Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI keep trying to download the 1099-NEC update wizard and it says nothing new downloaded. When will this be available for 2020 desktop version?

Hi there, Tthomas2.

The 1099-NEC update is already available to the supported version of QuickBooks (2018-2021). That said, you should already have the option to download the 1099-NEC. Since you're unable to this, I suggest contacting our QuickBooks Support Team. They have the tools to pull your account and investigate the cause of the issue.

For more information about 1099 forms in QBDT and when to file them, you can check out this article: Learn what 1099 forms there are and how you can prepare for the 2020 tax season.

I've also included a link in which will guide you when filing your 1099 form in the IRS: Tax Year 2020 - Instructions for Forms 1099-MISC and 1099-NEC

If you need any other assistance, feel free to post here anytime. Thanks for dropping by and have a nice afternoon.

Hello,

Thank you. I am all set for now.

pablo

Hey there, VRago.

We're glad to see that you're all set! If there's anything else I can do to help, feel free to post here anytime.

Thanks and I hope you have a lovely day.

I spent almost an hour on the phone with the support team trying to get them to understand my problem, in the end, they said they can send me the article w/ the list of steps they would tell me or I could pay for support so they could continue to walk me through it.....they sent the article and it's one I've already pulled online and it doesn't address my issue. Therefore, they were no help at all and if I paid them, they'd still be no help.

I can't believe no one else out there has the same problem I'm having....

Trish

I do not process payroll through quickbooks. I am trying to prepare for filing 1099 NEC and 1099 MISC forms. I cannot get quickbooks to display selection in 1099 preferences for 1099 NEC or 1099 MISC. HELP!

Thanks for joining this thread, @TrishF.

May I know the details of your concern? That information will help me find a timely solution. Please know that you can always post here in the Community for every concern you have with QuickBooks. There are a lot of QuickBooks experts that are willing to guide QuickBooks users, like you, on the correct steps when using the software.

Also, for your concern, @rstablini.

Let's ensure that your QuickBooks Desktop is updated to the latest release. This is to make sure that you have all the updated components. To do so, please refer to these steps:

If the issue persists, I recommend contacting our technical support team. They use specific tools to further investigate the root cause of the issue. Go to the Contact support page to connect with them.

Once done, please visit this guide to help you file 1099-NEC and 1099-MISC in QuickBooks: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

You might also want to visit our help page to browse articles that can guide you with your QuickBooks tasks. To get started head to our QBDT Help articles at this link.

Let me know how this goes and feel free to come back here if you have QuickBooks-related concerns. I'll be around to help you, Have a good one.

WOW !!! SAME PROBLEM as me rstablini and TishF .. I also stayed on phone for an hour and rep had no

idea what I was saying. I told her I updated it, we checked all (same thing i have done ) Its a shame that

someone that has purchased 2021 premiere qbdt and NEC 1099 no supported. Its crazy that I have to pay another software co to print/efile my 1099 Nec forms ! SHAMEFULL ! ALSO , a shame that we all are getting different anwers as how to fix .

@TimPottorf I am having the same issues with QBDT Pro 2018. I only have a limited number of forms to send, but I found this site to enter manually and print. I'm waiting it out to see if there is a QB update before the EOM.

https://formswift.com/builder.php?documentType=1099-nec-efile-2020

@wmgkatie I filed from QB Desktop 2018 with no problem once the update was installed and I followed the steps to map my accounts to either the NEC or the MISC. At what stage are you running into an issue?

HELP I have been on the string of inquiry of 1099NEC’s and was told to update to 2021, which I did, went to the File/Print forms/1099, 1096/ clicked on 1099wizard (update quickbooks), then poof I get an update error message that directs me to a support page that does nothing. The error message is 15103. When I go update from the help screen I get the same message...now I am really stuck...new version with no place to go!

Hello @TreeDown ,

It seems you have created a separate post needing help with the 1099 form. My colleague has already shared her response in the other thread.

For easy navigation, you can follow this link to check her response:

https://quickbooks.intuit.com/learn-support/en-us/reports-and-accounting/1099nec/01/764632#M106791

Let us know in the comments if you have any other questions. Stay safe!

I have printed my 1099s but I can't find where to print 1096. Can you help?

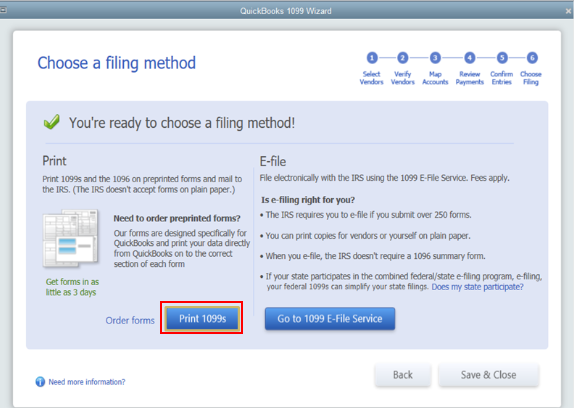

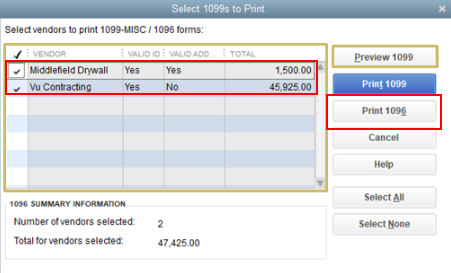

Printing 1096 is the same process as printing 1099s, @Dene.

