Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I've converted from Quickbooks Desktop to Online. In the conversion I've discovered billing errors made from years before. I need to clear out expense that should have been billed to the client that were not. They are listed as a billable expense. I need to somehow delete this or change it to not billable. Suggestions would be appreciated.

Solved! Go to Solution.

Go into the Expense, Check or Bill transaction that triggered the billable expense, and click the check mark (not "View") in the Billable column TWICE, to clear the box. Save.

To find them, go to Sales>Customers, and click the box that says UNBILLED ACTIVITY, click each customer and open the Billable Expense Charge. Then click the link on top left to the Expense, Check or Bill.

If there are many billable expenses, there is a utility to delete in batch:

I think I read that this does not work for QBD conversions. Let us know how it goes

Go into the Expense, Check or Bill transaction that triggered the billable expense, and click the check mark (not "View") in the Billable column TWICE, to clear the box. Save.

To find them, go to Sales>Customers, and click the box that says UNBILLED ACTIVITY, click each customer and open the Billable Expense Charge. Then click the link on top left to the Expense, Check or Bill.

If there are many billable expenses, there is a utility to delete in batch:

I think I read that this does not work for QBD conversions. Let us know how it goes

Is there a way to do this with Desk Top Pro?

How do I do this if I have Quick Books Desktop Pro 2018?

Hello there, @PJOH72358.

I'd be glad to help walk you through in turning off billable expense in QuickBooks Desktop.

Here's how:

Also, make sure not to put a check mark on the Billable column when creating the bill or writing the check.

That should do it! Feel free to visit us again, here in the Community. I'm always here to help you manage your expenses in QuickBooks Desktop.

If I go into Preferences now and uncheck the "Mark all expenses as Billable" will it change items in previous years that will change the P&L??

Hello, @TAnastasia.

I'm here to help share information about marking expenses as billable.

Changing your account preferences or unchecking the option to mark all expenses as billable won't affect or change the previous items/transactions created. The changes only affect on the transaction/s created after unchecking the Mark all expenses as billable box.

However, marking expenses as billable also depends if the Billable column is manually checked/unchecked.

If you have any other questions about billable expenses, just add a comment below. I'll be always here to help you. On the other hand, in case you have any other QuickBooks concerns in the future, you may also check our help articles: Help articles for QuickBooks Desktop.

Have a great day ahead!

Hello!

I have the same issue described here, and I am trying to follow the instructions (this is on a check that has billable items that are showing up in the customer accounts). However, I do not see a billable column anywhere on the check? Is there a setting that would hide this column, or another way to mark old expense charges unbillable?

Thank you,

It’s nice to see you again in the Community, @ashahrest.

The solution provided by @Malcolm Ziman can help change the expense charge to not billable. It’s possible that the Mark expenses and items billable setting is the reason the option is no longer showing on the check.

Here’s how to turn it on in QuickBooks Online:

Once done, go back to the check transaction and remove the check mark in the Billable column. Make sure to click the Save button to record the changes. For reference, check out this article: How to remove a billable expense charge.

That should answer your concern for today. Let me know if this works out for you, I’m more than happy to help. Take care and have a great day!

Hi KhimG,

Thank you for your response! Unfortunately, I don't see that option in the Account Settings, Expenses section. The only option I see is Default bill payment terms. I'm using QBO Essentials version. Is there any other way to get these old items marked unbillable?

Thank you!

Thanks for getting back, @ashahrest.

Allow me to chime in and help. First, I wanted to clarify a few things about the billable expense feature.

The ability to turn on billable expenses is available in QuickBooks Online Plus and Advanced. It seems the reason why the billable column is not showing on your check transactions is that you have the Essentials subscription.

If you've converted from Desktop to QuickBooks Online Plus, you can follow the suggestions provided in this thread. However, since you're using an Essential subscription, the only way to get these items marked as unbillable is to delete and manually recreate the transactions.

I know it's a time-consuming process, but it'll work in the meantime. If you're interested in upgrading your account's features, we make it easy for you to upgrade your product. You can refer to this article for more information: How do I upgrade my QuickBooks Online subscription?

Should you need some references for future use, please feel free to visit our QuickBooks Desktop Help Center. You can view some amazing articles that you may find helpful for your growing business.

