Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowYou can make use of progress invoicing feature, djohndi06.

This will allow you to create multiple invoices from a single estimate. With this option, you can invoice your client for 50% including taxes. The first thing we need to do is to turn on this feature.

Once done, create an estimate for the full amount and save it. When it's time to invoice your customer, let's open the estimate. Click on the Create invoice button at the upper-right corner. On the pop-up, select the second radio-button, then enter 50% on the first box and select Create invoice.

You can now print or send it to your customer. You can also attach the estimate summary when sending the invoice so your customers can see the remaining balance.

We also have a report called Estimates Progress Invoicing Summary by Customer. You can search and pull up this report on the Reports tab. Use this for your guide to see the list of all estimates and the linked invoices.

This method is so simple. Tag my name anytime if you need more help. Wishing you all the best!

As additional option, should you need more feature in your invoicing, explore this app to integrate with QBO. You may find something useful for your needs.

http://get.practiceignition.com/quickbooks

Hope it helps.

IF, if you are asking how to invoice for one half the item total plus the full amount of sales tax (many states require this) - you can NOT do that using progress invoicing. ie

widget, qty 4, total price $568.00

sale tax @ 8.25%, $46.86

Total invoice, $614.86

Progress invoicing will invoice (if you select 50%) $307.43

What I think you want is

item sale at 50%, 284

sale tax, 46.86

total partial invoice $330.86

QB can not do this

Hi @AlexV Or anyone who can assist.

Where it says "How much do you want to invoice"

where is the option to select qty rather than a dollar amount or %?

I.E i have an estimate/quote for 100 items.

I want to invoice for 37 items.

How do i quickly add invoice 37 items only?

Dont wish to grab a calculator to work it out. want it to be simple so any staff member can add this quickly to customer jobs.

Thanks

Hello @MPQ,

You can enter 37% on the box when creating an invoice from an estimate. Let me share a couple screenshots for your visual reference.

Additionally, here's an article you can read to learn more about converting an estimate to invoice: Convert an estimate into an invoice in QuickBooks Online.

Lastly, I've also included this helpful article for the steps about the different methods you can start in accepting payments from your customers: Record invoice payments in QuickBooks Online.

If there's anything else that I can help you with, please let me know in the comments if you have any other concerns. Stay safe!

Hi @JonpriL

Thanks for your reply.

in theory that works if the qty was 100.

let me give you another example.

lets say there was an item order for qty of 86 parts.

i wish to invoice 13 parts.

whats the best way to enter this "Easy"?

Cheers

Hello there, MPQ,

In QuickBooks Online, when you convert an estimate to an invoice you can only select the Amount or Percentage. It'll be deducted on the total items from the estimate.

For example, you'll want to calculate the percentage of 13 items out of 86 to come up with the percentage to convert. Or the total amount of 13 items out of 86.

You can check out the articles provided by my colleagues to learn more about invoicing in QuickBooks.

I'll be right here if you have other questions.

Surely its not to hard to update quickbooks to include the function to invoice X qty rather than trying to work out a dollar amount or %?

very frustrating.

In these help forums are alot of people who are manufacturers. so to add a invoice X qty function to this would be great!

Thanks

Hello there, MPQ.

We understand how important this feature is when running your business. For now, it is not available in QuickBooks Online. We'll share your idea with our product development team. Also, you can share it with them by contacting our Customer Care Team. They can pull up your account and create a request about this.

Or

Aside from that, new features and updates about QuickBooks Online are cascaded in the QuickBooks Blog.

Meanwhile, you can check third-party applications online that can do this. You can also search within the Apps menu in QBO or through the marketplace.

We'll be right here if you need anything else.

Consider having an inventory management app and/or manufacturing app to release partial invoice for certain quantities.

agree. and have been looking into it.

But what I described above should be such a basic feature thats already included with quickbooks.

Company has acquired an inventory management app as part of the family recently. So I won't expect the partial shipment feature will be available as basic feature in QBO for the time being.

https:// go.tradegecko.com/register?code=fiat-lux

If you are a manufacturing company, you may utilize the simple assembly feature. Otherwise, you may explore this manufacturing app.

https:// katanamrp.grsm.io/katana

I use QB Desktop rather than QB Online, so I'm not sure if this will work or not, but often QB has a built-in calculator in its fields. Try typing "13/86" and see if QB works out the percentage for you.

I am shocked you do not have a feature that I can send a 50% invoice that includes tax.

The 50% line item does not include tax therefore messes with my books and confuses the client (and me!).

Even Square has this simple basic feature.

Welcome to the Community, @TIS3. I'm grateful that you sent us your concern. I'd be happy to assist you sort things out.

QuickBooks Online has a feature that sends 50% of the invoice, including tax. You simply click the Tax option, then Select tax rate. I'll walk you through the process.

