Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Has anyone had their 4th Q 941 rejected due to the ERC? The 941 in completed correctly and the startup recovery box on the information page of the 941 is marked but it is being rejected and the rejection message is that the recovery startup business box is not checked when it clearly is.

I'll make sure you'll be able to file your 4th Quarter 941 seamlessly, Lisa.

I've got some troubleshooting steps to help you isolate and fix this issue.

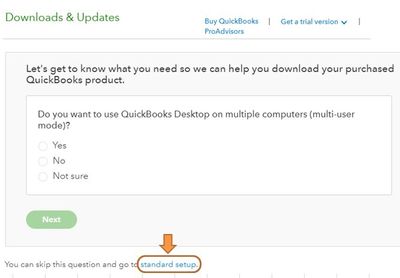

To begin with, I suggest updating your QuickBooks Desktop (QBDT) and downloading the latest payroll tax table to ensure the program is up to date. I'll show you how.

Then run the Verify Rebuild tool. This scans your company file for potential errors and fixes them right away.

You can also check out this link for reference on how to handle rejected payments: Handle payroll e-file and e-pay rejections.

Once done, you can now resubmit your tax payment. You might also want to check this link to know the status of your payment: Check e-file or e-pay status in QuickBooks Desktop Payroll.

You can count on me if you need more assistance managing your tax payments in QBDT. Just add them in your response and I'll answer them for you. Keep safe!

I wish the fix was as easy as being reported. I have tried that along with countless other update related fixes through over 10 hours of support calls with Level 1, 2, & 3 "Support". First they tried to make it a Windows 11 issue, but we tried with Windows 10 and had the same issue. Then, they had me uninstall and reinstall Quickbooks Desktop, again with no impact. Their "final conclusion" was that it is a "connection issue". That is obviously incorrect because I am able to successfully e-file 941's that do not have ETC included.

I finally stopped trying with the original agent and tried to start over with a new one. Their conclusion was that it wasn't a connection issue and that the rejection was on the IRS side. They suggested I call the IRS. Anyone who has tried to do this realizes that's an impossible option as the IRS is EXTREMELY difficult to connect with on the phone, even through the "IRS Practitioner's Hotline".

I'm completely perplexed as to what the next step should be and would be HIGHLY appreciative for anyone else's input, especially if they've filed successfully.

I've studied this issue a little more closely. and wonder if others having this error have seen the same.

Line 11c of Form 941, noting "Nonrefundable portion of employee retention credit" was $0 on previously filed quarterly returns (6/30/21 for example). The 12/31/21 filing auto populates this line when it appears it should be zero. If line 11c was zero, then Box 18b would not need checked, thereby allowing the return to be successfully e-filed. There appears to be a glitch in QB's form. Unfortunately, line 11c cannot even be overridden to make it zero, therefore not making a work around clear.

Does anyone else experiencing this issue have a suggestion?

I'm here to make sure your form 941 reports correctly without any further delay, @cfotogo.

First, we'll have to get the latest payroll tax table update.

You'll see a pop-up when the update is complete. After that, let's update your QuickBooks Desktop to the latest release version from our official website to get the latest features and fixes.

Once done, launch the QuickBooks and pull up your form 941 again to see if everything is reporting accurately. You can also turn on the automatic update to make sure that your QuickBooks Desktop and payroll tax table is always updated. Please check this article and follow the Schedule future automatic updates steps: Update QuickBooks Desktop.

Additionally, you can read through these links to check if your QBDT has the latest version already:

For future references, you can check these articles to learn more about the form 941:

Visit me here again in the Community and keep me posted on your progress with this Form 941 issue. I'm determined to help you succeed.

Thank you for your response. However, through the 10+ hours of my conversations with your Level 1, 2 & 3 Support Teams, I have already performed all these steps and still am receiving this error. I've even uninstalled and reinstalled the complete QBD.

Please refer to my earlier suggestion of allowing the overriding of Box 11c, to make it zero. In doing so, Box 18b would not be required to be checked and the return will likely e-file correctly. In my opinion as a CPA, Box 11b should be zero anyway according to my understanding of the Employee Retention Credit portion of the tax law.

Please advise further.

I have successfully found the work around . . .

Within the worksheet portion of the Employee Retention Credit section, Line 2e reads, "Enter the amount of the employer's share of Medicare Tax from Step 1a, or if applicable Step 1g". At least on my return, line 1a is appropriately $0. However, line 1g has an amount equal to half of the Medicare Tax (Employer's share). The solution is to override line 2e with a $0 and then the rest of the return calculates correctly.

I have now successfully efiled the 941 and it was accepted by the IRS.

Thanks so much for sharing what worked for you @cfotogo.

I appreciate you taking the time explain your steps so that other may benefit.

Please feel free to drop in to the Community any time with information you may want to share, or if we can help you with any questions.

Thanks for being part of the Community!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here