If you have other questions about billable expense, do let me know. I'm always here to help. Have a great weekend.

Hi,

I have an issue with a Bill Payment that is marked as a Billable Expense.

The thing is, The bill payment was an Expense and was marked as Billable in the beginning, but then, we realized that the Expense should be a Bill payment, so, we applied it to the open bill. But now, when I try to make the invoice to the client, the Bill and the Bill payment are pending to be created as a bill. So, how can you unmark the bill payment? The bill payment doesn't show the marked box.

I know maybe delete it could be the most easy solution, but I don't want to delete it because I already close my reconciliations.

Hope you can help me.

Thanks

Hi there, AndySoto.

I know that you don't want to delete a bill payment because you already closed your reconciliations. However, this is currently the recommended method to unmark the bill payment.

Since the transactions are already reconciled, you have the option to unreconcile and remove the individual transaction from a completed reconciliation. Before doing that, I suggest consulting an accountant to assist you in removing the transaction that is already reconciled.

If you want to decide to delete the bill payment, here's how:

1. Click the Expense at the left panel. Then Expense tab.

2. Select the customer.

3. From the customer's name, it will show the Bill and Bill payment transactions.

4. Choose the Bill payment and from the drop-down arrow under Action column, select Delete.

5. You'll be prompted with Are you sure you want to delete this transaction?, click the Yes button to confirm it.

Once done, please follow the steps below on how to unreconcile transaction. Before you unreconcile transactions, make sure you're making the right changes. Review the opening, beginning, and ending balances for the account holding the transaction. This will help you find the root of the issue and decide if you need to make changes.

After you've reviewed your opening, beginning, and ending balances, start unrceconciling the transactions by performing the steps below.

1. Click Accounting at the left panel and select Chart of Accounts.

2. Find the account and select View register.

3. Select the transaction you want to unreconcile.

4. Go to check column. The transaction is reconciled, so you’ll see an “R.” and change it by removing the R until the box is blank. This removes the transaction from the reconciliation.

5. Click the Save button. Then close your register.

You can always this website: Learn the reconcile workflow in QuickBooks .It contains more information about starting, fixing any differences, and completing the reconciliation process. You'll just have to click the links beside QuickBooks Online on every scenario.

Please let me know if you have other questions related with QuickBooks. I'm always here to help you.

If I follow the instructions and click in to the item Billable Expense (which also says Create Invoice) and go to bill and untick billable (View) what effect will it have on the accounts from past accounts and VAT closure periods?

I have old expenses that were marked as billable but should not have been. When I change them to Not Billable, will this affect my prior period reporting? I'm 98% sure that it won't, but would like a confirmation. Thank you!

You're right @GVDnA!

Changing the transactions from billable to non-billable won't affect the reconciliation/prior period reporting, unless the amounts are changed. So you're all set to make these changes!

You may find this article helpful: What is a non-posting transaction?

Please let me know if you have any additional questions on reporting or anything else within QuickBooks Online! Have a great weekend.

Hello,

I am trying to help a client who has some Billable Expense Charges in some old Customers that she would like to make inactive as she has not worked with them in years. She has the Essential version of Quickbooks Online so I do not see a column called "Billable" with a check box that I can uncheck. In doing some research online, it looks like I will have to create an Invoice and apply all billable expense charges to the invoice. (per this QB Q&A https://quickbooks.intuit.com/learn-support/en-za/other-questions/is-there-some-way-to-clear-all-anc... In the thread it says that the invoice total should be zero and it also mentions that the invoice will not automatically be sent to the customer. When I go to create a new invoice for one of these customers, I do not easily see a way to have the total equal zero. I also do not see how to mark the invoice so that I know it is not going to be sent to the customer. Any guidance you can provide would be greatly appreciated.

I can help you handle billable expenses in QuickBooks Online (QBO), @cpakc.

The billable expenses feature is only available for QBO Plus and Advanced. Thus, you're unable to see that option on your client's QBO Essentials account.

For more insights, please check out this article: Delete customer with unbilled charges.