Let's begin by creating an Estimate. Here's how:

Note that if you check the Tax option in the estimate, the amount on your invoice will change automatically.

Moreover, I've also added these handy articles to help you manage your transactions moving forward:

I'm always looking forward to assisting you in the future, TIS3. Please drop by again if you have further clarification. We're available 24/7. Have a nice day!

Hi is there a way to do this from an invoice? Our invoices are sent to QB's through 3rd party and we want to send a payment link for only 50% of the invoice for a deposit.

Currently we can only send the full amount and customer would have to edit the total amount minus 50%, however this confuses many of our customers. Please help me find a way to send an invoice asking for only 50% or a fixed #. I can beleive how much dificulty I am having trying to do this. Please help

Thanks for chiming into this thread, @StaceysHD.

Currently, QuickBooks Online (QBO) only offers a feature called progress invoicing that allows you to send 50% of your invoice with tax. However, your invoices will need to be manually created within the QBO program.

Since you're using third-party software to send an invoice into your QBO program, then there's no integrated way to edit the invoice before sending a 50% or fixed amount of the invoice to your customer in QBO.

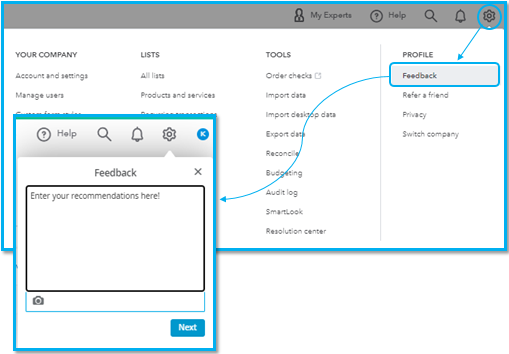

At this time, your customers will have to edit the total amount and send a 50% payment. While this option is unavailable, I recommend sending your feedback to our Product Development Team so they can review it and might consider implementing it in the future. Here's how:

Additionally, I'll add this article as your reference for receiving and categorizing invoice payments in QBO: Record invoice payments in QuickBooks Online.

Please let me know in the comment below if you have additional questions about this or anything related to QuickBooks. I'll be here to assist. Have a good one!

@AlexV I have a customer that I am requiring 50% down so I sent them a progress invoice. They came back to me saying that they do not pay sales tax on a progress invoice, they will only pay the full amount of the sales tax on the final invoice. I can't figure out how to make that possible. If I make the item or the customer non-taxable on the 1st invoice in order to take off the sales tax, then the final invoice is only taxing the other 50% of the taxable item, not 100% (obviously). I can't see a way around this. Do you know how to make it happen? Thanks in advance.

Thanks for getting involved with this thread, MrsCHV1.

Some people have found it helpful to add the remaining 50% of sales taxes as a line item on final progress invoices. If you do this, you'll want to make sure your line item is set to non-taxable, so that QuickBooks doesn't calculate taxes on it.

To properly identify if and how you should split sales taxes between progress invoices, I'd recommend working with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

Here's how it works:

Once you've found an accountant, they can be contacted through their Send a message form:

I've also included a detailed resource about working with progress invoices which may come in handy moving forward: Set up & send progress invoices

I'll be here to help if there's any additional questions. Have a great Wednesday!

@ZackE Thank you! I will do that. I appreciate the prompt reply and educated help.

"Some people have found it helpful to add the remaining 50% of sales taxes as a line item on final progress invoices. If you do this, you'll want to make sure your line item is set to non-taxable, so that QuickBooks doesn't calculate taxes on it."

Good evening, @MrsCHV1.

I appreciate you coming back by.

You're welcome!

If you have any other questions or concerns, don't hesitate to ask. We're always here to lend a helping hand. Take care!

Is there another way of doing this?

I use QB desktop and I don't see a 'progress invoicing' option.

Thank you

It's nice to see you back in the community, Sky15. To answer your question, yes there's a progress invoicing option in QuickBooks Desktop (QBDT). I'd be happy to guide you through how to proceed and accomplish this task.

To enable and use the progress invoicing feature in QBDT, follow these steps:

After completing these steps, you can create an estimate on the platform. Here's how to do it:

Once you have your estimate, you can now create progress invoices from it. For detailed instructions, refer to this article: Set up and send progress invoices in QuickBooks Desktop.

Additionally, to explore various methods for tracking customer transactions in QBDT and ensure your accounts receivable are accurate, check out this page: Get started with customer transaction workflows in QuickBooks Desktop.

The steps outlined above will assist you in setting up progress invoicing in QuickBooks Desktop. If you experience any issues or have further questions while using QuickBooks, please don’t hesitate to reach out for help. We are here to support you every step of the way.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here