Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'm using Desktop Accountant 2018 WITHOUT PAYROLL. My QB shows no new updates available so I am assuming it auto-updated. I don't see any mention of 1099-NEC in the 1099 Wizard, and the instruction to map non-employee comp to box 1 is still there. Will I see this change? Where's the update for those of us not using payroll?

Hi there, ChartWise.

Let's reset your QuickBooks maintenance release to make sure that you get the 1099 NEC. Here's how:

Wait for the update to complete. Then, restart your computer after getting a confirmation that the update process is completed. Once done, open QuickBooks and install the update once prompted.

After the installation, go back to the Vendors menu and check if you can see the option to process 1099 NEC.

Just in case you're QuickBooks is installed in a cloud or hosted environment, you'll need to wait for the host provider to install the update for you. I'd also like to reshare this article for additional reference:

The Community is always here if you need anything else.

Hello @ChartWise, thanks so much for the screenshots. Let me give you some information about the 1099-NEC.

You stated in a previous post you're using QuickBooks Desktop 2018. They are releasing 1099-NEC in waves and QB 2018 is set to get the update on December 29th so keep your eyes open on that day!

If you use QuickBooks in a hosted environment, you'll need to wait for the host to install the latest update before the 1099-NEC is available. For instance, Right Networks is scheduled to release theirs this weekend.

If you have any questions about this, please don't hesitate to reply to this post. All of us in the Community are happy to help you. :)

thank you!

I have Premier Contractor Edition 2018 and there has been no update as of today, 12-19-20, to accomodate the new 1099-NEC. Does anyone know when this will be available?

Thanks for joining in on the thread, CCampbell.

Just like Kiala_S said, the update is done by batch. We don't have an exact time on when this will be available on your end, but rest assured everyone will receive it on or before December 29th.

Though your QuickBooks will be update automatically, we'd still recommend updating it from time to time manually. This is to ensure that you'll have the updates added to QuickBooks. You can use this link for reference: Update QuickBooks Desktop to the latest release.

Keep us posted if you need anything else.

Nice try but it does seem to work with QB 2018. This article doesn't appear to address the step to update (not upgrade!!!) the program, nor does it address also updating the PR. If anybody has the correct steps to follow to update the 2018 program - please post.

Thanks for joining this thread, @mike3825.

I appreciate you for following the steps shared by my colleague. The above article can help you update the 2018 program. Before doing so, make sure to create a back up copy of your company file.

There are two ways on how to update your 2018 program, just follow the steps below in which prefer.

To do a manual update:

To set up automatic updates, here's how:

When the update finishes, close and reopen QuickBooks Desktop. To install the updates, select Yes.

See this article for more information: Update QuickBooks Desktop to the latest release.

Also, to know what’s new and improved in the latest updates to QuickBooks Desktop 2018 and Enterprise 18.0. Check out this article: Release notes for QuickBooks Desktop 2018.

Additionally, I've added this article on how to Fix error when updating Desktop or Payroll. It provides additional resolutions when you encounter any error code.

Feel free to add a comment below if you have any other concerns, we're always here to help. Take good care!

Thank you so much. I was under the impression from previuos posts that all would be updated on December 17. I do have automatic updates turned on so will watch for the update. Merry Christmas!

Still not working in QB Desktop 2018 and it is December 21, 2020. When will the update for 2018 be available?

The update will be released at the later part of the month, @Barb2574.

For QuickBooks Desktop 2018 version users, the update for the 1099 NEC form is scheduled to be released on December 29, 2020.

I'd encourage you to run a payroll update regularly so whenever any updates on this matter are made available will sync in automatically to the system.

Here's how to do that:

I've also included here a link in which will guide you when filing your 1099 form in the IRS: Tax Year 2020 - Instructions for Forms 1099-MISC and 1099-NEC

You can always get back to me here if you have any other concerns with QuickBooks. Happy holidays!

Great news, and this should mean the Mac version will be able to print paper copies instead of filing online also, correct? Any timeframe for the feature -- I'm getting nervous, as it's already January! Thanks!!

Thanks for checking this with us, AkashaDesign.

We're unable to provide a timeframe as to when the updates about printing paper copies instead of filing online in QuicKBooks Desktop for Mac will be implemented.

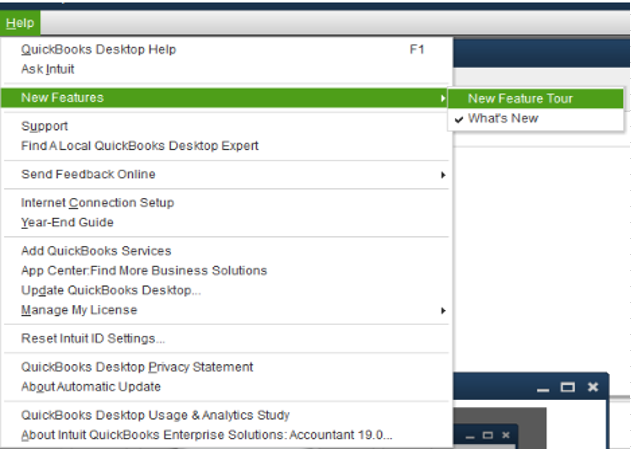

Once it's available, you'll receive a notification from QuickBooks to get payroll updates. Also, I want you to be updated with the new features added in the software by following the steps below:

Here's how:

I'll leave you with a guide to know more about QuickBooks Desktop for Mac features and functions: QuickBooks Desktop Mac 2020 User’s Guide.

