Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowplus menu vendors>credit card credit

use accounts payable as the account for the amount received and enter the amount, save

use pay bills, select the bill the CC credit created and apply the vendor credit, save

I was not able to save the transaction, a transaction amount must be set. Thanks

I have the same exact question- I was provided a Vendor Credit Memo from the Vendor, after already processing an invoice payment.

The Vendor then used the credit memo to pay another invoice, which left an open credit.

The vendor then refunded the difference, however I cannot seem to match this to the credit memo, and when I add it from the Bank transactions, it applies it as a negative number.

I went in an deducted the amount from the credit memo- and while that brought the balance back to $0.00, it didn't seem like it was the correct way to process the Vendor refund to credit card.

When I tried to apply the "Bank Deposit" steps to process to this transaction, it did not allow me to select the Credit Card account as the account to deposit the refund into.

Thanks for sharing enough details of your concern, Sundewurks.

No need for you to process a refund since making a deposit will zero out the balance. When your vendor pays the bill using the vendor credit, you can deposit them right away.

Here's how to do it:

Once done, let's go to Pay bills to match the deposited amount. All we have to do is locate the amount and vendor that you've entered into the deposit. Then, put a check mark and click Save.

For more details related to your concern, you can check out here.

Get back to me anytime if you need help when managing transactions in your book. Have a good one!

In the account space at the top left hand it won't let me choose the credit card account. In your example your account is set to 'sample', this is where users are getting stuck. If I want to deposit it back to my bank account great, if I want it on my credit card there is no option here unless I turn my credit card into a bank account, which causes a second problem in my chart of accounts and reporting. I believe it just doesn't work and I'm better off with a journal entry to DR Credit Card, CR Expense acct than an entry that uses the supplier credit module.

Hello, @accounts251.

If the refund that you've received was posted to your bank account, then choose to record it through Bank Deposit. However, if you've got it through credit card, then record it through Credit card credit.

Adding it through journal entries also works perfectly in recording this vendor refund.

To know more about this, check these articles:

Let us know if there's anything that you need. I'm always here to assist. Have a wonderful day!

Hi Rustler,

Everything went fine until I started reconciling my credit card account. Now I have a bunch of CC Bill Payment "Charges" that are hanging at the top of the list every time I'm reconciling the account with the statement. Do I have them charges increasing or lowering my expenses? It is 0.00 in Accounts Payable account when I look at the register. Please advise.

Thank you,

Val

Duplicate

My question is this:

We don't use credit cards for the business, we have debit cards issued from the bank. Our books got messed up and I'm trying to get them straight before tax season. I've come across refunds from The Home Depot, where it was refunded back to the debit card that used it, and in essence, the money was credited back to our account.

Now that I'm trying to get rid of all the duplicate entries, every time I come across one of these refunds, it will not allow me to choose the checking account that it was credited back to. It was only letting me choose "Home Depot Credit Card - Quickbooks"

I went in and changed this account to the business checking account, thinking that would solve my problem. Well, it didn't. Now for the account type, I can only choose "Credit Card" (remember, this is a debit card from our CHECKING Account).

How do I fix this and fix it fast before I pull out my hair.

Duplicate

I appreciate you joining in this thread, ACWorxLa.

The refunds you're trying to get rid of is most probably a credit card credit type of transaction. The reason why QuickBooks lets you choose the "Home Depot Credit Card".

To get this sorted out, you can choose the credit card and transfer them to your checking account or you can delete the duplicate entries by following the steps below:

Check out this article to know more about this process: Exclude expenses from downloaded bank transactions.

You might want to visit the links below. This will provide you with resources and videos about managing your QuickBooks Online account, income, and expenses:

Let me know how it goes by leaving a comment below. I’ll be here to keep helping. Have a good one.

I'm attempting to recording a vendor refund by credit card. This is the sequence of events:

1. Vendor sent bill

2. Vendor Bill was paid in full by credit card and recorded in QB.

3. Error in Bill was reported to Vendor (excess amount charged)

4. Vendor issued a credit card refund.

5. Vendor issue new statement showing (a) new bill amount (b) paid amount (c) Refund amount and Zero Balance.

I was following the guidance provided but I hit a bump when recording Bank Deposit. The Bank Deposit drop down does not let me enter credit card.

See screenshot:

What do I select in the Red highlighted fields?

Hi there, anonEthos.

Welcome back to the QuickBooks Community. I appreciate you providing detailed information and performing the steps shared in the article when recording a vendor refund.

How you record the refund depends on how you enter your purchases. Since you paid the bill by credit card, you'll have to enter the refund entry in QuickBooks as Credit card credit. This way you can easily record it to balance your transaction flow.

Here's how:

For additional information, you can refer to this article: How can I record a cash back to my credit card account?.