You'll want to make sure that you select Print 1096 in the Select 1099s to Print window. Here's how:

I'm adding this article for more guidance: Print 1099 forms.

Just in case you want to learn how to align forms in QuickBooks Desktop, feel free to check out this article for the detailed steps and information: Align forms for continuous-feed (dot matrix) printers.

Please know that I'm just a reply away if you need any further assistance printing 1099s or 1096. I'm always around if you need any help.

so no one can SOLVE this ? I have spend a lot of time on phone and on this site trying to figure out ho to do ?Other than adjust my COA , which is not as easy as it sounds...also , I am not sure if I go thru all of that if the NEC option be available for me to choose > any ideas ? would be greatly appreciated. Since its the new year I was going to set up all new accounts as i pay contractors ? ideas ?

yes , this is the site I used to print them, thanks ! Now I can pay to have them e filed or try to figure it out on qbdt to print copy A ( since I have already purchased my red copies )to send to irs.

did you do the misc ? or nec ? bc nec was grayed out on the wizard when you go to try to map accounts. I have 2021 qbdt premiere contractor so I was thinking it should be supported . I said it was already updated. If you can help , that would be awesome as I still need my Copy A to send to irs.

Hello there, @needtoknow20.

Yes, you're right the QuickBooks Desktop Premier 2021 is supported. To isolate why the 1099-NEC is grayed out , you can check the mapping of your 1099 MISC accounts.

If the accounts was map in the 1099-MISC that's the reason why your 1099-NEC is grayed out. If so, you'll need to remove the accounts from the mapping and start your 1099-NEC.

After that, check these articles for detailed directions on how to file the said form.

If there's anything else that I can help you with, please let me know by leaving any comments below. I'll be here to lend a hand.

Did they solve this problem for you? I am having the same problem.

Did they solve this for you. I have the same problem.

I’m here to help and get you back in running your business, @TeresaA.

I want to make sure I’ll be able to provide you with the right resolution to resolve this. Were you able to check the mapping of your 1099 as suggested by my colleague above? If not, I recommend checking it to isolate this issue.

Also, ensure you have the latest payroll tax table and your QuickBooks Desktop (QBDT) is updated to the newest release. This way, we can guarantee your program is up to date.

If you have and the issue persists, I recommend contacting our Support team. They have the proper tools to securely check your account and investigate the cause of this. Here’s how to reach out to them:

You can also see this article for more details and ensure to review their Support Hours to know when to contact them that is convenient for you: Contact QuickBooks Desktop support.

Once everything is all in place, you can utilize this article for your reference in creating your 1099 effectively in QuickBooks: Create and file 1099s with QuickBooks Desktop.

Keep me in the loop if you have other queries managing your 1099s in QuickBooks. I’m just around ready to back you up. Take care and stay healthy.

what do you mean "remove your accounts from mapping" ? are you talking about adjust the COA ? which is add new accounts or edit the existing ? to edit that means I have to edit each check...that's a lot ! I guess by the time i spend going back and forth with community I could have already done ...I am not happy with this at all >> and as you can see A LOT of ppl have same issue. One person below still telling me to call and "lets talk" if I can get a particular number and ext I would >>> as I said I talked w/ someone who had no business trying to help , she knew nothing about what I was speaking about >WE NEED A SIMPLE SOLUTION. if there is one yes or no ?

no they did not solve...they either say same thing over again >>ie talk to tech (did and no help) edit each transaction for each 1099 person and make it NEC s,,, (last resort for me) and make new accounts in COA (still a lot of time)maybe someone can get a clear simple answer ??

again.... WE DO NOT RUN PAYROLL >>> PAYROLL IS NOT 1099 'S s, its payroll. I am not paying another fee just to be able to print 1099;s NEC >>> that s crazy !

Hi, @needtoknow20.

I can see how hard you've tried in here. I'm here to provide additional troubleshooting steps so you can prepare your 1099s seamlessly.

Before we start with our resolutions, I would suggest backing up your company file to avoid data loss. You can use this article for your guide: Back up your QuickBooks Desktop company file.

Once done, you can proceed by updating your QuickBooks Desktop to the latest release. It keeps your software up-to-date and gets the latest QuickBooks features and fixes.

Here's how:

After that, close and reopen QuickBooks Desktop. Then, select Yes to install the updates.

Once QuickBooks is open, you're now ready to prepare your Federal 1099s. For more tips, I suggest opening this articles:

Just in case you're getting the same behavior, you may repair your QuickBooks Desktop or perform the clean install/uninstall process to fix any QuickBooks component issues on your system. You can open these links for the detailed steps:

Please let me know how else I can help you with your 1099 forms by adding a comment below. I'm more than happy to help. Keep safe always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here