The Community is always open if you have other questions. I'll be around to help. Wishing you a great day ahead!

what about a MAC version?

Thanks for joining in, @Cescat.

Yes! QuickBooks software updates, including vendor and payroll forms, will be available for all QB products in the 3 most current years.

If you are using QB Mac between 2018-2020, you're able to create 1099’s with the most current IRS forms.

You may find this article about preparing and filing 1099’s helpful: QuickBooks Desktop setup, troubleshooting, & FAQs.

Let make know if you have any other questions about year-end forms or anything else within QuickBooks. Take care!

This is great to hear, but do you have an ETA for the update to the Mac desktop software? The forms are due in just three weeks!

Hi there, @AkashaDesign.

As of the moment, our engineers are still working closely with the IRS for proper guidance regarding the 1099-NEC. The ETA will be available in the middle of this month. Rest assured, we will be providing more updates as they become available.

Here are 1099 NEC- related articles for more details about various updates and FAQs:

I've also included a link in which will guide you when filing your 1099 form in the IRS: Tax Year 2020 - Instructions for Forms 1099-MISC and 1099-NEC

Please let me know if you have anything else to add regarding 1099. I'm always here to help.

When attempting to print 1099's for 2020 a notification comes up saying we need to backup the company file to continue. When we backed the file up and tried again we got the same message. Also, I've made sure the file is totally up to date (no updates) & we were doing these tasks on the host computer in single file mode. Please advise.

Hello, ckfllc.

I'll ensure you're able to print your 1099s by helping you resolve the "backup message" loop.

This might be an issue with the PDF component. Though, the temp folder permissions (for printing) can also cause the "backup company" message to appear again.

First, let's reset the folder permissions to fix this. Here's how:

Next, print your 1099 form again. If it's still showing the same message, you'll want to run the QuickBooks Tool Hub. Follow the steps under Solution 1 in this article: Troubleshoot PDF and Print problems with QuickBooks Desktop.

Other troubleshooting steps can also be found there, too.

Need help taking care of other taxes or want a guide on year-end tasks? Check out the sub-topics here and look for an article.

I'll offer assistance again if you have other concerns. Drop by in the Community space with a new thread and I'll ensure they're addressed properly.

I just purchased the 1099 NEC forms for our subcontractors. Now I find out that my quickbooks must be updated (currently have the 2016 version). Forms must be in mail by Feb. 1st. I did not receive any notification that NEC's not able to be utilized with my QB version. Very upset. Should I upgrade to the 2021 version will

the 1099 forms be printable then.

Hello there, @Sharon947.

I know the importance of printing and mailing the Form 1099-NEC. That's why I'm here to share further details about this.

Currently, we're unable to provide payroll and tax form updates on the QuickBooks Desktop (QBDT) 2016 version. With this, you can upgrade to the software's latest release (i.e., 2021) and be able to print and mail the Form 1099-NEC on time.

Once you've installed and activated the latest QBDT version on your computer, you'll have to pull up your backup and upgrade the file through it. This way, you can smoothly manage your company file. You can refer to this article for the step-by-step guide: Upgrade your company files after switching to a new version of QuickBooks Desktop.

After that, you're set to print your Form 1099-NEC. For the detailed steps, you can check out this article's QuickBooks Desktop section: How do I print my 1099 forms?. It also includes instructions on which 1099 form to file and their due dates.

Let me know how it goes by dropping a comment below. If you have other 1099-NEC concerns, I'm just around to help. Take care always.

I have Desktop 2018 and can get the entire setup ready to print the 1099-NEC's but when I print, they are way off. The whole document needs to move down at least 3 lines. I've played with the fine align numbers to every degree and the sample will print correctly but not when I actually go to print the 1099. WHY? All updates in my system have been done.

I appreciate you for performing some steps and validating the results when printing the 1099 form, @IDPRelab.

To start, let's check the settings to align your 1099 form.

Take a look at this article for more information: How do I print my 1099 forms?.

Moreover, you can also check out the Make fine alignment adjustments section of this link for details on printer setup: Align forms for continuous-feed (dot matrix) printers. In case this is not the steps you've taken when doing the fine align numbers you've mentioned.

Please let me know how this goes on your end. I’m more than happy to assist further. Have a great day ahead.

Are the new 1099NeC compatible with QuickBooks Pro 2019

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here