Please refer to this article on how you can run a report that reflects all payments made to vendors: Run a report with vendor totals.

Please let me know if you have any other questions or concerns by clicking the Reply button below. I'll be here to assist. Have a great rest of the day!

Thank you that was helpful.

Do I need to create a Vendor Credit? I guess not, as that transaction is being replaced by Credit Card Refund.

When I run by vendor report, I see a credit balance and not zero. Here are the transactions I see:

1. Bill $110.00 [Charged $10 extra]

2. Pymt -$110.00 [Paid full amount]

Total: $0.00

3. CCRefund -$10.00 [excess charge]

Total: -$10.00

What transaction must occur prior to transaction-3 so that the total is $0.00?

Thanks for coming back, anonEthos.

Since there's a $10.00 excess charge, it will be posted as a credit and it will not be total as $0.00. To zero it out, you can create a bill and apply for the credit on it. Just use the vendor credit as payment for an open bill. Here's how you can apply it to the open bill:

To learn more about this one, see the Enter a credit from a vendor article for more information about vendor credits.

Feel free to visit the Expenses and vendors page for more insights about managing your vendor transactions.

I'd like to know how you get on after trying the steps, as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Take care always.

Thank you for your response.

Your solution is hinged on the fact there is a vendor credit. This vendor credit is applied to a bill that is the excess amount charged.

My situation is different. The Vendor has refunded the excess charge by a credit card refund. I have used the Credit Card Credit transaction to record it in QB. Question is how do I reconcile. In summary I need to transfer funds from Vendor account to credit card account.

I have listed the sequence of events that have occurred. What QB transactions do I perform at each event?

I guess I'm missing something here, this situation is common -- credit card partial refund and should be possible to capture in QB.

Looking for guidance.

I appreciate the clarification that you gave, @anonEthos.

You've got me here to help share some steps on how you can track the refund that you've received from your vendor.

You'll need to deposit the refund from the expense account that you've used for the bill to the credit card account. This way, the transaction will show up in the right account.

To do that:

From there, you can now reconcile your bank transactions smoothly. You can always utilize this link to guide you with categorizing and reconciling your bank entries: Categorize and match online bank transactions in QuickBooks Online.

Lastly, I'm also sharing this reference, which talks about recording vendors prepayments in the system you need it in the future: Record vendor prepayments or deposits for prepaid parts or services.

Let me know if there's anything else that I can assist you with. I'll be around for you. Take care!

Thank you for your detailed response.

However, I'm unclear what to choose in 3 (Account) of your image. When I attempt, it only shows my bank accounts in the dropdown. I don't see the credit card account.

Can you also elaborate on Temporary Account in the Cash goes back to field

Allow me to join in this thread and share why you're unable to select a credit card account, anonEthos.

You can select a bank or other current assets account when making a bank deposit in QuickBooks Online.

For the Cash goes back to field, you can record a cash-back amount to identify the account that should be adjusted for the cash back.

For example, you're making a $1,000 deposit, but want to hold $100 of the deposit back as cash. Then, use the Cash Back Memo field to describe the reason for the cash-back transaction.

Going back to recording a vendor refund, you're already on the right track when using the credit card credit. However, you need to use Accounts Payable for the category to zero out the vendor balance (CC Refund -$10 excess charge). See the attached screenshot below for your visual guide.

Now that transactions are in QuickBooks, you can start reconciling your bank accounts. This ensures your books are accurate and there aren't any duplicate entries.

Stay in touch with me by commenting below if there's anything else I can help you with recording a vendor refund. I'll be right here if you need additional assistance.

@MaryLandT : Thank you very much for providing lucid explanation, both verbal and visual.

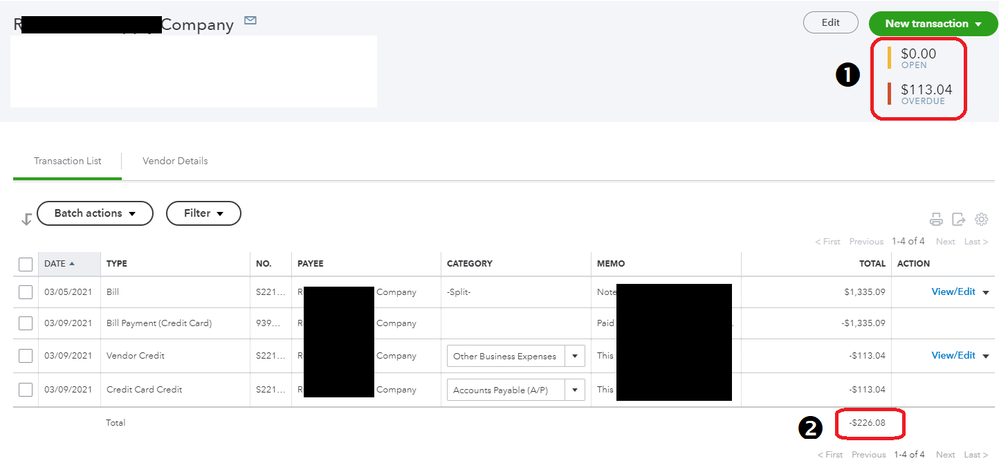

I have followed your guidance in changing the Category to Accounts Payable (A/P). However the totals are not zero as in your image. Here is my screen shot and more details below:

1. Bill (with excess charge) ($1335.09)

2. Bill Payment for amount in 1.

3. Vendor credit as partial refund ($113.04)

4. Credit Card Credit using AP.

My totals are not $0.00 as in your image. Please see Red highlights numbered 1 and 2.

Transactions 2, 3, and 4 have not posted from the credit card company.

Is this correct?

Thanks for adding more details about your concern, anonEthos.

Based on the screenshot shared, the entries are properly recorded in QBO. Also, the amounts will show a negative amount.

The Transaction List page will show all activities or transactions related to the vendor. That’s why it shows a -$226.08 total amount (credits).

When you go to the Vendor’s page, the Open Balance column will show a zero amount. I’ll help show the steps on how to get there.

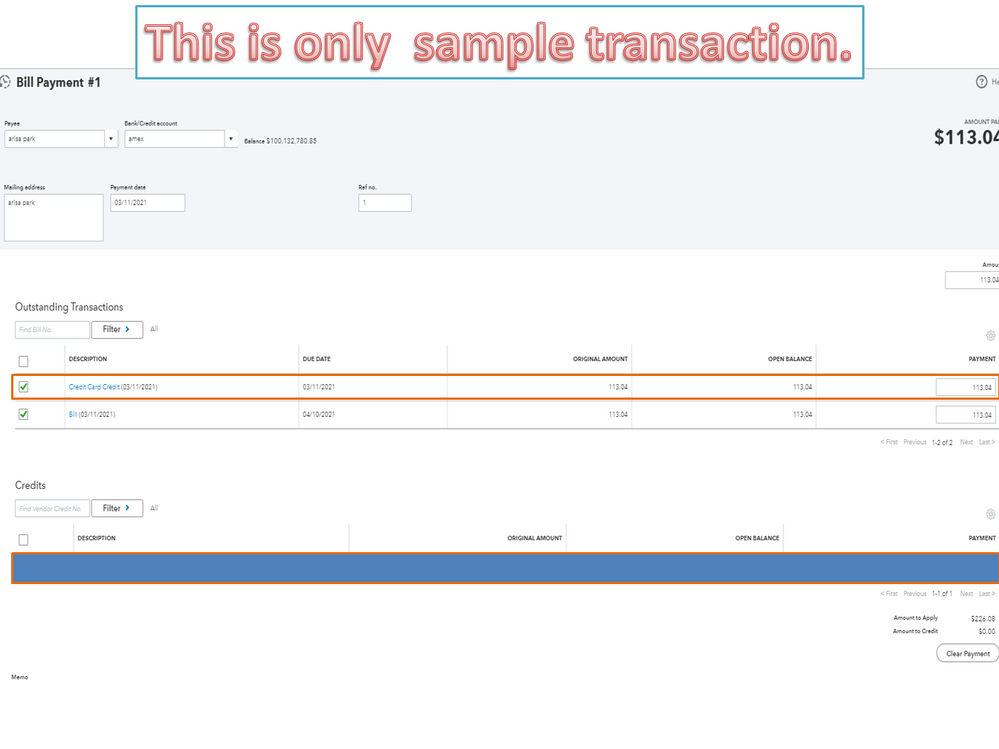

If you’ll create a bill and pay it, the Credit Card Credit will show in the Outstanding Transactions section. Then, the Vendor Credit is recorded in the Credits section.

For additional resources, click here to access our self-help articles. It includes guides on how to handle expenses and vendor transactions.

If you have any clarifications or questions, add a comment below. I’ll get back to answer them for you.

Hi After creating the Credit card credit for the vendors. How you reconcile or how you categorize them.

Thanks

Greetings, @TEHCA2021.

Thanks for joining in on this thread. I hope your day is going well so far.

All you need to do is a few easy steps in your account to reconcile or categorize these transactions. Here's how:

Categorize Transactions

For each transaction, you'll have the option to match, add, or view multiple matches. For further details, use this link: Categorize and match online bank transactions.

Reconcile an account

This article can provide some more insight into reconciling.

These steps should do the trick. Let me know if you have any other questions or concerns. I'm only a few clicks away if you need me. Have a splendid day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here