the QB interview Sick Leave section. Unfortunately it is not. We must set up a different payroll code for this particular pay in order to flow the credit on Form 941. That means we must enter the sick leave with the proper coding on the paycheck in order to trigger the flow to the proper line on 941.

Your help is greatly appreciated.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here