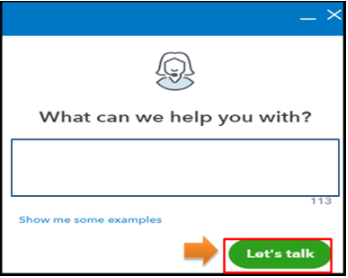

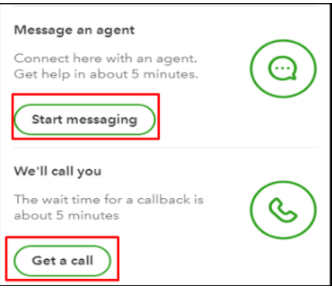

Also, it looks like you've imported your data from QuickBooks Desktop with billable expenses charges. If so, you don't have an option to get rid of them by yourself manually. Thus, getting in touch with our support team is the best option at this point.

One of our representatives can help remove those billable expenses linked with some customers for you. Before you proceed, I suggest checking our support hours to make sure they can assist you timely.

Here's how to contact our support:

For your other concern, you can make the invoice total equal zero by creating a line item with a negative value that's equal to the outstanding amount (see screenshot).

Then, make sure to click Save and close instead of Save and send when saving your invoices. Also, please ensure to turn off the auto-reminder feature. This way, QuickBooks won't send them to your customers automatically.

Lastly, you can customize your invoices to personalize the details you want.

Stay in touch with me if you need a hand with managing your invoices in QuickBooks. I'm always around to assist you.

Go to YouTube and search "Get Rid of Unwanted Billable Expenses in Batch Trick in Quickbooks Online." It took me about 2 minutes to "close" 5k billable expense items. Lifesaver.

This does not work. For each and every "job" expense, or Vendor invoice I enter, once I select the Customer job to apply the invoice to, the "billable?" option is automatically changed to checked. I don't want ANY expenses to be billable. Do you know how to resolve?

There is no billable column in expenses. These instructions don't work at all.

Thanks for joining the thread and providing an update, @slkgjldfgkj.

This isn’t the kind of impression that I’d like you to have. I’ll make certain that you can utilize the billable expense in QuickBooks Online.

Beforehand, please know that the billable expense feature is exclusive to QuickBooks Online Plus and Advanced versions. Otherwise, ensure you turn on your billable expense tracking. I’d be glad to show you how:

1. Go to Settings ⚙, then select Account and Settings.

2. Go to the Expenses tab.

3. From the Bills and expenses section, select Edit ✎.

4. Turn on the following:

5. Enter Default bill payment terms.

6. Select Save.

From there, you’ll now be able to see the billable column in expenses and record billable expenses in QBO. You can check this article for more insights about this process: Enter billable expenses.

In addition, I've got this helpful resource to guide you further if you want to delete a billable expense charge in the system: How to remove a billable expense charge.

If you have any other questions about billable expenses, please feel free to leave a comment below. I'll get back here to help you again. Thanks for dropping by, and wishing you a good one.

I have Online Essentials, and I am not seeing billable expenses anywhere from any of these instructions. I'm trying to prevent it from being marked as billable going forward, but I know have thousands of old "billable" expenses that won't allow me to clean up and make former clients inactive because they have "open billable expenses". Can I not change that in Essentials??? I'm really not happy if it's not possible, it's so unorganized otherwise and will make it difficult to work.

Hello there, barevalo0205.

The billable expense feature is only available in QuickBooks Online and Advanced. That's why we're unable to follow the instructions shared above. If I were in your situation, I wouldn't be happy too.

I see how difficult it is. I have ways to share that you might consider doing.

We have the option to upgrade your QuickBooks Online Essential to the Plus or Advanced plan. It helps us control how we can track customer transactions.

We can visit and review this article: Enter billable expenses.

In QuickBooks Online Essential, we can delete those billable expenses or transactions that are not needed.

These are the steps to make them inactive:

If you're unsure how those transactions will affect your book once deleted, it would be best to consult your accountant. They'll guide you further and make sure to keep your accounts and business data accurate. Check this link: Find an accountant.

Check these articles for more details about handling customer data:

Visit again if you have more concerns about billable expense and managing customers transactions in QBO. Take care and stay safe.

Thank you for this information. As I understand it and seems to bear out in reality...this method only deals with each individual transaction, correct? Is there a way to make the "non-billable" the default setting for all transactions and not have to "uncheck the box" each time?

Thx,

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here